I argued last week that it has never been a worse time to buy or rent a home.

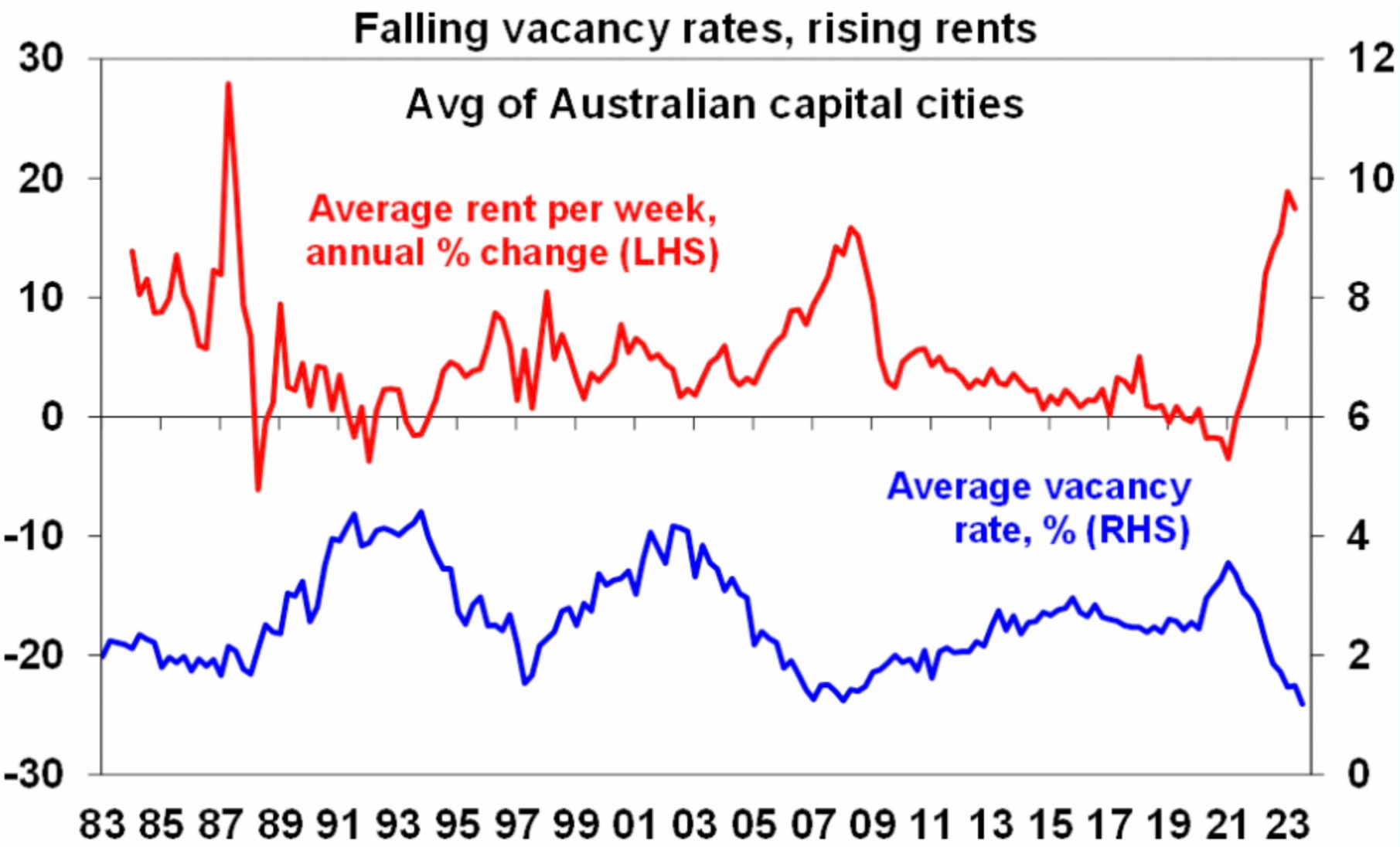

The next chart from AMP chief economist, Shane Oliver, shows that rental prices are rising at a near double-digit rate nationally amid the tightest vacancy rates on record:

Source: Shane Oliver (chief economist at AMP)

