On Tuesday, Statistics New Zealand released CPI inflation data showing that inflation pressures are moderating across New Zealand.

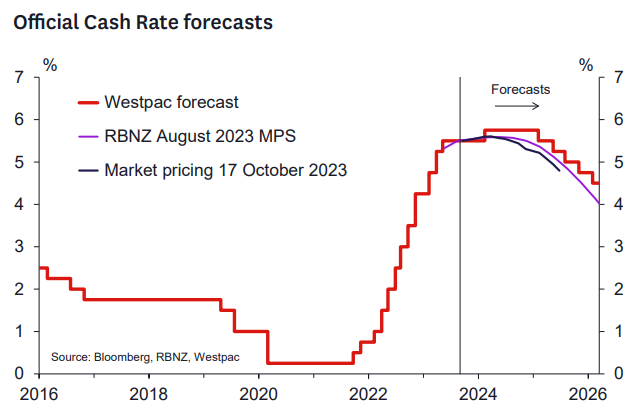

Accordingly, Westpac believes the Reserve Bank will keep the official cash rate (OCR) on hold at 5.5% for the remainder of the year.

However, Westpac believes it will still hike another 0.25% at its February 2024 meeting because of “reasonably strong domestic inflation pressures out there – most notably from the historic population boost coming from net migration which is yet to show any signs of easing”.

Key Points:

- We now expect no change in the OCR at the November Monetary Policy Statement.

- Further tightening expected at the February 2024 Statement.

- Headline CPI weaker than the Reserve Bank’s expectations, core pressures still high but in line, which will leave them comfortable with a 5.5% OCR for now.

- “Watch, worry, and wait” is likely still the order of the day – but plenty of worrying left to do.

Near-term policy implications of today’s Consumers Price Index news.

Since the May Monetary Policy Statement, the RBNZ has been communicating a strong desire to leave the OCR at 5.5% for a potentially protracted period.

Their most recent update in October 2023 continued with that “watch, worry and wait” theme and suggested that recent data had not substantively moved their judgement on the appropriateness of a 5.5% OCR for the foreseeable future.

A key piece of data that could have challenged the RBNZ’s view was today’s Q3 CPI. Given the RBNZ’s high hurdle to shift the OCR before next year, it was going to take an upside surprise to the CPI – particularly in the core inflation measures – to shift the dial towards an increase in November as we have forecasted since early August.

We didn’t see that upside surprise in the numbers released on Tuesday.

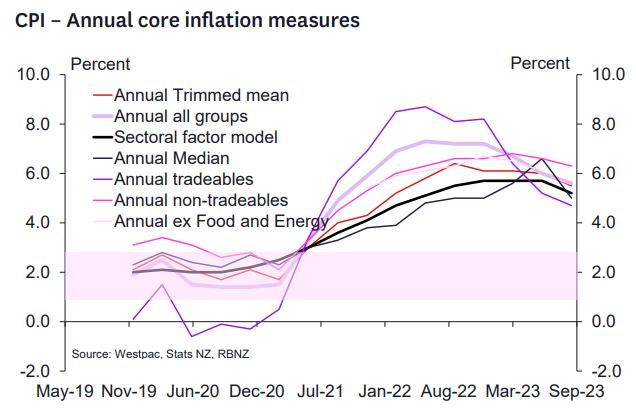

As discussed in more detail below, core inflation pressures remain strong, but no stronger than the RBNZ forecast when they put together their projections back in August.

Aggregate inflation in fact came in a bit weaker than they expected back then – largely because of lower imported and tradable goods prices – even though petrol prices have increased steeply in recent months following the reversal of the government’s excise tax cut and as global oil prices have increased.

These lower tradable good prices reflect continued easing of supply chain issues that boosted inflation by so much a year or so ago, together with reduced discretionary spending on durable goods.

In addition, the reversal of adverse climatic factors that had previously lifted fruit and vegetable prices is now helping to bring these prices down.

Overall, the RBNZ will be comforted by this combination of results. That said, they are probably still nervous on the stickiness of core inflation, which is still running in the 5.0-5.5% range and much higher than target.

Risks to inflation expectations and hopefully wages growth will likely be seen as better managed and will keep alive the hope that overall inflation will get back to the 1-3% target range in a reasonable timeframe.

So, we think the RBNZ will be happy to sit on their hands in November and see how the economy and inflation evolves through the summer period. They will need to factor in a new government’s fiscal stance into their projections – although they may not have much to go on at the time of the November Statement.

