Friday night saw more strong DXY price action as it held all the gains:

AUD tried and failed again:

The AUD short came in a bit:

CNY is pancaked:

The machines are buying oil:

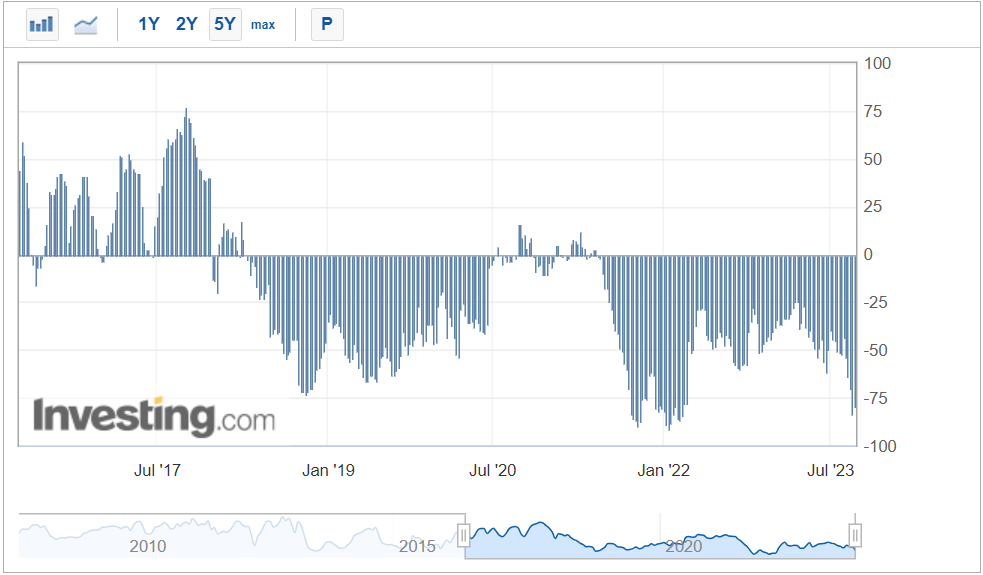

Dirt not so much:

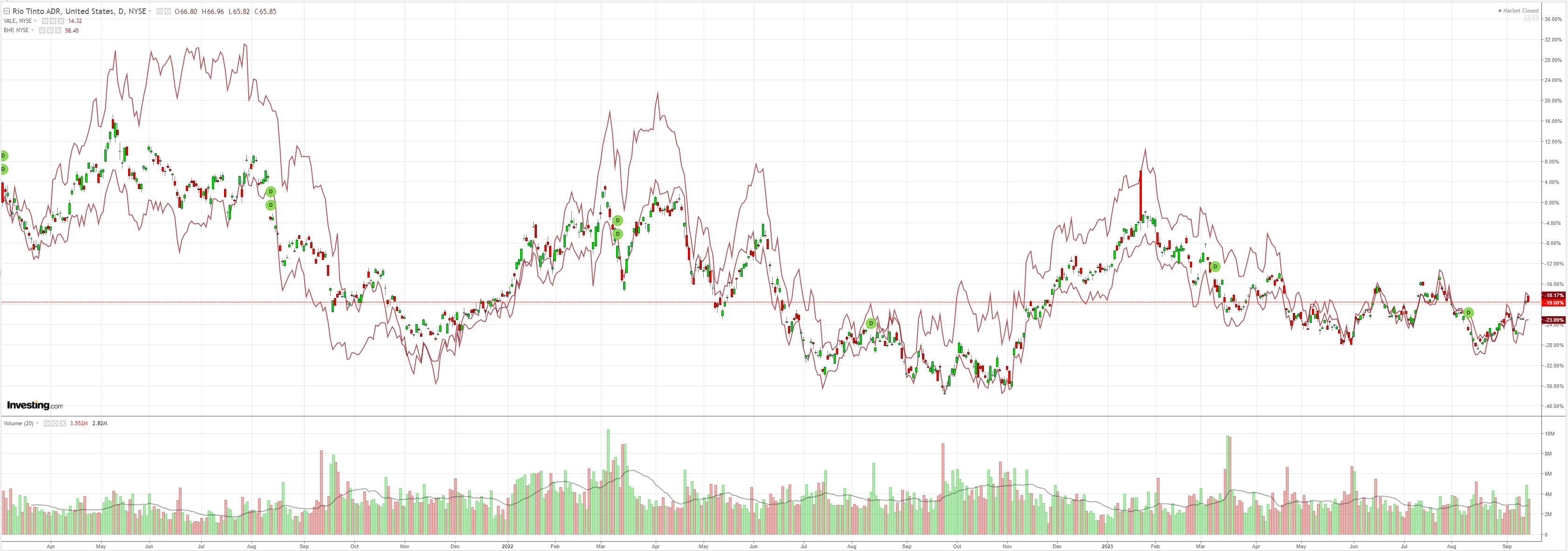

Big miners flamed out:

