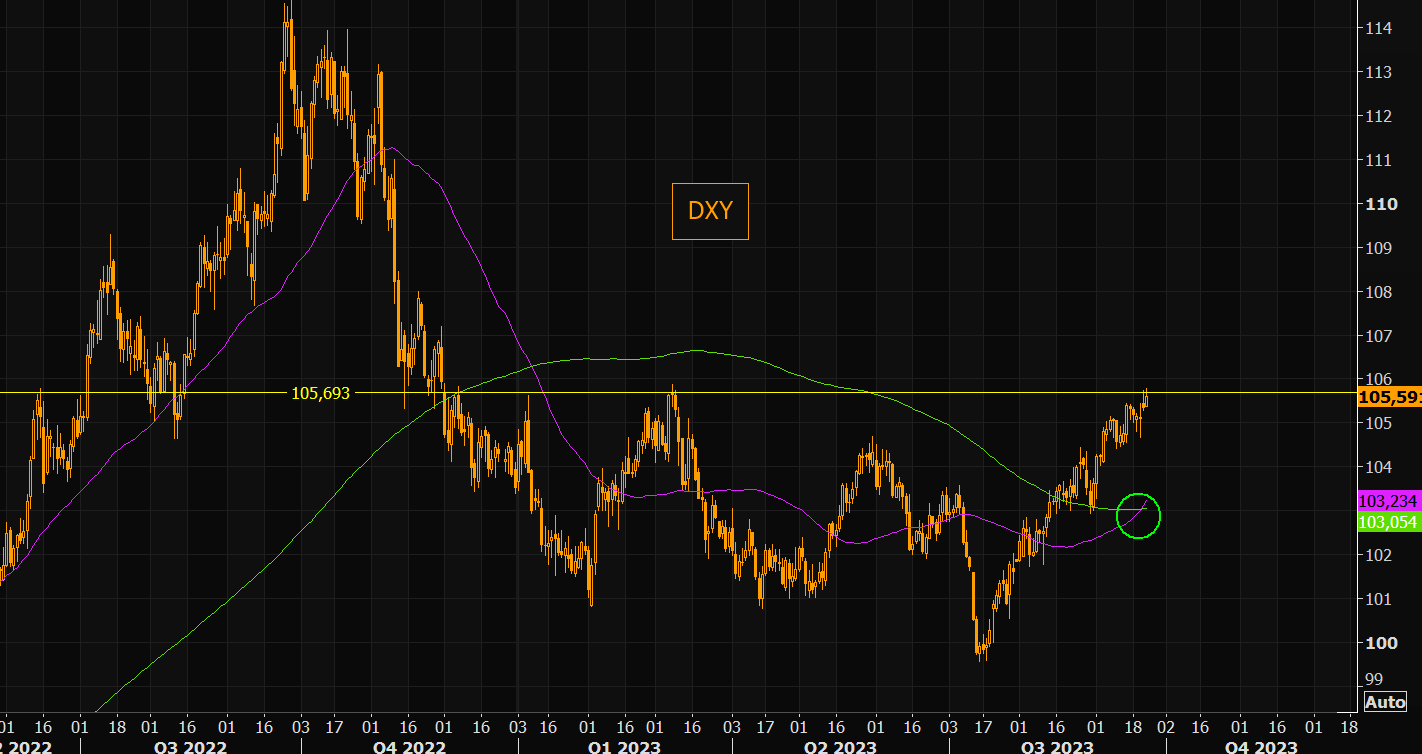

DXY is breaking out:

AUD managed to firm but it’s not going anywhere:

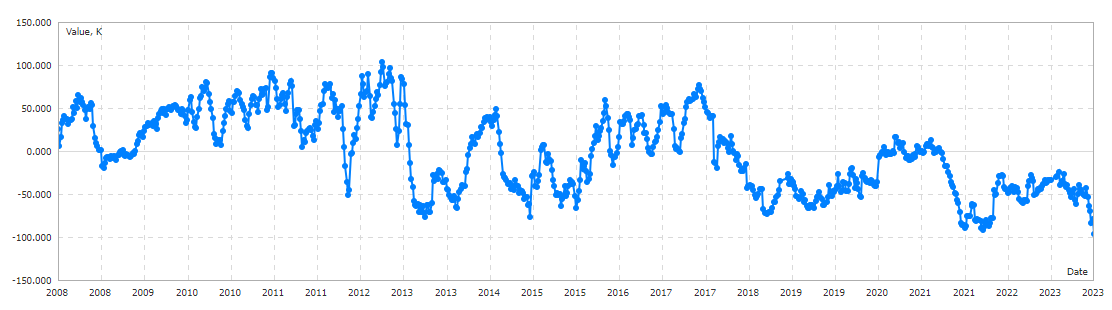

The CFTC AUD short is at an all-time high near -100k contracts:

One reason why is CNY is nailed to the floor:

Oil is now a massive problem for markets. Any fall in yields lifts oil and chokes everything off:

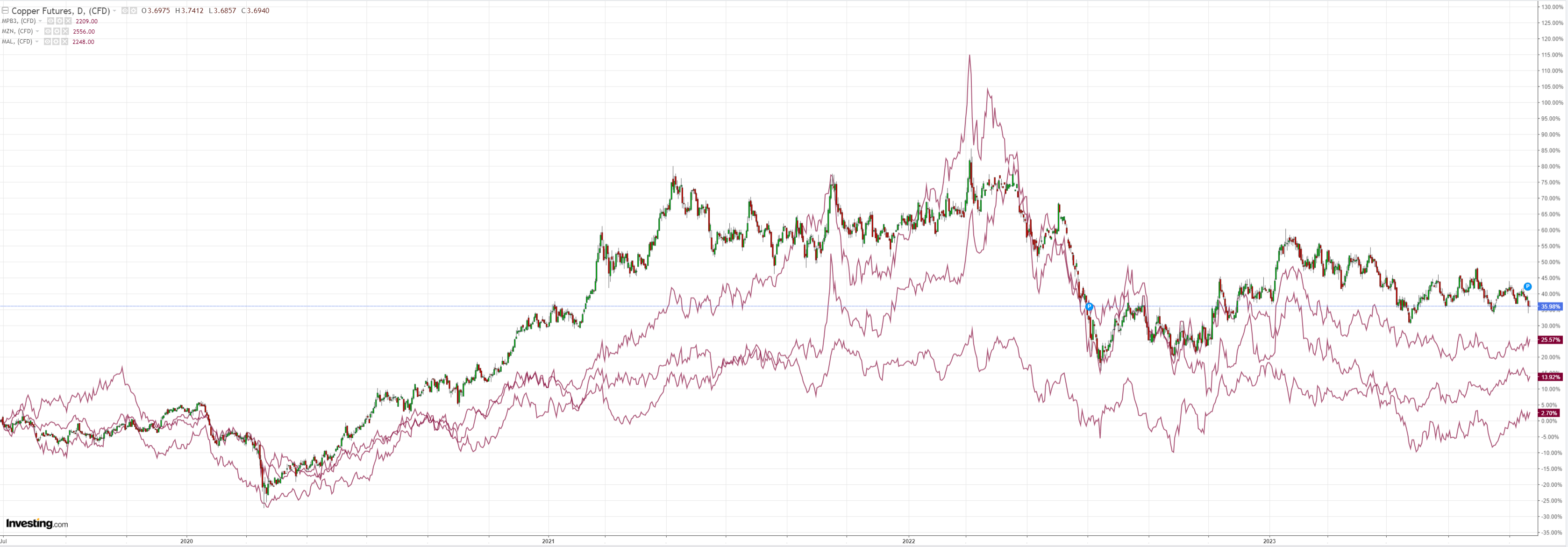

Dirt is doomed:

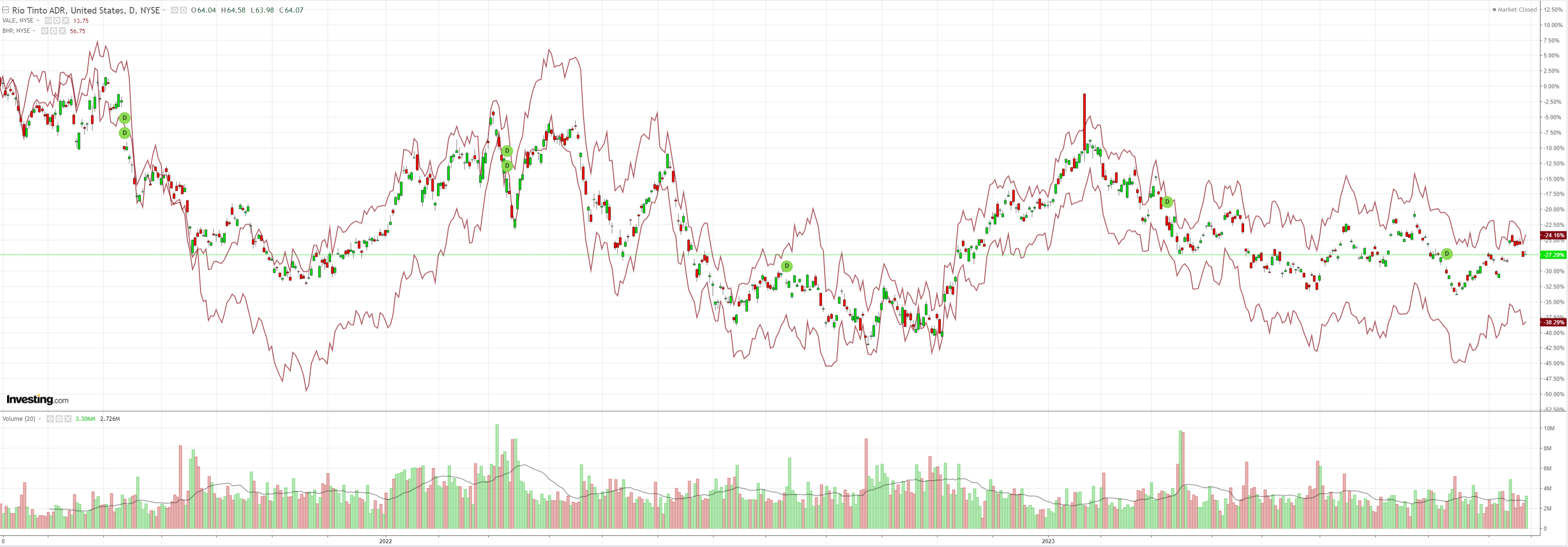

Miners did better:

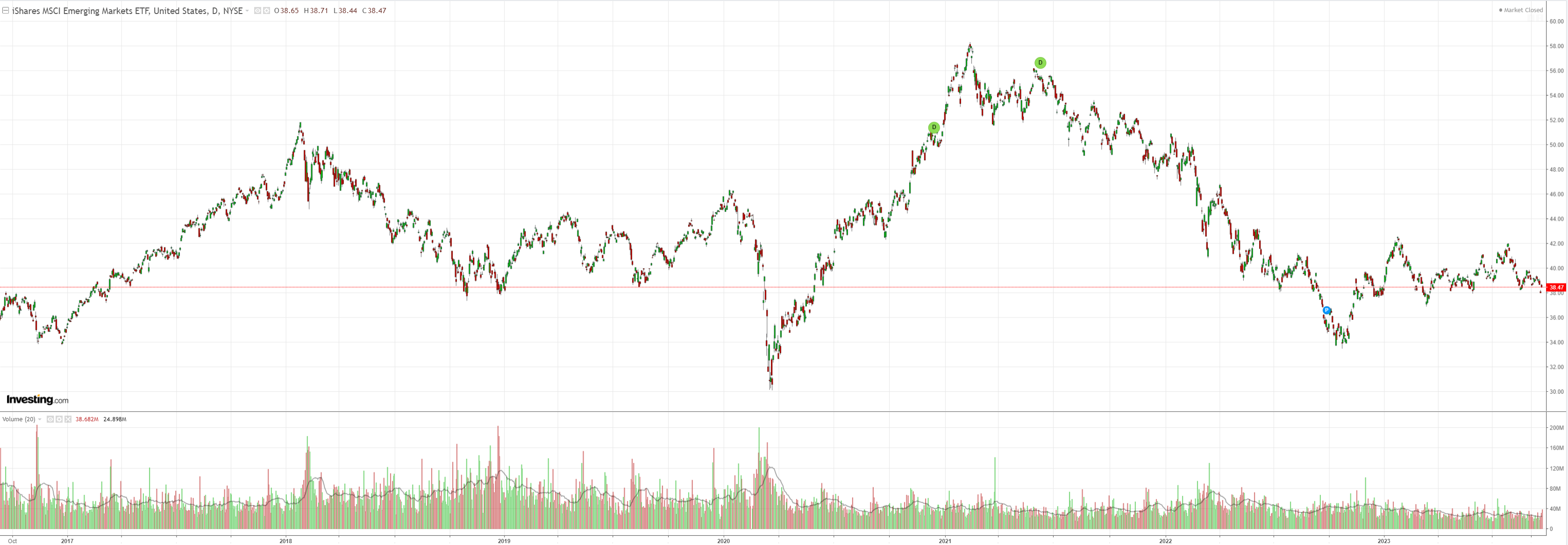

EMs stocks are trash:

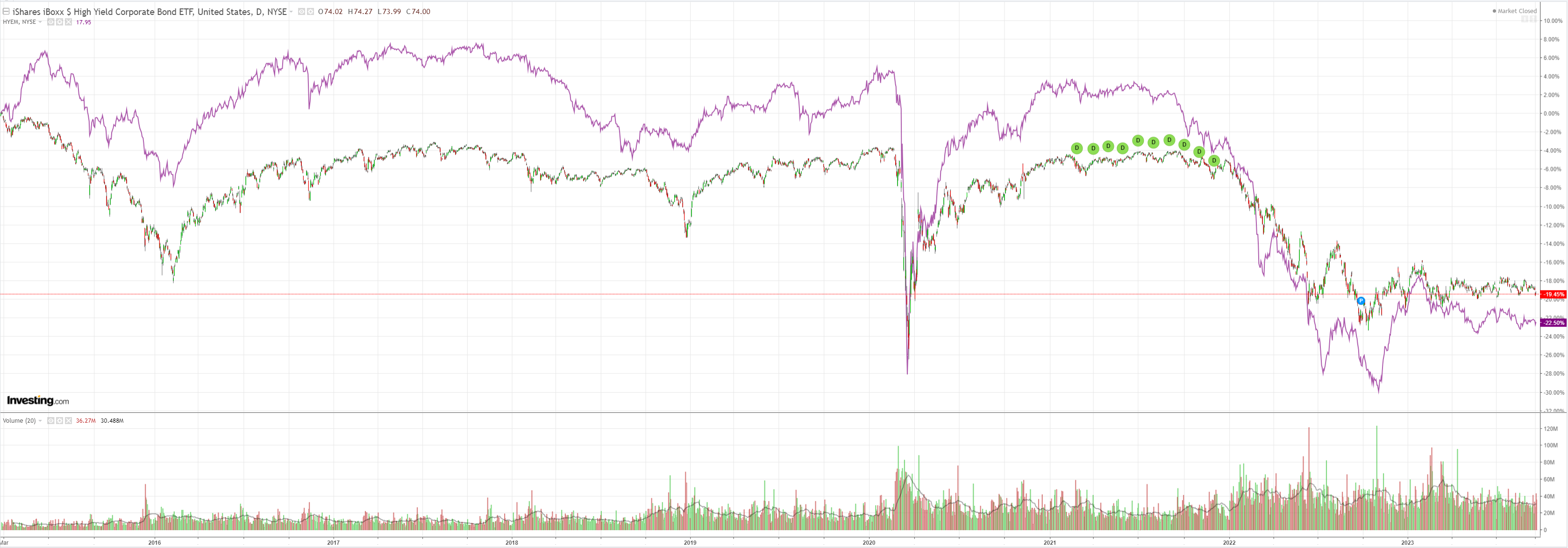

Junk firmed:

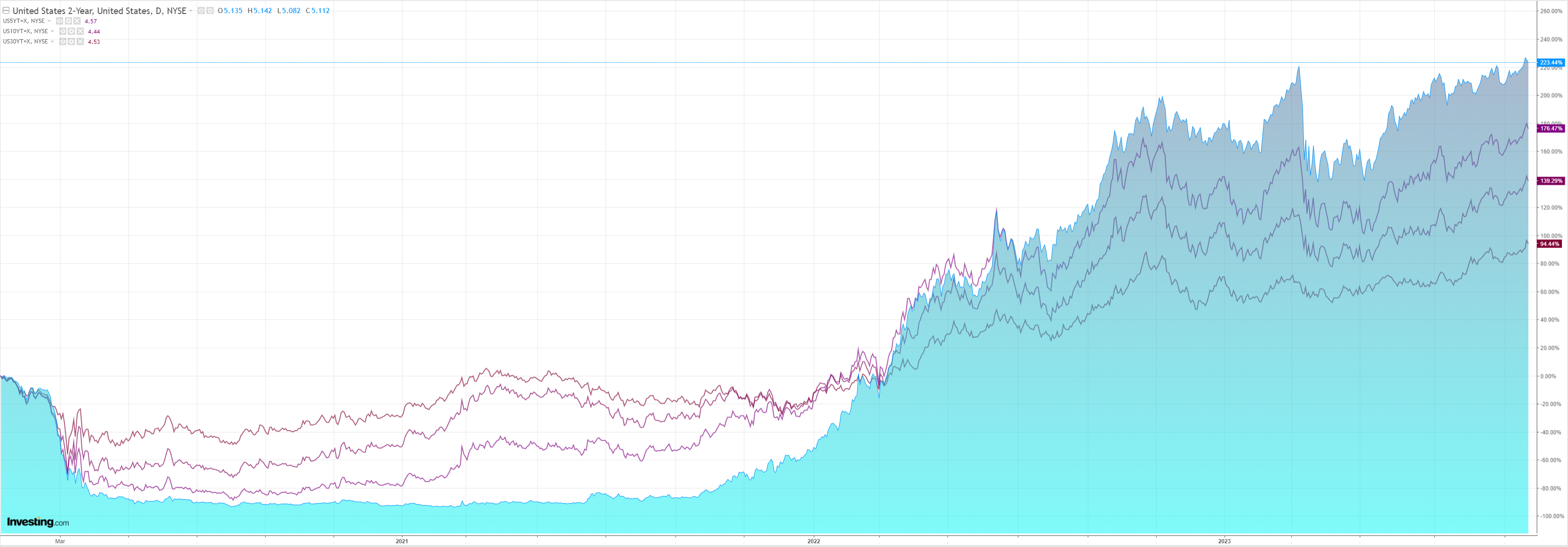

Yields eased:

But stocks know the bind they’re in with oil and the Fed now:

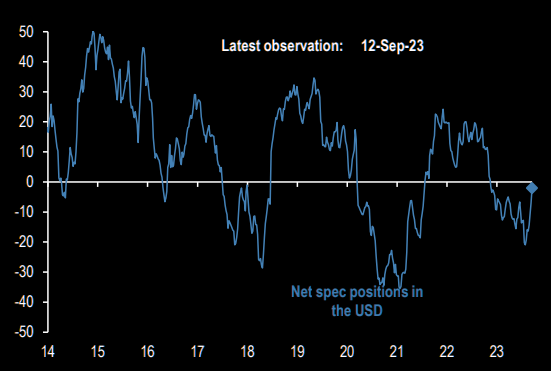

The extreme AUD short appears to be chasing my ruminations about further falls, perhaps as low as into a 4-handle. Of course, I cannot influence a market this liquid, but I am not the only one that identified the drivers. Ironically, this makes further falls in the AUD less likely.

Still, DXY continues to firm, and it now has a golden cross to get the technical machines’ excited:

Nor is the market long. Nothing like it:

Yet the outlook for DXY remains very bullish:

- Europe is still in recession with worse ahead.

- China is struggling manfully, but the property tide is still going out.

- Rising oil is DXY bullish.

- Resilient US growth has the Fed set to hike again as other major central banks stop.

Note that my original forecast for AUD with 4-handle was five years away. It was based on the notion that Chinese growth is turning Japanese while the US economy is about to launch into an AI supercycle.

I firmly believe China is stuffed, but it may take that long for it to be fully reflected in waning growth.

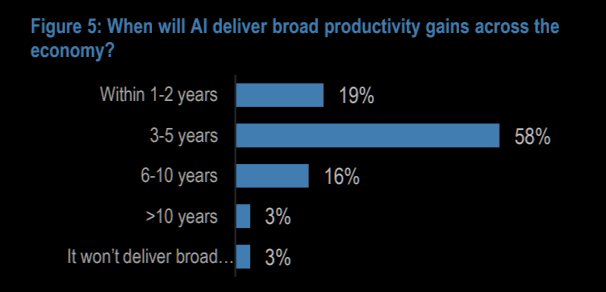

JPM research indicates a similar timetable for US artificial intelligence profits Nirvana:

The extreme AUD short will prevent it from going much lower today.