Wages gained just 0.8% in June, softer than the market expectation for a 0.9% lift and Westpac’s 1.0% forecast. The bottom of the forecast range in Bloomberg’s analysts survey was 0.8%. Wage inflation has been quite disappointing compared to just how tight the labour market is and the announced outsized gain in the minimum wage this year. It is true that the increase in the minimum wage is not applied till July 1st, so its main impact will appear in the September quarter, but we had thought it should have some signalling impact on near-term wage bargaining.

The 0.8% increase was meaningfully less than our expectation and, on its own, will result in a 0.2ppt downgrade to our current year-end forecast of 4.1%yr for wages growth. But the important question is: with three quarterly prints of 0.8%, has the momentum in wage inflation topped out? We will have to wait for the September quarter and the post-minimum wage impact to get a clearer picture. But still, we need to have an open mind to the idea there has been a significant change in wage/price setting behaviour and that wage inflation will peak at a lower rate than was initially anticipated.

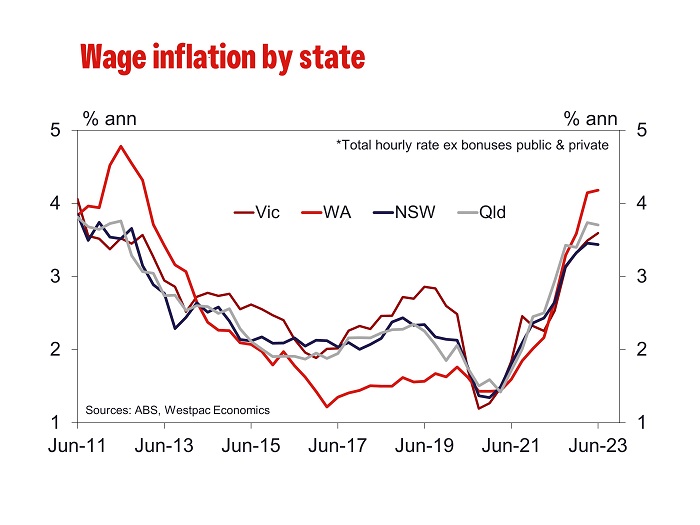

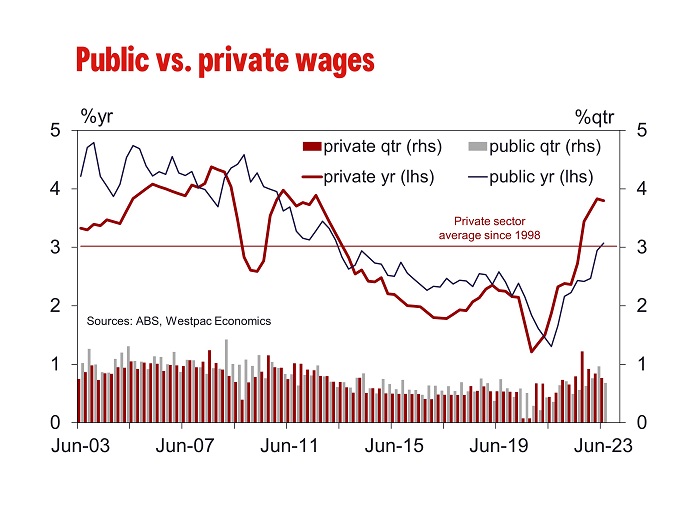

In the June quarter, private sector wages lifted 0.8%qtr/3.8%yr (flat on 0.8%qtr/3.8%yr in March) while the public WPI rose 0.7%qtr/3.1%yr. After the March WPI, we had thought that an uptick in public sector wages would be enough to hold our forecast peak at 4.1%yr. However, that forecast implied a step up in the quarterly pace of wage inflation. With the ongoing moderation in the pace of private sector wage inflation, now coupled with a moderation in public sector wages (0.8% in Q4, 1.0% in Q1 and now 0.7% in Q2), it is getting harder to argue for a sustained lift in wage inflation momentum even if we see something of a minimum wage boost in September.

