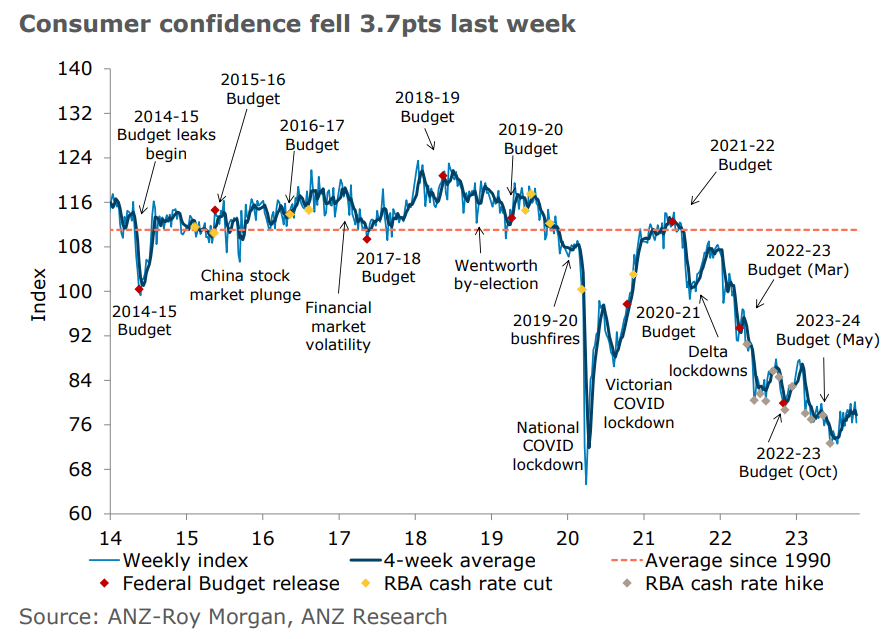

Australian consumer confidence has been in the doldrums for 18 months:

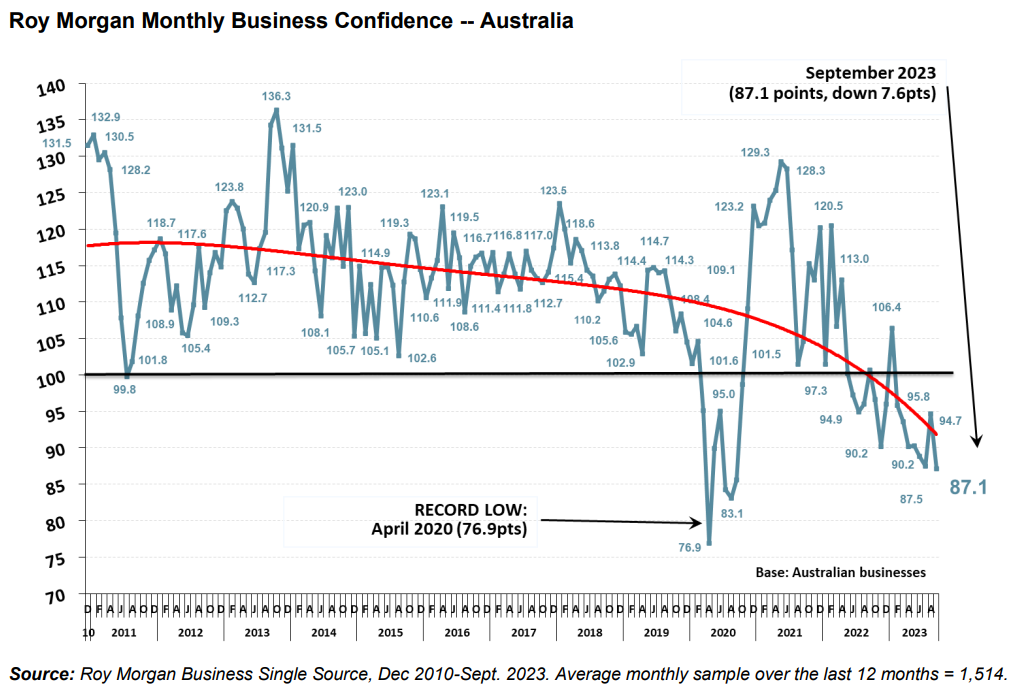

Now business confidence has joined the funk, with Roy Morgan reporting that confidence collapsed to a three-year low in September amid growing concerns around inflation and the outlook for the Australian economy:

According to Roy Morgan:

“This is the lowest Business Confidence for three years since September 2020 when Victoria was in an extended lockdown and New South Wales was enduring significant COVID-19 outbreaks”.

“The Business Confidence survey was conducted after the RBA left interest rates unchanged for a third straight month in September at 4.1%. However, there were renewed concerns about inflation during September with average retail petrol prices hitting a record high of over $2.05 per litre during September”.