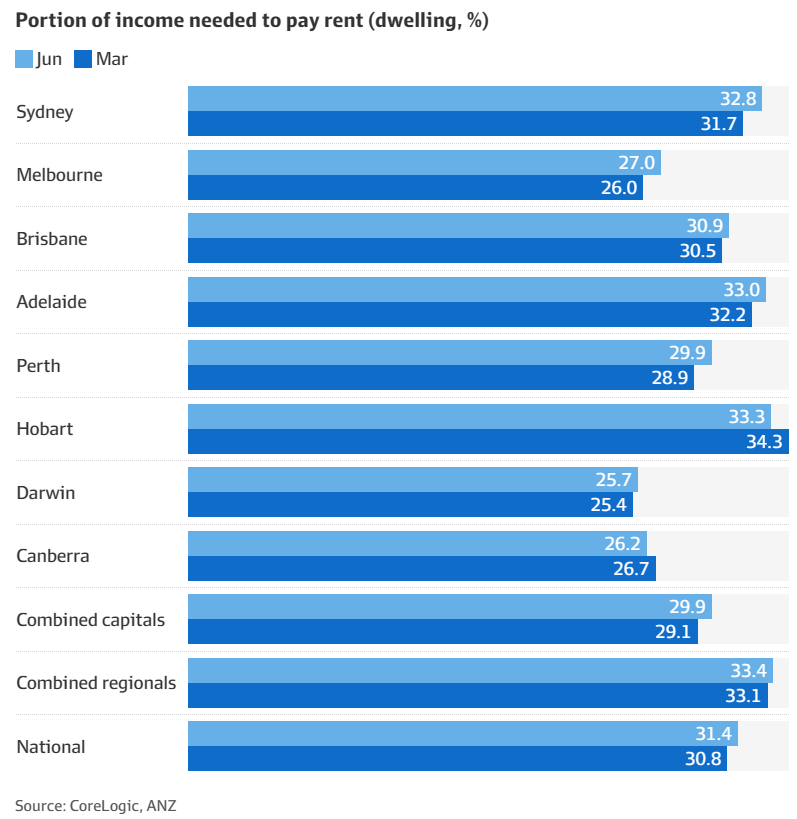

CoreLogic’s latest housing affordability report also showed that the share of household income required to rent a median prices dwelling rose to 31.4% nationally in the June quarter, up from 30.8% in March:

The news isn’t much better for people looking to buy their first house.

CoreLogic data shows that dwelling values have climbed by 4.9% nationally and by 8.8% in Sydney since the market bottomed out in February.

As a result, the time necessary to save a 20% deposit on the median priced home in Sydney has increased to 12.3 years, up from 11.8 years in the March quarter.

CoreLogic also showed that a 20% deposit on the median priced property now translates to 148% of median household income, up from 136% in the previous five years.

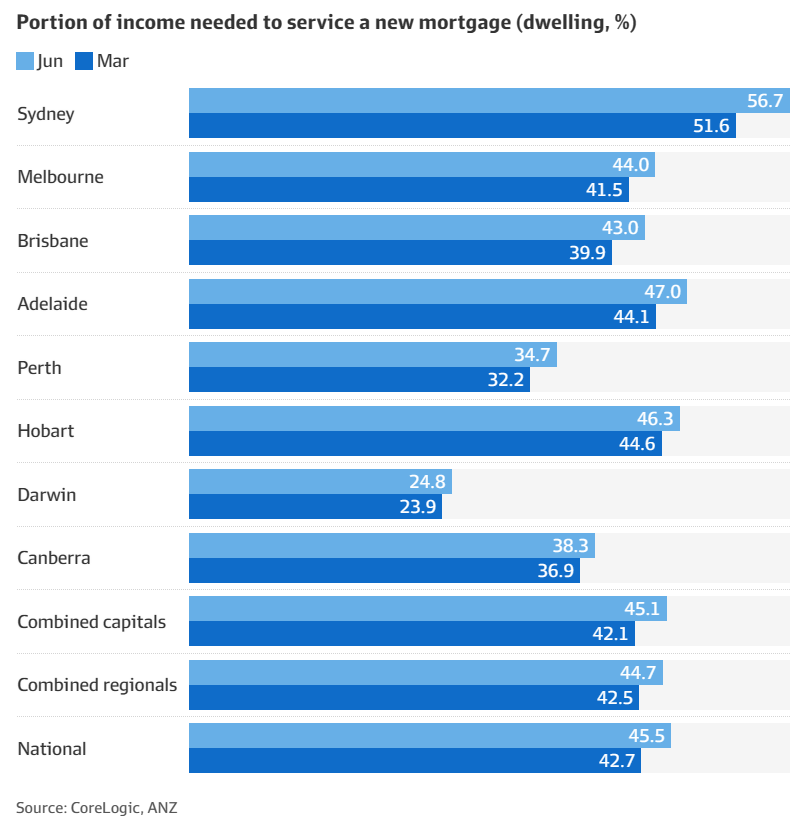

The share of household income necessary to service a mortgage has likewise grown to 45.5% overall and 56.7% in Sydney:

CoreLogic head of research, Eliza Owen, warned that housing affordability would continue to deteriorate:

“Property prices are expected to keep rising as interest rates stay on hold, and they could increase faster once interest rates start coming down next year, which means first home buyers would need to save a bigger deposit, which would take a lot longer”.