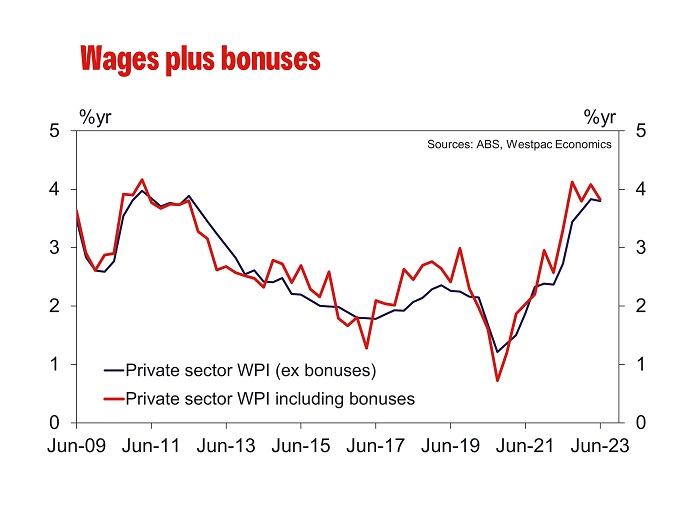

Even when bonuses are included, wage inflation is moderating in the private sector. The private WPI with bonuses rose 0.8% in June, down from 0.9% in both March and December, which saw the annual pace ease to 3.8%yr from 4.1%yr in March (the fastest pace since March 2011). The public WPI with bonuses lifted 0.7% in June, down from 1.0% in March, for an annual pace of 3.3%yr vs. 3.2%yr in March. Note these figures were seasonally adjusted by Westpac.

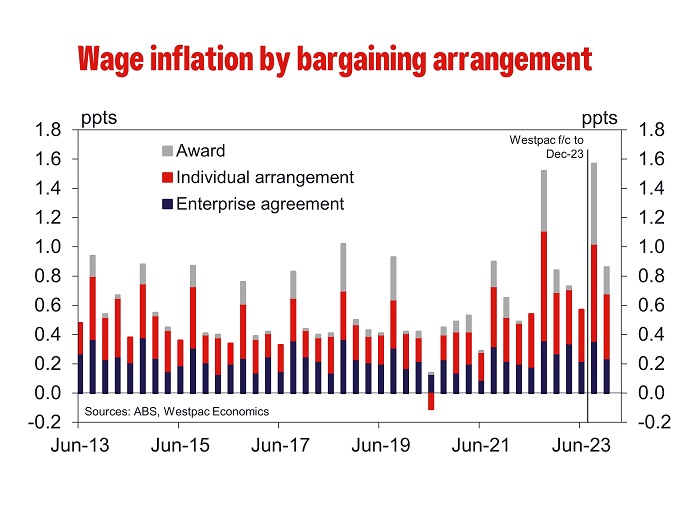

In terms of wage pressure by bargaining arrangement, we are starting to see something of a moderation in the contribution from individual wage arrangements. Back in 2022, the contribution from this group lifted from 0.28ppt in March to 0.36ppt in June. This year the contribution has dropped from 0.37ppt in March to 0.35ppt in June. It is an early sign that maybe we have seen the peak in the momentum in wage inflation from individual arrangements.

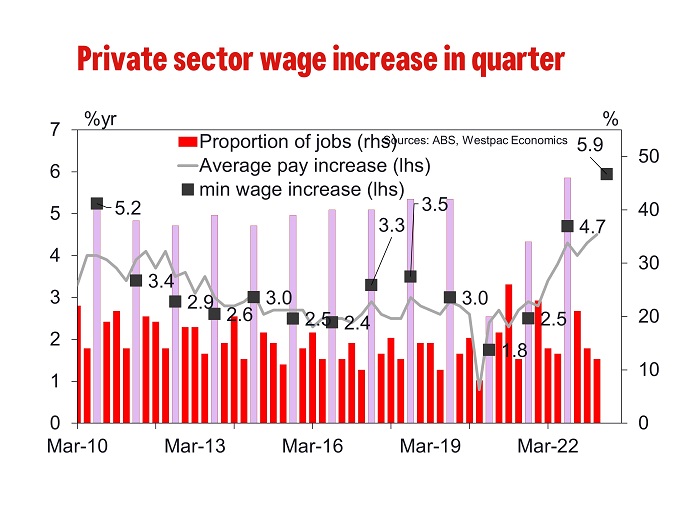

However, looking at this data for September 2022 suggests we can hold to our current 1.1%qtr forecast for September 2023. Last September, awards contributed 0.41ppt to the WPI based on a 4.7% increase in the minimum wage. This year the increase in the minimum wage was 5.9%, suggesting the contribution could be around 0.55ppt this September. If we get the same contribution from enterprise agreements as last year (0.36ppt), then even with a moderation in individual arrangements contribution (say 0.66ppt compared to 0.75ppt last September), then we have a 1.6% rise in the September WPI in original terms. Our current forecast is 1.5%qtr, which is 1.1% seasonally adjusted.

Looking at the segment of jobs that recorded a wage movement in the quarter can be insightful into current wage dynamics. For the private sector, the average hourly wage change for those jobs was 4.5%, higher than the 4.3% in March and 3.8% in the same quarter last year. About 12% of private sector jobs recorded a wage increase in June 2023, a touch less than the 13% reporting a wage rise in June 2022.

Given that the increase in the minimum wage was 4.7% last year, resulting in an average wage increase of those that received one last September of 4.3%, the 5.9% increase in the minimum wage in 2023 should result in a significantly larger average increase this September (we think at least around 5¼%). This is another reason why we are holding to our 1.1%qtr forecast for the September quarter WPI and do see possible upside risk to it.