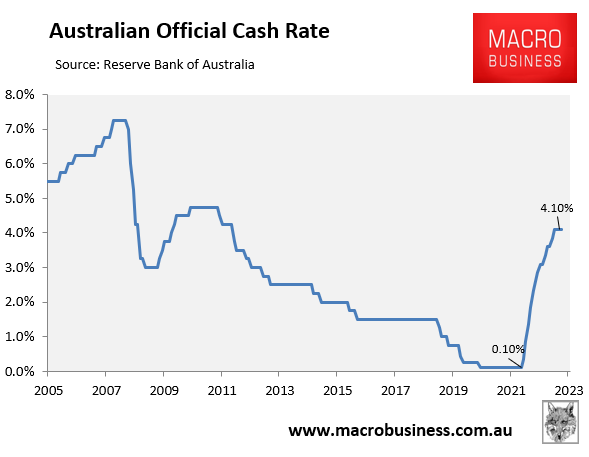

The Reserve Bank of Australia (RBA) last week decided to keep the official cash rate (OCR) at 4.10% for a third consecutive month.

This left the OCR at its highest level since April 2012, which follows the nation’s sharpest hike in interest rates in history:

The language and tone of the Board Statement were largely unchanged, with several paragraphs carried over from the August statement.

In essence, the RBA suggested that it will hold interest rates steady barring any major upside surprises in the economic data.

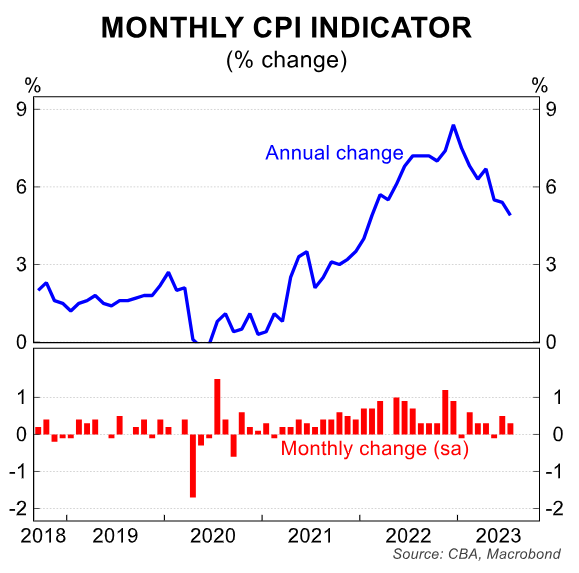

Australian inflation has fallen:

The monthly Consumer Price Index (CPI) indicator for July “showed a further decline”, according to the RBA, despite the fact that “inflation is still too high and will remain so for some time yet”.

The annual rate of CPI inflation decreased to 4.9% from 5.4% in June. This is a significant decline from the peak of 8.4% in December 2022 and the lowest annual rate of inflation since February 2022:

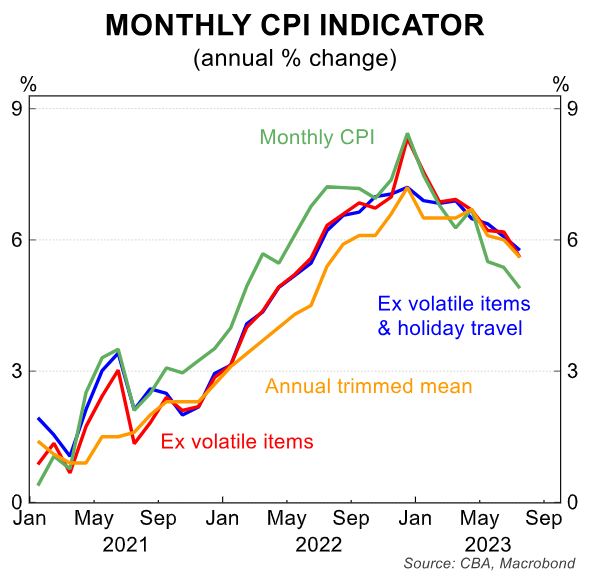

Underlying inflation rate was falling more gradually, however.

CPI excluding volatile items was noticeably higher than the headline measure, with annual inflation falling to 5.8% in July from 6.1% in June.

Moreover, annual trimmed mean inflation just marginally decreased from June’s 6.0% to 5.6% in July.

