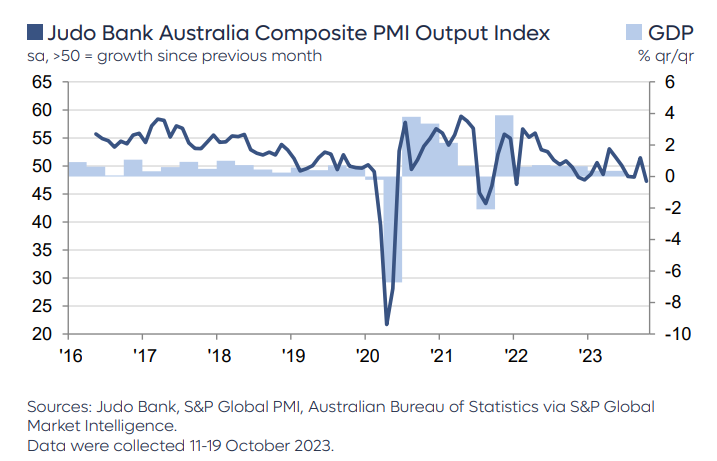

Judo Bank Aussie flash PMI sags.

– Flash Australia Composite PMI Output Index: 47.3 (Sep: 51.5), 21-month low.

– Flash Australia Services PMI Business Activity Index: 47.6 (Sep: 51.8), 10-month low.

– Flash Australia Manufacturing PMI Output Index: 45.6 (Sep: 49.0), 41-month low.

– Flash Australia Manufacturing PMI: 48.0 (Sep: 48.7), 6-month low.

October saw a renewed decrease in business activity in Australia, reversing the return to growth posted in September. Output was reduced amid lower new orders and a drop in confidence in the outlook, while cost pressures remained elevated. On a more positive note, employment continued to rise.

The Judo Bank Flash Australia Composite PMI® Output Index* posted below the 50.0 no-change mark for the third time in the past four months during October.

At 47.3, down from 51.5 in September, the reading was the lowest in 21 months and represented a solid monthly decline in activity.

Output was down across both the manufacturing and services sectors, with the pace of reduction more pronounced in the former.

The fall in business activity coincided with a renewed decrease in new orders, which fell for the second time in the past three months. A generally weak demand climate, inflationary pressures and high interest rates were among the factors leading to lower new business, according to respondents. New export business was also down, and for the eighth successive month.

Input costs continued to rise rapidly, with the rate of inflation ticking up to a three-month high. Increased fuel costs pushed up input prices across both monitored sectors, while service providers also highlighted rising wages.

Output prices also increased, but weaker customer demand impacted pricing power, resulting in the softest pace of charge inflation since March 2021.

That’s a margin crush. As it continues, jobs will be cut next. Not a bad report for the RBA.