DXY was up again last night:

AUD hit new one-year lows but rallied to hold 0.63 as the immense short prevented a rout:

The new CNY peg is rock solid:

Oil fell, gold was firm:

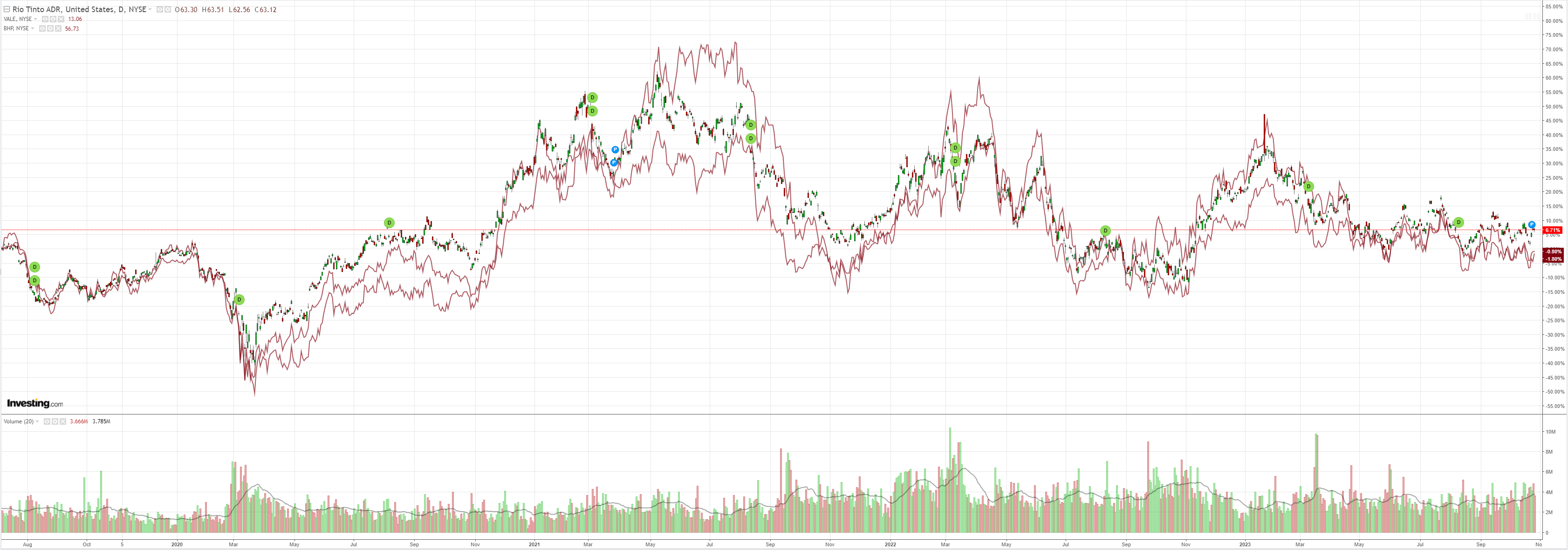

Dirt is still at the cliff:

Miners are a safe haven for now:

