China’s steel industry is dying and iron ore is next

Friday was a bad day for iron ore on the Dalian exchange:

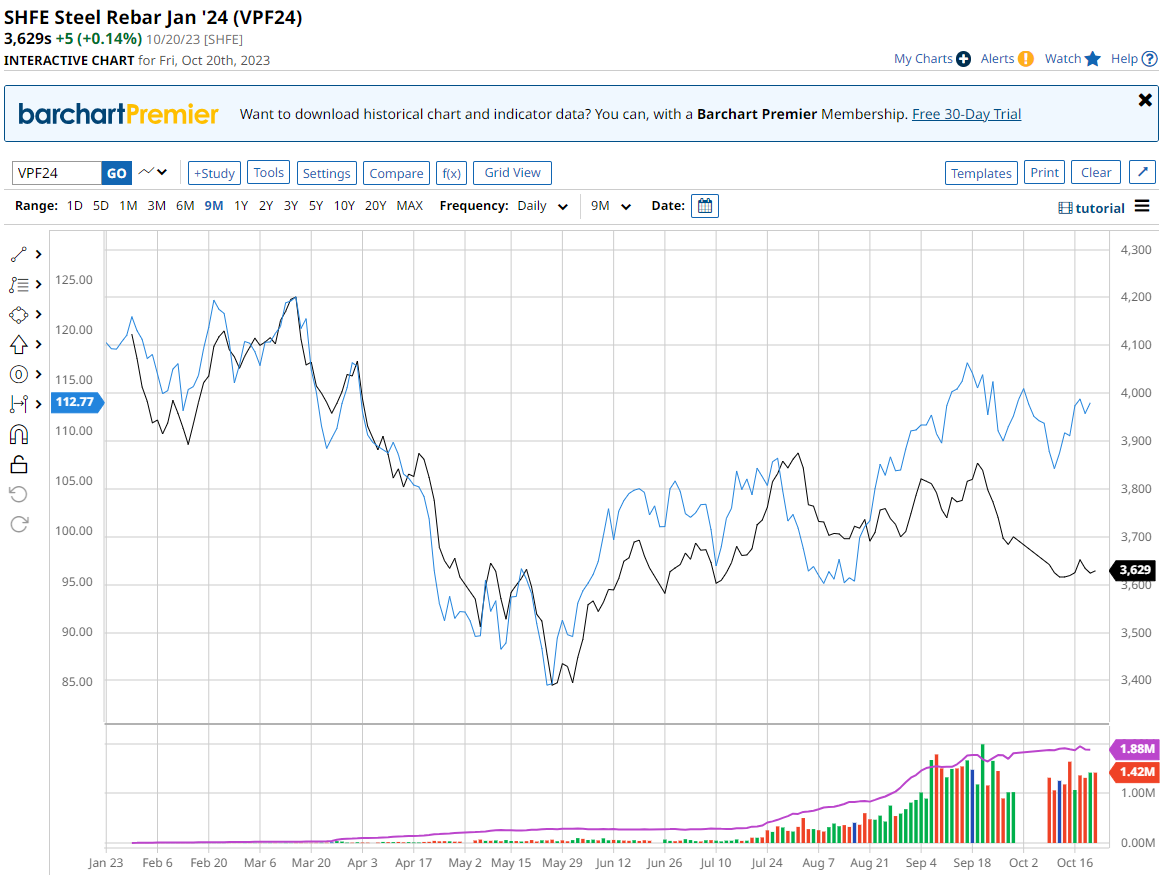

There is a large set of jaws between the miracle metal and steel prices based upon hopes for stimulus:

But it isn’t coming. Goldman:

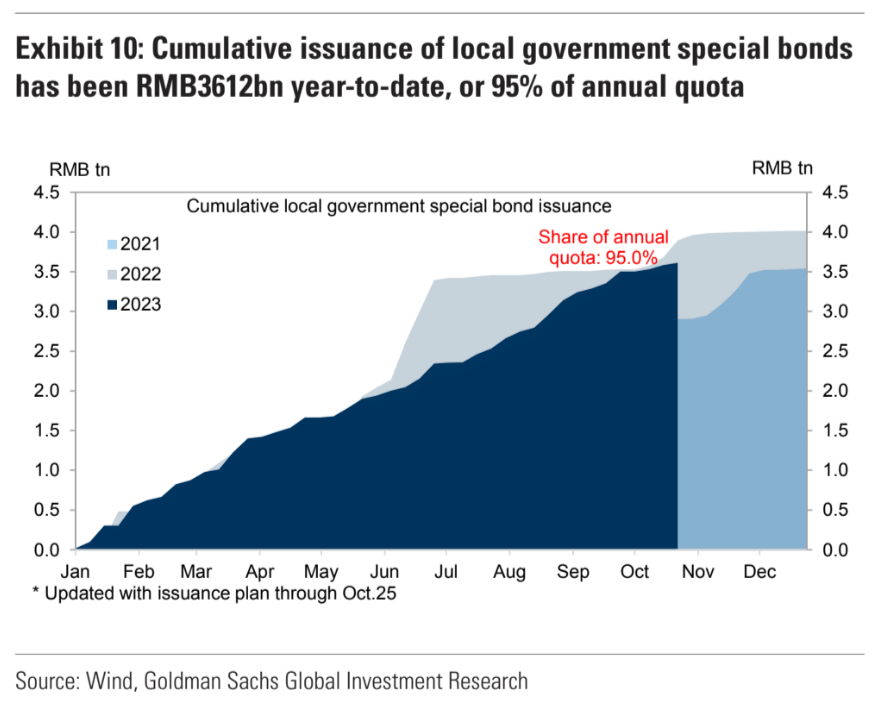

Policymakers have stepped up concrete measures to contain local government debt risks since early October, including encouraging more local governments to tap their unspent bond issuance quota to refinance and/or swap their liabilities, and requiring some banks to roll over part of local government implicit debt.

Based on our tracking, as of 19 October, 19 provinces had issued a total of RMB911bn in special-purpose refinancing local government bonds so far this year, with the lion’s share taken by less-developed provinces such as Yunnan, Inner Mongolia and Liaoning.

In our view, recent policy measures should help alleviate near-term risks from LGFV bonds, but they appear still insufficient to fully address LGFV related risks, and some supplementary supportive measures may be necessary.

We maintain our forecast for more fiscal easing measures in coming months, but the government is unlikely to choose the high-profile route of raising its 2023 official budget deficit target.

We continue to expect a 25bp RRR cut and a 10bp policy rate cut in Q4 to accommodate bond issuance and boost growth/market sentiment, and note some major policy events in Q4 and beyond likely related to China’s fiscal stance and local government debt resolution.

