Australian apartment rents are set to soar as record immigration-driven demand collides with falling supply.

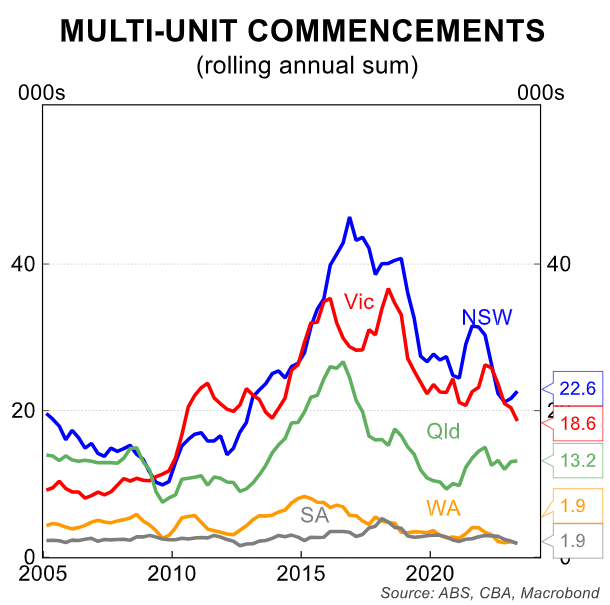

According to the Australian Bureau of Statistics (ABS) the number of unit & apartment commenced has collapsed across Australia to levels that are around half the 2016-17 peak:

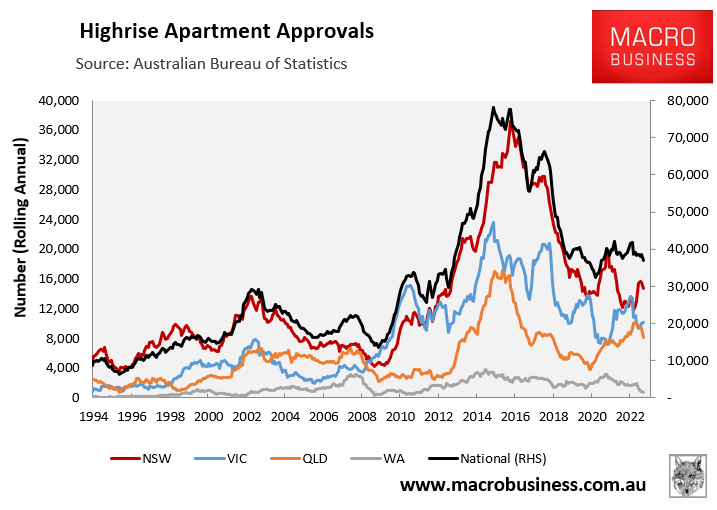

In a similar vein, high-rise unit & apartment approvals have experienced a similar decline, falling by around half from the 2016-17 peak:

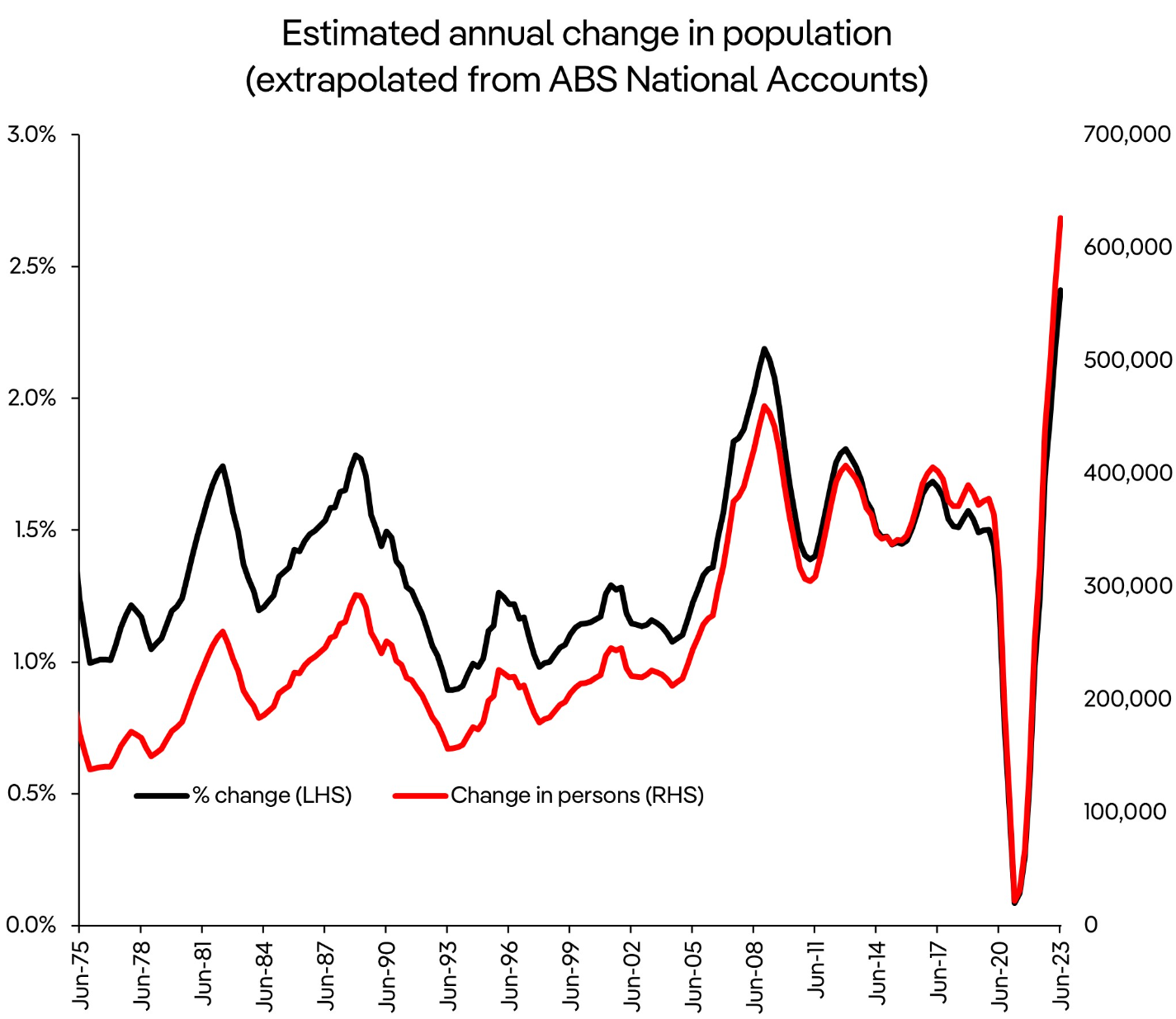

At the same time, Australia’s population grew by an estimated 626,000 in the 2022-23 financial year, driven by net overseas migration of around 500,000:

Source: Cameron Kusher (PropTrack)

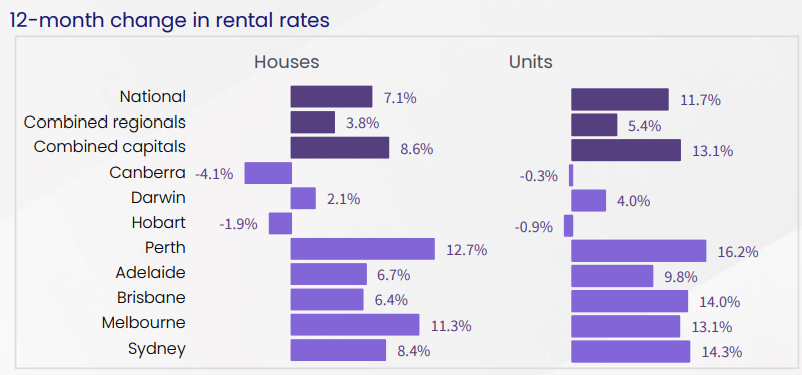

Most new migrants (especially international students) seek apartments to live in, and the excess demand has pushed rental vacancy rates to record lows, alongside double-digit rent rises across the major capital cities:

Source: CoreLogic

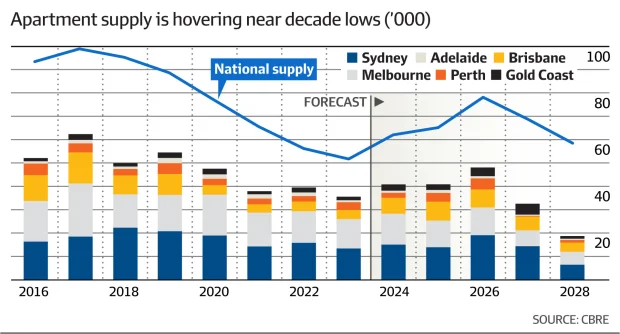

Analysis by real estate firm CBRE, published in The AFR, has tipped that apartment rents will spike by more than 30% over the next five years amid the ongoing undersupply:

In its Apartment Rent and Vacancy Outlook report, CBRE examined 53 apartment districts and projected that median rents for two-bedroom apartments across these districts would increase by $120 per week (or 26%) between 2023 and 2028.

There are five markets where growth of more than 30% is anticipated: the eastern suburbs of Sydney, Parramatta, the northern suburbs of Melbourne, Perth City, and virtually all precincts in Brisbane.

“At the start of 2013 just four precincts in Australia had an average rent of over $600 per week for two-bedroom apartments, being the Sydney and Perth CBDs, Sydney’s eastern suburbs and Sydney’s Lower North Shore”, said CBRE’s Pacific head of research Sameer Chopra.

“By June this had grown to 20 precincts, and by 2028 we expect 38 precincts – or over 70% of Australia’s two-bedroom apartments – to have a rent exceeding $600 per week”.

CBRE estimated that 75,000 new apartments would need to be provided annually to keep up with population growth and prevent a decline in vacancy rates and a corresponding surge in rents.

Over the five-year period, supply will be insufficient to meet demand since, while 80,000 flats are scheduled to be delivered in 2026, supply will decrease to as low as roughly 60,000 in 2024 and 2027, which is 40% below the last peak in 2017 and near decade lows.

If anything, CBRE’s rental forecasts look conservative given the current pace of growth and the gaping imbalance between supply and demand.

Regardless, this decade is shaping up as a disaster for renting Australians.