The Australian Bureau of Statistics (ABS) released its September labour force survey this month, revealing that Australia’s unemployment rate fell by 0.1% to 3.6%.

The monthly ABS labour market survey is always capable of producing unexpected results. And the release this month was no exception.

The 6.700 growth in employment in September was less than the 20,000 consensus market prediction, which would normally be considered a negative outcome.

However, the 0.2% drop in participation meant that the jobless rate declined modestly, indicating a positive result.

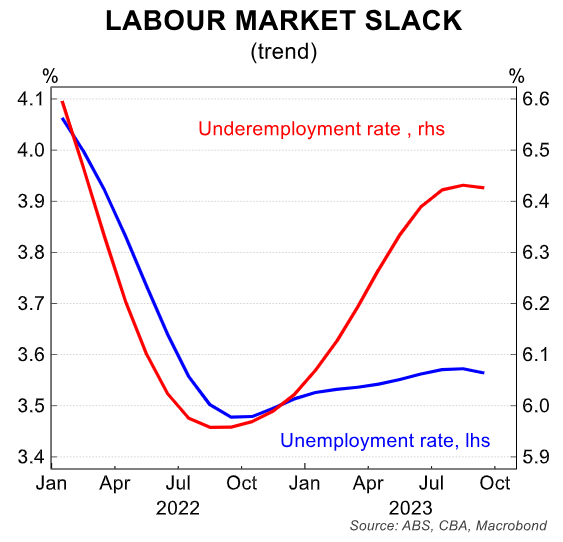

The ABS trend series smooths monthly volatility and demonstrates a labour market that is gradually relaxing.

While the unemployment rate has climbed by only 0.2% since October 2022, the underemployment rate has increased by almost 0.5% during the same time period:

Thus, according to the official ABS labour market survey, Australia’s employment market has loosened over the last year but remains tight overall.

The unemployment rate in Australia is about to rise:

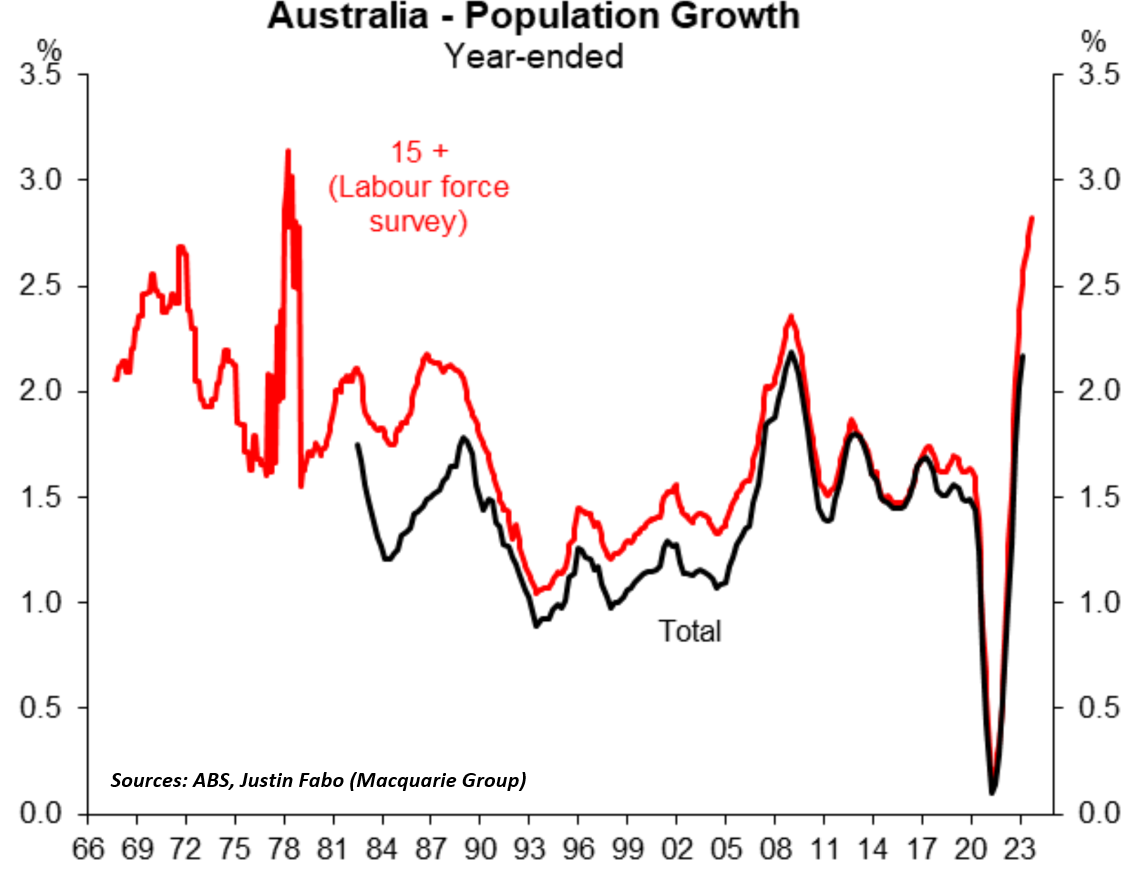

Because of the federal government’s record immigration program, which saw around 500,000 net overseas migrants arriving in Australia in 2022-23, Australia’s labour force is growing at its fastest rate since the late 1970s:

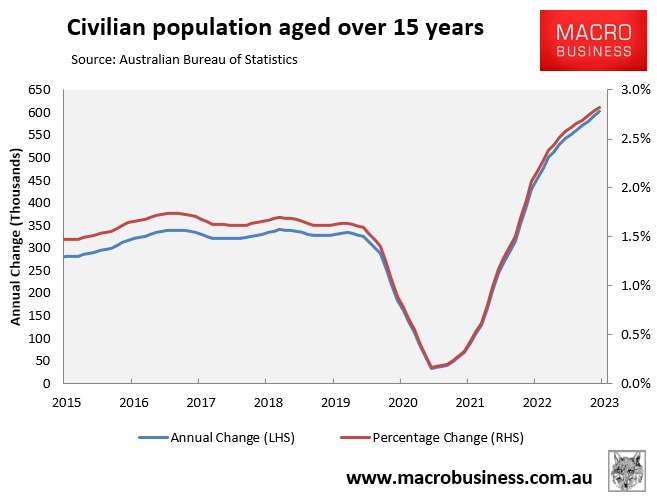

According to the ABS, Australia’s population aged 15 and up increased by 601,000 (2.8%) in the year to September 2023, about double the rate of the pre-pandemic period:

To maintain a steady unemployment rate with an unchanged participation rate, Australia’s labour market must currently generate roughly 37,000 jobs per month.

Alternative labour market indicators point to an increase in Australia’s official ABS unemployment rate in the period ahead.