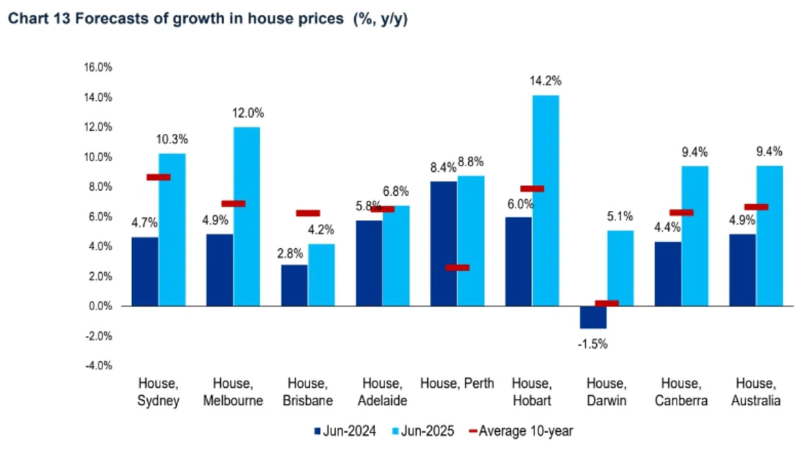

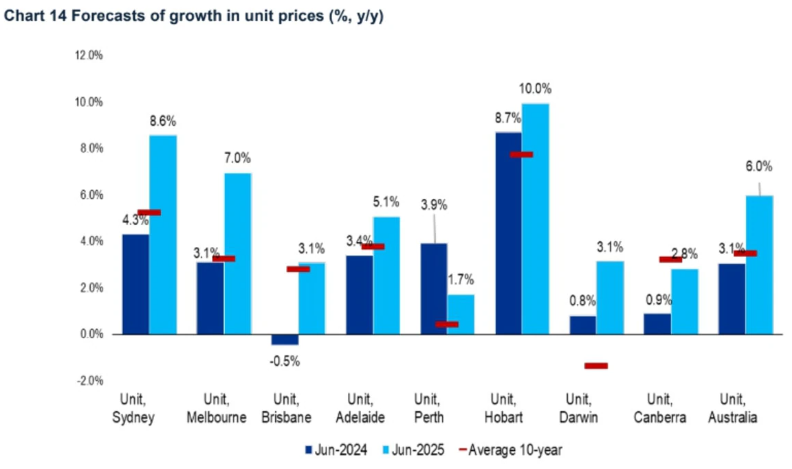

Indeed, new forecasts from KPMG tip strong property price and rental growth over the next 18 months, driven by strong levels of net overseas migration:

Source: KPMG

“Despite high interest rates, constrained supply will likely dominate the factors influencing property prices in the short term and result in continued price gains in most markets during FY24”, KPMG Chief Economist Brendan Rynne said.

“House and unit prices will then accelerate further in the next financial year as dwelling supply continues to be limited, due to scarcity of available land, falling levels of approvals and slower or more costly construction activity”.

“The supply issue will combine with several other factors to push asset prices up – higher demand due to heavier migration, anticipated rate cuts moving into financial year 2025 and potentially relaxed lending conditions”.

“Based on our projections for new dwelling completions and the Treasury’s population forecasts, we estimate that annual rent growth will be 5.6% over the next two years – which is 2.5% higher than the long-term average of 3.1%”.

“We assess that dwelling completions would have to be around 76% higher than is currently forecast for those rental costs to be pulled back to normal levels”.

“Either that or population growth from migration would have to be brought down to considerably lower levels than at present – which would mean short-term costs over-riding long-term economic benefits”, Brendan Rynne said.

Source: KPMG

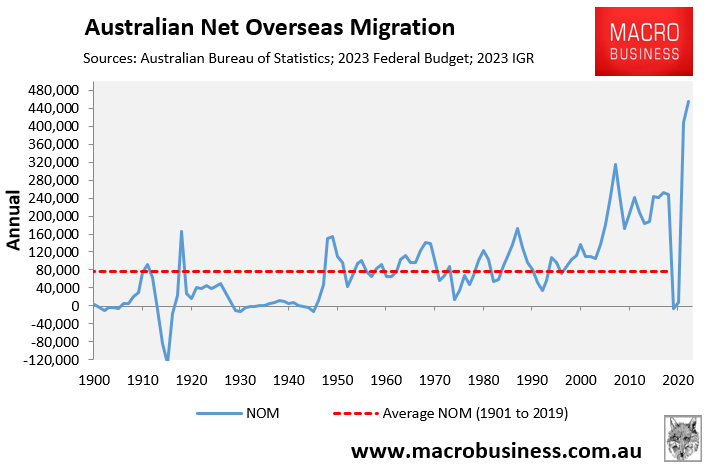

The current decline in housing affordability has been driven by the federal government’s mass immigration program, which pushed net overseas migration to an all-time high 454,300 in the year to March, driving the overall population up by 563,200:

The Albanese Government has deliberately engineered the housing shortage, which is disproportionately impacting younger and poorer people.

It’s a marvel that younger Australians aren’t rioting in the streets.