A survey of 13 economists predicts that Australian house prices will rise 7.7% this year calendar year and then climb a further 4.5% in 2024.

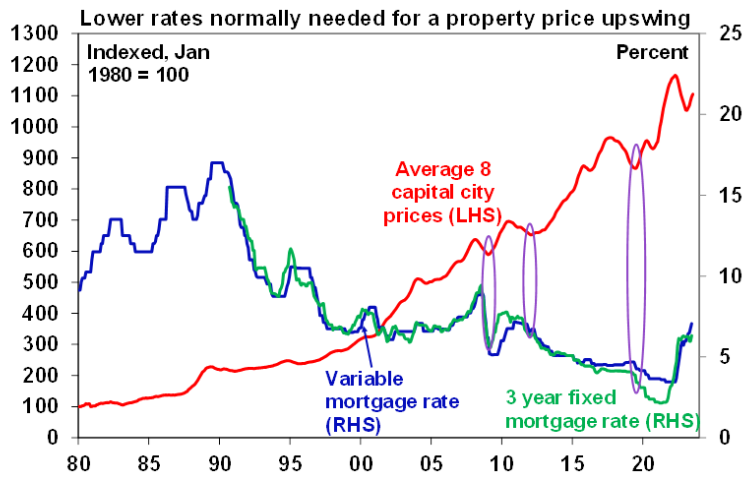

It would be the first time that Australian house prices have rebounded during a period of monetary tightening since at least the early 1990s, when the Reserve Bank of Australia (RBA) began inflation targeting.

“The Australian housing market has proved much more resilient to higher interest rates”, said Andrew Boak, chief economist for Australia at Goldman Sachs.

“We view the risks to our already above consensus growth forecasts for 2023 and 2024 as skewed slightly to the upside”.

“It stands to reason at the moment that housing values would continue to rise in the near term”, said CoreLogic Head of Research, Eliza Owen.

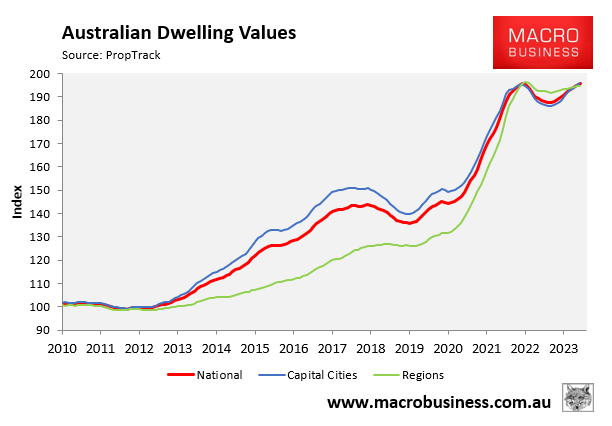

PropTrack’s home values index has already fully recovered the losses from the RBA’s 4.0% of interest rate hikes:

The unexpected rebound in prices has caught almost all economists off guard, the notable exception being Stephen Koukoulas.

This includes the RBA, which warned that it has been caught off guard by rising house prices in its latest Minutes.

The previous episodes when house prices rebounded from a fall involved the RBA reducing borrowing costs, as shown in the chart below from Shane Oliver:

Source: Shane Oliver (AMP)

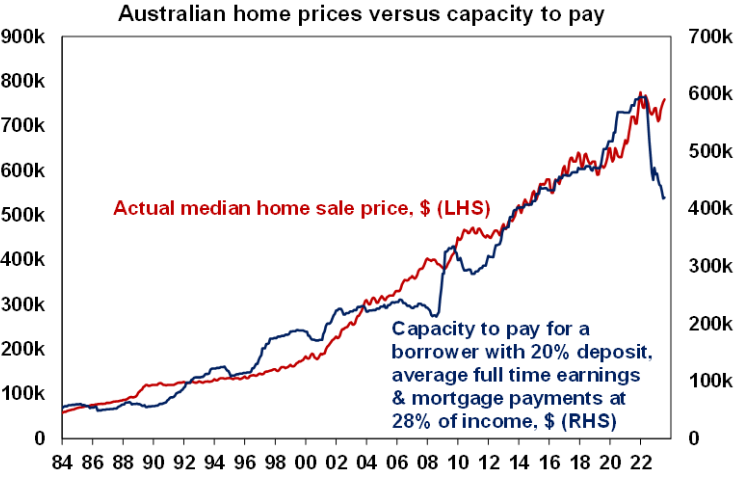

The rebound has also come despite a circa 30% decline in borrowing capacity arising from the RBA’s rate hikes, which would typically cause prices to fall:

Source: Shane Oliver (AMP)

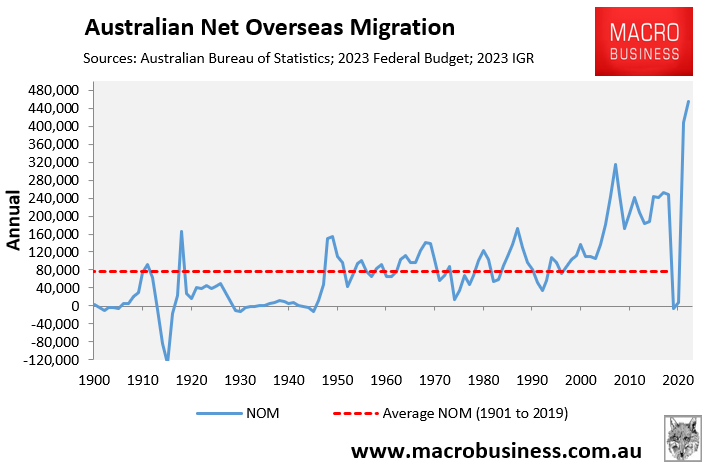

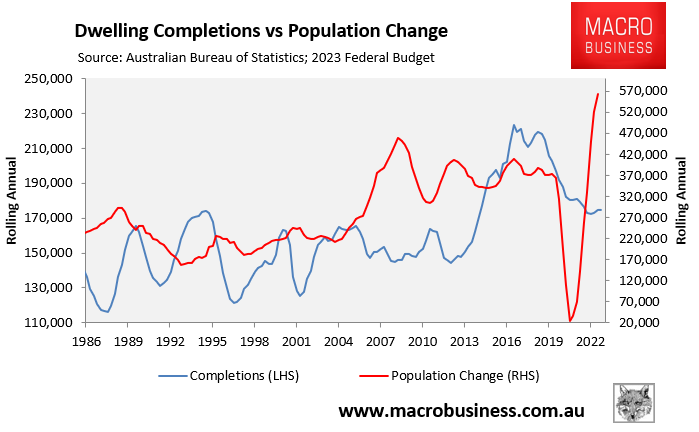

The unprecedented rebound in net overseas migration, which has smashed all records, is the obvious driver of the house price rebound:

This sheer weight of numbers looking for housing has created Fear-of-Missing-Out [FOMO] and scarcity in the market, driving up both prices and rents.

Given the rate of dwelling supply is now falling at the same time as the population is expanding at a record rate, there is only one way for prices to go: up.

If the RBA cuts rates next year, this will obviously provide further stimulus to house prices.