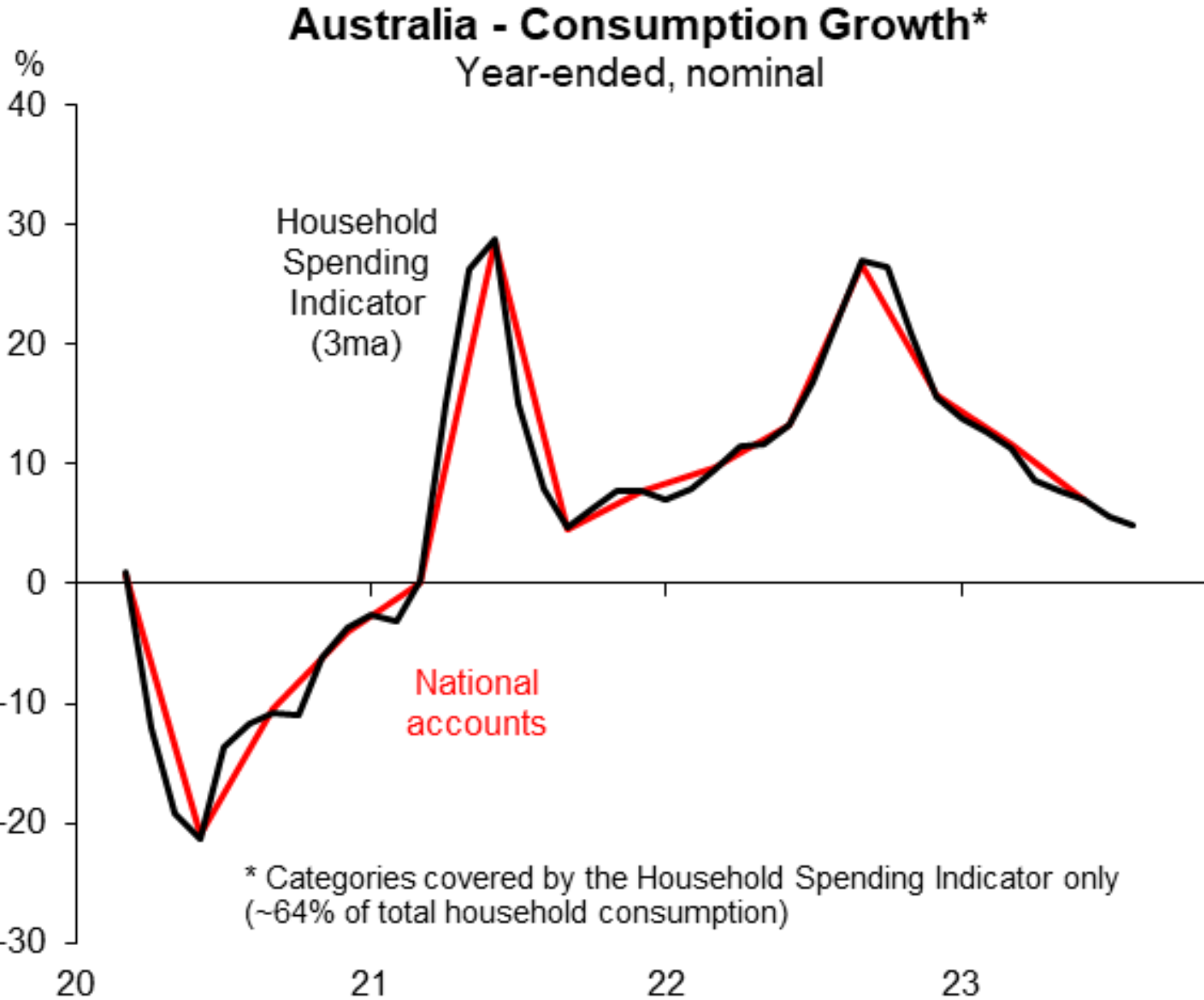

Last week, Justin Fabo from Macquarie Group posted the below charts on Twitter showing the sharp deceleration in nominal household consumption, as measured by the quarterly ABS national accounts and the more timely ABS Household Spending Indicator:

Source: Justin Fabo (Macquarie Group)

