CBA has upgraded its house price forecasts due to the unprecedented surge in immigration and ongoing supply shortages. Details below.

The house price outlook

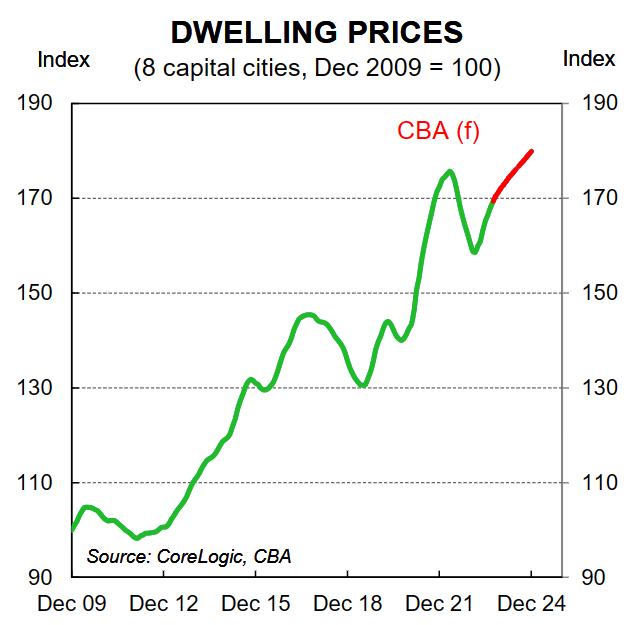

In May; we forecast national home prices to rise by 3% in 2023 and a further 5% in 2024.

The pace of gains since then have exceeded our expectations. The lack of new listings on the market, tight rental markets and strong population growth have pushed up prices more than expected.

As a result, our May forecast has already been met this year. Gains in calendar 2023 to August sit at 4.7%.

Given the current momentum in the market we revised up our estimate for home prices gains in 2023 to 7% last week.

We still expect a 5% gain in 2024. This increase would take home prices 2.3% above the last peak reached in April 2022, before a 10% peak to trough fall occurred as the RBA began to lift interest rates.

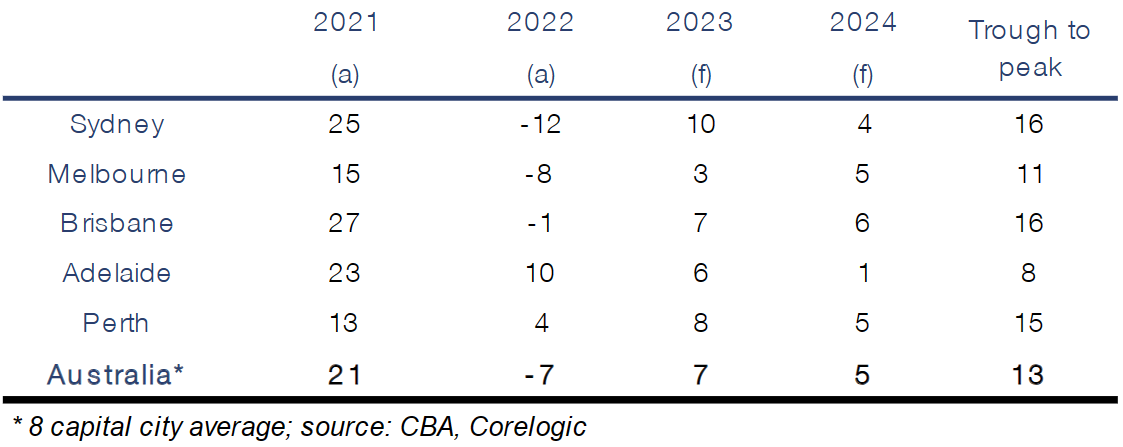

The table below shows the outcomes by state. We expect the largest gains in Sydney, Brisbane and Perth. And more modest gains in Adelaide and Melbourne.

Much of the driver of home prices from here will be driven by the level of supply.

As we noted above, new listings and total advertised stock remain below average levels.

We could see a lift in supply over the normal spring selling season which could slow the pace of monthly gains. However there is considerable uncertainty around this.

A lift in listings requires people to sell, normally this would be either through upgraders, or investors looking at moving on. Challenges around refinancing given the level of interest rates could make this harder also.

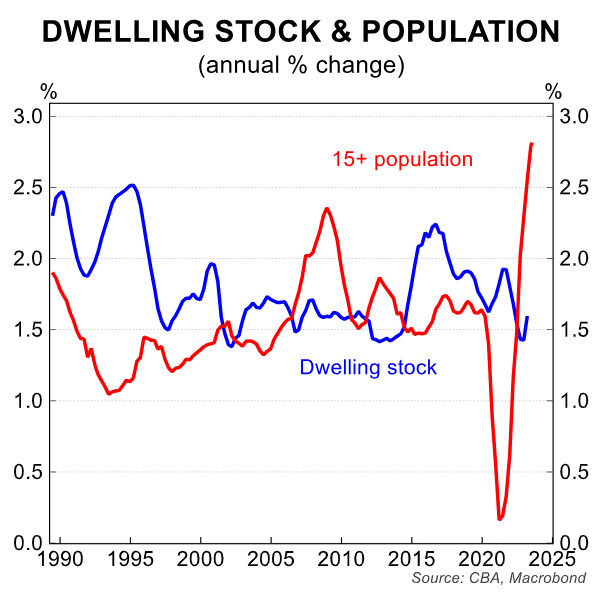

At the same time, a lack of supply of housing for both renting and owning is contributing to very low vacancy rates at a time when population growth is high.

We see the outcome being this continued lift in prices to buy and prices to rent.

Leaning against this trend though is a behavioural response to high rents and low vacancy rates.

We have seen a lift in household formation rates, with people moving back to share houses and living together. The number of people per home has risen.

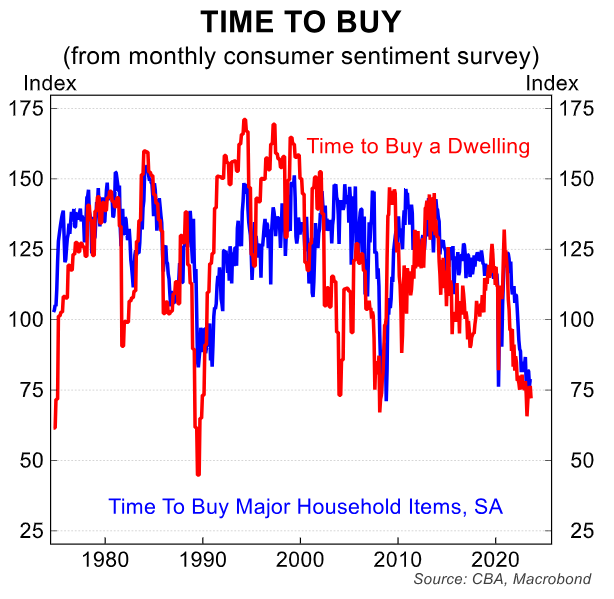

Also sentiment readings on time to buy a dwelling have been falling, particularly in Sydney.