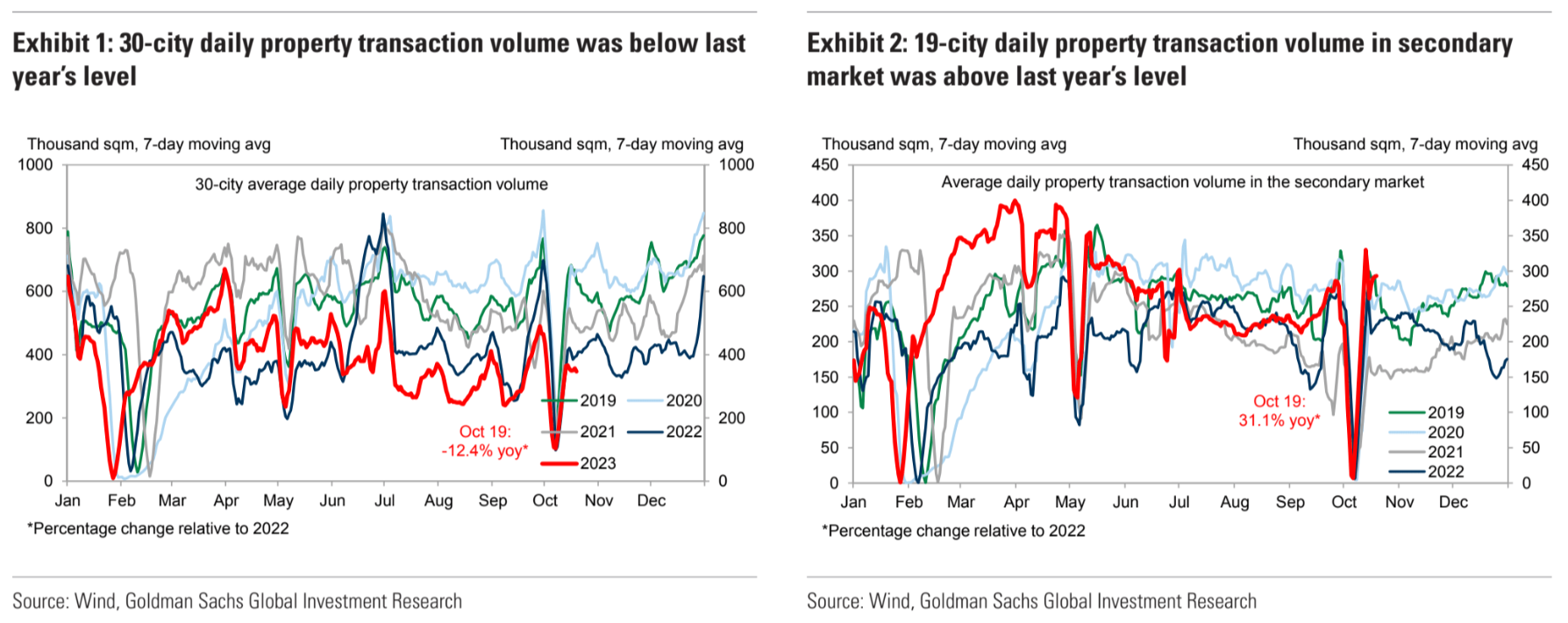

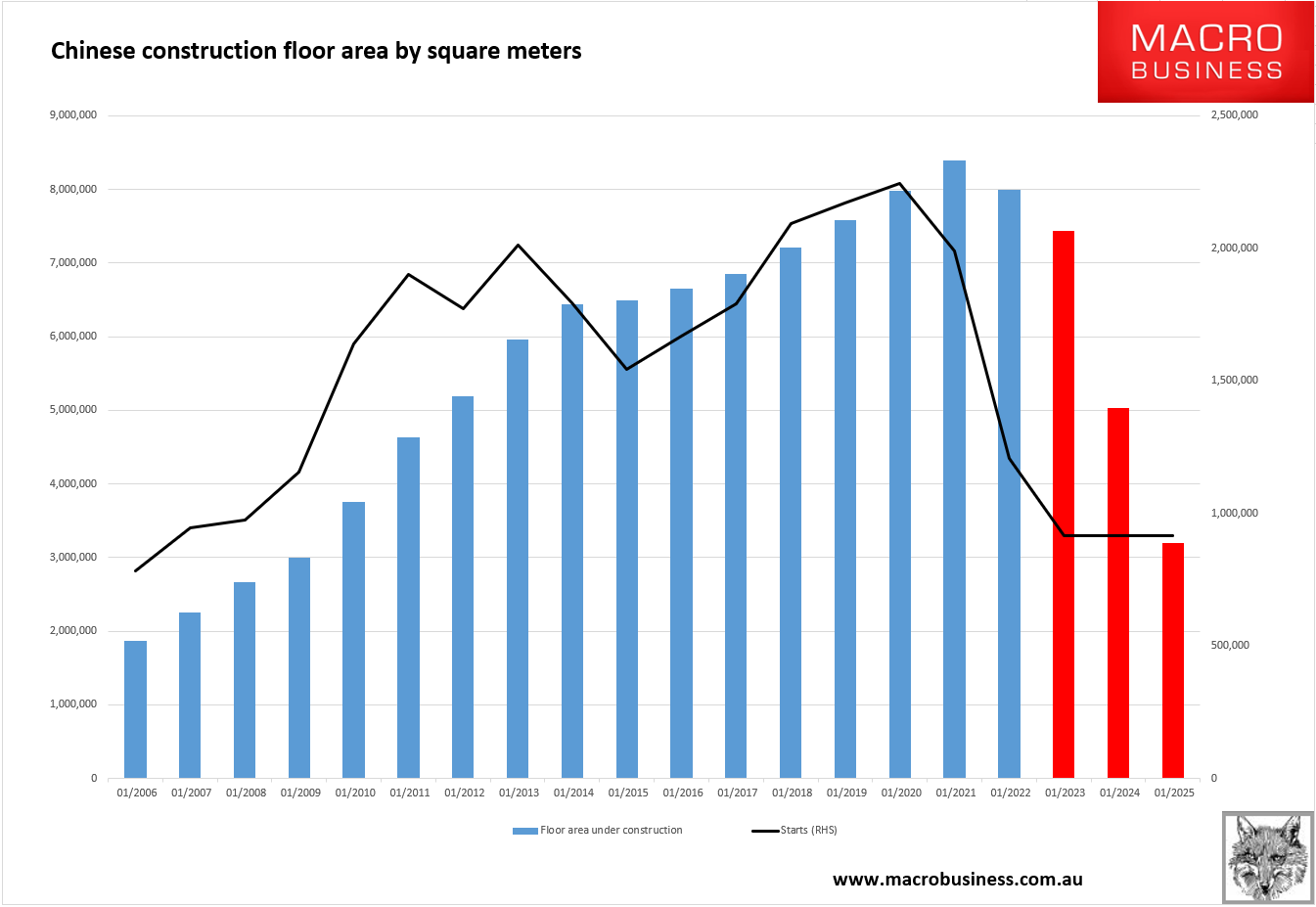