But inflation risks remain:

Although the inflation data has been largely favourable, there are still pressure points that might lead the RBA to raise rates again or, more likely, keep them unchanged for a considerable amount of time.

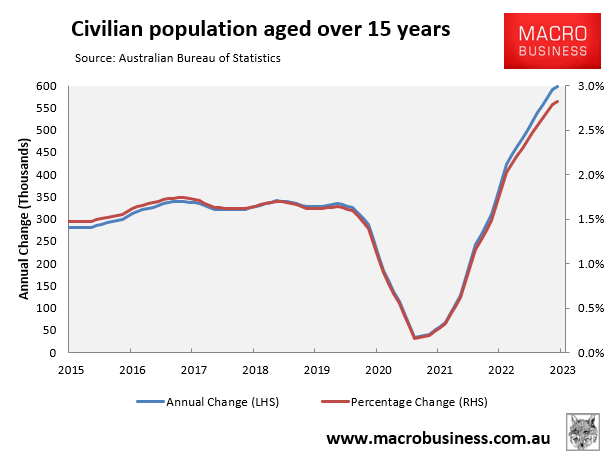

First, the record immigration program of the Albanese Government increased Australia’s civilian population of people over 15 by a record 598,000 in the year to July, or by 2.8%:

That rate of labour supply growth is roughly twice as fast as the years prior to the pandemic, when the population aged 15 and over increased by around 300,000 each year.

The strong rise in labour supply (immigration) has reduced wage growth and raised the unemployment rate, but it has also pushed up property rents, which comprises around 6% of the CPI basket.

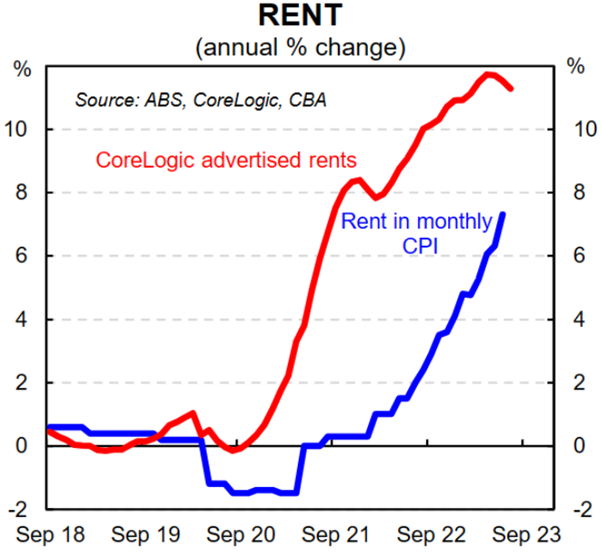

As shown below, the CPI measure of overall rents is still rising as they catch up to advertised rents:

Outgoing RBA Governor Phil Lowe recently cautioned that residential rental growth would likely hit a three-decade high of 10%, which will continue to fuel inflation.

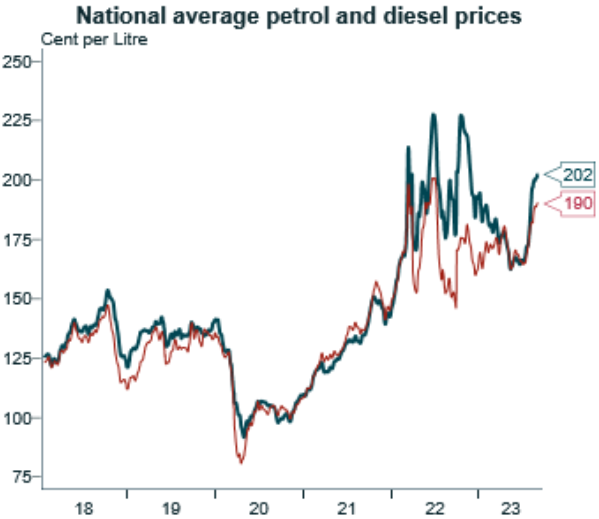

Second, across the major cities, the cost of petrol recently increased to sround $2 per litre:

Source: Alex Joiner (IFM Investors)