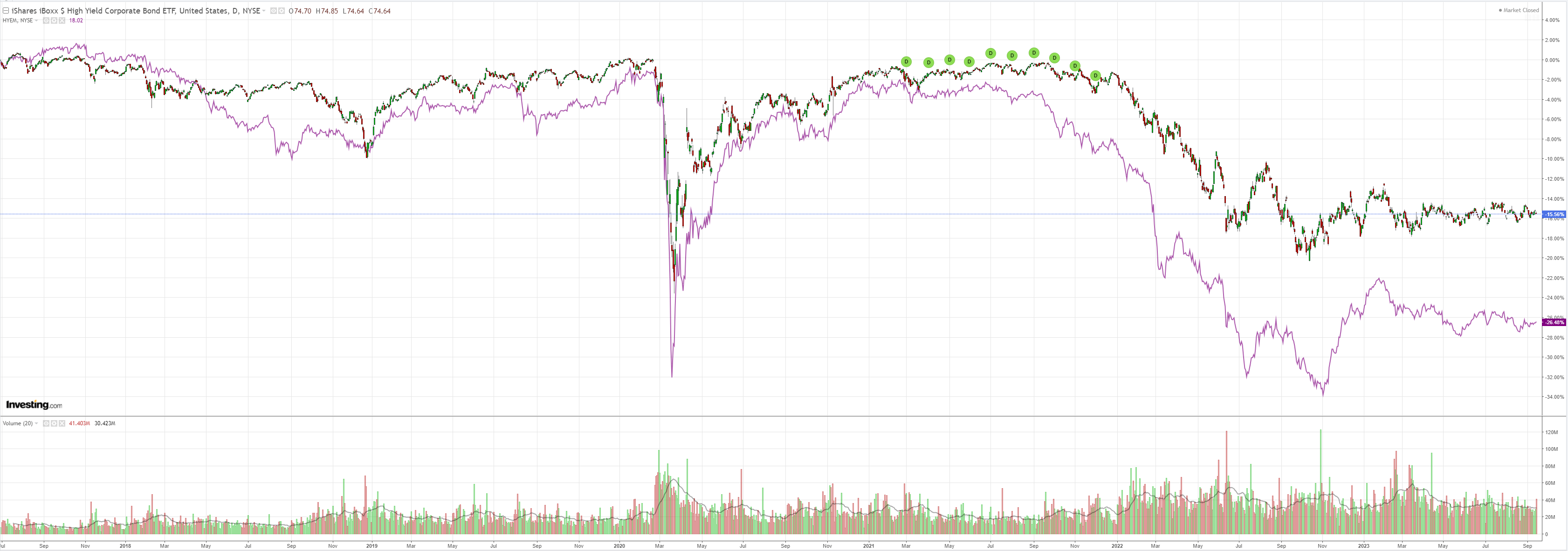

EM stocks and junk are dead:

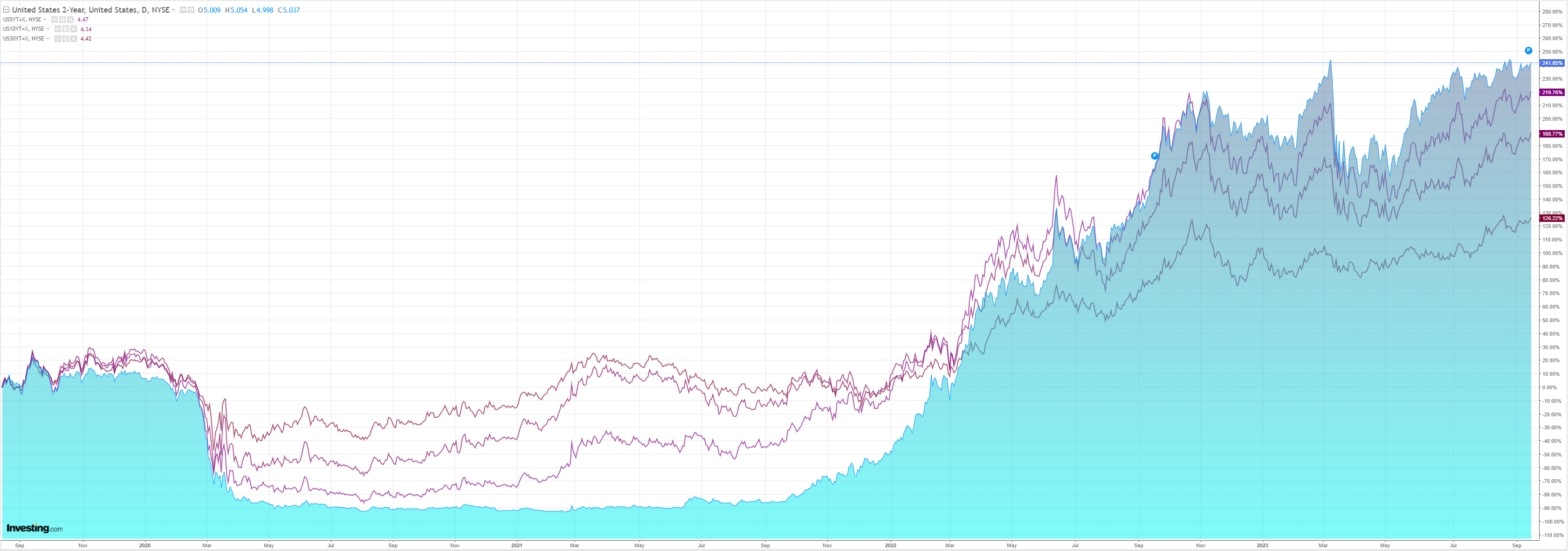

The curve bull steepened:

Stocks puked:

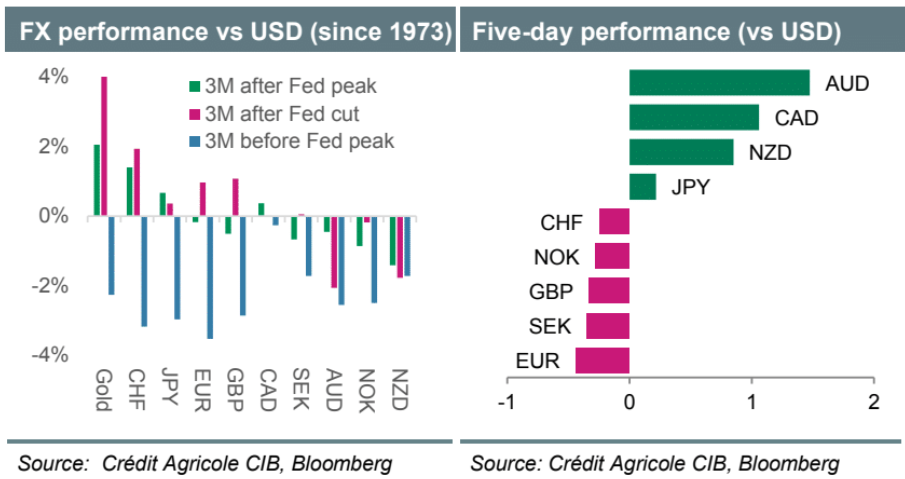

Credit Agricole has more:

King USD continues to reign supreme in the run up to next week’s Fed meeting and its strength reflects: (1) the build-up of market expectations that the Fed could deliver a ‘hawkish skip’ in September, followed by a November hike; and (2) the fact that, historically, past USD bull-runs only ended after the Fed tightening cycle had truly peaked and rate cuts drew into view. Ahead of next week, we expect the Fed to pause but think that its dot plot would continue to signal another rate hike this year. Should this, coupled with the Fed’s updated forward guidance, reinforce rate hike expectations, it could give the USD a boost across the board.

The above being said, our house view remains that the Fed tightening cycle peaked in July and that rates will remain on hold in the coming months in view of the slowing economy and inflation. This is not a reason to turn bearish on the USD just yet, however. Indeed, a look at the currency’s performance around turning points of the Fed policy cycles since 1973 would suggest that the end of past Fed tightening cycles tended to weigh on the currency mainly vs liquid, safe havens like the JPY, EUR and CHFas well as gold, while the USD sold off across the board after the start of the Fed easing cycle. We expect the Fed to starteasing only in Q224 and think that this could lead to USD losses in H124.