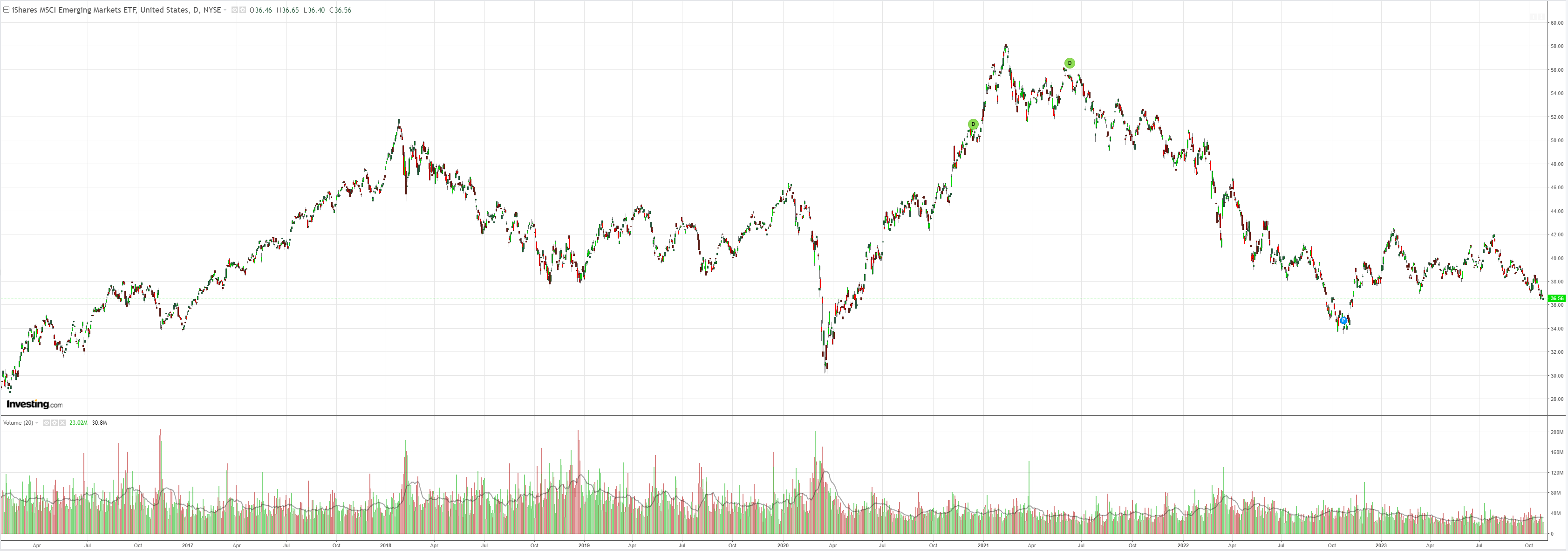

EM dead:

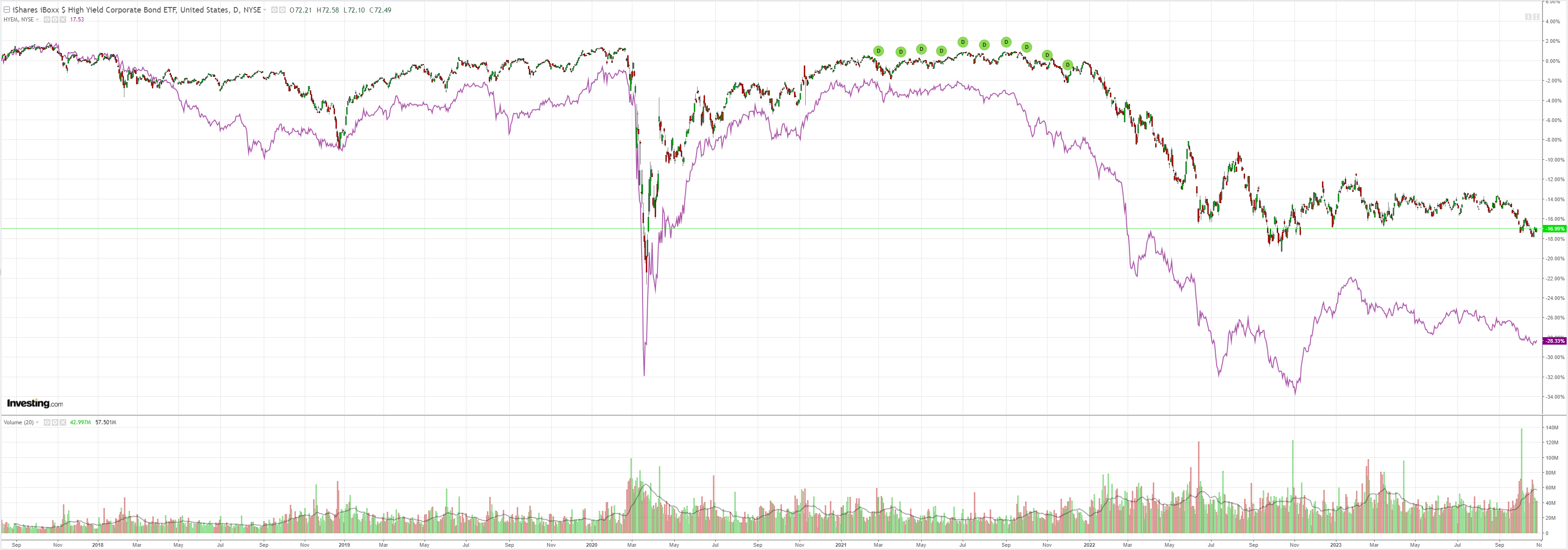

Junk did better:

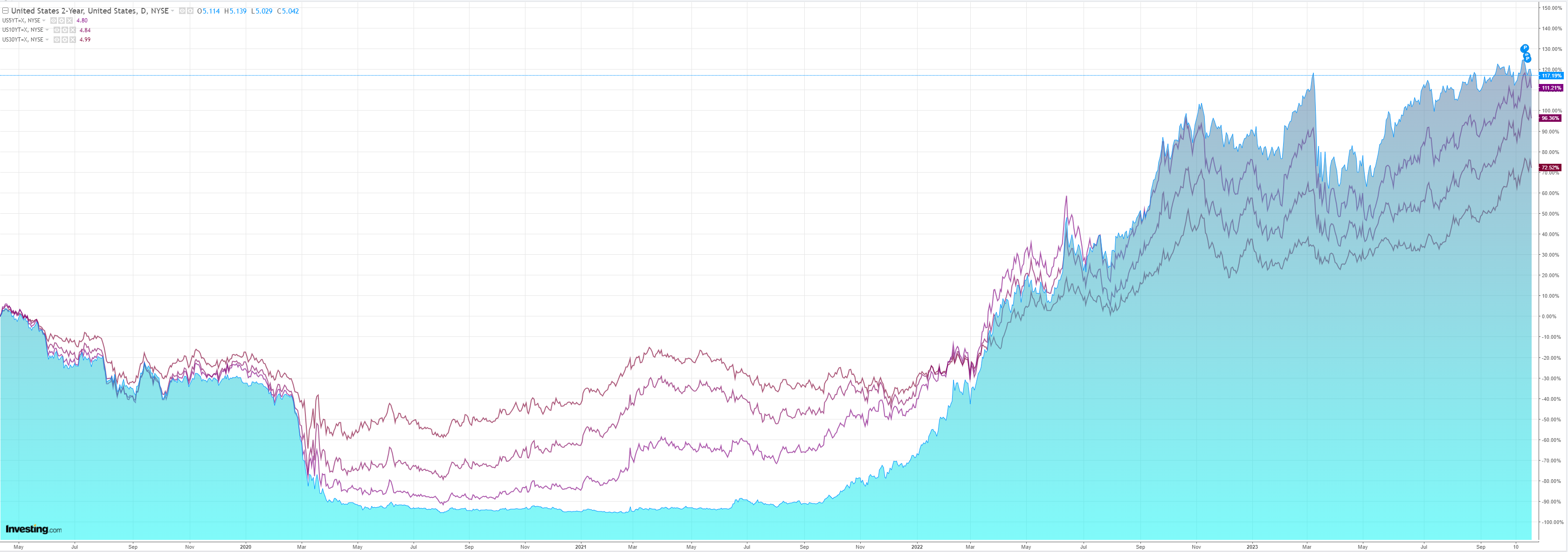

As Treasuries were bought:

Whoa stocks!