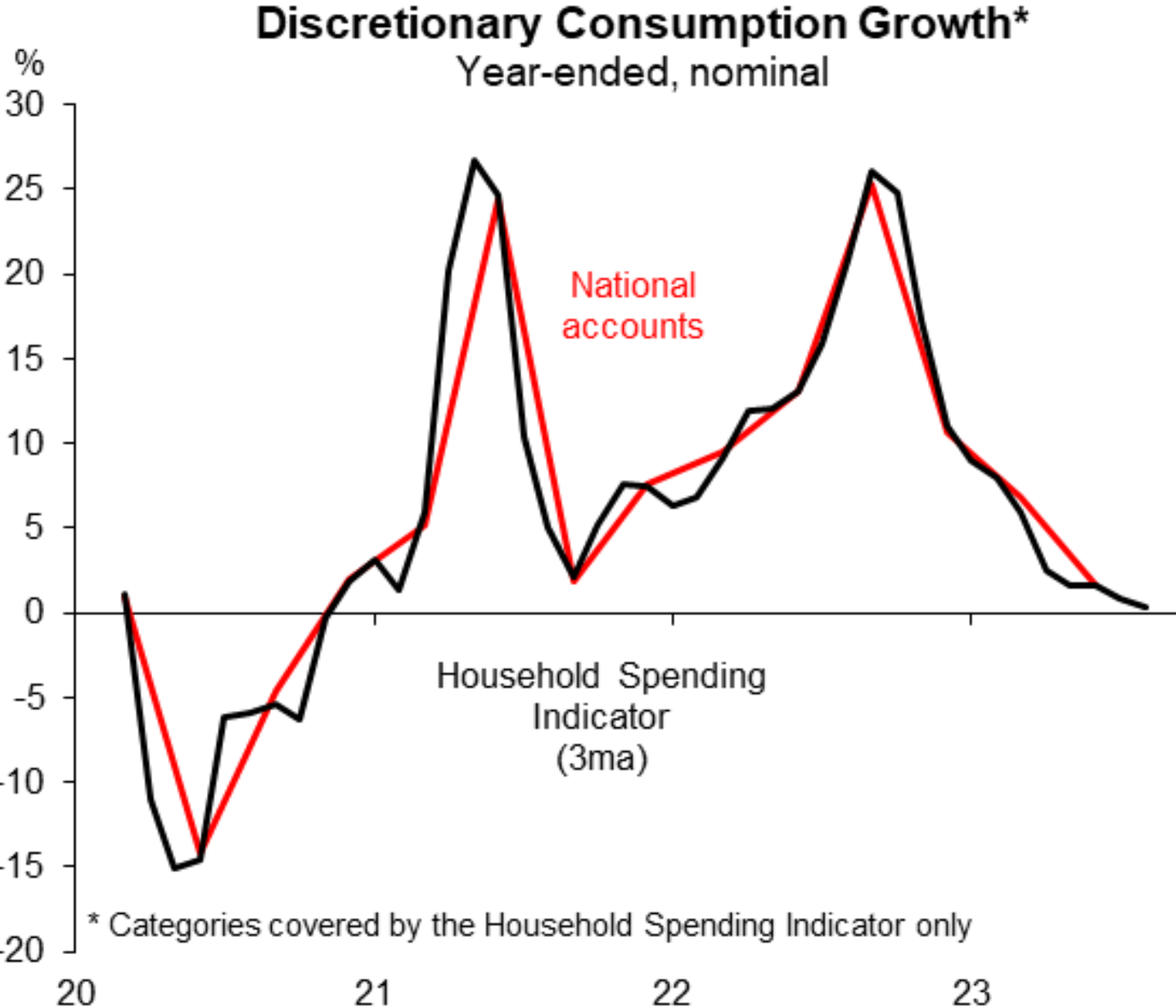

To nobody’s surprise, discretionary spending is leading the decline in consumption growth:

Source: Justin Fabo (Macquarie Group)

