Australia’s manufacturing sector has been in terminal decline for decades.

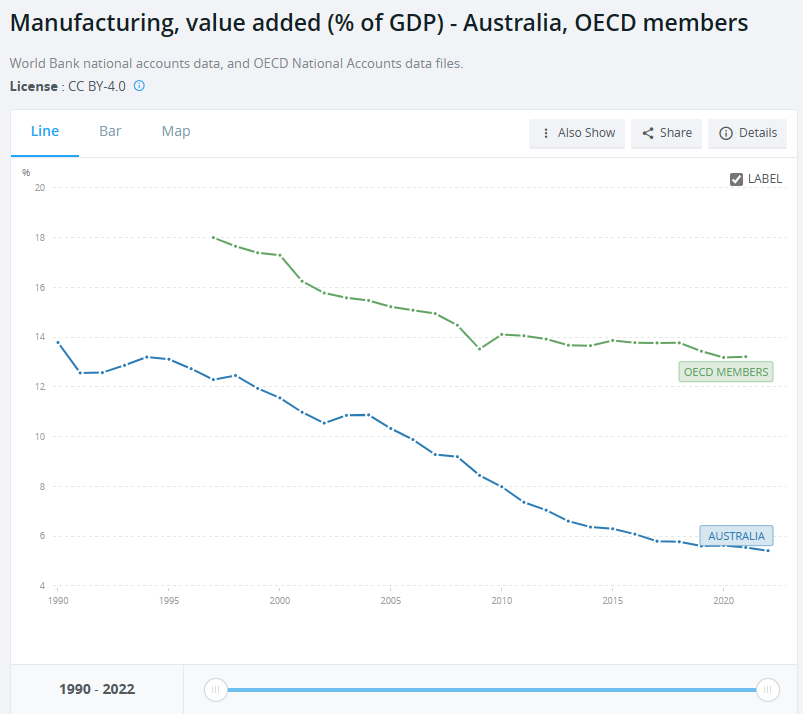

According to the World Bank, Australia’s manufacturing value added as a proportion of GDP has plummeted from 14% in 1990 to 5% in 2022:

This compared to 13% of OECD member countries.

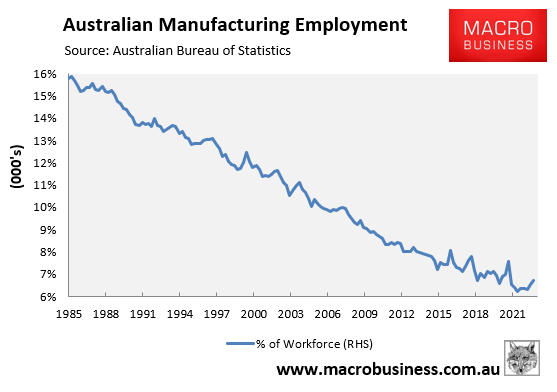

The share of Australian workers in manufacturing has also collapsed, from 16% in 1985 to under 7% currently:

The picture is unlikely to change given the nation’s failed energy policies, which have spiked energy costs despite Australia being one of the world’s most energy rich nations (the ‘Saudi Arabia of gas’).

A case in point is Boral – Australia’s largest cement, concrete and asphalt producer – where high electricity costs have forced it to halt manufacturing each day, leaving thousands of staff idle:

The construction materials maker said its electricity bills had inflated over the past year by 54%, adding millions of dollars to its manufacturing costs, with prices now peaking at levels that force it to shutter its production at 300 plants around the country for up to half an hour a day to constrain costs.

“At a certain point during the day, when the price goes up to a certain level, our manufacturing stops,” Bansal told The Australian Financial Review energy and climate summit on Monday.

“We’ve worked out economically, it’s actually better to have thousands of people waiting idle for the prices to come down than actually do the work.

That’s a real issue we are facing every single day on 300 manufacturing sites across the country,” he said. Staff were working overtime and night shifts to manage energy costs and get supply of building materials to customers, he said.

That’s certainly one way to kill productivity, isn’t it?

As Matt Barrie said this year in his keynote address to The SMH Sydney 2050 Summit:

“Australia’ manufacturing’s share of GDP… is on par with a tax haven like Luxembourg, but worse than Botswana, which sells diamonds and where you can see cheetahs”.

“Harvard ranks us 91st in the world for economic complexity, a measure of how unique and sophisticated our industry is, behind Kazakhstan, Guatemala and Laos”.

“It’s fallen 40 places since 1995, a year when Australia made things like cars, for which we’re still taxed $1.5 billion a year, to protect an industry that no longer exists”.

Our economy is becoming less complex by the day as it shutters manufacturing in favour of low productivity people-servicing industries.

