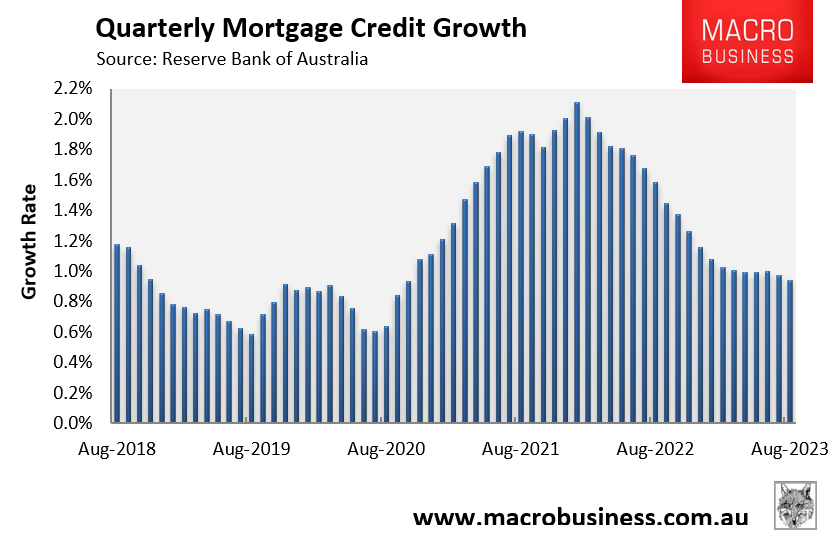

The Reserve Bank of Australia (RBA) has published data on outstanding mortgage debt, which increased by 0.31% in August to be up only 0.9% for the quarter:

It was the weakest quarter of mortgage growth since October 2020 during the height of the pandemic.

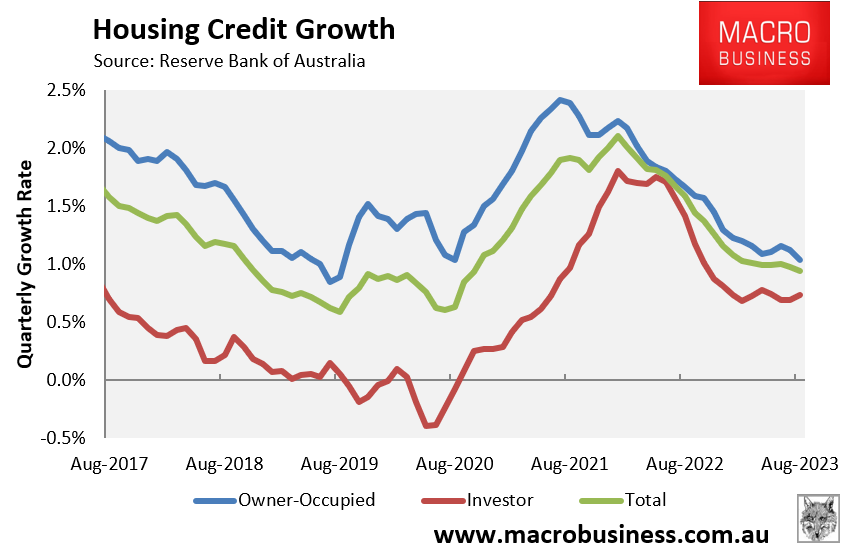

Owner-occupier mortgage credit growth rose by 1.0% over the quarter, whereas investor mortgage credit growth rose by only 0.7%:

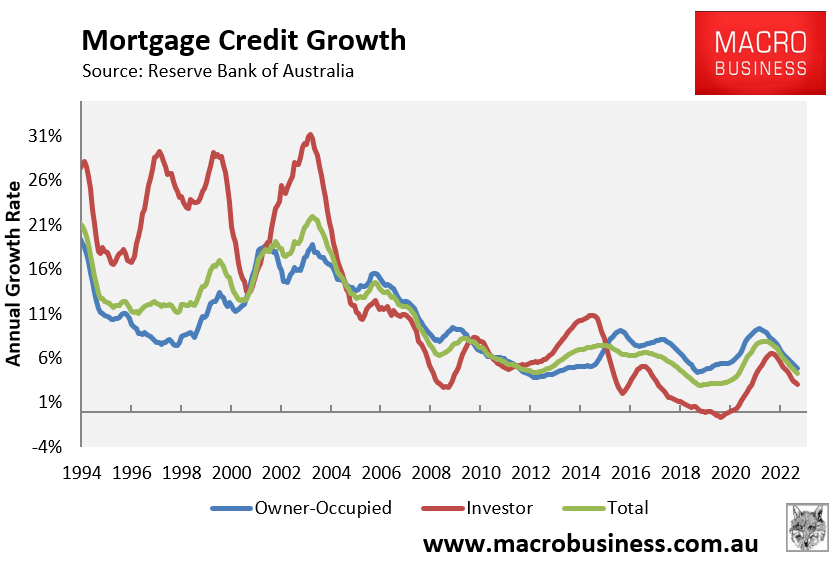

Annual mortgage credit growth has fallen to 4.3%, which is the weakest growth rate since March 2021.

Owner-occupier mortgage growth has fallen to 4.9% year-on-year, whereas investor mortgage growth has fallen to just 3.1%:

Next week, we will receive data on new mortgage commitments for August from the ABS.

As this data excludes refinances and repayments, it will provide a better insight into the level of buyer demand in the housing market.