Having said that, they will at least take comfort that a centre-right coalition will likely run a tighter fiscal ship than the alternative may have delivered which is helpful for medium term inflation pressures at the margin.

The RBNZ will also be happy that longer term interest rates have moved significantly higher in recent months as this will do some of the work for them.

Mortgage rates on offer have increased 10-20bps since the RBNZ’s August Statement which is helping restrain inflation pressures. And there remain valid concerns about aspects of the global economic outlook, especially as pertains to China.

On balance, we still don’t think the job has been done. Core inflation pressures, especially those related to domestic prices pressures, are still running at high levels.

The onus is on the data to show a strong and sustained downward trend in core inflation if we are to see inflation back in the range in 2024 or 2025.

We have pencilled in a 25bp OCR increase in at the February 2024 Statement.

We still see some reasonably strong domestic inflation pressures out there – most notably from the historic population boost coming from net migration which is yet to show any signs of easing.

We think that the summer period will show the strengthening in the housing market that the RBNZ indicated it was still not sure about in its October Monetary Policy Review. Those trends will add to medium term inflation pressures and likely eventually force the RBNZ’s hand in 2024.

In the near-term attention will now turn to the next set of quarterly labour market indicators, to be released on 1 November. We expect a further lift in the unemployment rate from the 3.6% rate recorded in the June quarter.

Perhaps more important will be whether there are signs that labour cost inflation has passed its peak, providing more confidence that non-tradeable inflation will continue to trend down over the coming year.

September 2023 CPI.

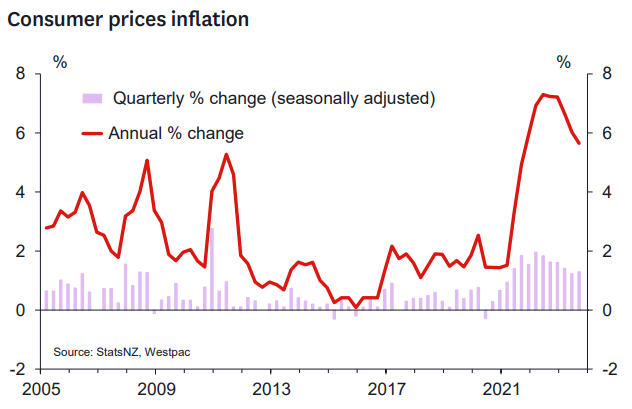

Consumer prices rose by 1.8% in the September quarter and are up 5.6% over the past year.

September’s rise in prices was a little lower than our forecast for a 1.9% increase. However, it was well below the RBNZ’s forecast for a 2.1% rise.

To be fair, the RBNZ’s forecast was published back in August at the time of their last Monetary Policy Statement, and developments since that time might have led the RBNZ to expect a slightly softer number ahead of today’s release.

Even so, we still think today’s CPI result will have been a downside surprise to the RBNZ.

Digging into the details of the September quarter inflation report, aggregate inflation pressures are easing faster than we or the RBNZ had been expecting.

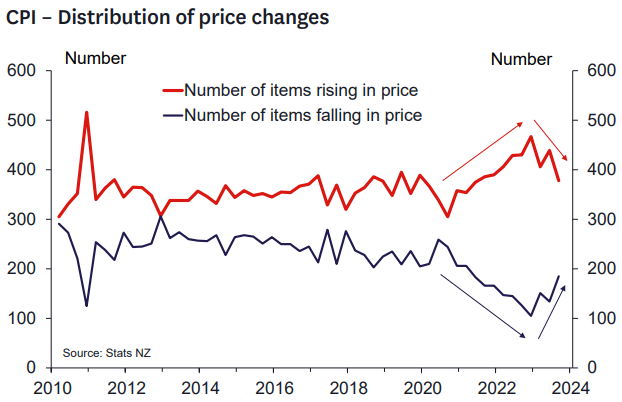

Looking at the distribution of price changes, we’re now seeing increasing number of prices being reduced each quarter, along with fewer price `increases. Nevertheless, both indicators are some ways from levels consistent with at-target inflation.

Inflation is set to continue easing over the year. That will be welcome news for the RBNZ. However, the RBNZ is certainly not out of the woods yet.

Firstly, while inflation is off the peak that we saw last year, at 5.6% it’s not low by any stretch of the imagination.

