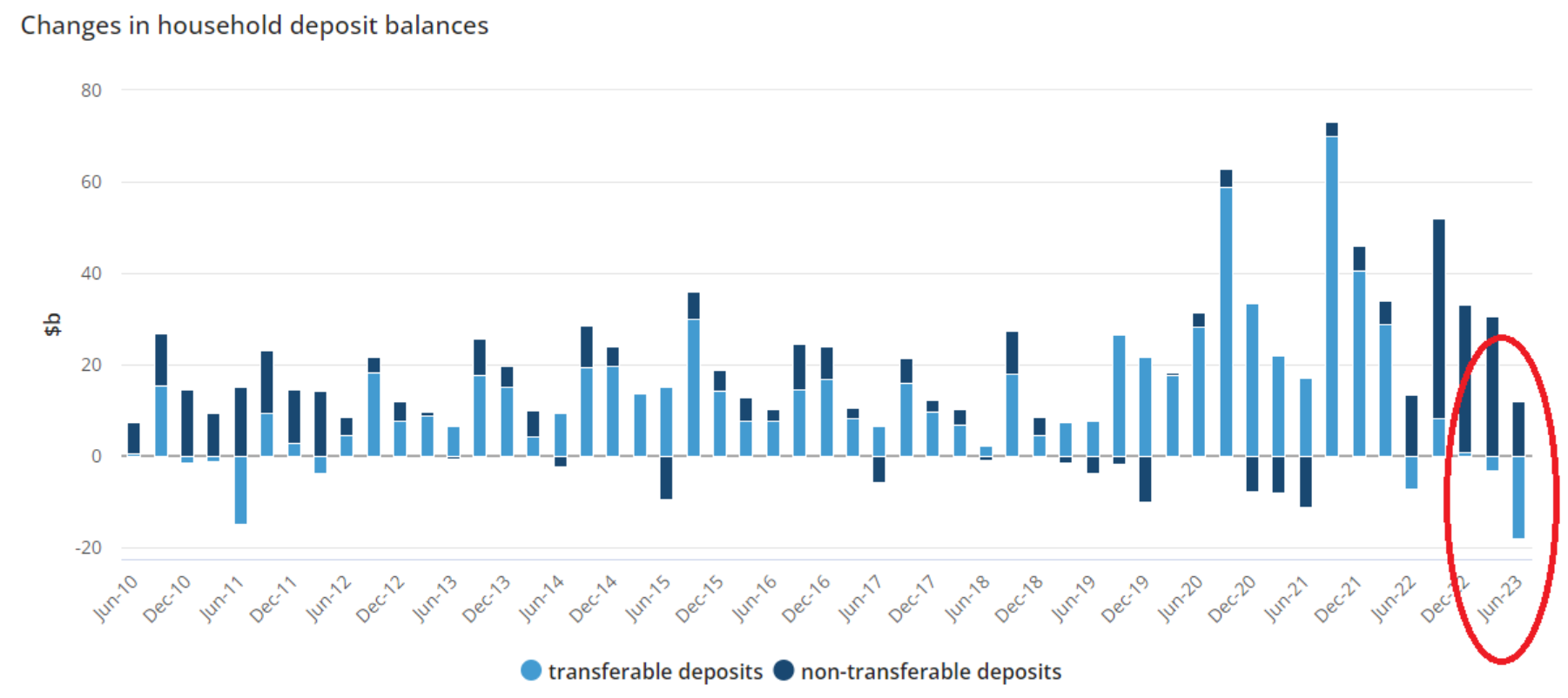

The Australian Bureau of Statistics last week revealed that value of household deposit accounts decreased by $6 billion in the June quarter, with it being the first decline in 16 years:

Source: ABS

“This was the first fall in deposit balances since the Global Financial Crisis and indicates that the household sector was tapping into cash reserves amid rising cost pressures”, said Dr Mish Tan, ABS head of finance statistics.