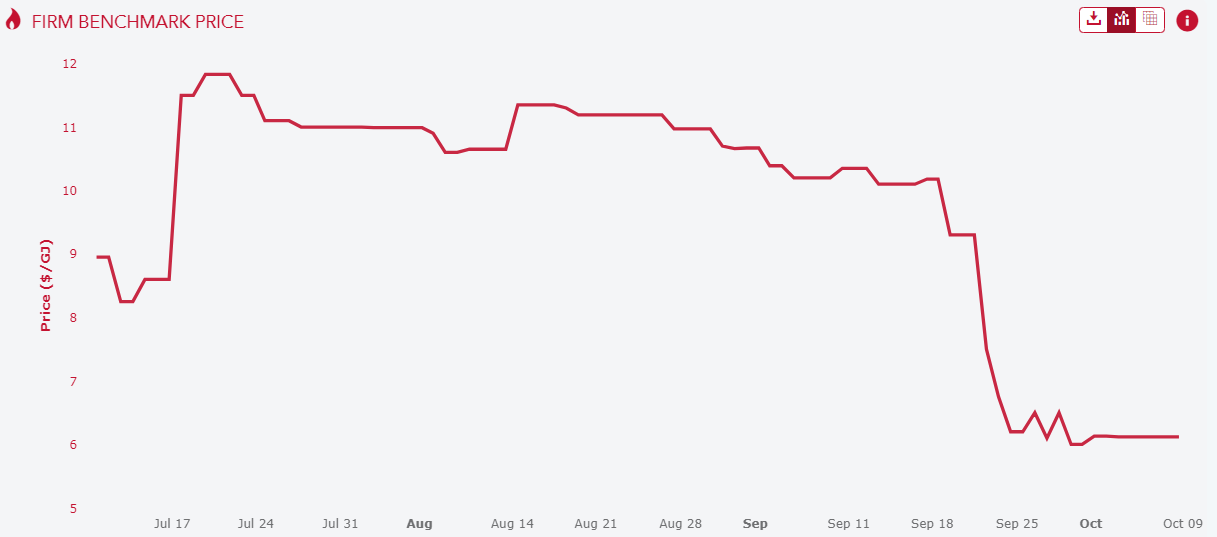

The one silver lining is that warmer weather has caused Australian gas prices to tank:

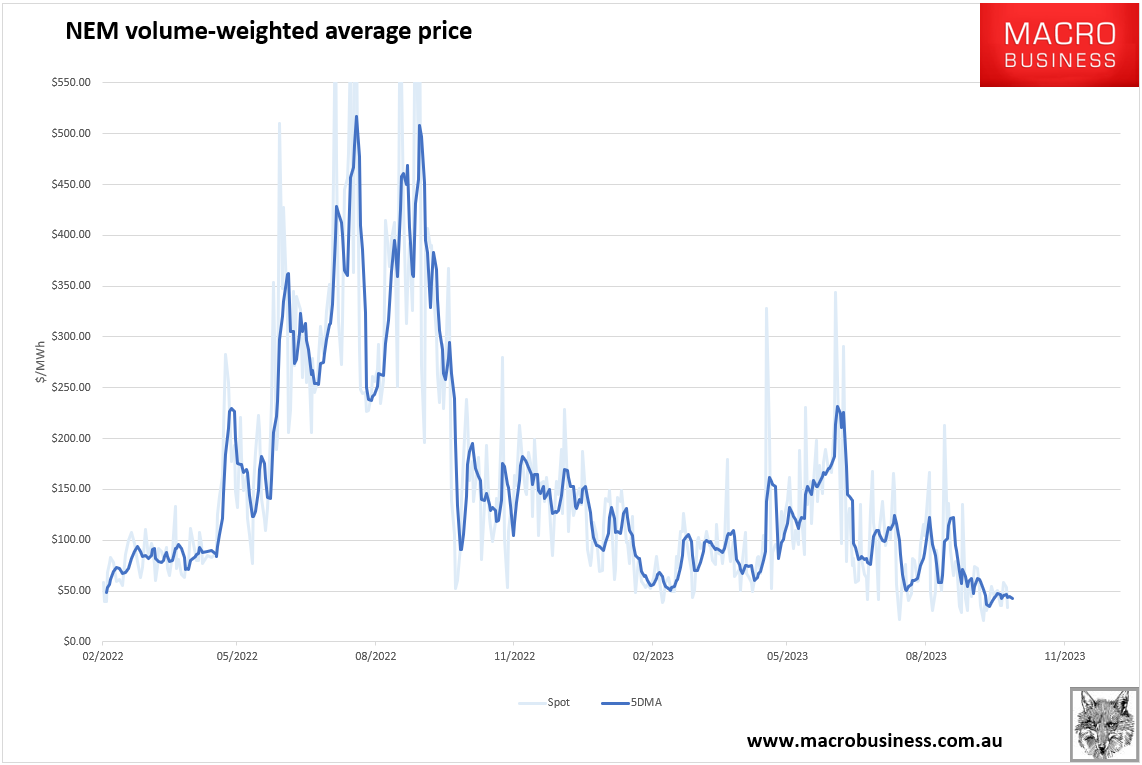

Therefore, so are power prices:

However, futures are still double owing to the uncertainty surrounding coal power station retirements:

And the warnings for summer are mounting:

Matthew Warren, principal of energy advisory service Boardroom Energy, said that going all-out for the 2030 target was “crazy” and that it was more important to keep power reliable and affordable through the transition, to maintain public support.

Despite some near term relief, Australian power prices risk being structurally higher, which will send more manufacturing to the grave yard.