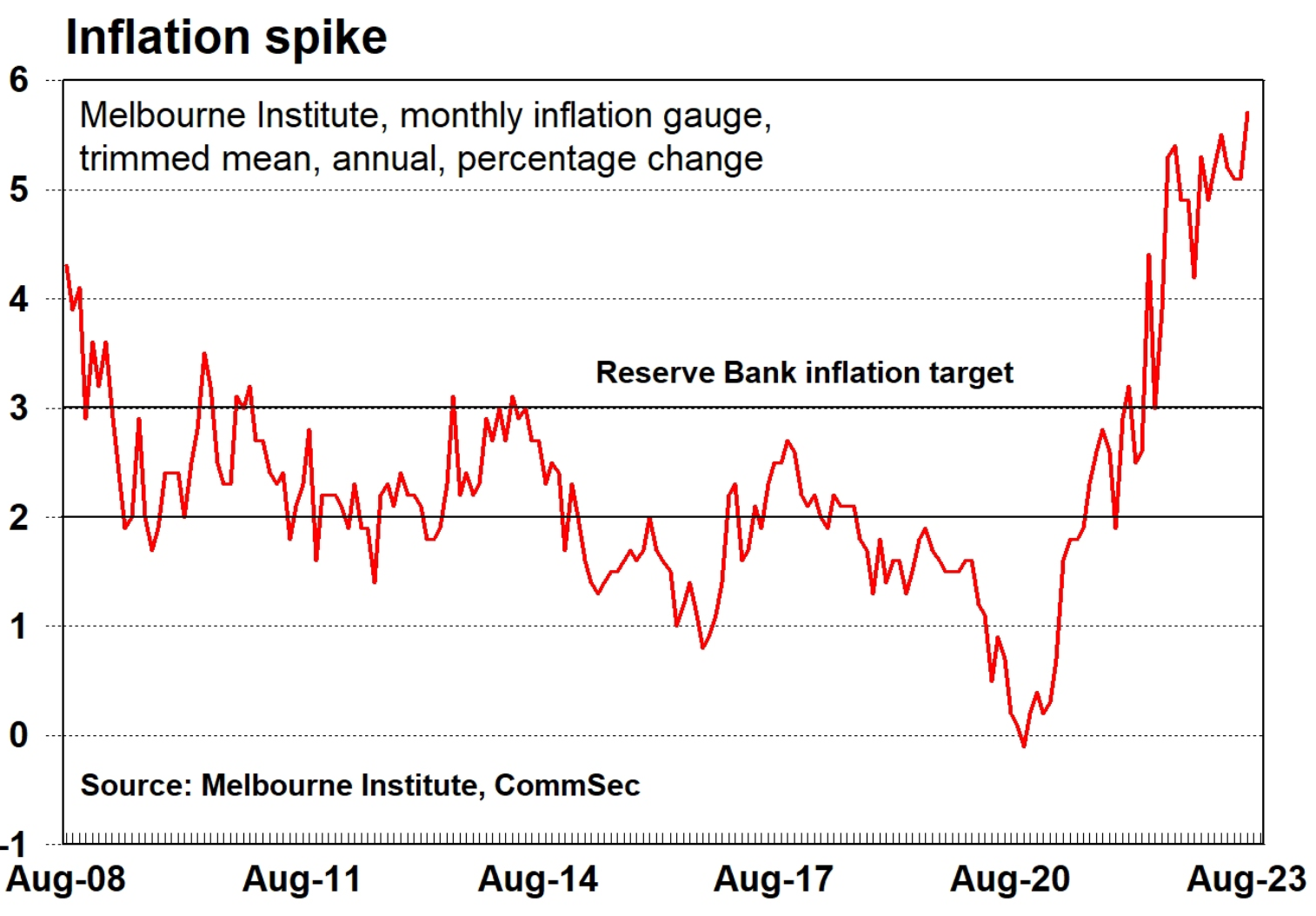

Australian inflation, as measured by the Melbourne Institute, has rebounded with the trimmed mean metric hitting a new record high for the current cycle:

The trimmed mean measure (shown above) was up 0.1% in August with the annual growth rate accelerating from 5.1% in July to 5.7% in August.

