DXY is still cosolidating:

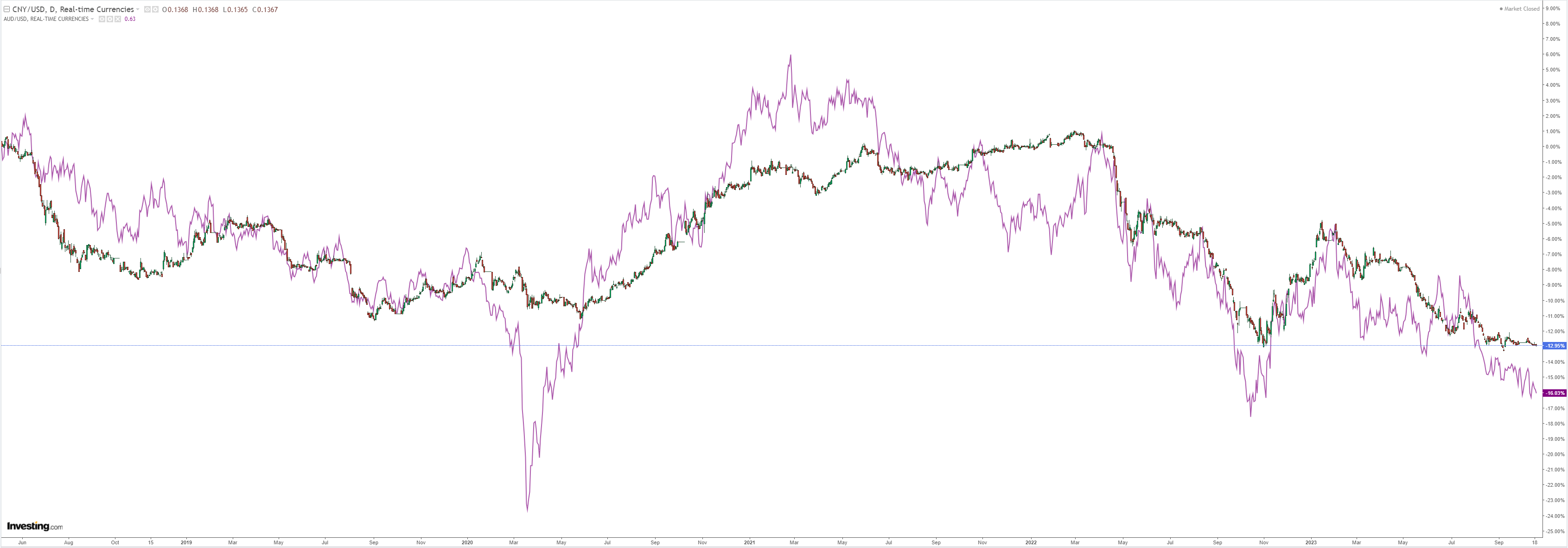

AUD is at the lows:

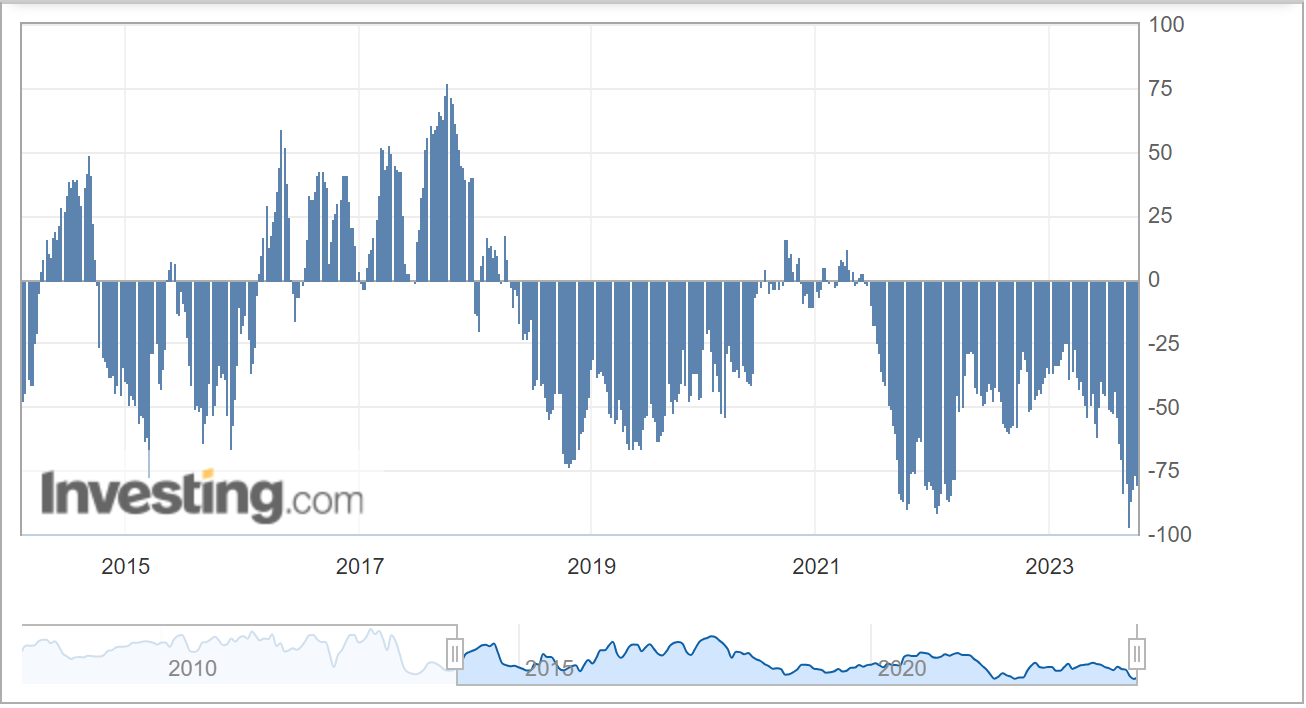

CFTC shorts are still big:

CNY stuck fast offers support too:

Oil and gold march on:

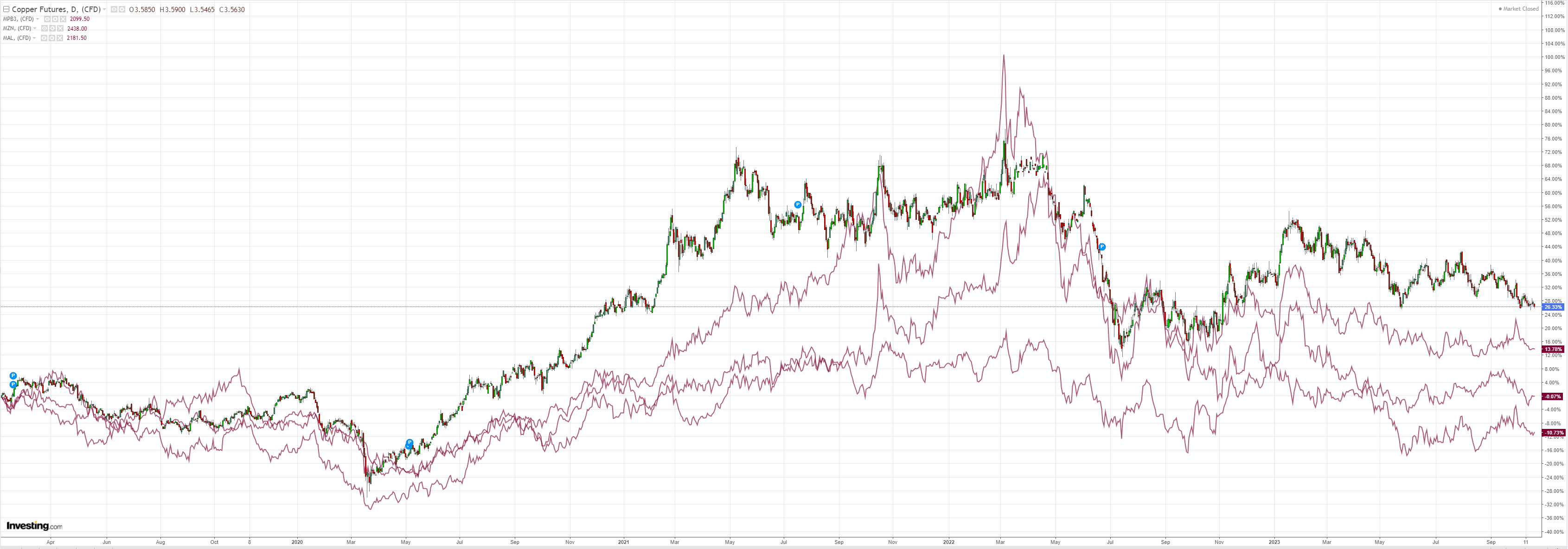

Copper is ready to break:

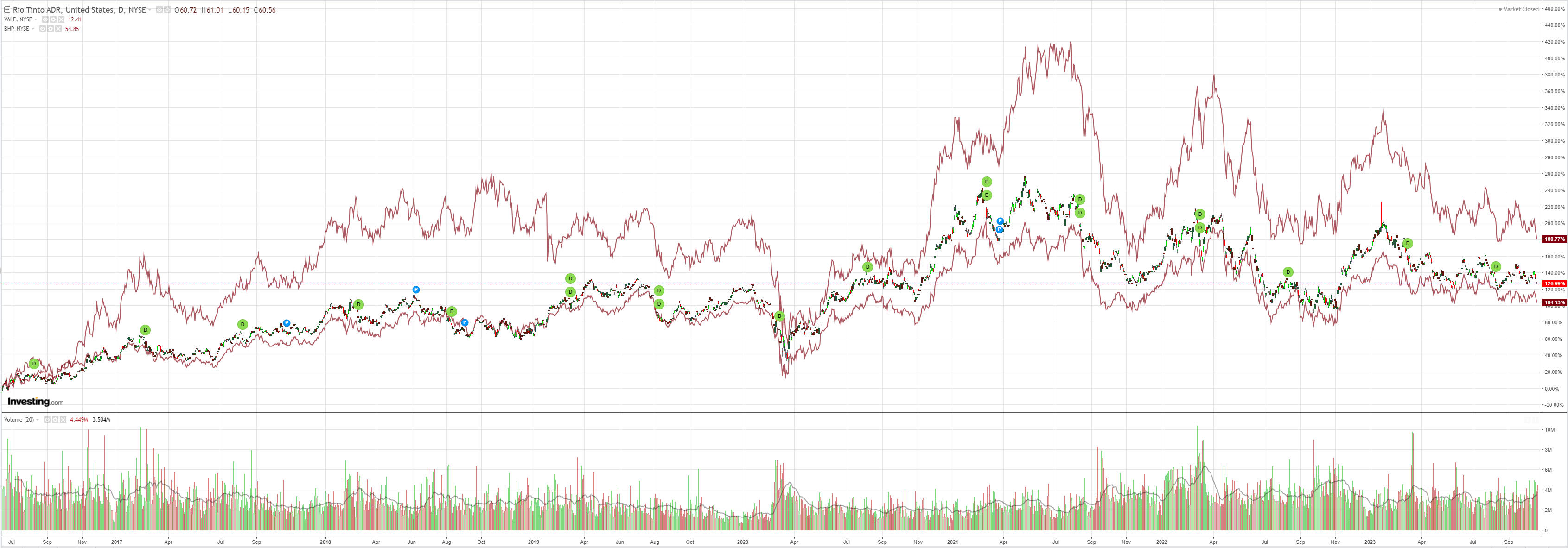

Miners were smashed:

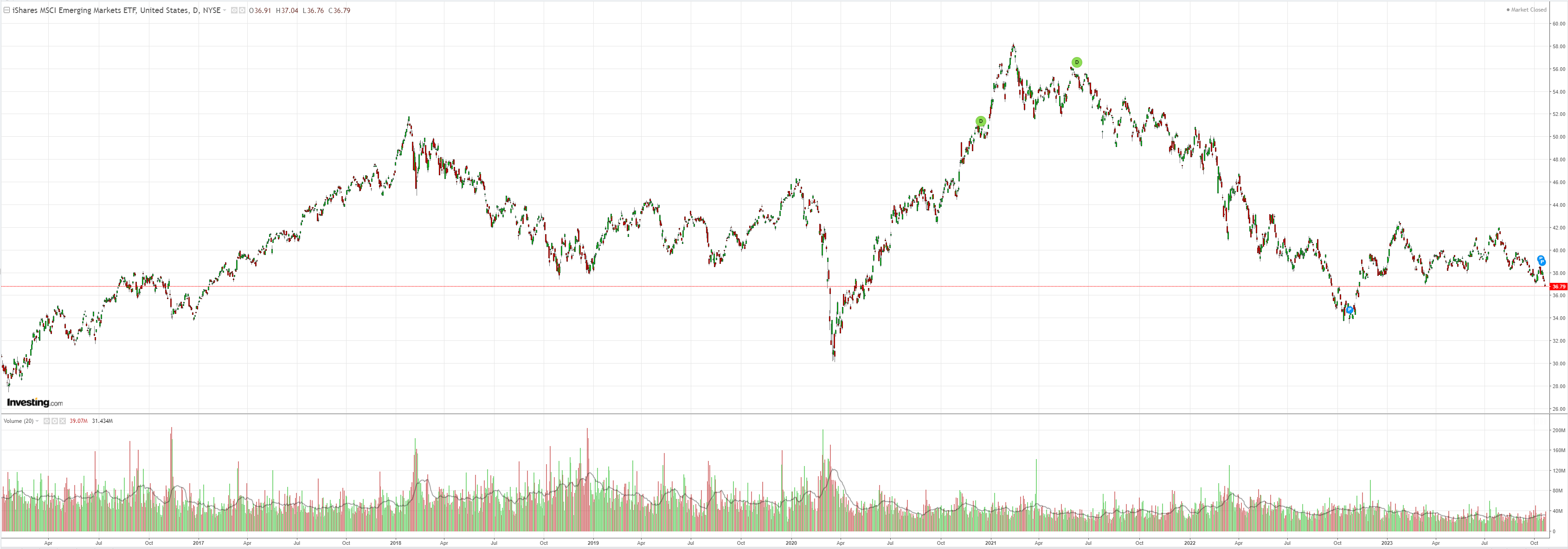

EM stocks yuck:

Junk leading the way lower:

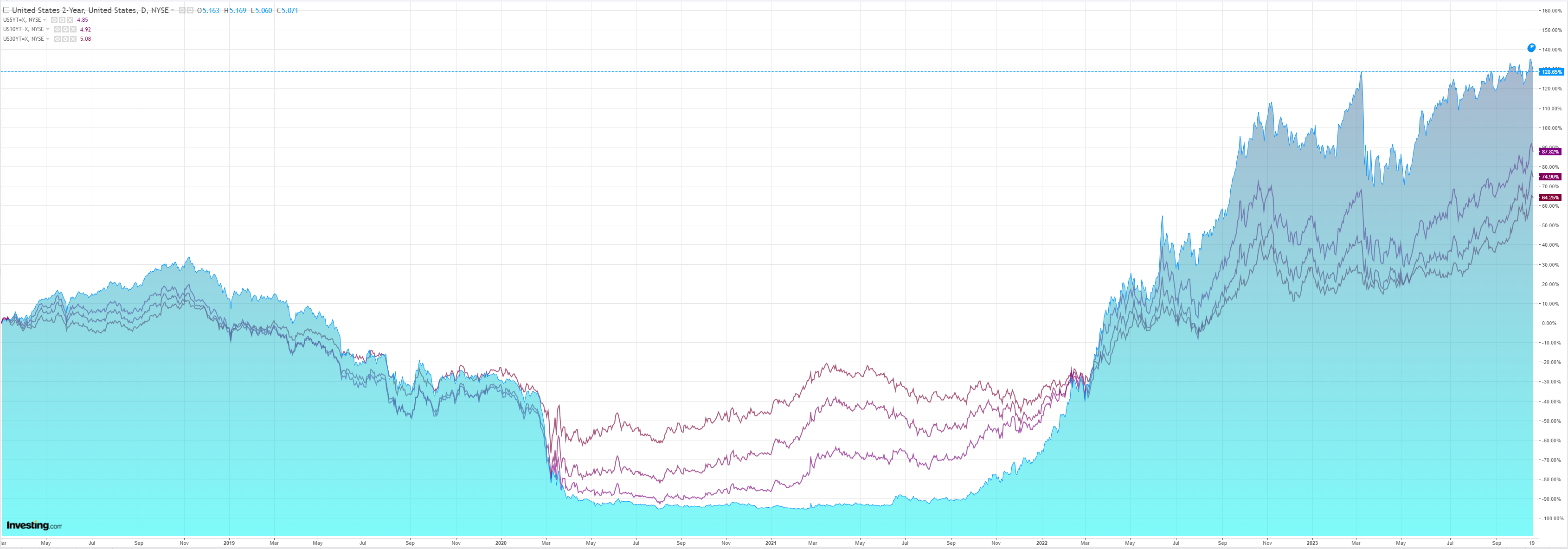

Treasuries were bid:

Stocks thumped:

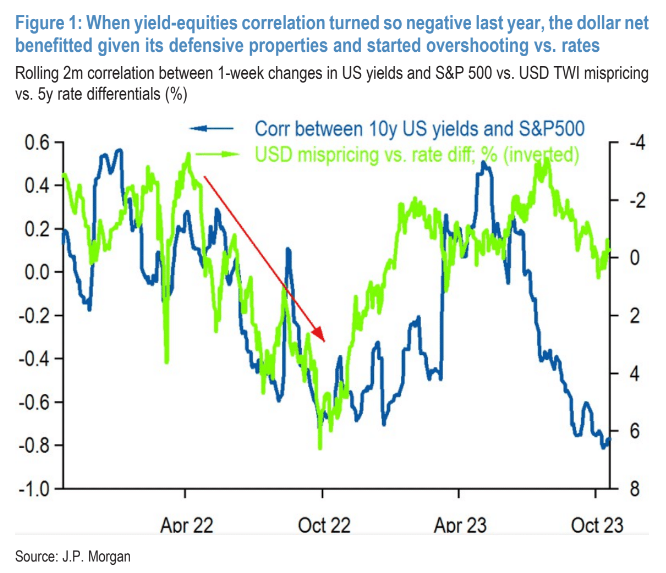

JPM has some notes:

Macro tensions are complicating our bullish USD narrative.

Improving momentum in China / Europe and a less aggressive Fed would normally be USD-bearish, but rising US yields and escalating geopolitics is USD-bullish.

We still lean net USD bullish. Rising yields, higher energy prices and negative yield-equity correlations should result in greater safe-haven FX demand, benefitting USD and CHF.

(Figure 1 When yield-equities correlation turned so negative last year, the dollar net benefitted given its defensive properties and started overshooting vs. rates)…

… and be a larger drag on currencies that are already growth-challenged.

Euro to underperform vs. USD, CHF, JPY and select high-yielders (CAD,MXN). Underweight GBP, SEK; overweight CHF.

Historically, rising US yields and improving China growth has been supportive of higher yielding cyclical FX/ carry.

In EM, neutral overall; underweight Asia but overweight EMEA and Latam.

Targets: USD upped on rising US yields. EUR/USD downgraded intra-month, 4Q at 1.00 (1.05). AUD/USD0.66 (0.68). NZD/USD0.61 (0.62).

EM:USD/CNYunchanged (4Q 7.35) but USD/Asia upped.USD/KRW1370(1340). USD/INR83.50 (83.00).EUR/PLNrevised down on favourable elections, 3Q24 4.35 (4.70).USD/MXN17.75 (17.00),USD/BRL5.00 (4.85).

It’s interesting that JPM sees both DXY and AUD rising from here. I wouldn’t go that far. Any scenario in which DXY is rising will likely see AUD falling, but I agree that we are near the bottom.

The huge AUD short makes pushing the currency materially lower very difficult. From here, every shove lower is coiling the spring for more powerful rebounds.

We need to clear out some shorts before the currency falls further and stays there.