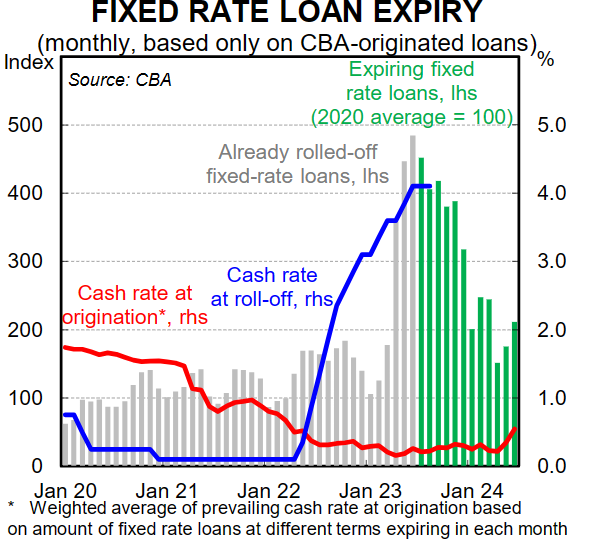

Recent estimates by CBA put the value of fixed-rate mortgages that expired in the six months to 30 June 2023 at $34 billion, with another $52 billion worth of fixed-rate mortgages expected to expire over the six months to 31 December.

As a result, Australian borrowers had only experienced around two-thirds of the 4.0% of official cash rate (OCR) hikes.

However, that number is predicted by the CBA to rise to around 85% by the end of the year as more borrowers convert their fixed-rate mortgages to variable.

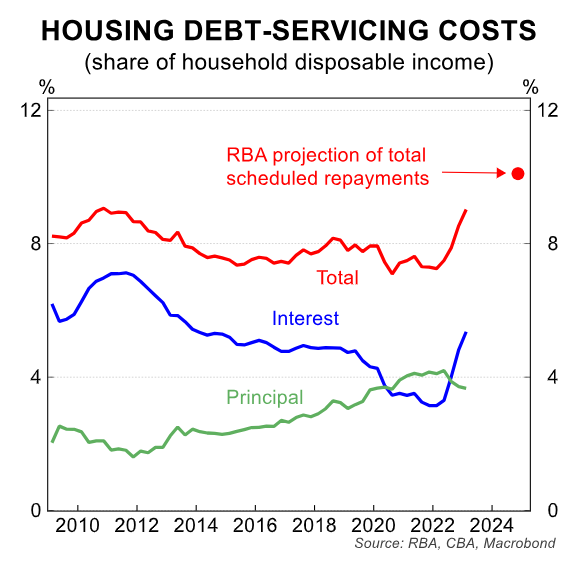

By mid-2024, once the bulk of fixed-rate mortgages have rolled-off, CBA estimates that Australian households will spend around 10% of their disposable income on debt servicing costs, which will be easily the highest amount on record:

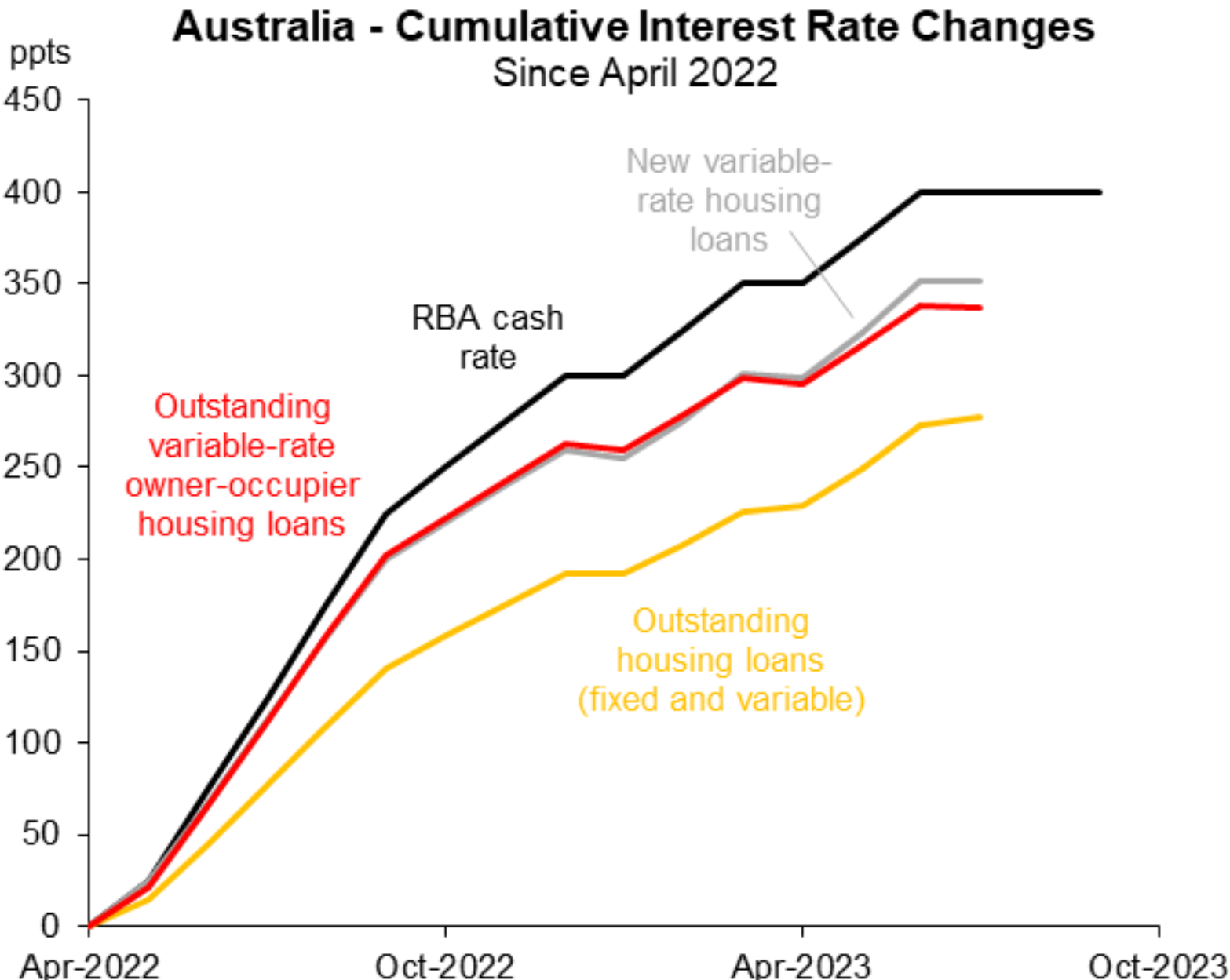

On Monday, Macquarie Group senior economist, Justin Fabo, Tweeted that the “RBA cash rate has risen 400bps, but (as at July) the weighted-average rate on outstanding variable-rate owner-occupier home loans in Australia had risen ‘just’ 337bps”.

“For all outstanding home loans, the rise was 278bps”, according to Fabo:

Source: Justin Fabo (Macquarie Group)

Therefore, average interest rates paid by Australian mortgage holders will continue to rise as fixed-rate mortgages expire.

Because of this ‘built in’ tightening, I believe the RBA most likely will not raise rates again this cycle.