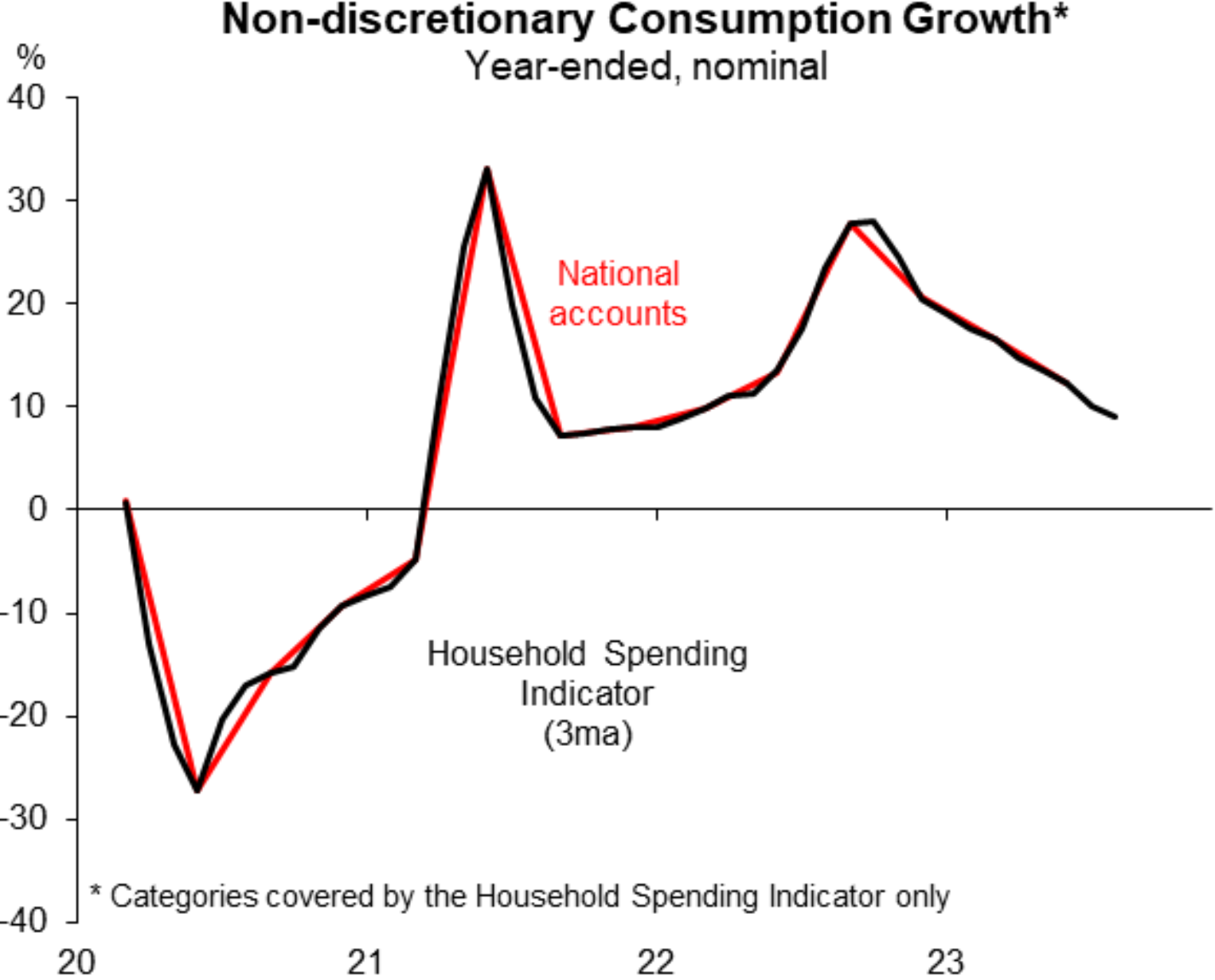

Non-discretionary spending growth is also declining, but not as steeply and from a higher base:

Source: Justin Fabo (Macquarie Group)

