Another day, another Chinese capital flight into Australia scam:

A transnational crime syndicate is accused of laundering $228 million in dirty funds and tainted cryptocurrency via a money moving business spruiked by a former Howard government minister and allegedly secretly controlled by Chinese gangsters.

On Wednesday morning, Australian Federal Police officers from Operation Avarus-Nightwolf swooped on seven suspected Melbourne members of what agents called the “Long River” – an Australia wide crime syndicate – accusing them of serious financial crime.

…The arrests on Wednesday will also ramp up pressure on the federal government to introduce long-stalled “Tranche 2” laws. The laws would force accountants, real estate agents and lawyers to face the same obligations as bankers and casinos to report suspected money laundering.

Don’t make me laugh. Albo loves the flow of dirty Chinese money into Aussie property. He’s spent 18 months restoring relations to get it moving again.

For years, MB has called for the tightening of Tranche 2 anti-money laundering (AML) laws.

Bizarrely, this was how I ended up in AHCR’s hate crime process—campaigning against illegal Chinese property raiders!

In 2015, the Paris-based Financial Action Taskforce (FATF) – the global AML regulator – warned that Australian residential property was being used a haven for international money laundering, particularly from China, and recommended that Australia implement counter-measures to ensure that real estate agents, lawyers and accountants facilitating real estate transactions are captured by the regulatory net.

FATF’s findings were supported by the Australian Transaction Reports and Analysis Centre (AUSTRAC), warning that “laundering of illicit funds through real estate is an established money laundering method in Australia”.

Australia agreed in 2003 to implement comprehensive global AML rules that would cover accountants, lawyers, real estate agents, and other non-financial industries.

However, the second tranche of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 legislation, which would have covered these non-financial gatekeepers, has laid dormant for nearly two decades by the federal government.

This has given Australia the weakest money laundering rules in the world:

Over these two decades, billions of dollars have been laundered through Australian homes, mainly from China.

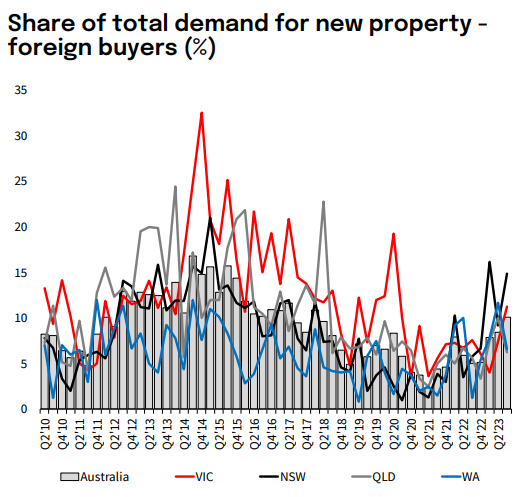

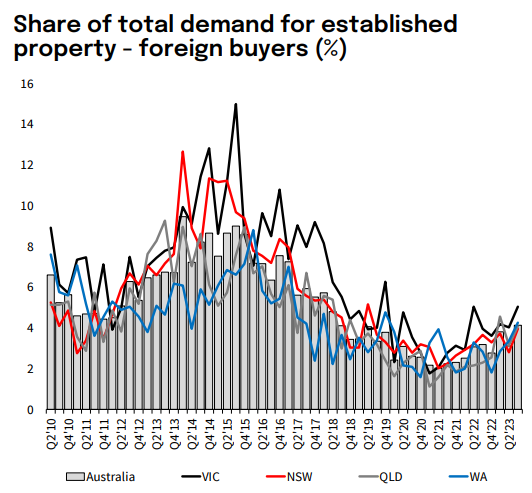

The flow of dirty money into Australia is again driving up Chinese property purchases:

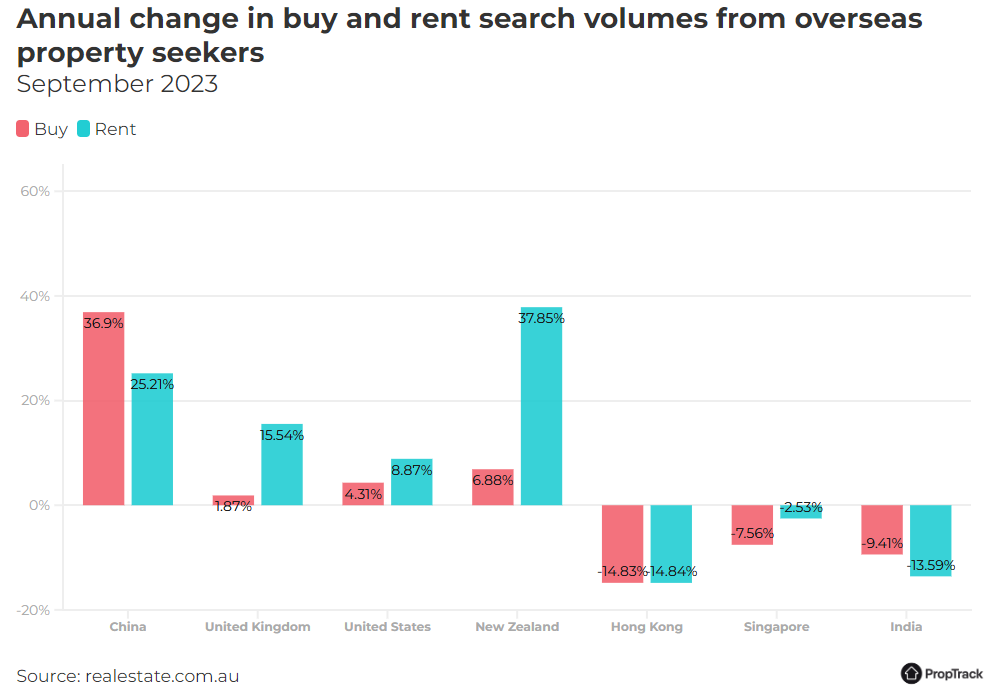

More evidence is available today:

- Searches on realestate.com.au for Australian properties from overseas property seekers have continued to increase in the past three months, with buy searches rising 11.5% and rent searches up 7.8%.