US Q3 data was a ball tearer. Goldman has more.

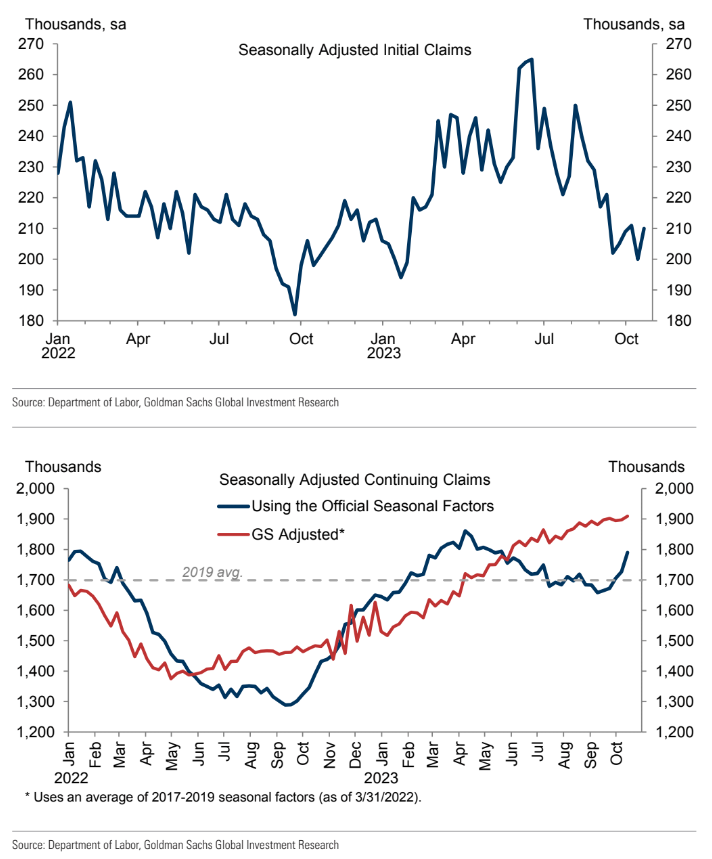

Real GDP rose 4.9% annualized in the third quarter, four tenths above consensus and the fastest pace since the reopening boom of 2021. The composition was not quite as strong, as inventories contributed a quarter of the growth and should weigh on the Q4 pace. Nonetheless, demand growth proceeded at a strong clip, with final sales rising 3.5% annualized led by consumer and government spending. Core PCE prices rose +2.4% annualized in Q3, below consensus expectations. Following today’s report, we lowered our September core PCE estimate by 1bp to 0.27% (mom), corresponding to a year-over-year rate of +3.66%. We similarly lowered our September headline PCE estimate by 1bp to 0.33% (mom), corresponding to a year-over-year rate of +3.43%. The goods trade deficit widened slightly in September, driven by an increase in both exports and imports. Durable goods orders increased 4.7% in September, above consensus expectations for a moderate increase, and core capital goods orders also grew by more than expected. Wholesale inventories were flat, slightly below consensus expectations for a modest increase. Initial claims increased by more than expected, while seasonal distortions likely boosted continuing claims. Pending home sales rose 1.1% month over month in September, above expectations for a decline.

The problem is that despite blowout 7.5% nominal GDP, earnings are falling for the broader market as margins disappear with lower inflation. Worse, M7 valuations are being cut to ribbons by elevated yields. This is killing stocks.

Ahead, there is falling fiscal, the FCI shock, oil shock, currency shock, student loan shock, ongoing private credit contraction and a possible government shutdown after Trump appointed a flunky to the Speaker role.

Not to mention the European recession and Chinese property implosion.

The question is, if earnings can’t make hay in Q3, how will they fare as the many growth headwinds converge into year-end?

Hence, the general bearishness holding down risk and the AUD, even if the immense short is working a charm to prevent any meaningful move lower.