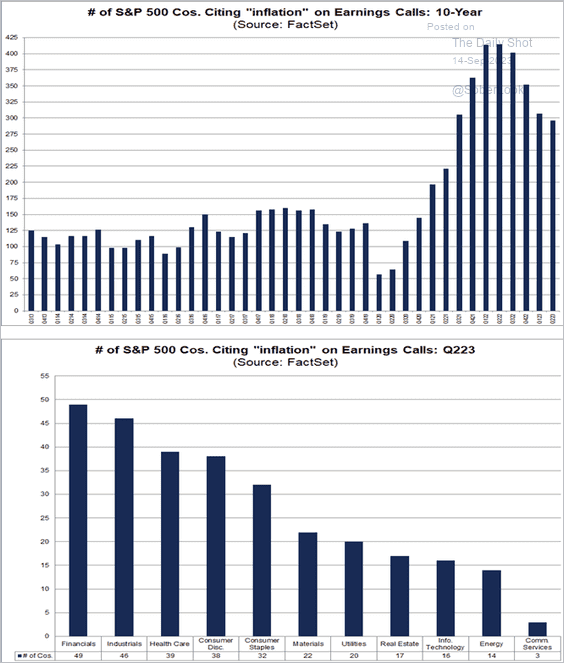

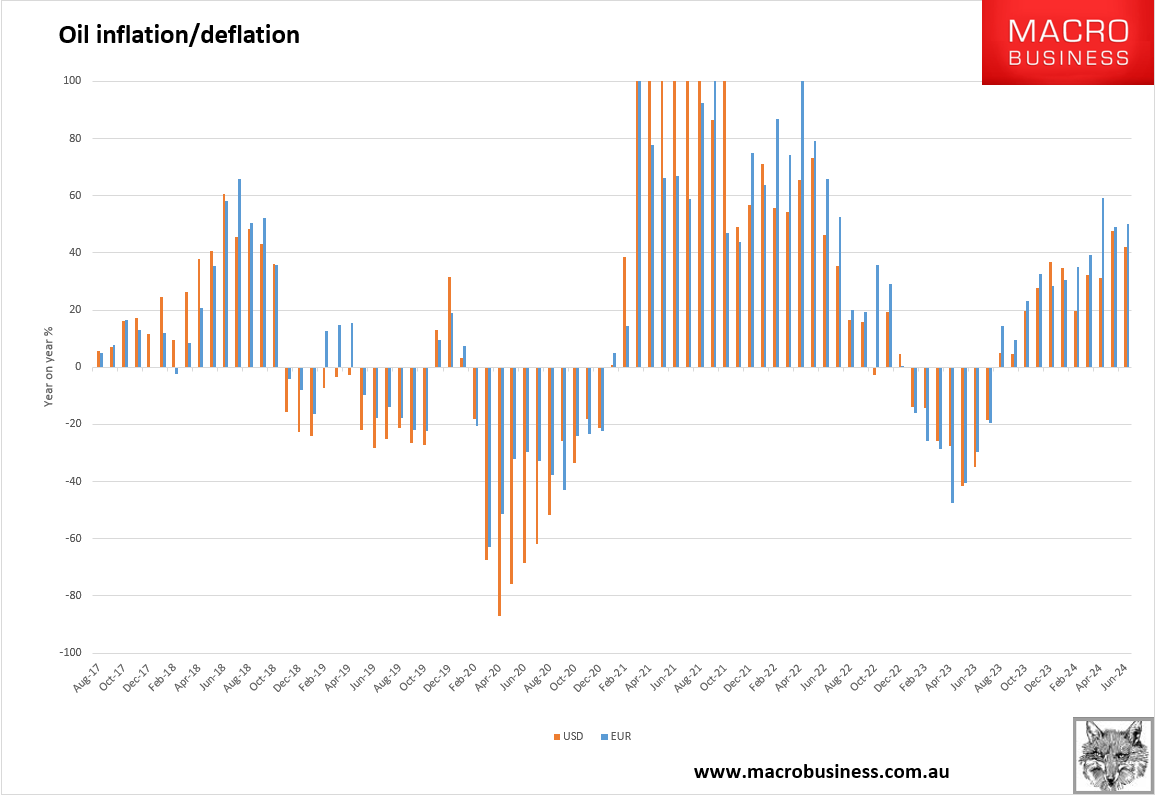

I would generally agree that the Fed will look through oil. US core inflation is still falling promisingly. But I would not be surprised to see the Fed hike next week. Ignoring energy inflation is part of how it got so far behind the curve last time. Greedfaltion is not extinguished:

Given oil is rallying on a supply shock, it has to keep going higher until we see demand destruction. That means well above $100 before year-end, perhaps peaking around $110:

It is self-defeating to hike into energy prices but the Fed could decide it is the lesser of two evils.

More generally, the prospect of another Fed hike in November rises with oil.

This setup is still very supportive of DXY. The US oil patch needs to roll out the rigs in response and the US jobs market is still robust.

We can add that the Chinese recovery is largely arithmetic as property crashes unabated and will be forced to ease more aggressively. The ECB is done as stagflation guts growth.

I can see DXY back at $110 before this cycle is done.

That would probably equate to an AUD somewhere in the high 50s. If we get a global growth stall led by US tightening, it might get AUD to the mid-50s.

Getting to the 4-handle I have speculated on will likely take years. It will require that markets capitulate on the end of Chinese growth. And need another US boom cycle driven by AI.

These two forces are coming but will fully manifest in 3-5 years.