BofA with some interesting observations on the AUD.

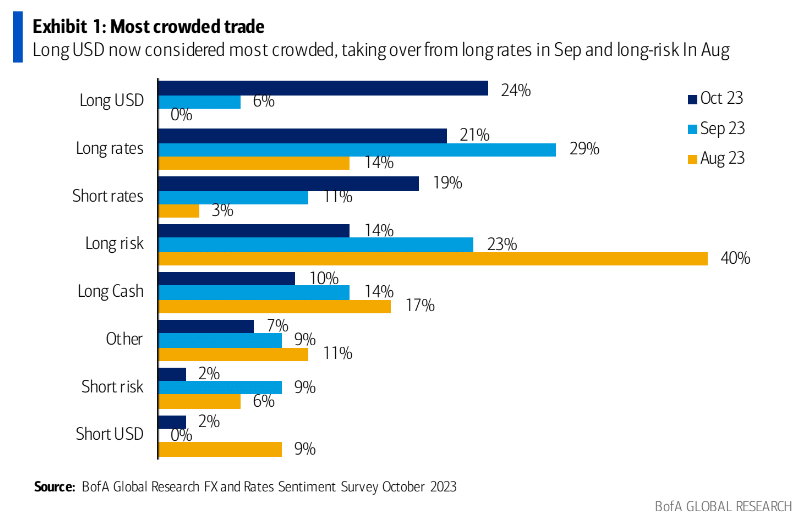

USD longs now considered most crowded trade

The change in perception of the most crowded trade is the best summary of how investor sentiment has shifted over the summer. And to what extent price action has affected these perceptions. At these tartof August respondents were most concerned about longs in risk. In September the most crowded position was considered to be the long in rates. And now, investors are most worried about the longs in USD. This could be a concern, given that equities and rates corrected after making it to the most crowded pole position. The USD long is objectively crowded when looking at the extent to which investors extended their longs in September, but early signs of selling are showing up. We believe USD is near the peak, further strength requires a change in narrative.