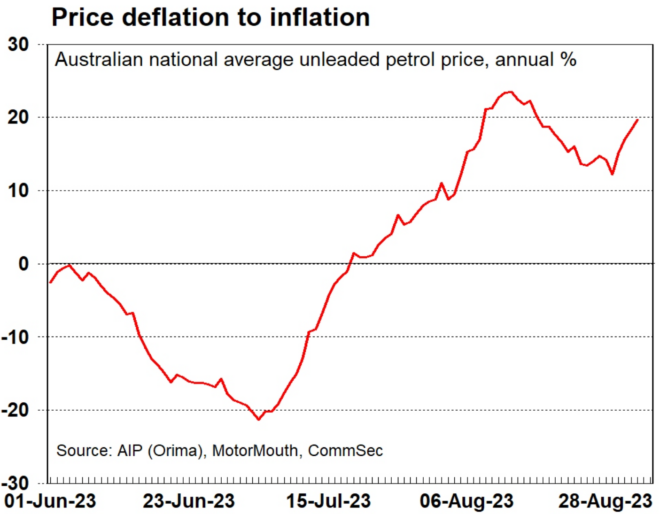

The next chart illustrates the current state of petrol prices, which are growing at a rate of around 20% annually after falling by a rate of 21% in early July:

If the rise in petrol prices continues, it will be more difficult to bring inflation back to the target range of 2% to 3%.

Finally, and related to the previous point, the Australian dollar has dropped significantly and is currently trading at about US$0.64.

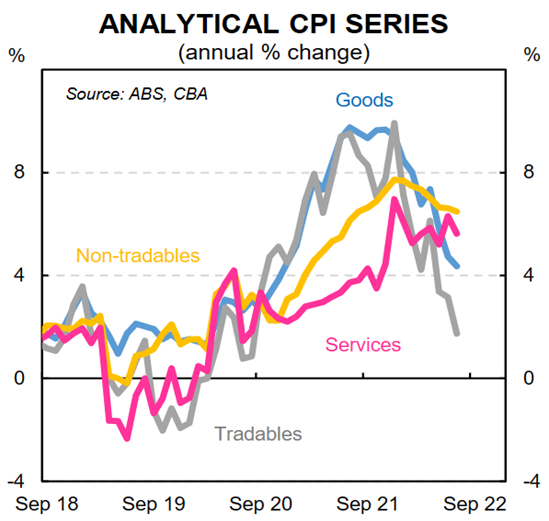

The dramatic reduction in tradable inflation, which is depicted in the following chart, is what has caused the monthly CPI to fall:

The lower Australian dollar will increase the cost of imported goods (other things equal), which risks keeping inflation higher for longer, forcing the RBA to maintain a tightening bias.

Rates will hopefully still remain on hold:

The RBA has decided to adopt a “wait and see” strategy with regards to interest rates.

It has suggested that rates will remain on hold unless there are upside surprises in the economic data.

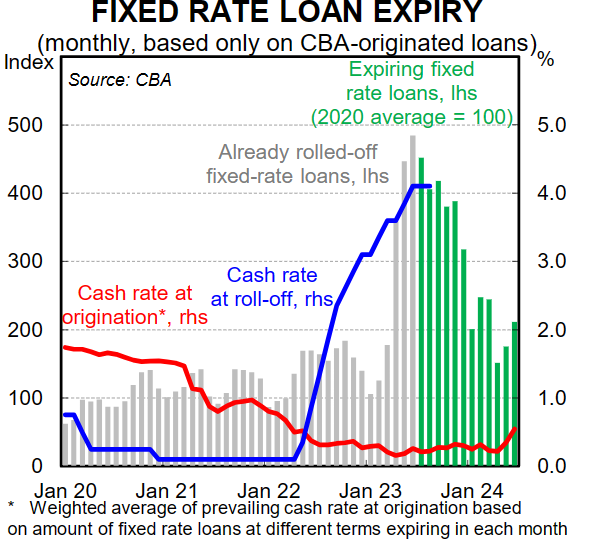

This is the right course of action since there are still large numbers of fixed rate mortgages that have not yet been converted to variable rates, leaving a significant degree of monetary tightening “built in” to the system:

According to recent estimates from CBA, $34 billion worth of fixed-rate mortgages expired over the six months to June 2023, with a further $52 billion expiring in the 6 months to December 2023.

As a result, only two-thirds of the current OCR increase has been felt by borrowers, but this will rise to around 85% by year’s end as more fixed rate mortgages transition to variable.

The RBA is, therefore, unlikely to hike rates again this cycle as a result of this ‘built in’ tightening.

However, the sharp increase in petrol prices, the decline in the Australian dollar, and the ongoing rise in property rents implies that inflation will continue to be “sticky” and that the OCR will stay on hold for prolonged period of time.