Preliminary auction data from CoreLogic shows that Sydney’s residential clearance rate rose to 76.8% in the week to Saturday, with 937 homes offered for sale across the week – the second busiest weekend of auctions this year.

The preliminary clearance rate in Melbourne rose to 75.7%, with 989 auctions scheduled for the week.

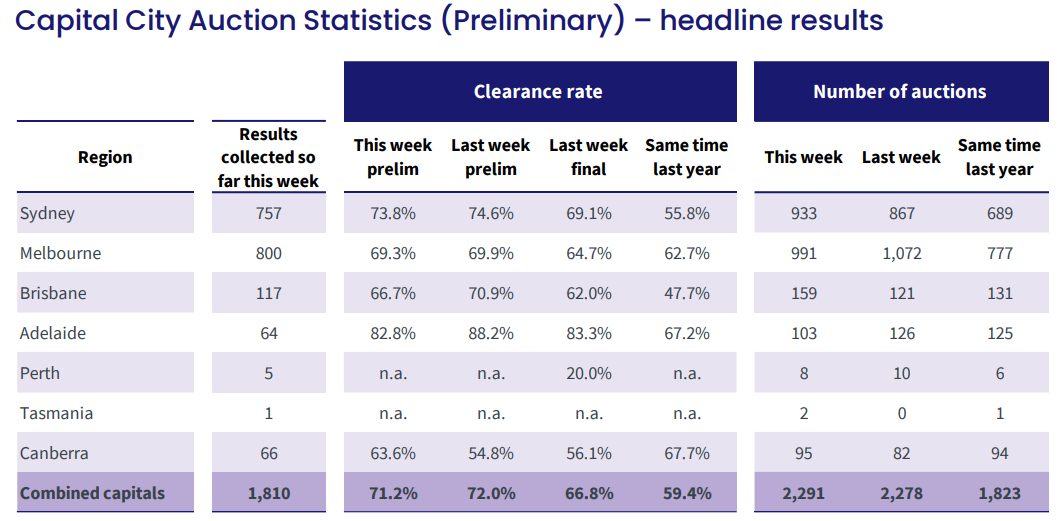

The national preliminary clearance rate eased to 71.2%, with almost 2,300 scheduled auctions.

Source: CoreLogic

SQM Research MD Louis Christopher says it was the strongest start to a spring selling season since 2019, prior to the COVID-19 pandemic.

“It’s by far the strongest start in terms of auction activity since 2019. Confidence is recovering with listings”, Christopher said.

“During 2022, people were quite reluctant to list during the downturn, but the pick-up in buyer demand has meant the spring selling season vendors have come out more confident”.

Ray White chief economist Nerida Conisbee said that record immigration alongside acute rental shortages has driven up buyer demand:

“We didn’t necessarily expect that the level of bidding activity would be as high as it was and that properties would sell so easily, because financing is still really expensive”, she said.

Conisbee added that the strong bidding activity suggested that population growth via immigration, housing shortages and rising rents meant there were higher-than-normal numbers of people trying to leave the rental market.

“There just seems to be a whole variety of influences, which is leading to much higher demand than we would have expected”, she said.

Meanwhile, in his weekend wrap, prominent Sydney real estate agent and auctioneer, Tom Panos, suggested that “panic buying” is behind the strong buyer demand:

“What’s really interesting is the amount of buyers I notice who are panicking to buy a property before the bank takes away the loan that they’ve approved”.

“Because I think some people get 90-day approvals so that’s why they’re buying”.

One can only imagine what will happen if the RBA commences an interest-rate cutting cycle.

The associated reduction in mortgage repayments and increased borrowing capacity should drive demand and prices higher.