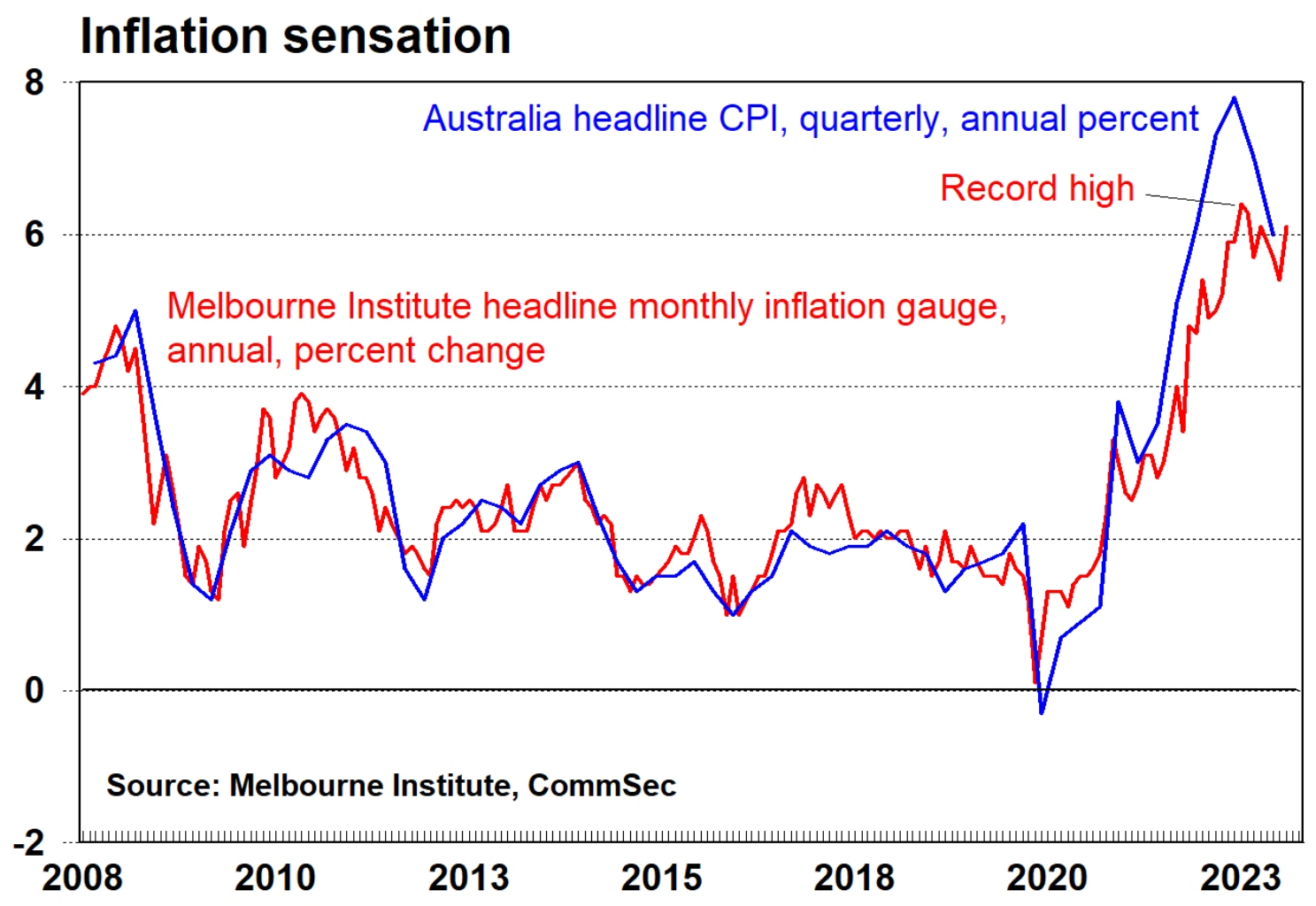

The headline Melbourne Institute inflation gauge rose by 0.2% in August to be 6.1% higher on a year ago (prior: 5.4%):

While the recent CPI Inflation data has been positive, there are still major pressure points.

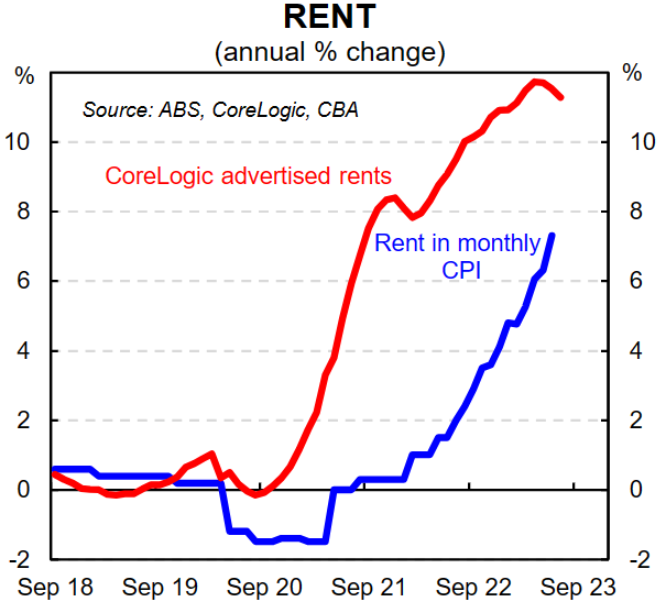

Most notably, rents as measured as part of the CPI continue to rocket as they catch-up with advertised rents:

Energy policy failures mean electricity and gas prices continue to rise at double-digit rates with the full impact of the 1 July price increases yet to be fully felt.