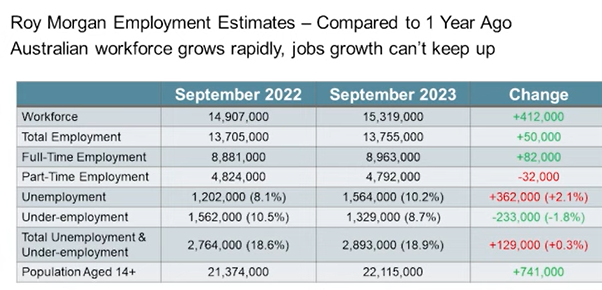

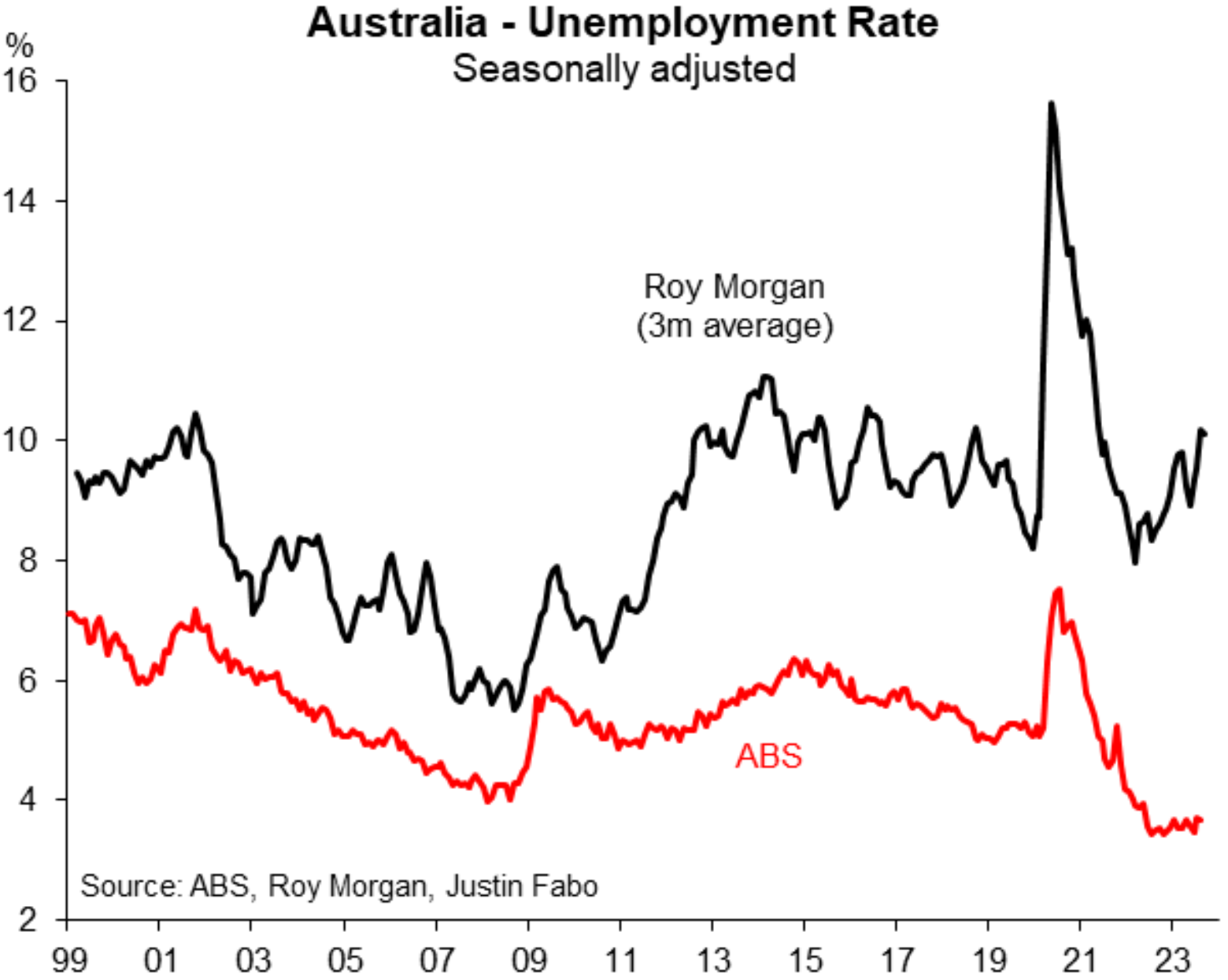

The Roy Morgan unemployment estimate is derived from a poll of people aged 14 and up across Australia.

Roy Morgan classifies someone as unemployed if they are seeking work at any time.

According to Roy Morgan’s alternative labour market survey, unemployment increased by 1.5% year-on-year to 10.2% in September.

Roy Morgan estimated that 50,000 new jobs were generated in the year to October, well below the estimated 412,000 increase in Australia’s labour force over the same period:

While the methods used by the ABS and Roy Morgan to calculate unemployment differ, the two statistics have historically tracked each other:

Therefore, the increase in Roy Morgan unemployment indicates that ABS unemployment will rise in the coming months.