Nor is housing showing any sign of recovery for volumes:

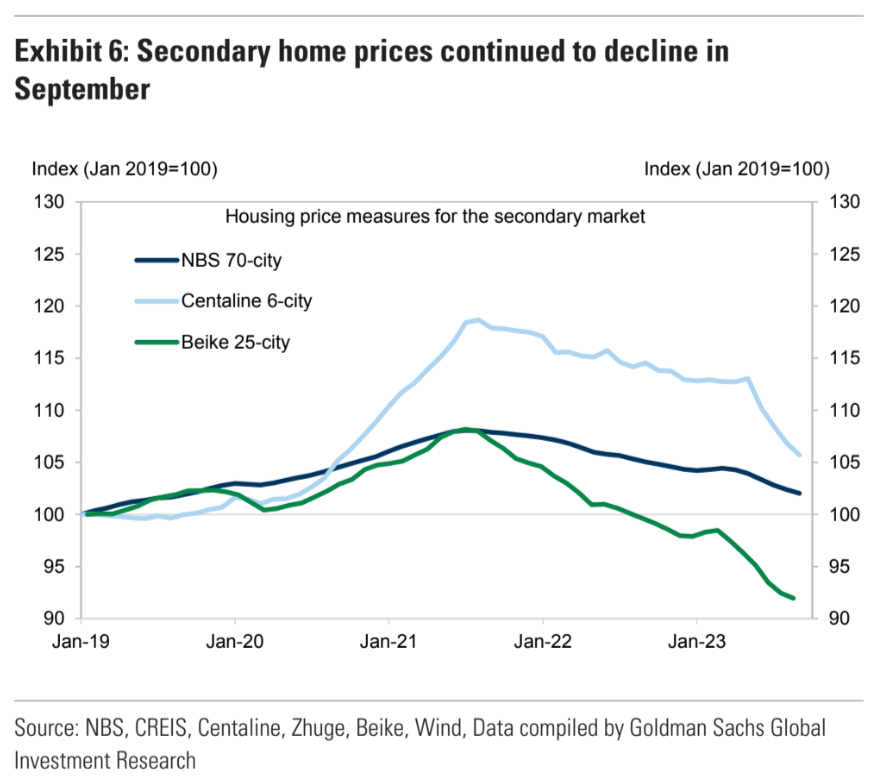

Or prices:

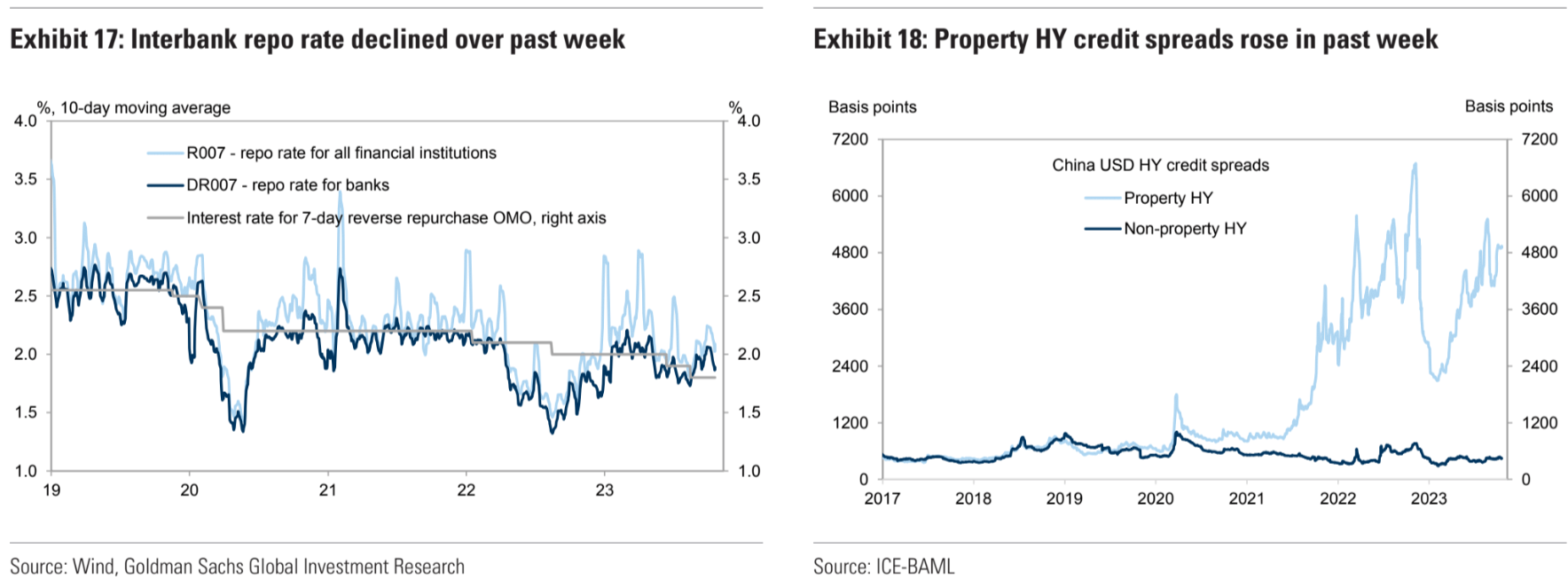

Developer funding remains cut off:

With massive downside ahead for building volumes. The only question is the speed of completions:

Infrastructure funding is still materially down year on year as well:

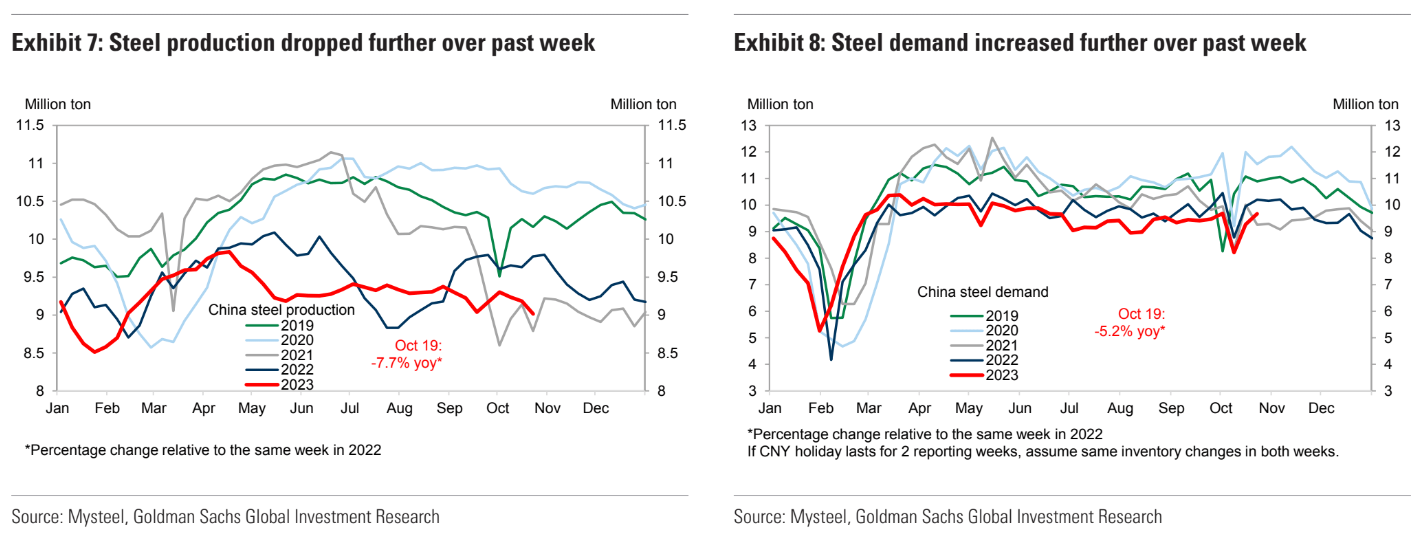

Steel demand is weak, and production is even more vulnerable as bloated iron ore prices smash mill margins:

