In August, the National Cabinet announced a plan to build 1.2 million new homes over five years, starting 1 July 2024.

Federal, state and territory governments won’t build these 1.2 million homes, however. Their plan is to relax planning and zoning rules to allow higher density in the hope that private developers build them.

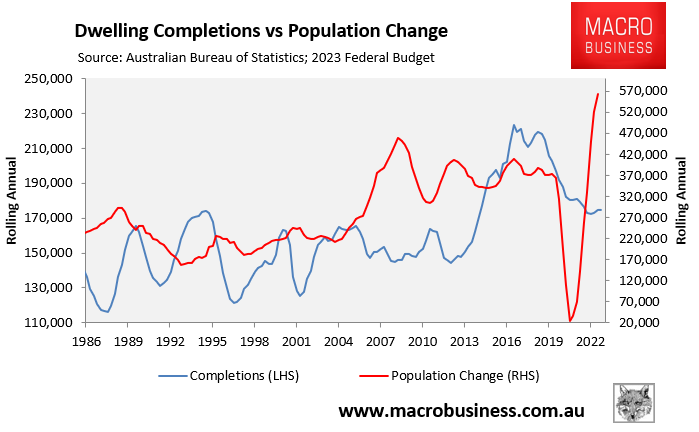

PropTrack senior economist, Eleanor Creagh, warned this month that “to meet the 1.2 million goal, we need to increase our pace of building by almost 40 per cent from where it currently stands”.

Worse, “based on current estimated annual growth of close to 600,000+ people per year (both natural increase and net overseas migration), the new residents will simply absorb the 1.2 million homes based on an average household size of 2.49”, Creagh warned.

CBA economist, Harry Ottley, penned a report based on Wednesday’s Building Activity data from the ABS explaining why the 1.2 million homes target “looks hard to achieve”:

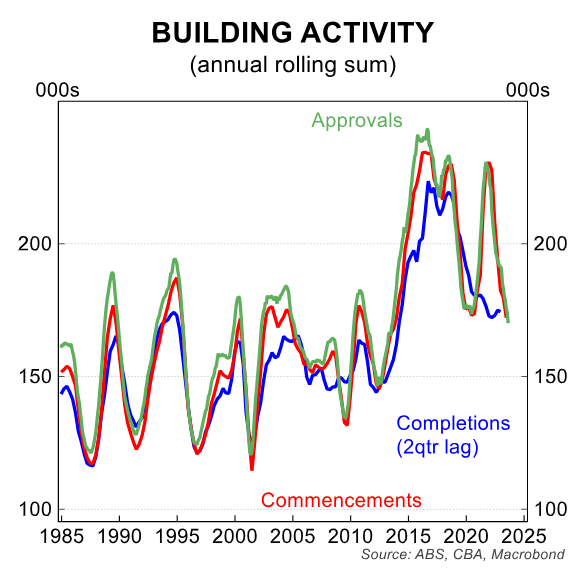

“The level of commencements in the June quarter is the lowest in a decade and near record lows on a per-capita basis”.

“The weak commencement datareflects a range of forces”.

“Higher borrowing costs, elevated costs for new dwellings, poor consumer sentiment, uncertainty around the path of the cash rate as well as profitability and insolvency concerns in the sector are all weighing on near term activity”.

“This weakness comes during a period of rapid population growth and stress in the rental market”.

“Building completions fell by 7.5% in the quarter to be down 1.2% over the year”.

“Historically, there has generally been predictable pass through from approvals to commencements to completions in the lifecycle of a newly built dwelling. The current cycle is different in that completions have lagged”.

“There have been a multitude of issues in the construction sector that are delaying projects. In the initial stage of the pandemic, material shortages were a major constraint”.

“As supply chains have recovered, this has become less of an issue. But reported labour shortages are still expected to weigh on construction activity in the period ahead”.

“In addition, delays are being caused by increased insolvencies in the industry due to tighter financial conditions and input cost pressures that have negatively impacted sector profitability”.