“Business Confidence has now spent eight consecutive months below the neutral level of 100, the longest stretch in negative territory since October 2020 during the first year of the COVID-19 pandemic”.

“A majority of businesses are worried about the performance of the Australian economy with 55.2% expecting ‘bad times’ for the economy over the next year and even more, 63.1%, expecting ‘bad times’ for the economy over the next five years”.

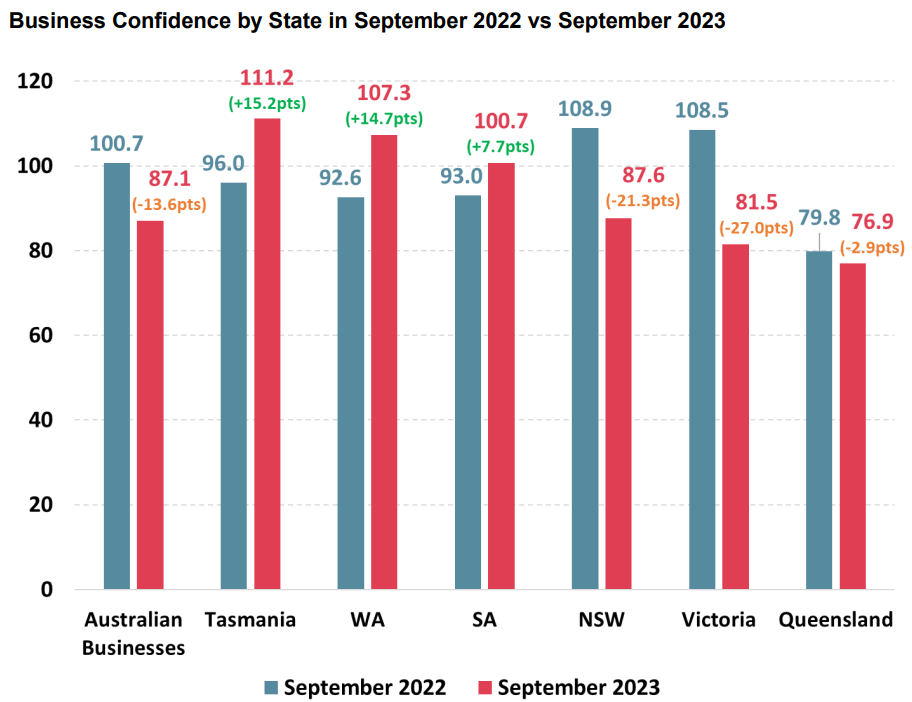

The largest annual falls have occurred across Victoria and NSW, while Queensland has the lowest overall confidence:

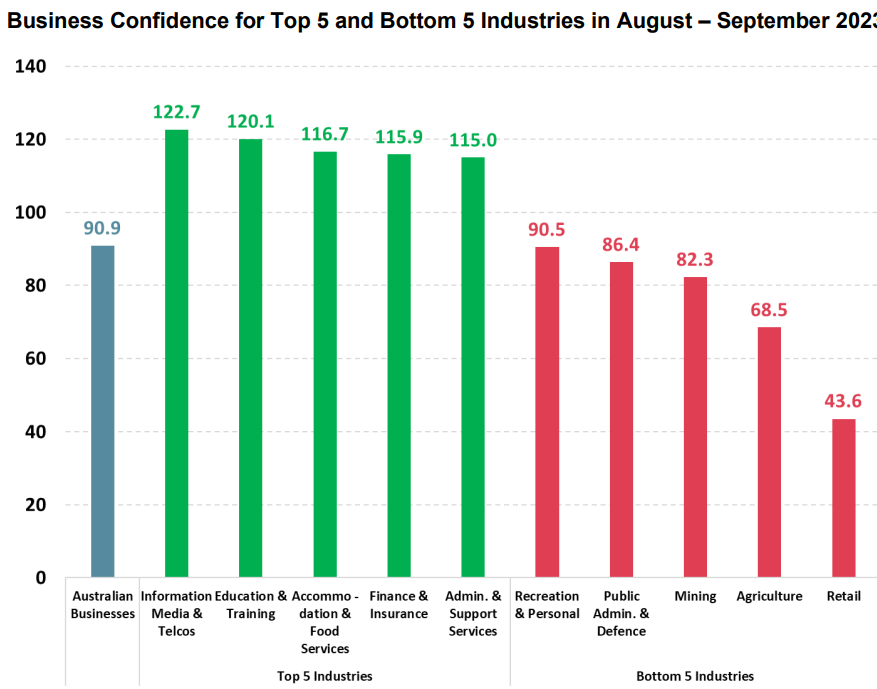

Reflecting the fall in discretionary spending, confidence is lowest in the retail sector:

While the overall economy is not technical in recession, due to record population growth, the economy is suffering a per capita recession.

This is clearly being reflecting by both consumer and business confidence.