Similarly, most measures of core inflation (which smooth through the quarter-to-quarter swings in prices and track the underlying trend in inflation) remain elevated.

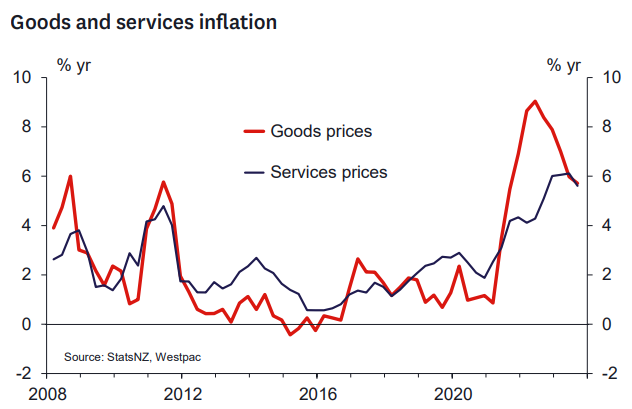

The details of the latest inflation numbers should give the RBNZ pause for thought. Specifically, the softening in inflation that we’re seeing is mainly related to an easing in the prices of imported goods.

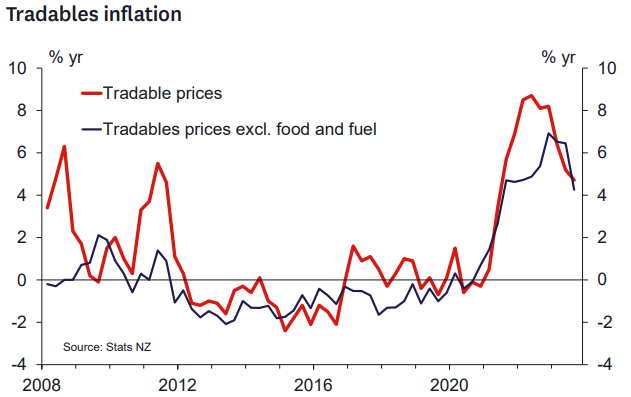

Excluding the volatile food and fuel groups, tradables inflation has now slowed to 4.3%, well down on the rates of over 6% that we saw over the past year.

The past few months have seen softness in the prices of furnishings and some recreational items. That said, some of this softness likely reflects reduced discretionary spending as tighter financial conditions squeeze households’ budgets.

While that softness in the prices of imported goods will in part reflect the cooling in domestic spending, it also reflects offshore factors. The prices for these same items rose sharply over the past couple of years because of disruptions to supply chains and global shipping, and those disruptions have now eased.

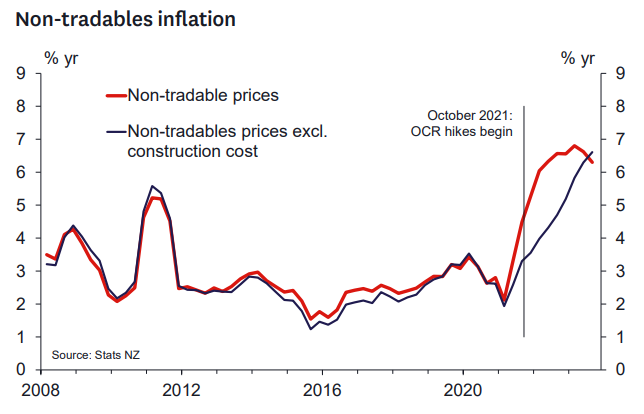

But it’s a very different picture when we look at the domestic side of the inflation picture, with non-tradable prices up 6.3% over the past year.

Importantly, the drivers of domestic inflation have been changing. Over much of the past two years, non-tradables inflation was boosted by the rise in construction costs, which has now dropped back.

However, non-tradables inflation in other areas (which account for close to half of the CPI) is not showing signs of softening.

In fact, over the past year, non-tradables inflation excluding construction costs rose to 6.6%.

Non-tradables inflation tends to be more persistent than imported inflation. Consistent with that, our recent discussions with businesses around the country highlighted ongoing pressure on operating costs, including wages.

In line with those trends and the continued tightness in the labour market, we expect non-tradables inflation will ease only gradually over the coming year.

This ongoing strength in domestic inflation means that the RBNZ still has a long road ahead of it.

Even with the cooling in imported inflation, we don’t expect that inflation will be back under 3% until the latter part of next year at the earliest.