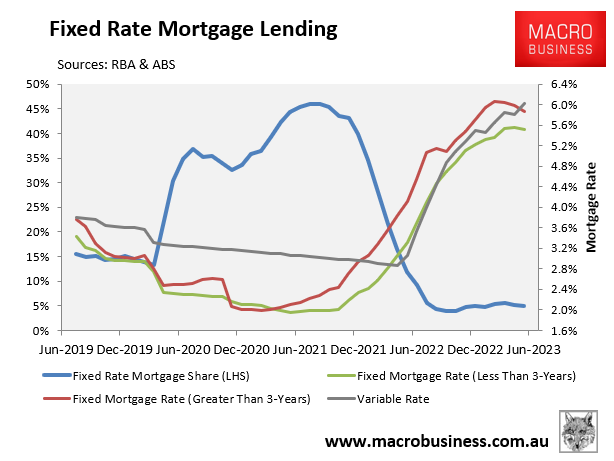

There was an abnormally high share of mortgages originated at fixed rates over the pandemic, as illustrated in the next chart:

The share of mortgages originated at fixed rates shot up from a historical average of around 15% of the total to an average of around 40% during the pandemic.

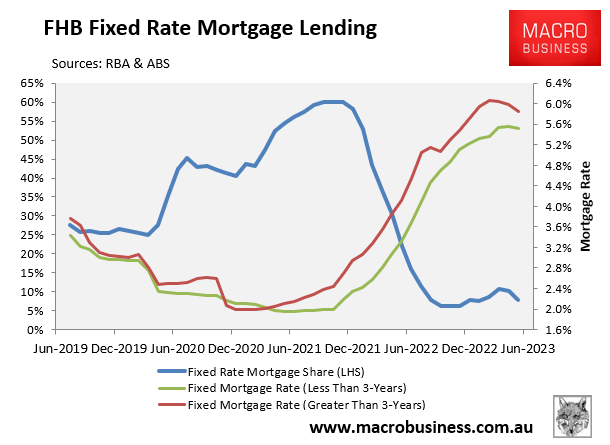

The share was even higher for first homes buyers (FHB), where the proportion of mortgages originated at fixed rates hit a peak of around 60% over the pandemic:

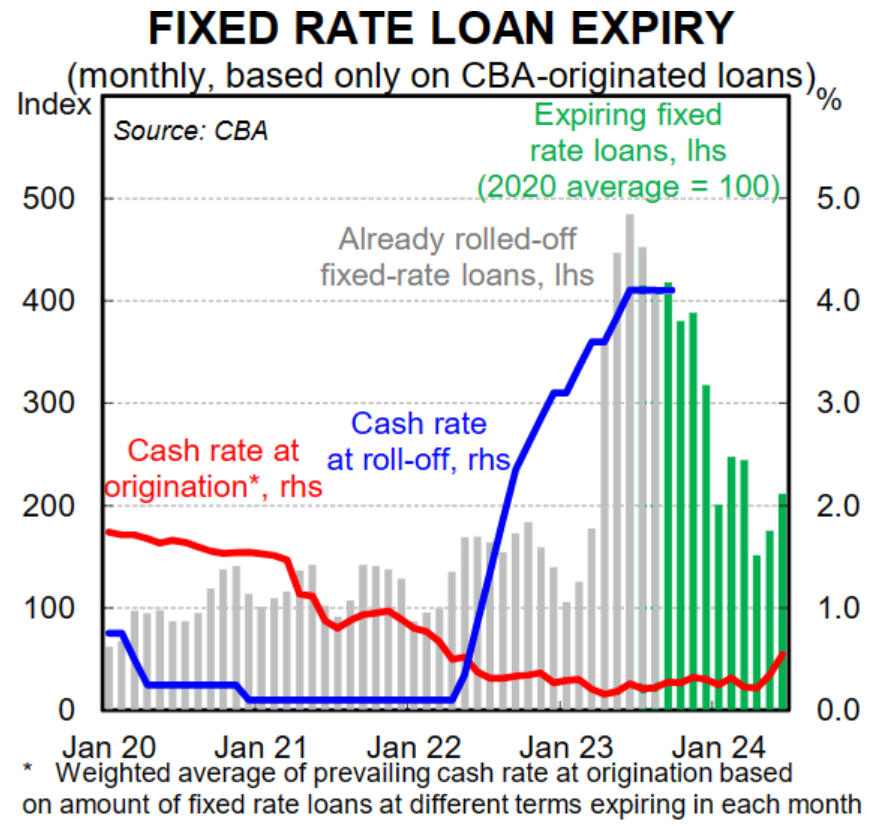

2023 has seen huge volumes of cheap 2% fixed rate mortgages expire and transfer to variable rates of around 6% or more:

CBA estimates that $34 billion worth of fixed-rate mortgages expired in the six months to 30 June 2023, while another $52 billion worth are forecast to expire over the six months to 31 December.

Because of the abnormally high share of borrowers on cheap fixed rates, CBA recently estimated that only around two-thirds of the 4.0% of RBA rate hikes had been felt by borrowers.

But that number is expected to rise to around 85% by the end of this year as more borrowers convert variable rates.

Not surprisingly, the spike in fixed rate mortgage expiries is bringing with it a bounce in distressed listings across mortgage belt suburbs:

During August, the number of distressed listings nearly doubled in certain heavily mortgaged districts, including as Blacktown in Sydney’s west, Domain data shows.

One out of every seven homes offered for sale in the Blacktown district were selling in distressed conditions, a significant increase from a year before when only 8.7% were.

The proportion of distressed listings remained high in a number of Gold Coast locations, including Mudgeeraba, Nerang, and Southport, where more than one out of every ten houses sold under duress.

“We’re starting to see a spike of distressed listings in the mortgage belt districts, particularly those in Sydney. I think they are the most vulnerable in terms of higher distressed listings because you have to be highly leveraged to gain access to that market”, Domain chief of research and economics Nicola Powell said.

“These are areas where people have really stretched themselves to buy a home”.

These numbers should obviously rise as more fixed rate mortgages roll off.

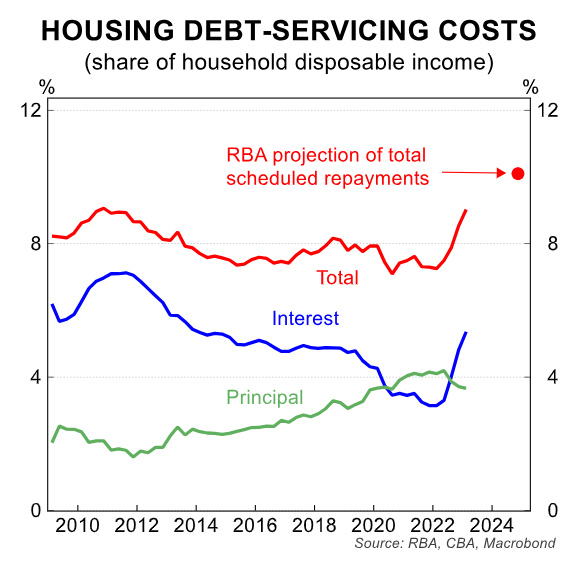

Once the bulk of these pandemic fixed-rate mortgages have expired, CBA estimates that households will spend around 10% of their disposable income on debt servicing costs in aggregate, easily the highest share on record:

While these certain mortgage belt suburbs will be heavily impacted, the broader market can take comfort in the fact that distressed sales have not spiked across the broader market.