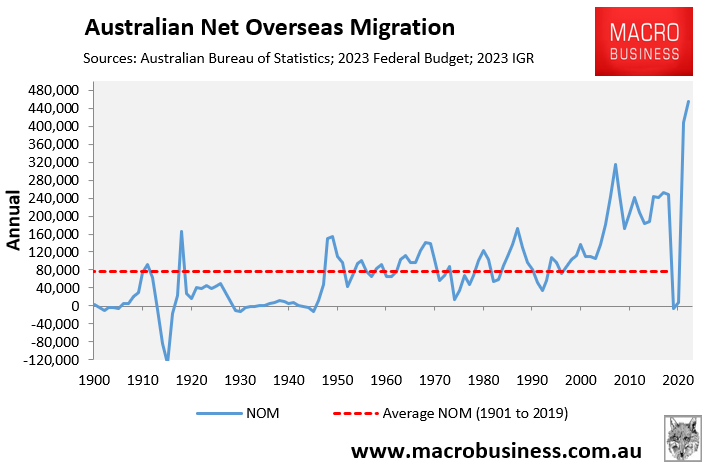

Jarden chief economist, Carlos Cacho, is the latest economist to warn that the Albanese Government’s unprecedented immigration program is directly driving up inflation and making the Reserve Bank of Australia’s (RBA) job much harder:

“The real challenge for the fiscal side is the record migration and very strong population growth”, Jarden told The Australian.

“There’s a clear need to invest more in infrastructure and housing. I don’t know what the right answer is, but the fiscal stance at the moment is not helping the RBA”.

The right answer is actually pretty obvious: moderate immigration flows to a level that is commensurate with the nation’s ability to supply housing, infrastructure and business investment, while also being compatible with environmental carrying capacity.

Anybody that is not a vested interest can see that current immigration levels are running well ahead of the supply-side of the economy.

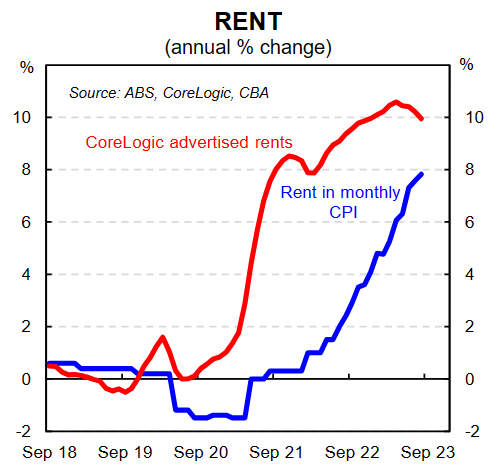

In turn, we are seeing residential rents, (the single biggest driver of inflation) surge into the stratosphere:

We are also seeing productivity growth collapse as the massive influx of people drives “capital shallowing”, which occurs when the capital stock per worker shrinks.

In a recent note, AMP chief economist, Shane Oliver, explained the productivity destroying impact of Australia’s mass immigration program:

“Very strong population growth with an inadequate infrastructure and housing supply response has led to urban congestion and poor housing affordability which contribute to poor productivity growth”.

Ross Gittins made similar observations this week:

“Every extra person dilutes our existing per-person investment in business equipment and structures, housing stock and public infrastructure: schools, hospitals, police stations, roads and bridges, and much else”.

“Is it mere coincidence that productivity improvement has been weak during the period in which immigration-driven population growth has been so strong? I doubt it”..

“Using immigration to raise our living standards is like trying to go up a down escalator. You have to run just to stop yourself going backwards. This is smart?”.

By pumping Australia with so many people, the Albanese economy has created the “burnout economy” described by independent economist Tarric Brooker.

The RBA’s efforts to slow the economy and inflation via interest rate hikes are being thwarted by the Albanese Government’s unprecedented immigration, which has driven demand higher than supply across multiple areas.

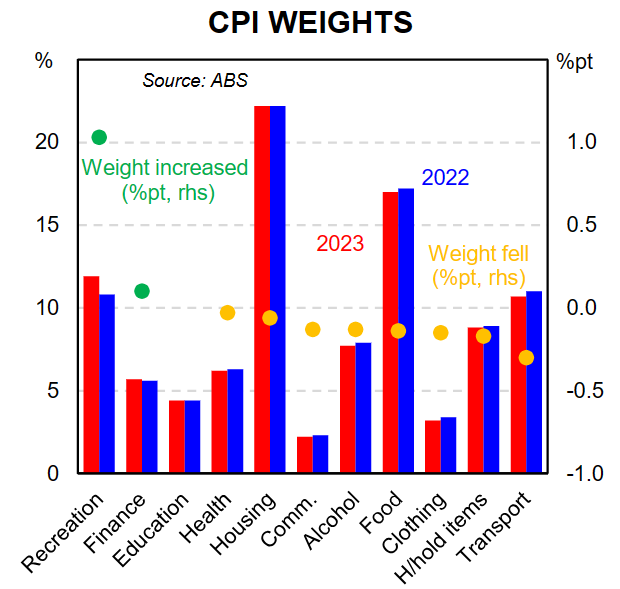

For example, housing alone contributes over one-fifth of Australia’s CPI inflation basket, and their costs are being driven up by record population growth, which is pumping up rents, materials prices, house prices, etc:

Accordingly, the Albanese Government’s unprecedented immigration is directly driving up inflation and will require the RBA to either hike further or hold rates higher for longer.

This is obviously terrible news for the nearly two-thirds of Australians who rent or have a mortgage, as well as for workers in general, who will see lower income growth.