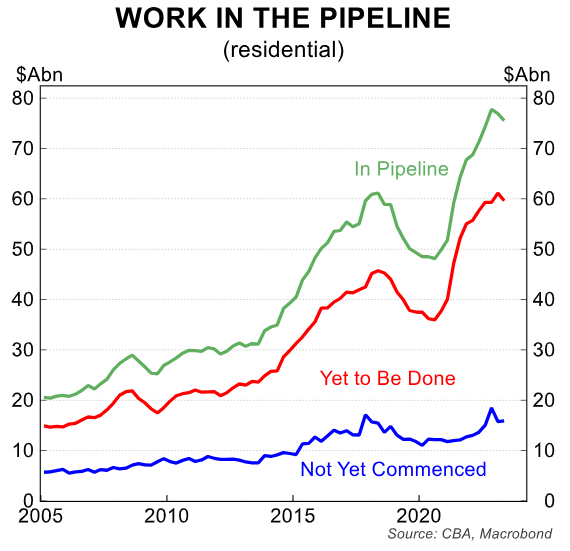

“Builders that charged a fixed price for a project then saw their own costs surge, often making certain work unprofitable. The consequence of this has been a large build-up of work in the pipeline”.

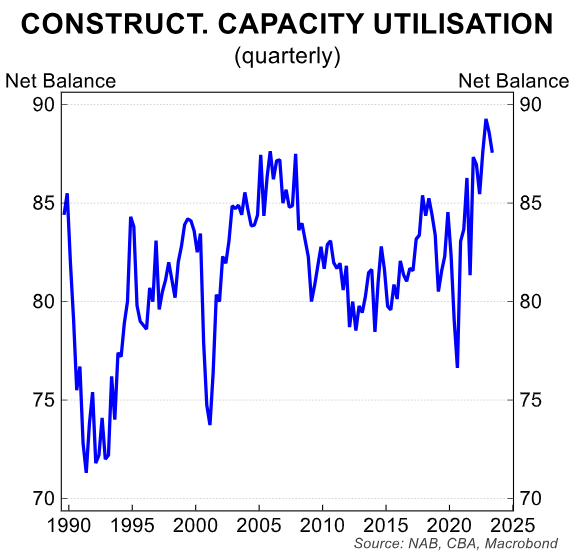

“One of the issues keeping the pipeline so large is capacity constraints in the construction industry, as evidenced by recent record highs in the NAB business survey”.

“Residential construction is just one part of the industry and there is high competition for key skills which is exacerbating acute labour shortages”.

“Demand for non-residential construction has been robust and the strong public sector capex program is also keeping the demand for skilled labour in the construction space elevated”.

“This does make the Federal Government’s target of building 1.2m dwelling units over 5 years from July 2024 look ambitious”.

“To be sure, there is a clear need for more housing. Household formation changes (less persons per household) spurred by the pandemic coupled with very strong population growth has created significant dislocation in the rental market”.

“Dwellings in Australia are also very expensive by international standards (largely because of the cost of land)”.

“However, to meet the Government’s target, quarterly completions would need to rise to a record high of 60,000”.

“Even if policies designed to boost supply (such as zoning reform, tax changes or grants) are delivered, it remains unclear if the Australian construction industry has the capacity to build dwellings at this rate given current circumstances”.

“We continue to forecast total commencements to total 164,000 this year and 166,000 in 2024”.

“An expected loosening in monetary policy over H2 2024 should stimulate activity but there are lags in the construction cycle. As such, the current cycle is unlikely to alleviate the current housing supply issues in the near term”.

“In more positive news, there is close to a record high number of dwellings currently under construction (238,000)”.

“Expediting the delivery of these dwelling units will help increase housing stock in the near term but would require the easing of the discussed capacity constraints”.

Given there is no way of actually meeting the 1.2 million homes target, the only way of solving the housing shortage is to moderate population growth by reducing the flow of net overseas migration:

Net overseas migration must be reduced to a level that is below the nation’s capacity to supply housing and infrastructure.

Otherwise, the housing crisis will continue to worsen.