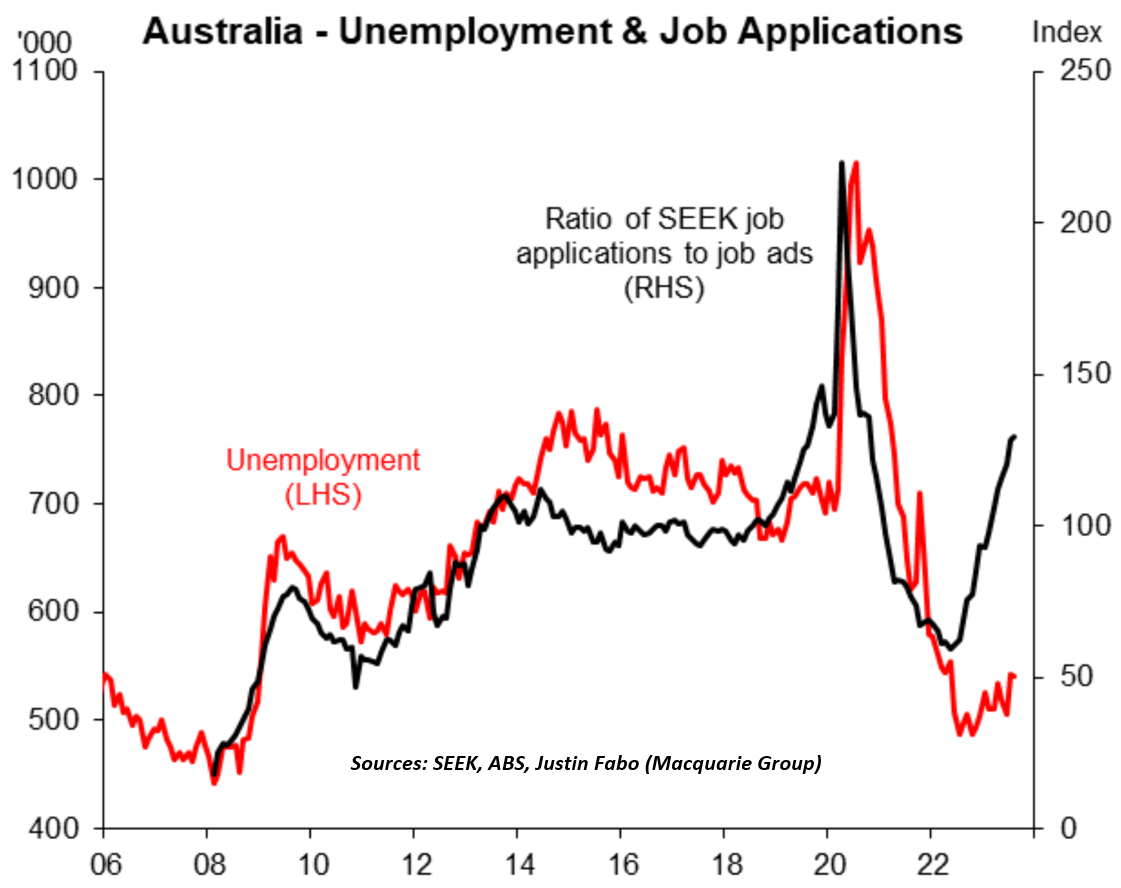

The same can be said for SEEK’s applications per job ad indicator, which has risen well above pre-pandemic levels due to weaker job demand paired with rapid labour supply growth.

SEEK’s metric has historically been a strong leading indicator for the ABS unemployment rate, pointing to higher unemployment in the near future:

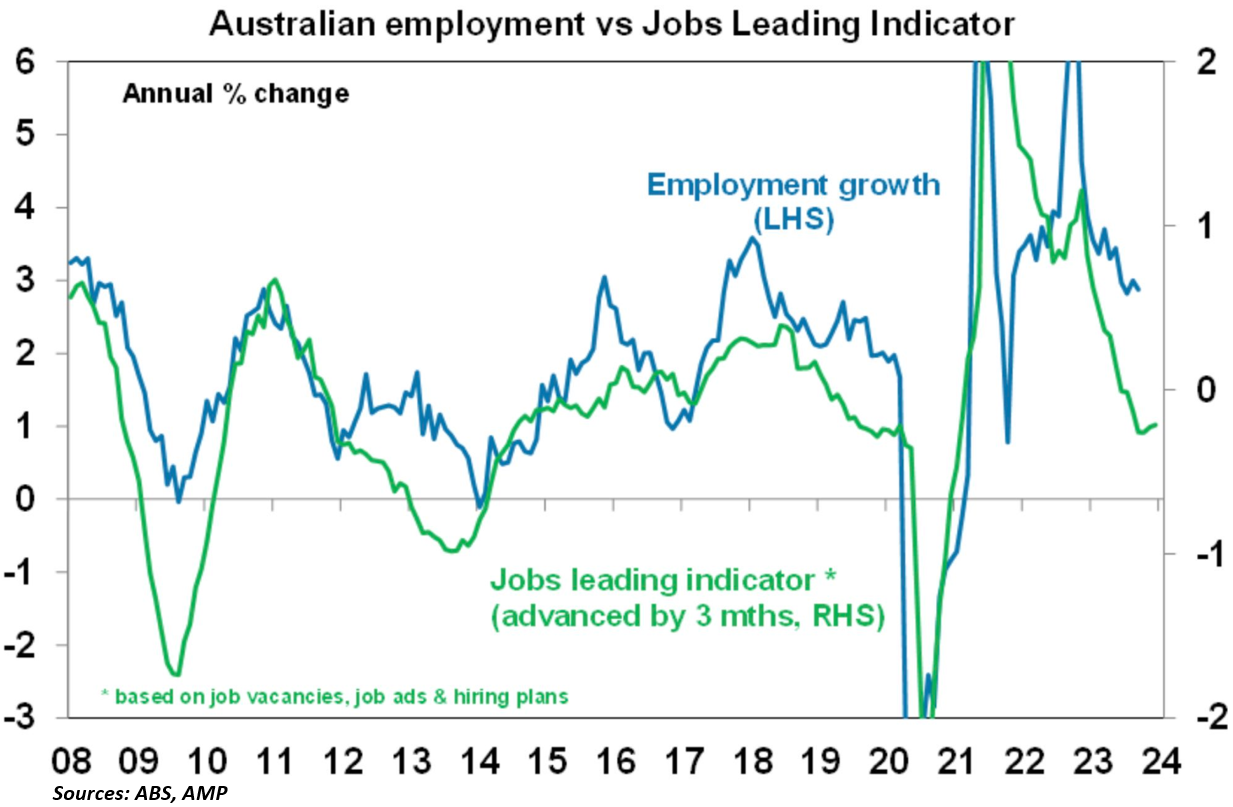

Finally, AMP’s leading job indicator “points to jobs growth slowing to around 12,000 per month”, which is well below the circa 37,000 employment growth required to keep the unemployment rate stable (assuming a constant participation rate):

How much could unemployment rise?

