By Matthew Hassan, Senior Economist at Westpac:

- Leading Index growth rate lifts slightly to –0.6% in July from -0.67% in June.

- Twelfth month of negative prints, longest run in seven years (ex-COVID).

- Below-trend growth momentum set to extend into 2024.

- Some support from resilient labour market and end to rate rises.

- But significant hit coming from sharp falls in commodity prices.

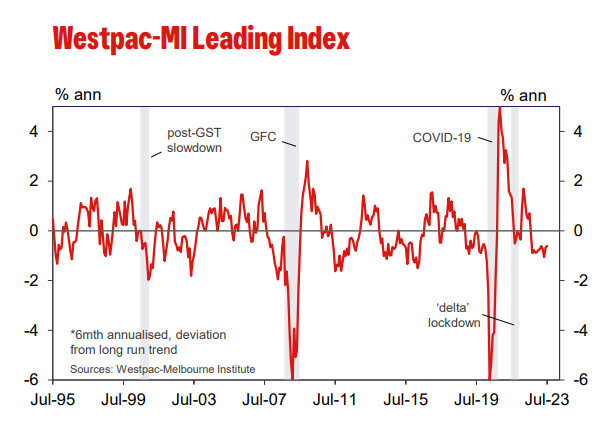

The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, lifted to -0.60% in July from –0.67% in June.

The economy continues to see an extended period of weakness.

Despite a slight improvement in the July month, the Leading Index growth rate remains firmly in negative territory, the latest reading of –0.6% broadly in line with the –0.73% average seen since August last year.

The July update is a clear indication that the weak, below-trend growth momentum we are seeing in 2023 will extend into 2024.

Westpac expects GDP growth to slow to just 1%yr this year, lifting only marginally, to 1.4%yr, in 2024, most of that coming towards the end of the year.

The Leading Index growth rate has improved marginally since the start of the year, from –0.78% in January to –0.60% in July, a lift of 0.17ppts. The net lift conceals some divergent trends in Index components.

The main improvement has come from: a renewed pick-up in total hours worked (adding +0.41ppts to the overall index growth rate); a stabilising yield spread (adding +0.19ppts); and less pessimistic consumer expectations for unemployment (adding +0.11ppts).

The shifting contribution from the yield spread reflects the end of the RBA’s tightening cycle, short term interest rates largely unchanged over the last two months, having risen steeply over the previous year.

The resilience of Australia’s labour markets continues to be a major source of support. Indeed, without the positive contributions from hours worked and unemployment expectations, the six-monthly annualised growth rate in the Leading Index would be running closer to –1%.

These supports have been partially offset by a weakening in other components since the start of the year.

The most notable increased drags have been from: a further decline in commodity prices (taking an extra –0.26ppts off the Index growth rate); a renewed decline in dwelling approvals (–0.21ppts); and a patchier performance for the S&P/ASX200 (–0.16ppts).

The fall in Australia’s commodity prices is particularly striking with prices now down 18.6% compared to March (measured in AUD terms), albeit with the pull-back coming from elevated levels.

The Reserve Bank Board next meets on September 5. We expect the Board to again keep the cash rate unchanged at 4.1%, which we see as the peak of the current tightening cycle.

The RBA Governor’s recent testimony before the House of Representatives Standing Committee on Economics confirmed that policy is now in a ‘calibration’ phase with small adjustments still possible if the data starts to show clear risks of a slower return to low inflation.

However, with growth momentum still clearly weak – as confirmed by the latest Leading Index update – and the broader picture around price and wage inflation continuing to track in line with the RBA’s expectations the threshold for additional tightening is high and unlikely to be met.