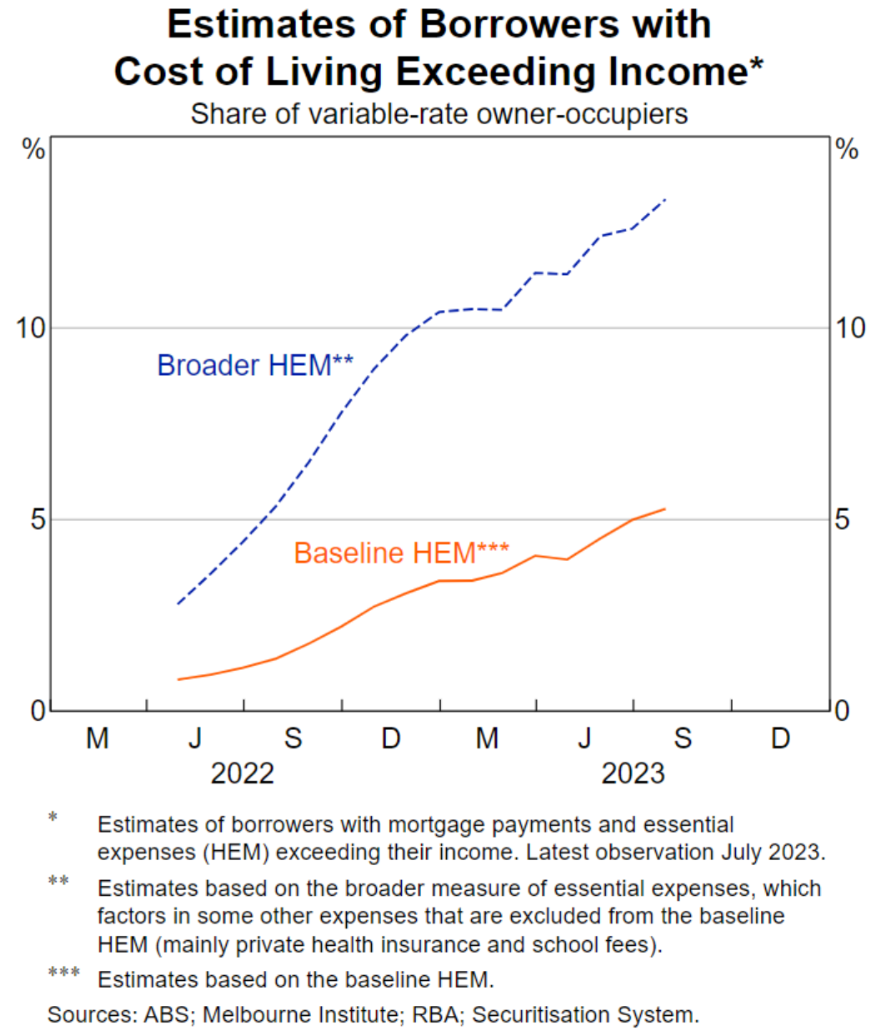

The latest Financial Stability Review (FSR) from the Reserve Bank of Australia’s (RBA) shows that around 13% of mortgage holders are spending more on essentials and mortgage repayments than they earn, up from around 5% prior to the RBA’s first rate hike in May 2022:

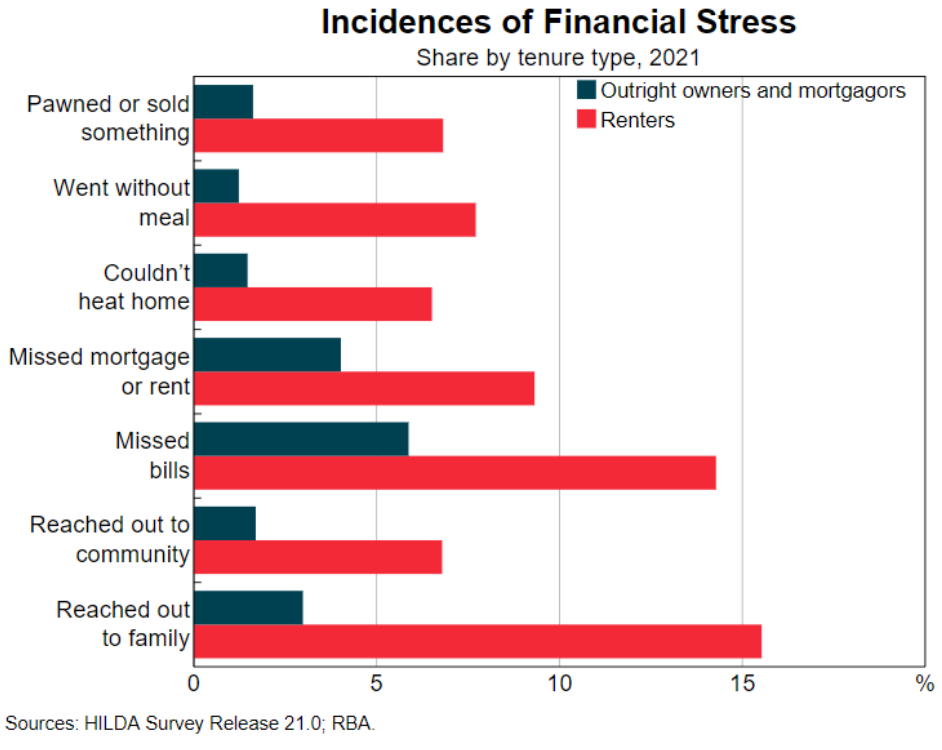

Despite this, the RBA FSR shows that financial stress is actually more likely to occur and is more frequent for renters than for owner-occupier households:

This result makes sense.

Generally speaking, households that rent have lower incomes and substantially lower savings than mortgage holding households.

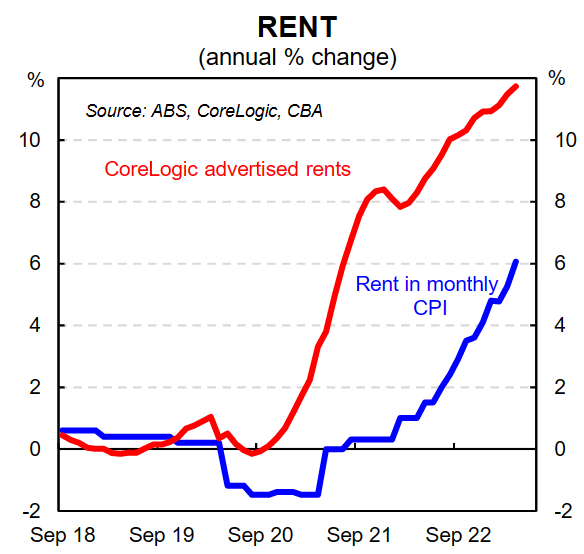

Rents have also increased significantly over the past 18 months, as shown below by CBA

I’ll add that Roy Morgan’s 2023 Wealth Report showed that renters have fallen significantly behind homeowners.

According to this report, between March 2020 (pre-COVID) and March 2023, Australia’s wealth climbed by 7.0%.

This gain in wealth was mostly driven by an increase in the value of owner-occupied residences, which grew in value by 43.2%, from $4.16 trillion to $5.95 trillion.

Half of the population, predominantly homeowners, account for 95.4% of Australia’s net wealth.

The bottom half of the population, largely renters, also had their wealth share improve, although only from 3.6% to 4.6%.

The truth is that renters tend to be poorer and have lower wages.

Therefore rising rents impact them more than rising mortgage repayments do homeowners.

The overwhelming majority of homeowners can also sell up and walk away with fat capital gains, whereas renters can’t.

Finally, once the RBA begins cutting interest rates, mortgage holders will benefit. Whereas rents almost never fall.