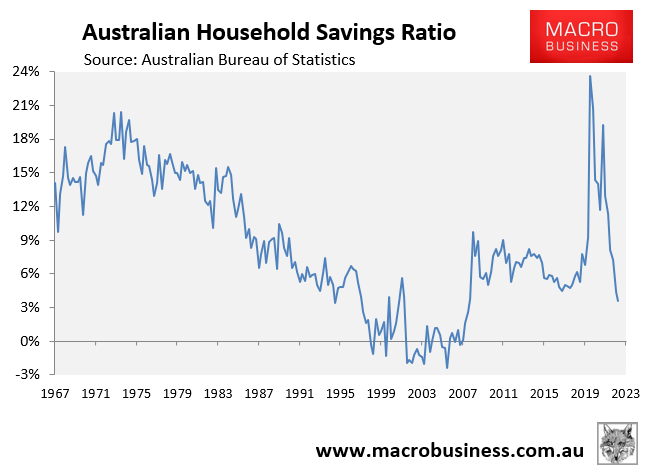

“This was consistent with a falling household saving ratio which is at its lowest level since June quarter 2008. Higher interest rates and income tax payable, paired with high consumer inflation, has reduced households’ savings buffers”.

The decline indicates that households are ‘running’ down savings built up during the pandemic to pay for bills and loans as a result of the Reserve Bank of Australia’s (RBA) aggressive interest rate hikes to fight inflation.

Meanwhile, figures released by the RBA on Friday indicate a growing number of people are using their credit cards to cover the cost of increased bills, with the stock of personal credit having risen by 1.6% in the five months to August.

“Personal credit outstanding is now 1.2% higher over the year. This is a very sharp up-tick in the pace of personal credit growth, with the entirety of the increase coming through since March (up 1.6% over the past five months)”, CBA economist Stephen Wu said.

Australians are also increasingly turning debt help lines and buy now pay later services:

“RBA documents about mortgage stress released under freedom of information reveal the National Debt Helpline is receiving an increasing volume of calls from people who have never experienced financial hardship nor drawn on social services”, reported The Australian.

“Following a meeting with the NDH, an internal RBA email in July said the agency “reported a significant number of callers experiencing hardship who are accruing additional debts via credit cards, Buy Now Pay Later, borrowing from friends and family, and increasingly unpaid obligations to the ATO, their utilities providers and council rates”.

“As well, representatives from the helpline told RBA assistant governor Brad Jones that underinsurance of homes, cars and personal belongings was an increasing problem, while other borrowers were “asking about how they could qualify to tap into their superannuation balances”.

“All of this meant that there was a long lag between households making significant adjustments to their personal finances as they become more stressed (especially if they had managed to ‘roll over’ a hardship arrangement for up to 12 months), and falling into arrears as reported in the official data,” said the email from the unidentified RBA financial stability official”.

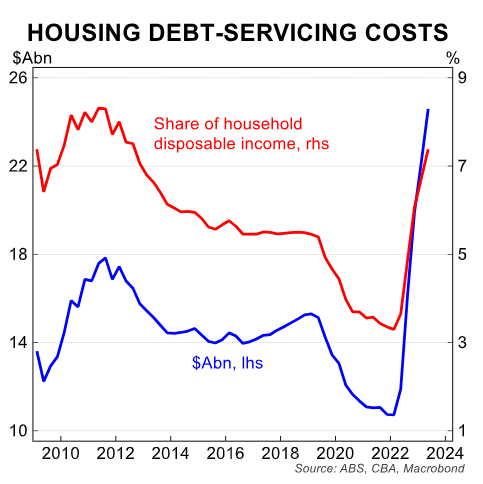

Clearly, the approximately doubling of mortgage interest repayments in the year to June has hit households hard:

Households’ situation will surely deteriorate for three reasons.

