DXY is still pulling back:

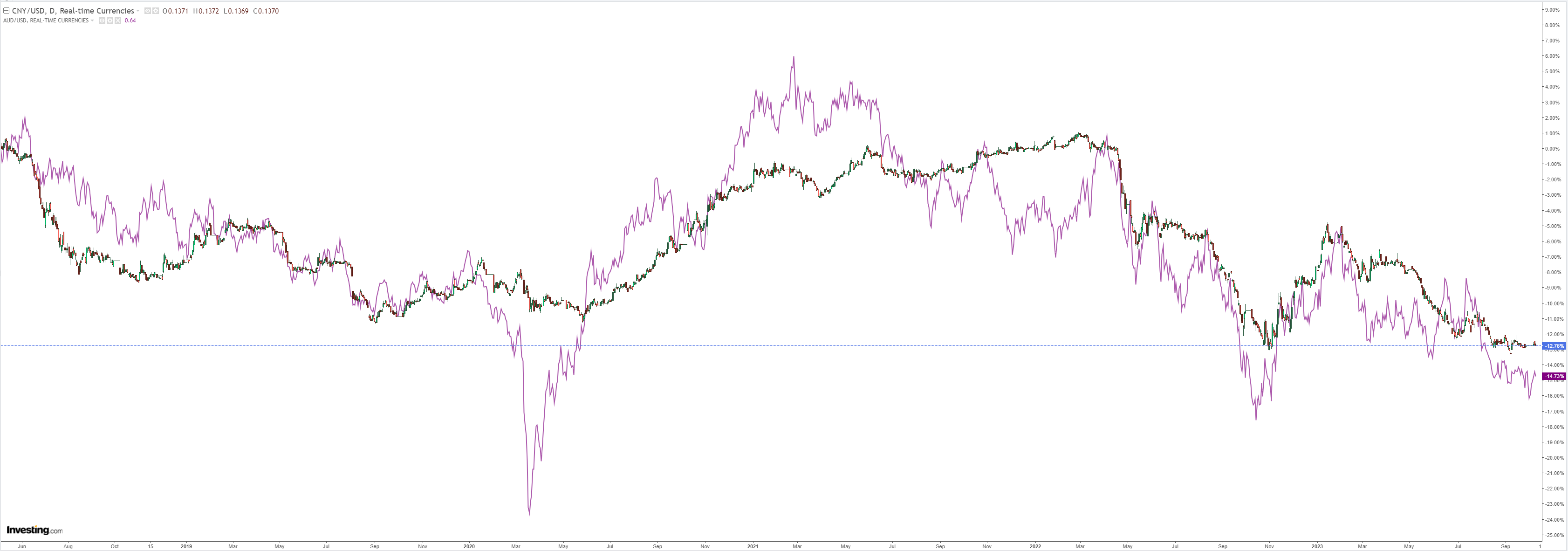

AUD was whacked anyway:

CNY lol:

Oil sagged, gold firmed:

Copper is weak:

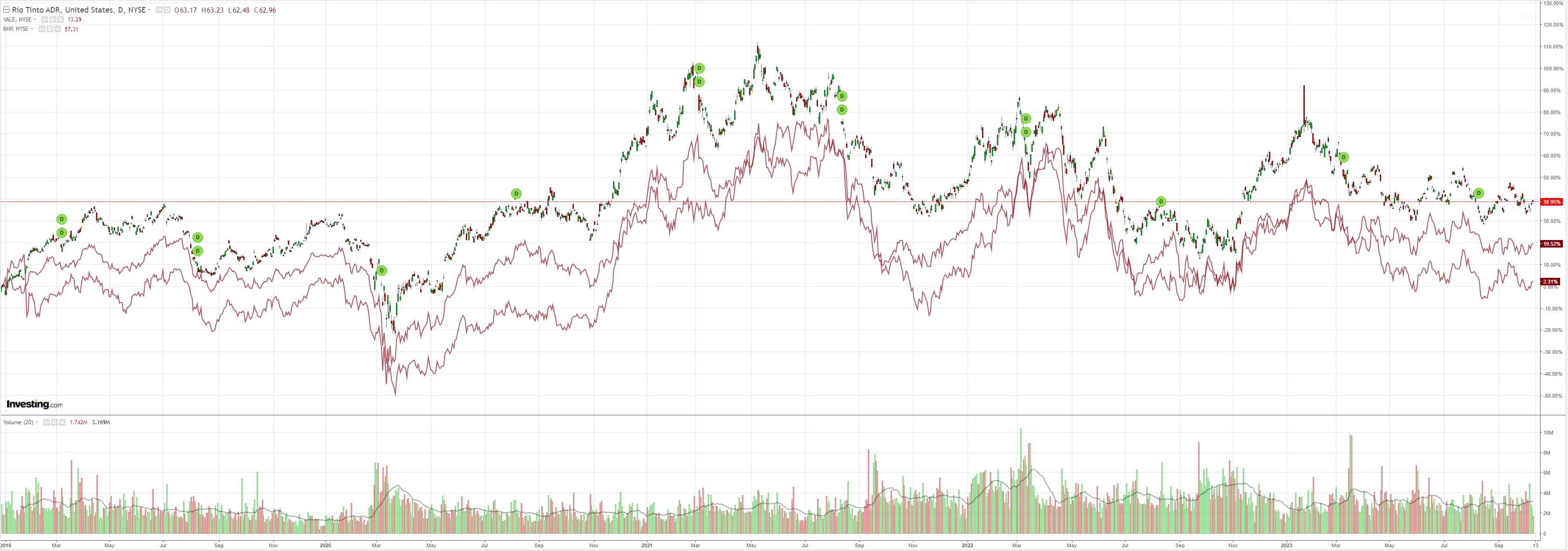

Miners were OK:

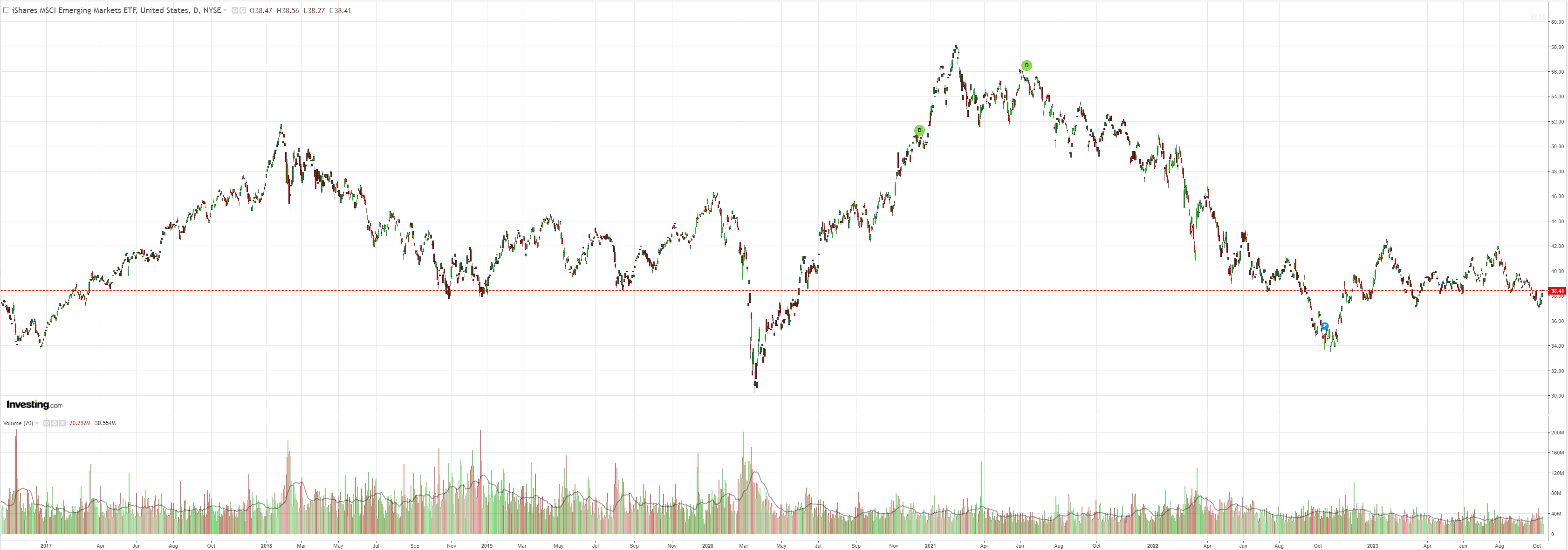

With EM:

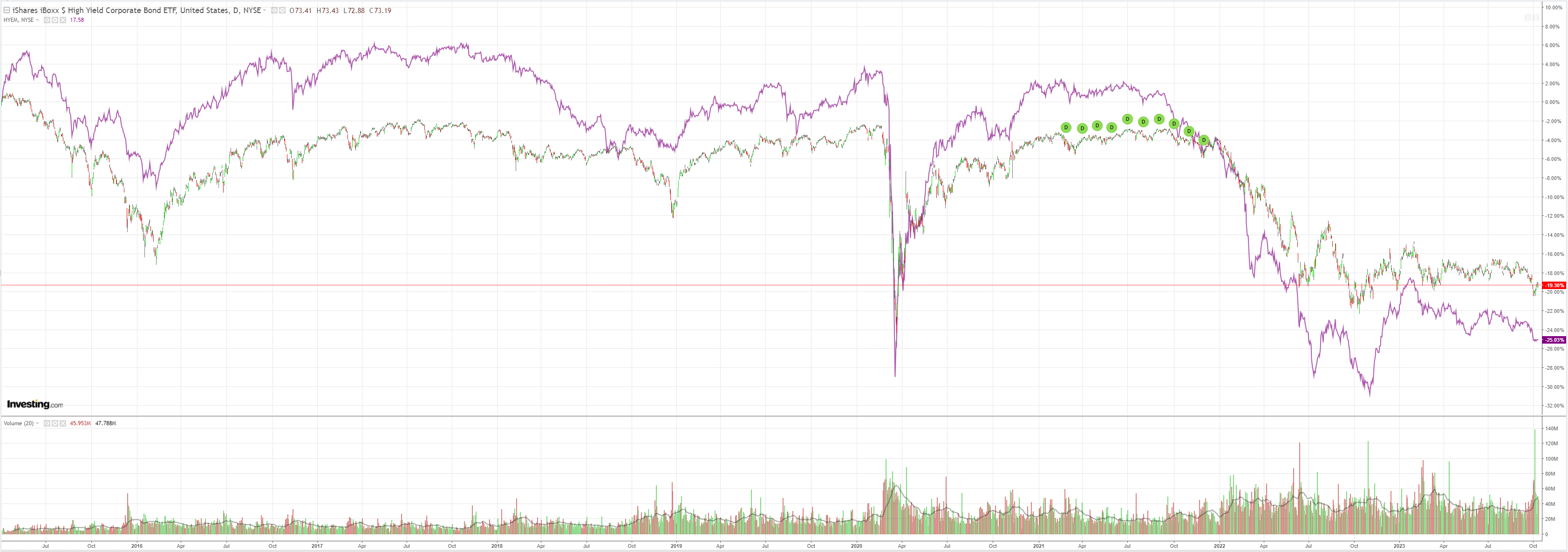

But not junk:

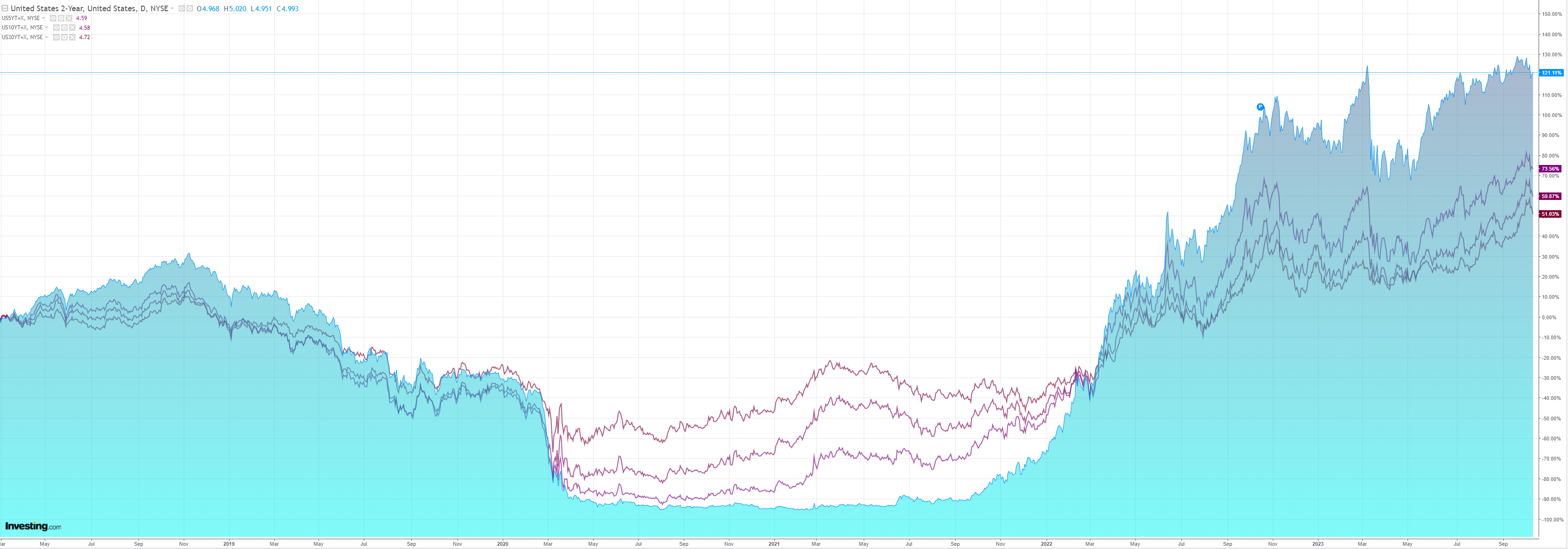

Yields fell and the curve flattened:

Stocks are enjoying the Fed put:

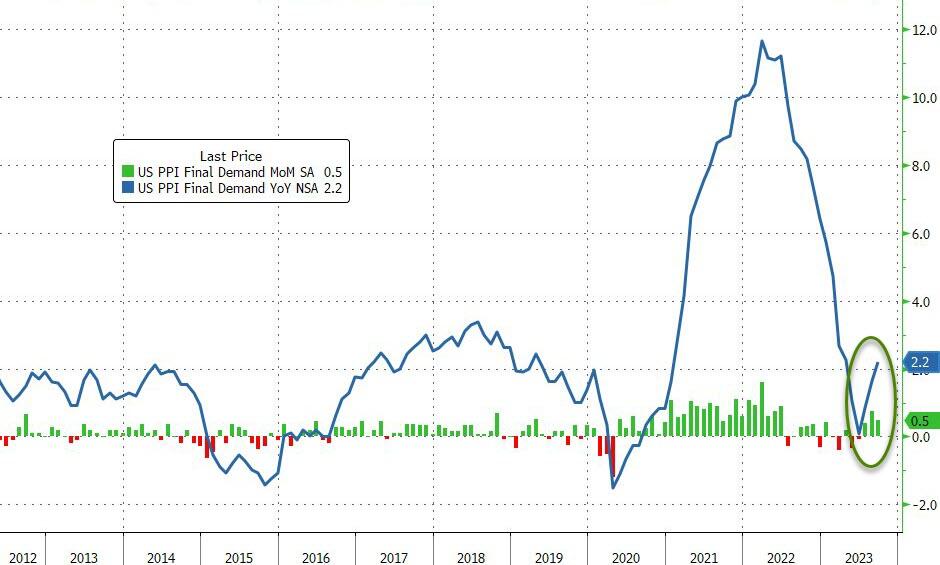

The US PPI was red hot at 0.5%, which makes three months in a row. The annual number will keep climbing as base effects wash out:

The Fed was a bit hawkish in the minutes:

In discussing the policy outlook, participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2 percent objective over time. A majority of participants judged that one more increase in the target federal funds rate at a future meeting would likely be appropriate, while some judged it likely that no further increases would be warranted. All participants agreed that the Committee was in a position to proceed carefully and that policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks.

But, this, via Credit Agricole:

The latest surge of geopolitical risks in the Middle East seems to have had a less pronounced and persistent FX market impact. Part of that reflects the fact that investors are still assessing the longer-term implicationsof the unfolding crisis onthe broader region and by implication on global energy prices. And, while the riskof a potential escalation of the crisis and its negative impact on global oil supply remains non-negligible, market participants are not rushing into defensive positioning and thus into buying the USD just yet. Another reason for the muted USD reaction seems to be the fact that several Fed speakers have recently highlighted that the latest rally of UST yields has reduced the scope for further tightening. Moreover, given that further risk aversion spikes could contribute to thetightening of US financial conditions, they could reinforce the perception that weare past the last hike of the current Fed tightening cycle. This will hold so long as the latest Middle East crisis does not fuel a sustained rebound of global energy prices.

In short, the Fed is already making the same mistake it made earlier this year by slowing hikes and putting a thermal under stocks, which will undo the very tightening it claims will prevent further tightening.

The inflation job is still not done yet here we are reflating again. Why they can’t just hold the line I will leave to you.

AUD can work off its oversold condition while markets celebrate but we can’t say it has bottomed until US inflation is defeated.