DXY is still powering:

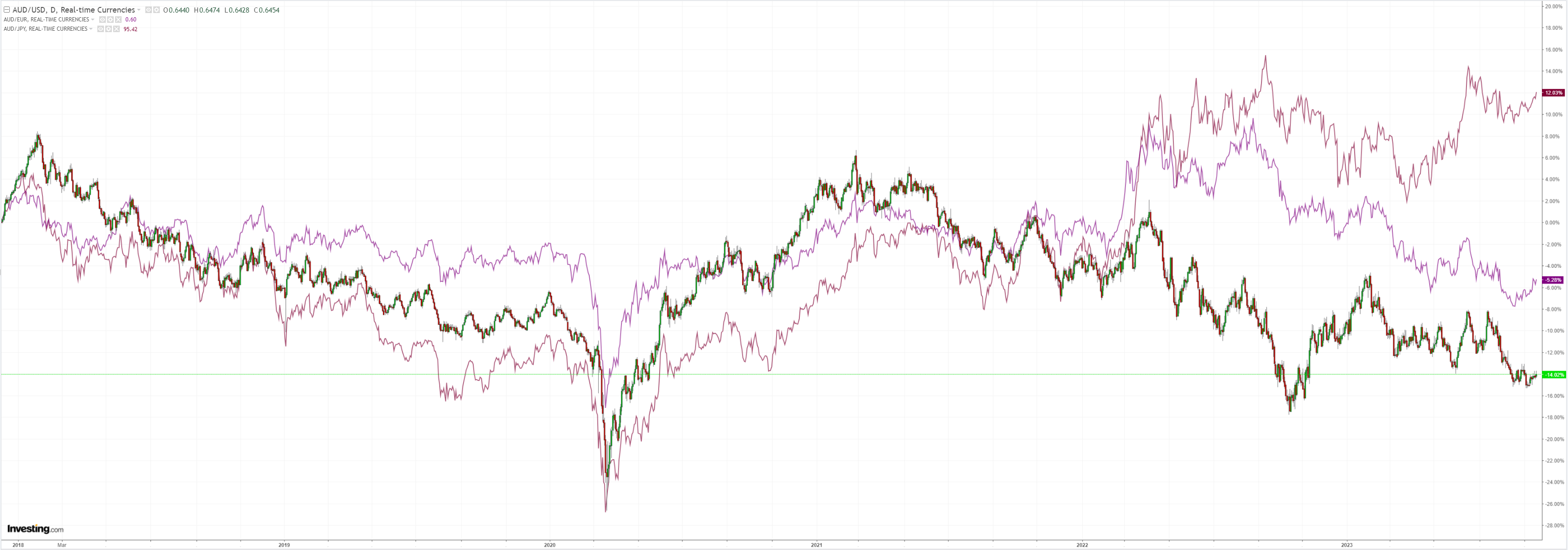

AUD is firming anyway:

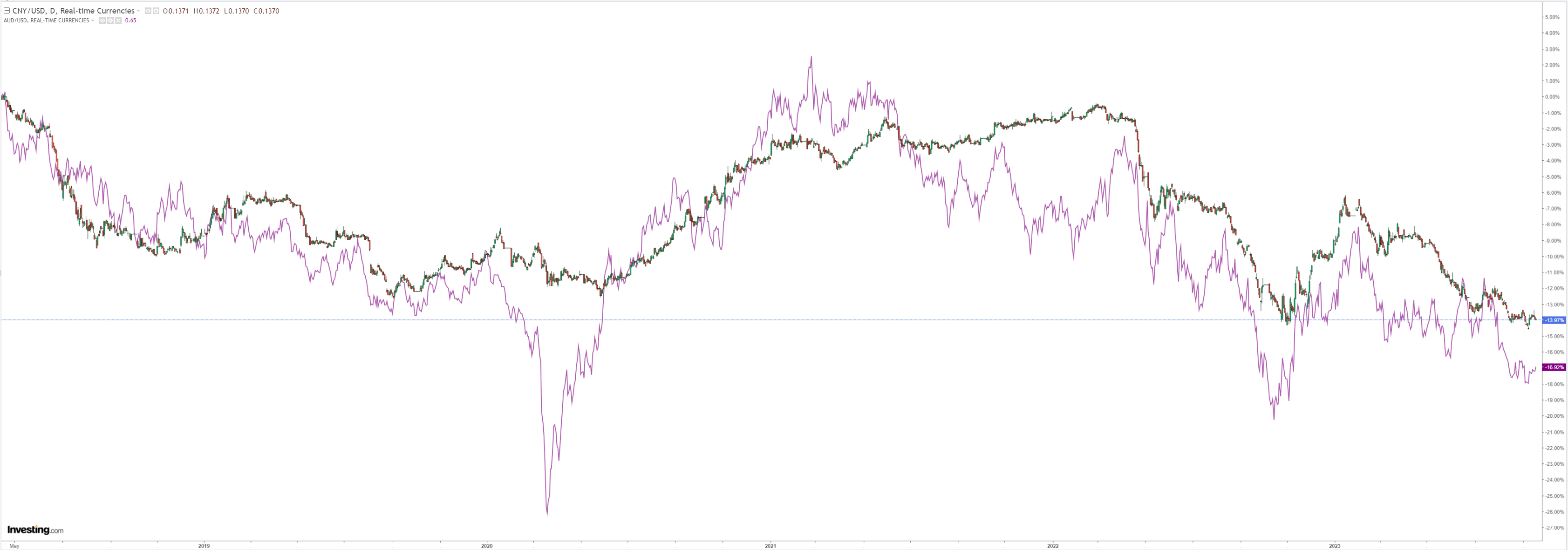

CNY only goes down:

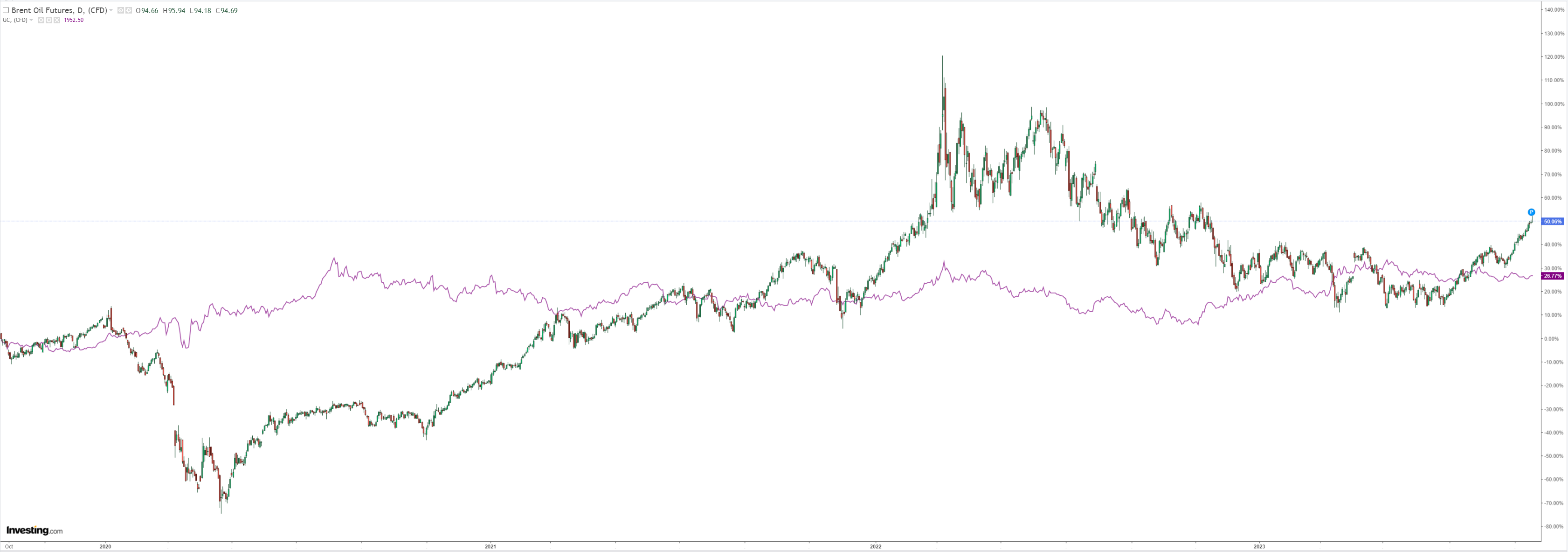

Oil only goes up:

Dirt yawn:

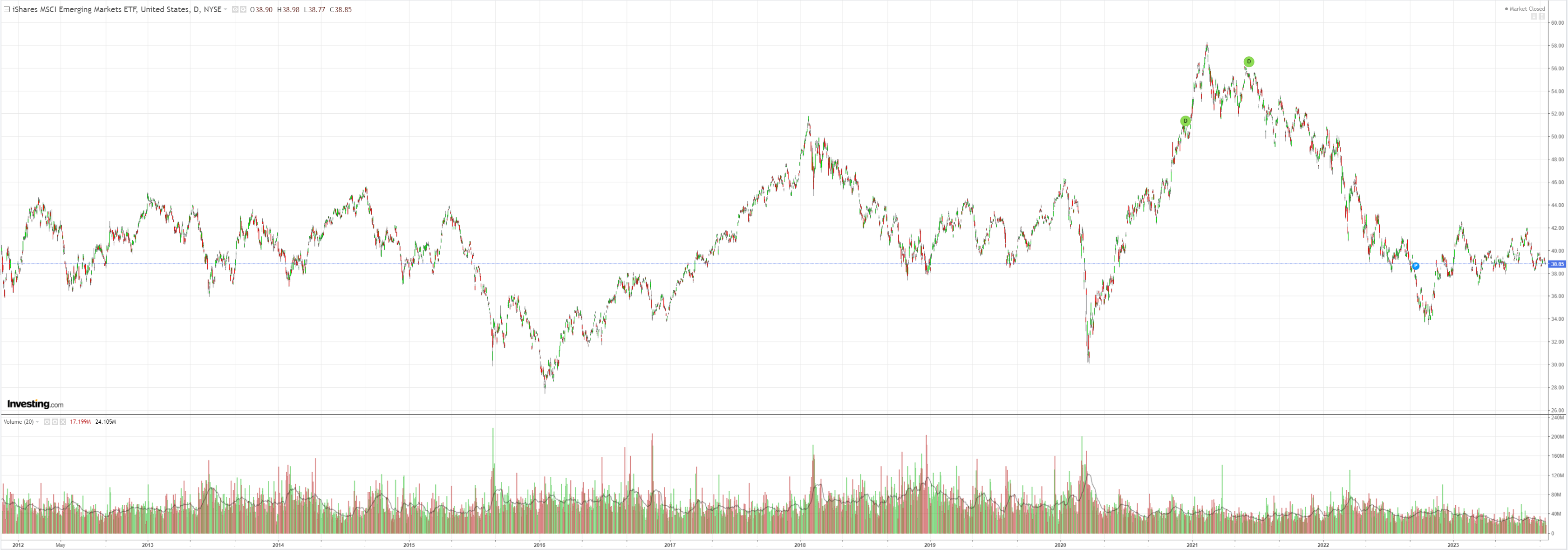

EM yawn:

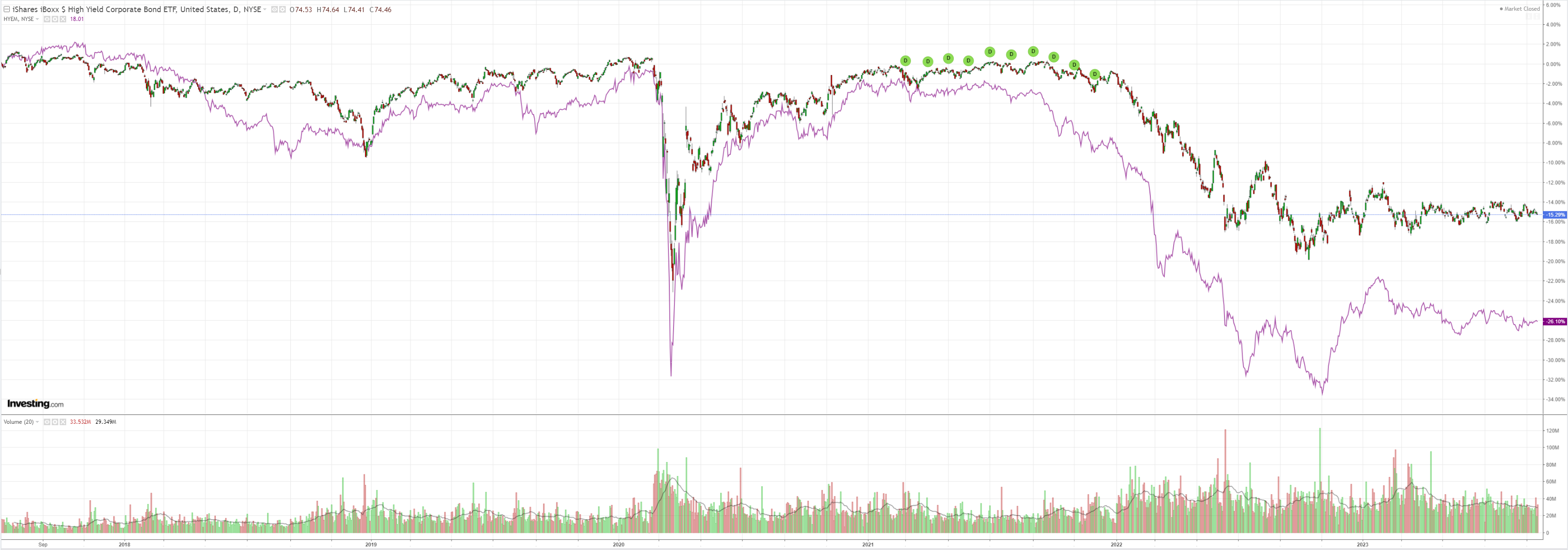

Junk yawn:

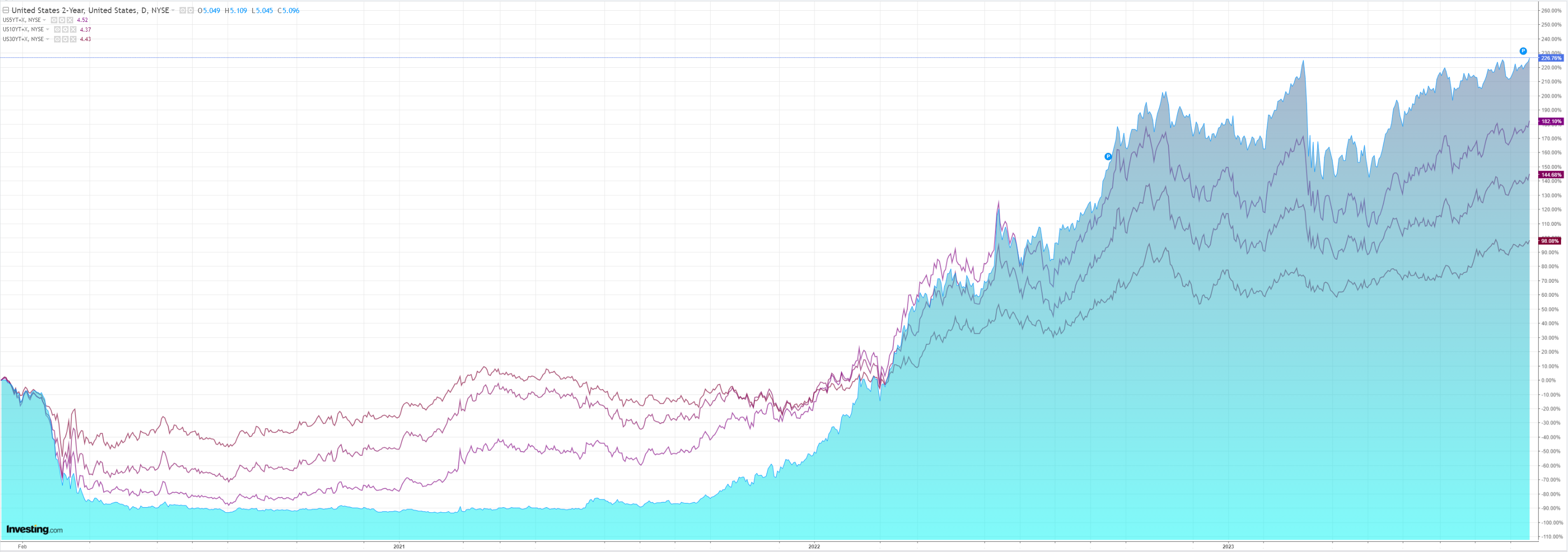

Yields know oil:

Stocks can’t hold if oil runs on:

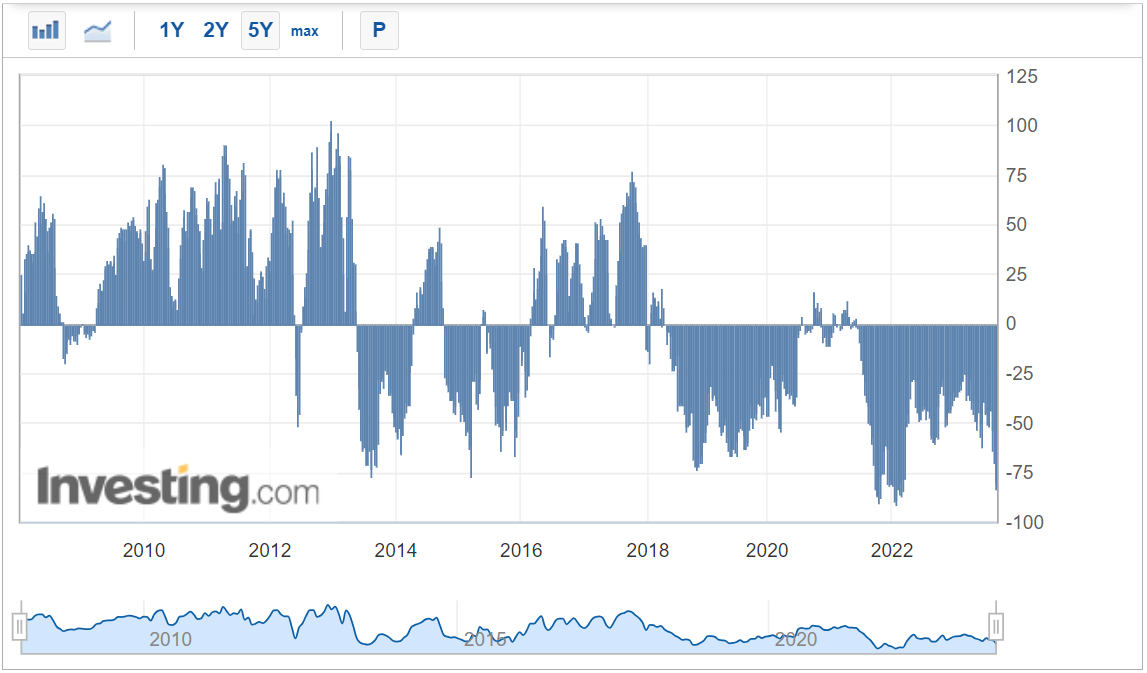

AUD is massively oversold on CFTC:

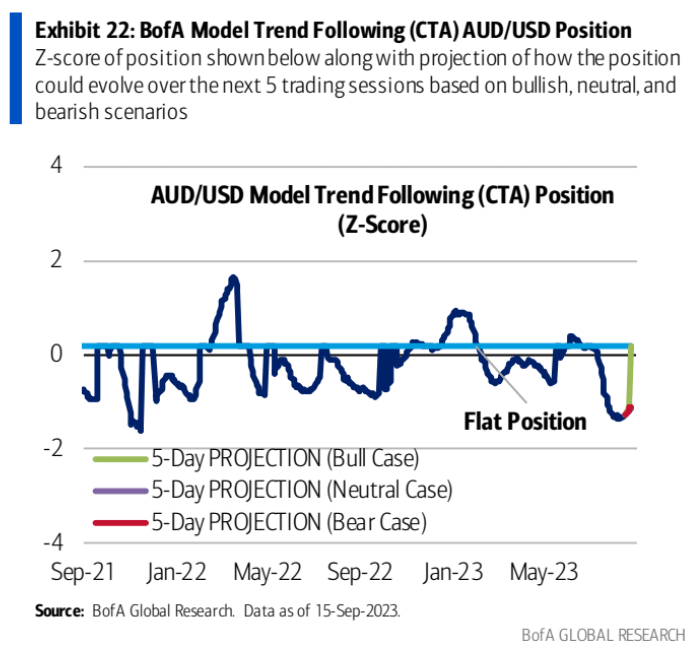

CTAs likewise:

Credit Agricole has triggered a positional long, though it does not have a great recent record:

Our positioning model G10 FX PIX 2.0 signals that the EUR and AUD are oversold. Subsequently, we have entered long positions in EUR/USD and AUD/USD with a target of +3% and a stop-loss of -1.5%.

The model is down-4.3% with a hit ratio of 42% over the past 12months.

There is an argument that AUD could run higher with oil. So far, coal, LNG and iron ore have run with it. Though more out of positioning sympathy than fundamentals.

Perhaps this is enough to help AUD work off its oversold positioning.

That said, I’m still a seller of any rallies.