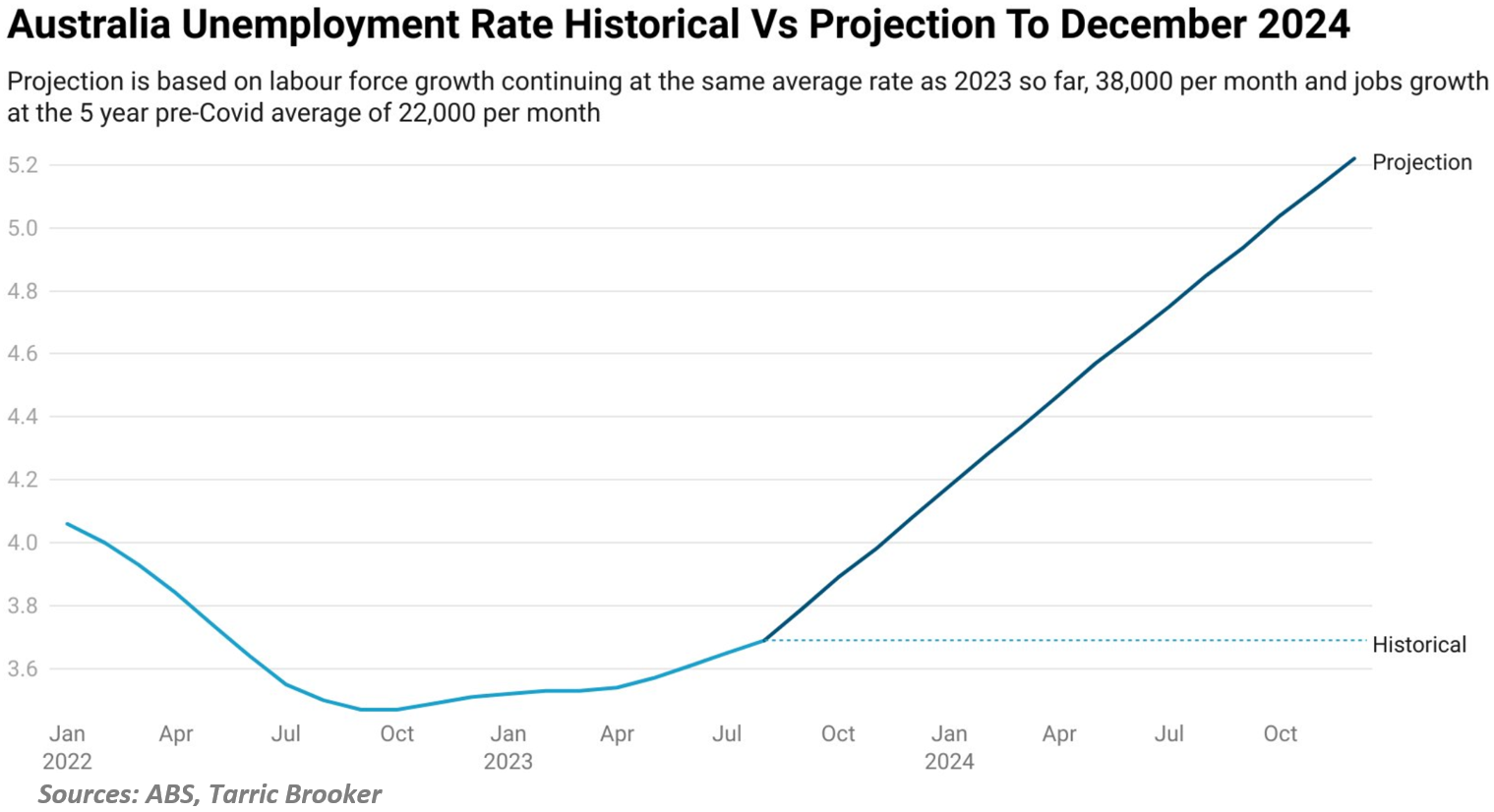

According to the Reserve Bank of Australia (RBA), Australia’s official unemployment rate will grow to 4.5% by the end of 2024, up from 3.6% percent now.

Given the above facts and the extraordinary rise in Australia’s labour force as a result of the Albanese government’s record immigration program, this projection appears optimistic.

Independent economist Tarric Brooker estimated that if Australia’s labour force continues to grow at its current rate and job growth simply returns to its five-year pre-pandemic average of 22,000 per month, Australia’s official unemployment rate will rise to 5.2% by the end of 2024:

The bottom line is that Australia is adding more workers through net overseas migration than it can absorb through new job creation.

In turn, Australia’s official unemployment rate will rise and could exceed 5% within a year.

The rise in unemployment will put downward pressure on Australian wages, causing incomes to continue to lag behind inflation.

It is particularly bad news for Australian tenants, who are experiencing rapid rental inflation.

Rising unemployment, lower wage growth, and rising rents are a triple whammy for the one-third of Australians who are renters.

All three whammies are exacerbated by the Albanese government’s unprecedented net overseas migration.