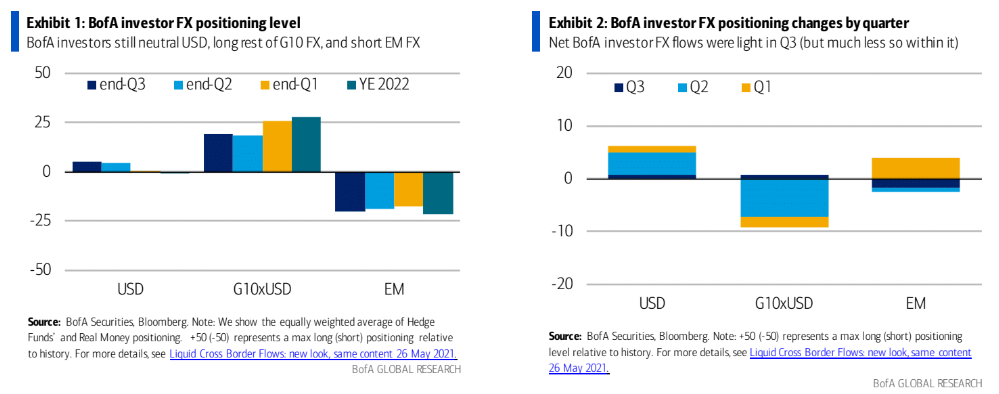

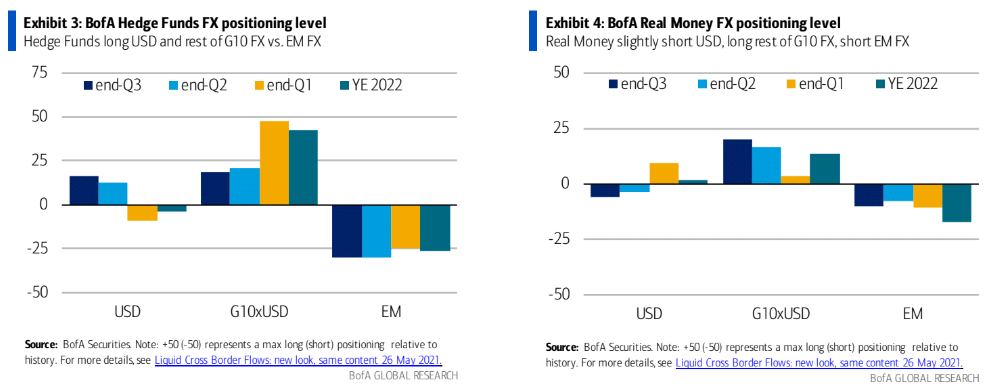

However, other data suggests DXY longs are still relatively neutral.

Despite the USD rally, our analysis based on proprietary flows suggests that investors ended the third quarter still neutral USD, long the rest of G10 FX, and short EM FX (Exhibit 1). Net FX flows were light in Q3 for the quarter as a whole, but we saw more variation in monthly data. The market increased slightly its position in G10, both in the USD and the rest of G10, at the expense of EM FX(Exhibit 2).

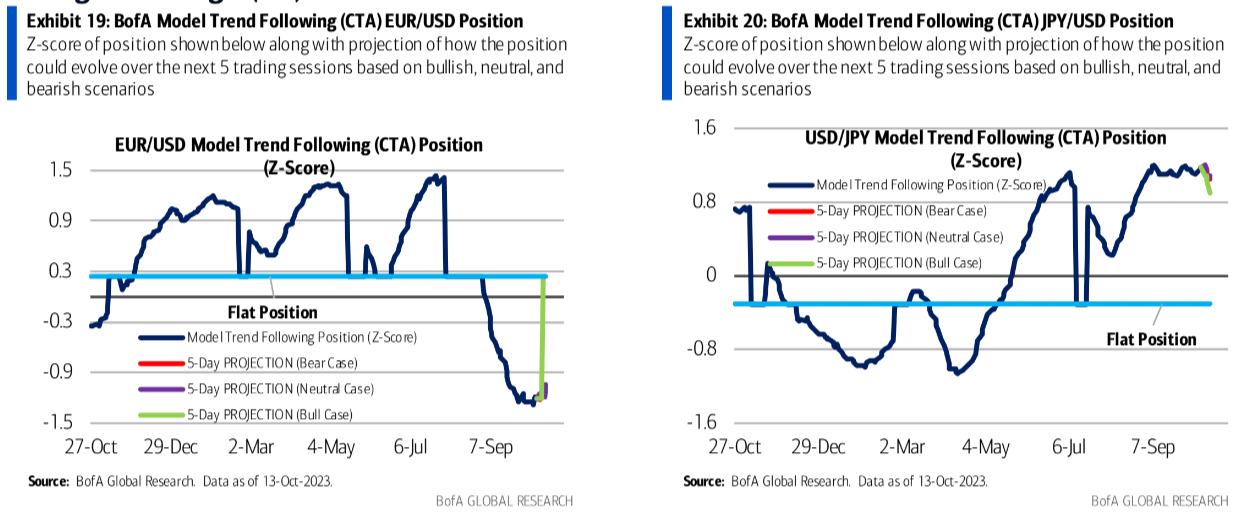

Throwing another loop, momo chasers are long.

EUR, GBP, JPY most stretched shorts against USD

In FX, our CTA model’s USD longs came close to hitting stop loss triggers, but the positions ended the week intact and still stretched. Shorts are largest in EUR, GBP, and JPY and their stop loss triggers remain in reach. Next week the CAD short could see a sizeable increase while the MXN long is in the process of unwinding and could turn short.

All up, that strikes me as room for DXY to go higher but the more explosive moves are accumulating in a reversal.

This is the flip side of the AUD. Going lower but closer to the bottom and bigger amplitude moves will be up.