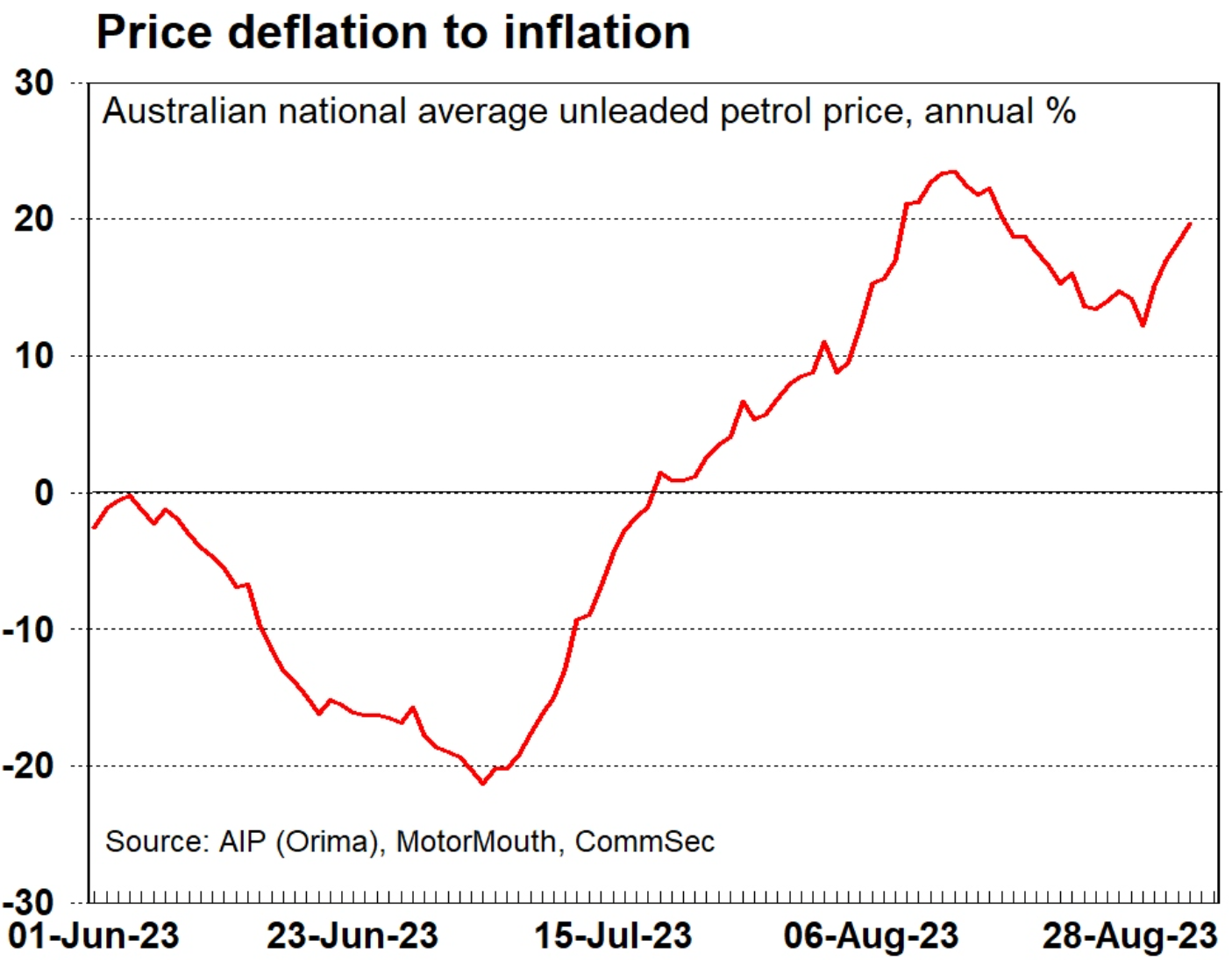

Petrol prices have also surged above $2 a litre over the past month, which will add to inflation directly and indirectly as higher costs are passed on to goods and services prices:

The sharp depreciation of the Australian dollar will also raise the price of imported goods, which should lift inflation (other things equal).

Accordingly, Australia’s inflation could remain ‘higher for longer’, meaning more interest rate rises are possible. Or at least rates will remain on hold for longer.