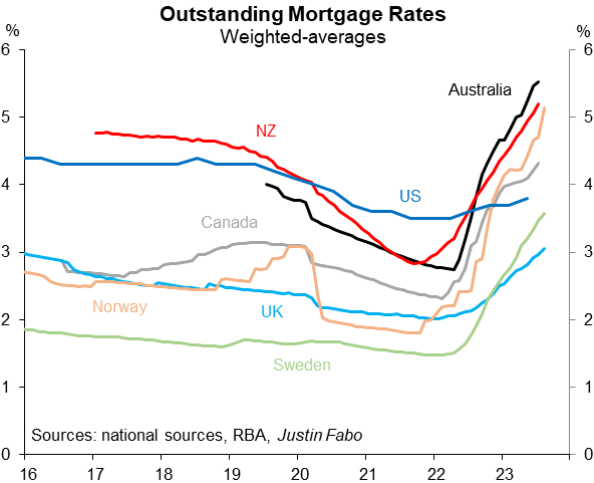

Macquarie Group senior economist, Justin Fabo, published the below chart last week showing how Australian mortgage holders have been hit harder by interest rate hikes than residents of other nations:

This is due to Australia having one of the largest proportions of variable rate mortgages in the world, with the vast majority of fixed rate mortgages also having periods of less than three years.

In turn, changes in official interest rates are passed on to mortgage holders in Australia far faster than elsewhere.

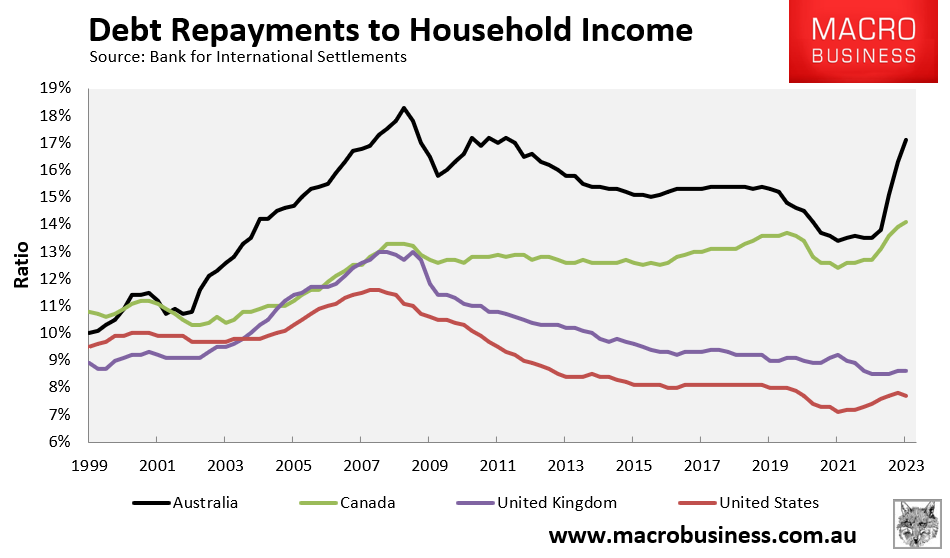

Australian households also have one of the largest debt burdens in the world, which means that debt repayments as a share of income are much greater in Australia and have grown far faster, as illustrated below using data from the Bank for International Settlements:

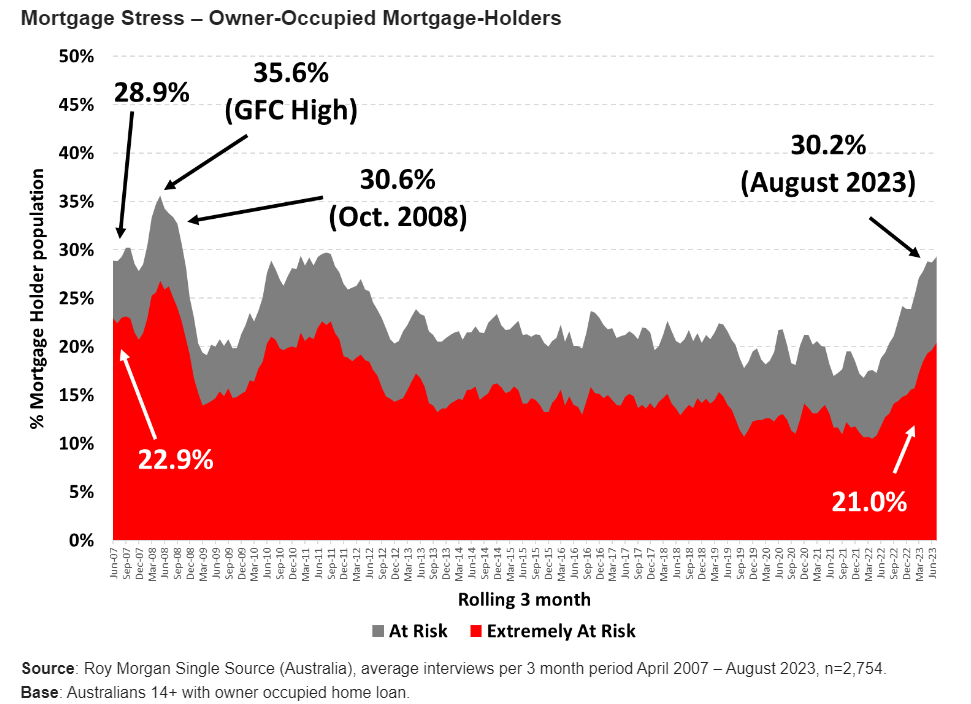

Roy Morgan recently reported that mortgage stress in Australia has hit its highest level since the height of the Global Financial Crisis:

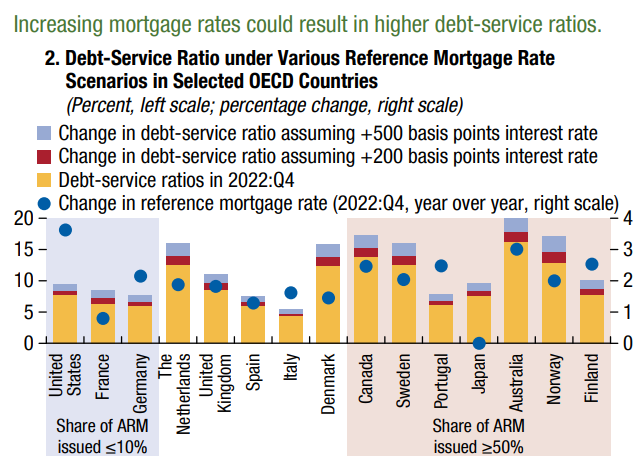

Now, the International Monetary Fund (IMF) has released its Global Financial Stability Review showing that Australian households are experiencing the greatest level of mortgage stress in the world with 15% of income devoted to paying off loans:

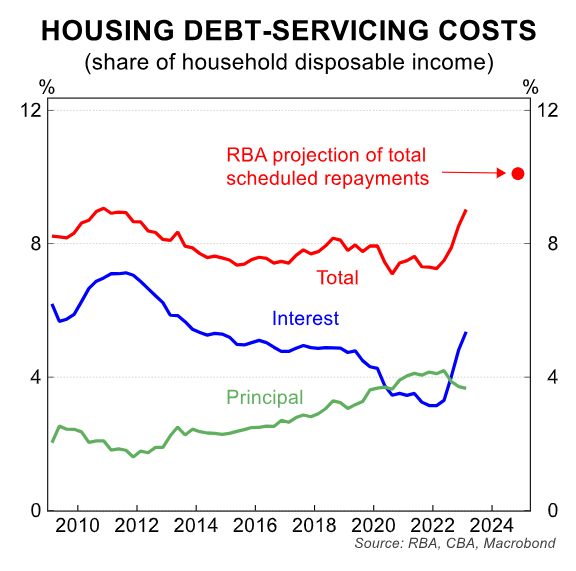

After the pipeline of cheap pandemic fixed-rate mortgages expires, scheduled mortgage repayments in Australia will hit an all-time high share of household income by mid 2024:

Even if the RBA does not raise interest rates further, there is still some tightening ‘built-in’ to Australian monetary policy as low-interest fixed-rate mortgages expire.

Regardless, Australia is the worst country in the world for mortgage holders.