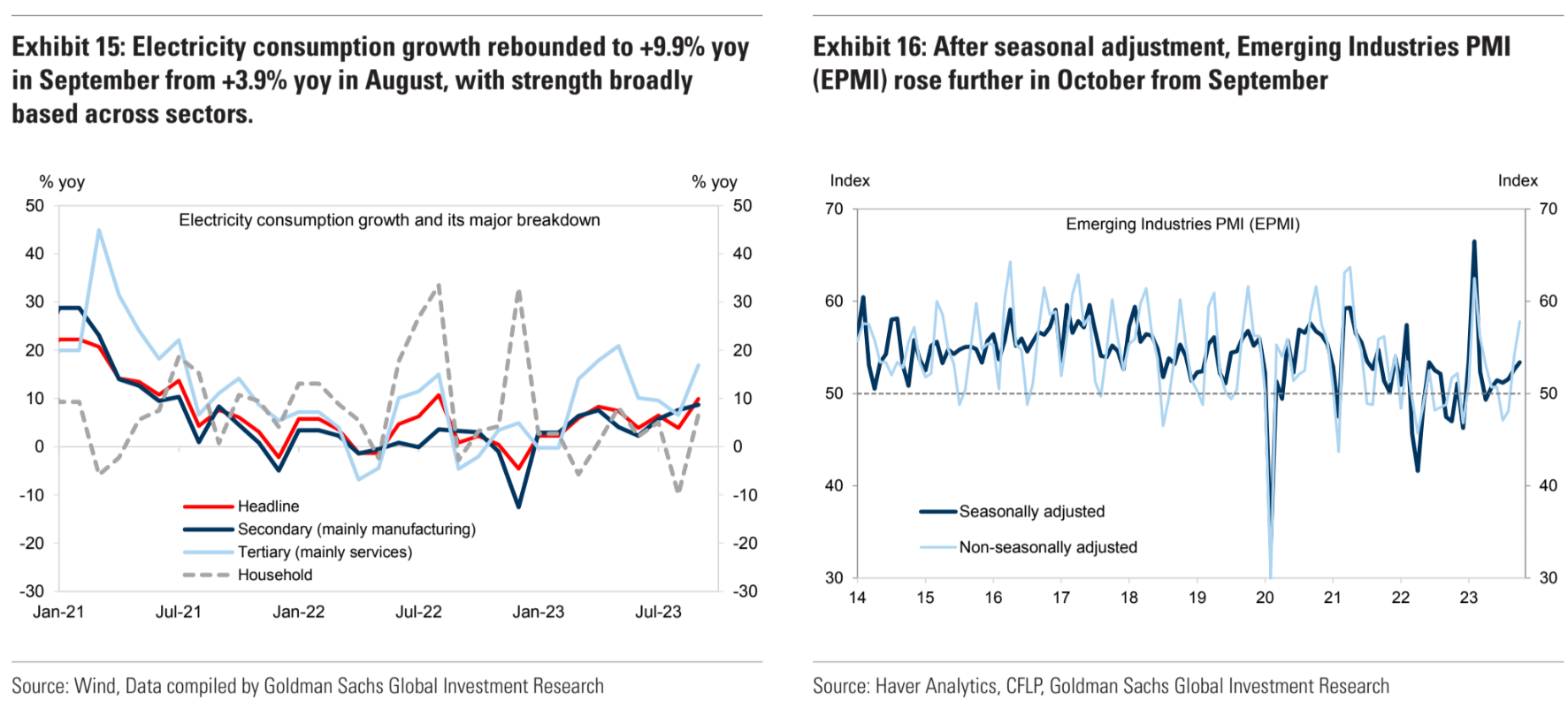

New industries are helping the broader economy:

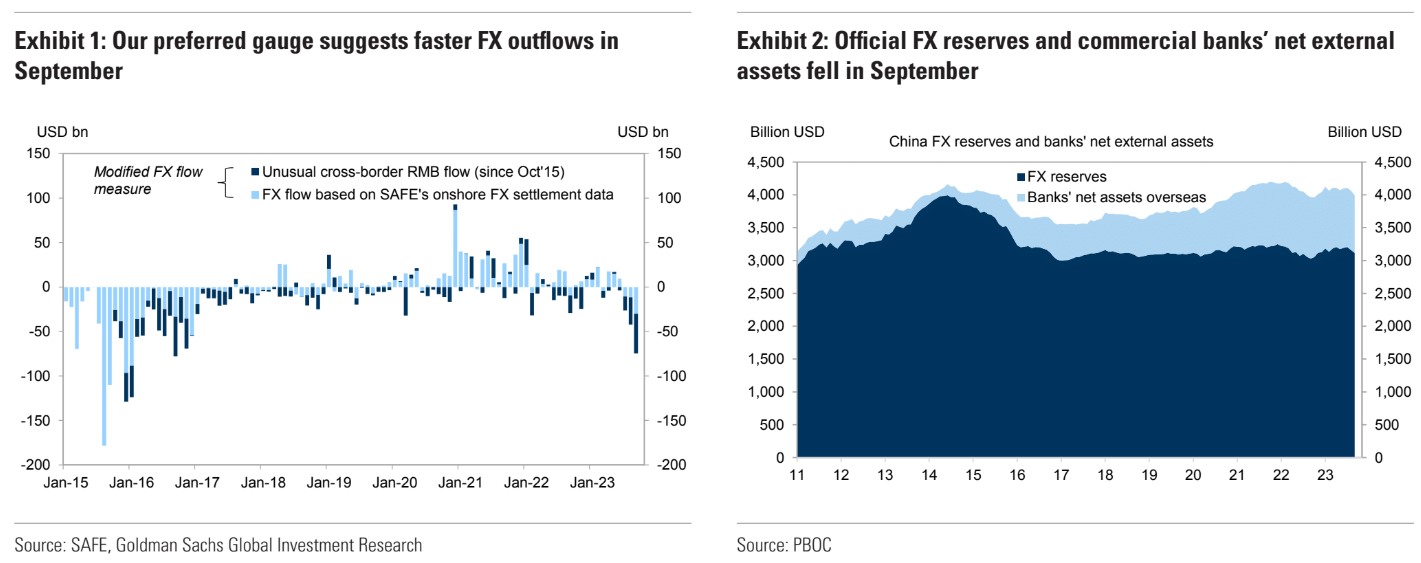

But capital outflow is accelerating:

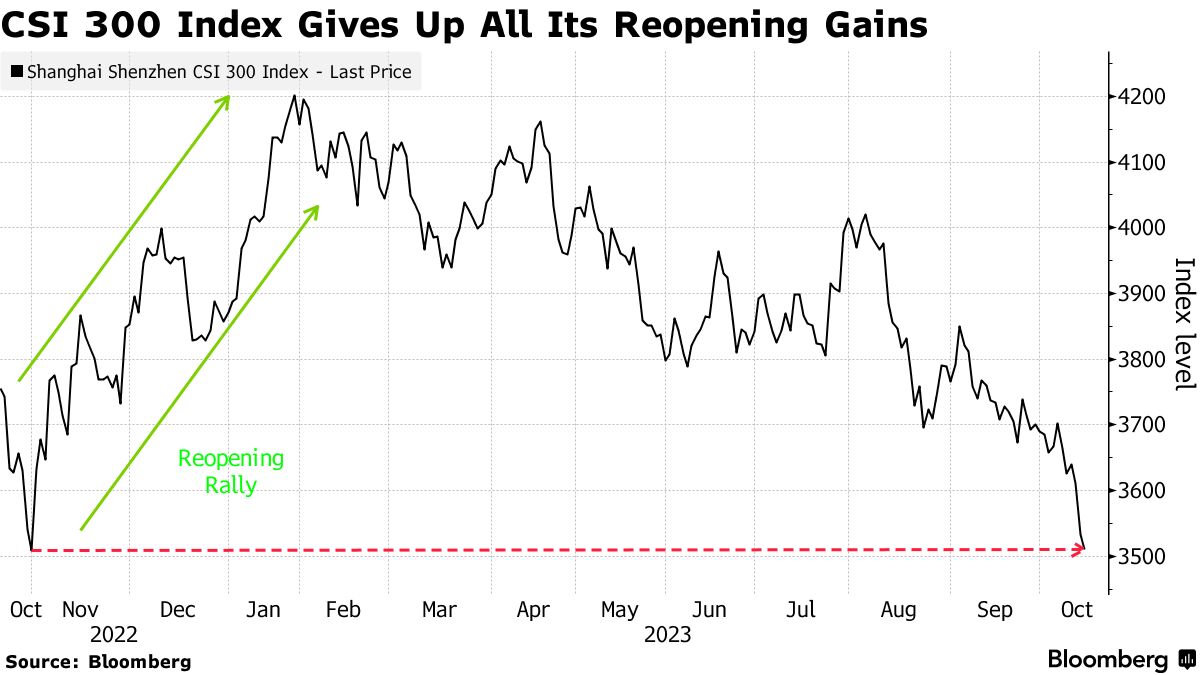

Destroying the stock market as foreign money flees:

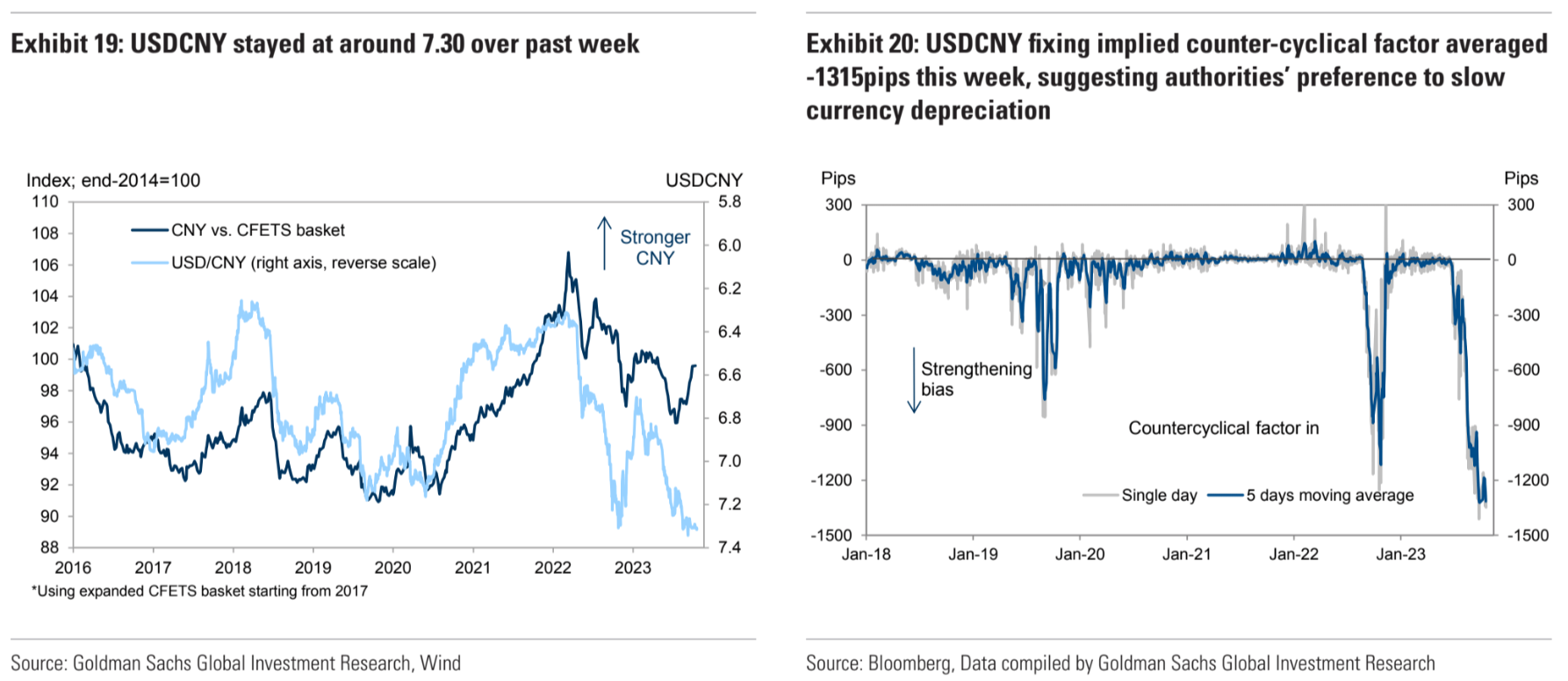

Despite the PBoC throwing the kitchen sink at holding up CNY:

Put bluntly, China is fighting for its economic life as the impossible trinity unwinds.

New industries are struggling to keep it afloat as old industries die, including steel.

Iron ore is next.