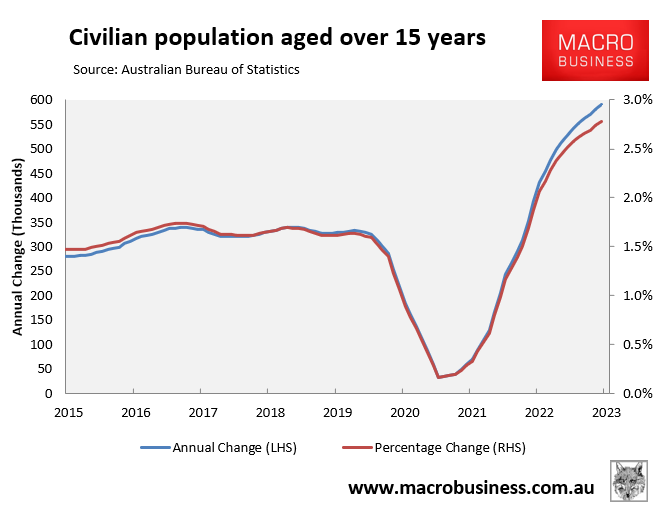

First, the unemployment rate is presently rising as a result of the nation’s slowing economy and a record increase in labour supply (due to record net overseas migration):

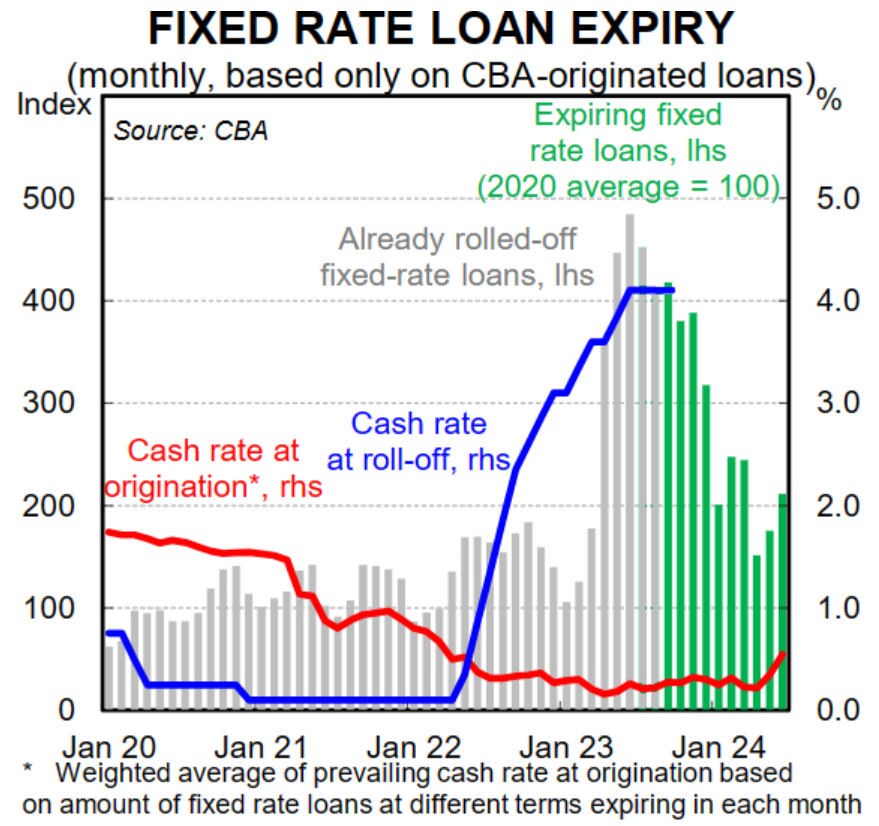

Second, average mortgage rates will continue to rise as more fixed-rate mortgages are converted to variable-rate mortgages:

Third, inflation is expected to remain higher than wage growth for several more quarters, implying that real earnings will continue to fall.

The Albanese Government’s enormous immigration program is covering up the economy’s flaws, while the financial condition of Australian households worsens and living standards fall.