- New Zealand property seekers remain the number one fan of Aussie homes, with rent searches up 38% on this time last year and searches to buy up 7%.

- Rental searches were up from September 2022, especially in China and the UK, rising 25% and 15.5%, respectively. Rental searches from China are nearly double the volumes seen before the pandemic.

- Searches to buy were up year on year, particularly in China, which increased by 36.9%

The below chart from PropTrack tells the tale:

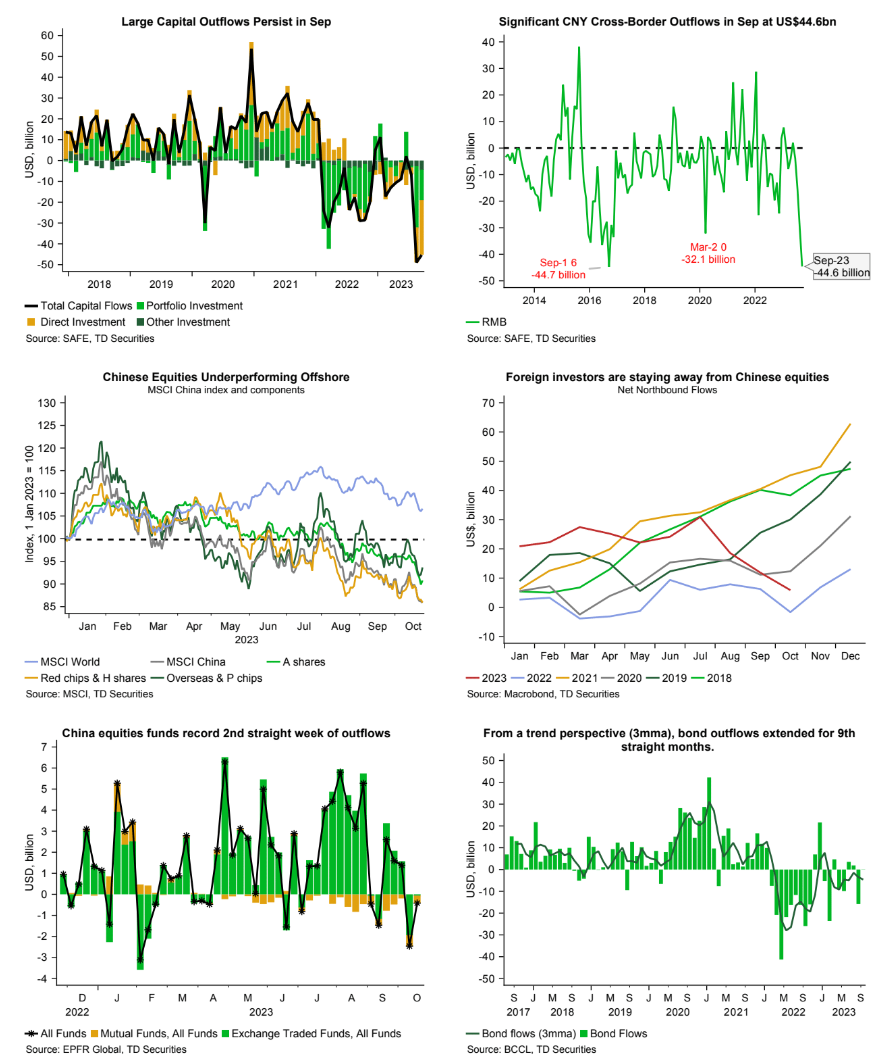

The flood of money is intensifying. TD Securities has more:

Investors are shunning China with large capital outflows persisting in September at US$45.3bn. Of this, US$26bn came from direct investment (largest outflow recorded) and US$15bn from portfolio investments (Aug: US$29bn).

Cross-border payments in CNY have also risen markedly, with outflows matching the previous high in 2016 at US$44.6bn and signals that hot money outflows are underway.

The deterioration in Chinese capital markets probably caught authorities’ with China equities underperforming sharply vs offshore, revisiting the COVID 2020 lows.

Equity inflows are almost fully reversed YTD, reflecting bearish investors’ sentiment while China’s ETFs registered its 2nd straight week of outflows.

Against this dire backdrop, we expect more active involvement from Central Huijin (China’s domestic SWF) to stem the decline in equities after shoring up stakes in Big Four banks and purchasing onshore ETFs.

Foreign bond outflows extended on a trend basis and are negative YTD despite PBoC’s forceful easing and could persist with foreign investors de-risking from Chinese assets, foreign bond holdings at 2019 levels. We suspect the severe capital outflows situation will be a major discussion point at the half-decade financial policy conference next week (Oct 30-31), with possible policy follow-ups to curb outflows as officials try to mitigate any undue pressure on the yuan.

We can expect Chinese authorities to intervene more forcibly to prevent the capital flight.

We can expect Albo to welcome the Chinese dirty money as a part of his systematic grovelling.