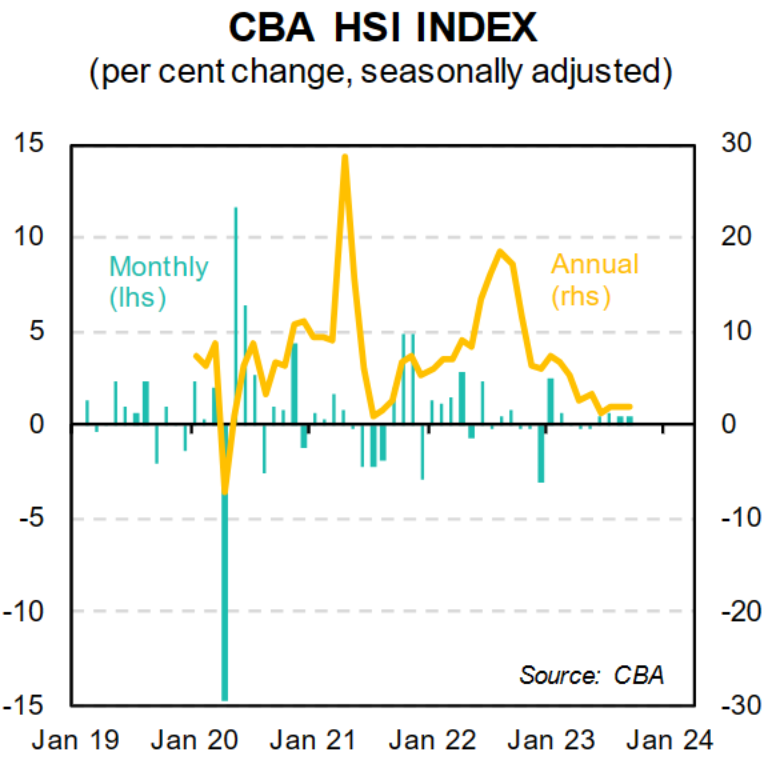

On Wednesday, CBA released its Household Spending Index for September, which showed that overall nominal household spending grew by only 1.8% over the year, which was well below the combined 5.2% increase in CPI inflation in the year to August as well as the circa 2.5% growth in the population:

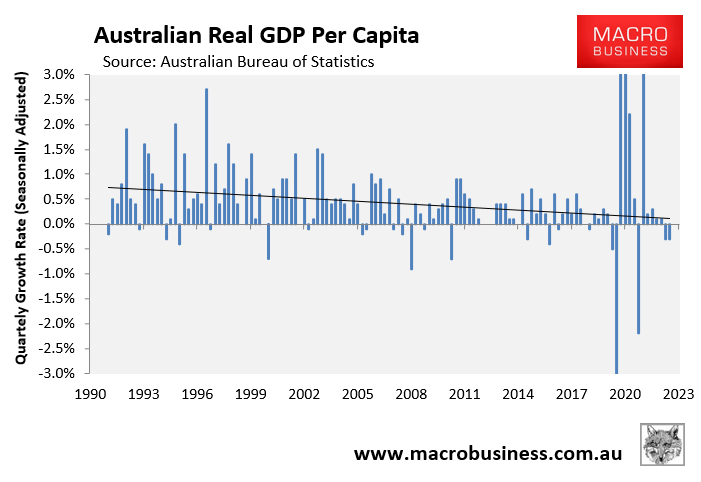

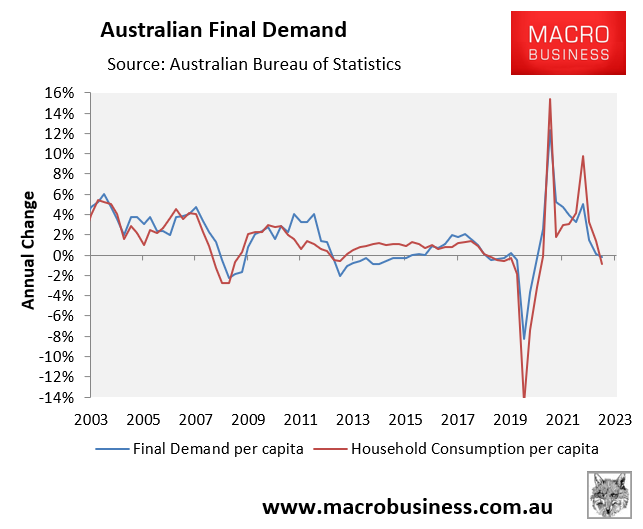

This is clearly bad news for Australia’s economy, which was already in a per capita recession in the June quarter:

This recession has been driven by a 0.2% decline in real household consumption per capita in the year to June:

More than half of the nation’s economic growth is attributed to household consumption. As a result, when it falls, GDP usually follows, as the chart above clearly shows.

Indeed, the IMF this week projected a two-year per capita recession in Australia, with 2024 projected to be considerably worse than 2023.

The Albanese Government’s record immigration program is the only thing keeping Australia from entering a full blown “technical recession” – that is, two consecutive quarters of negative aggregate GDP growth.

While the nation’s economic pie continues to rise due to record population growth, everyone’s slice of the pie is shrinking and living standards are falling.