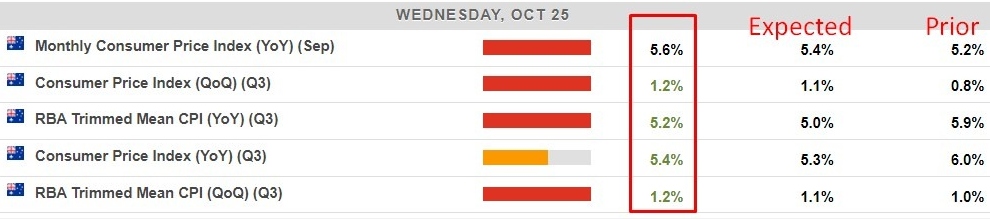

Australia’s CPI inflation came in stronger than expected in the September quarter, with headline inflation rising 1.2% over the quarter versus 1.1% expected:

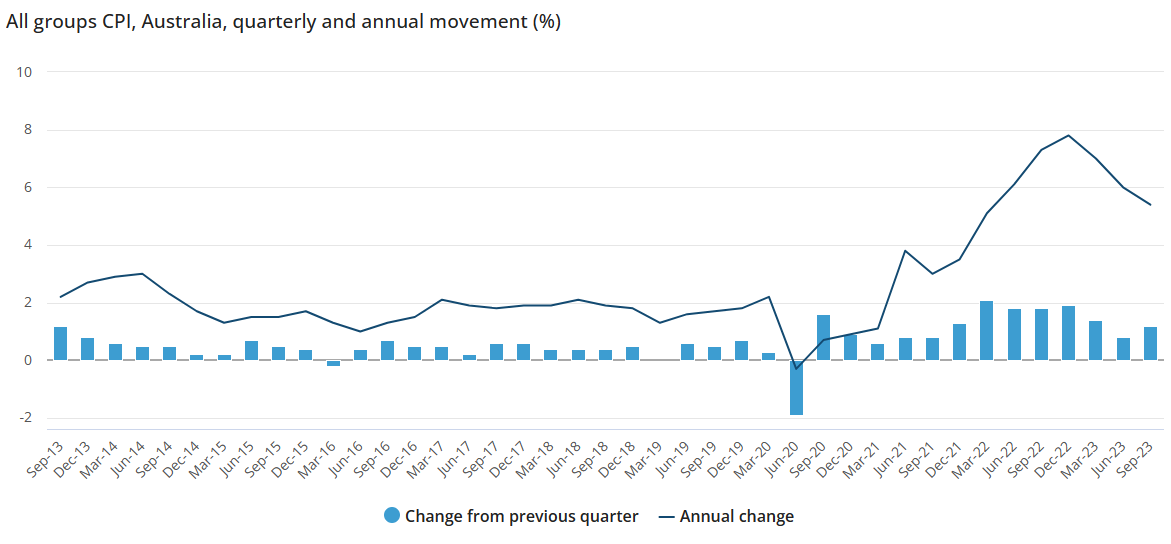

Michelle Marquardt, ABS head of prices statistics, explained: “CPI rose 1.2% in the September quarter, higher than the 0.8% rise in the June 2023 quarter. The rise this quarter however continued to be lower than those seen throughout 2022″.

Petrol prices and housing (especially rents) continued to drive inflation higher:

“The most significant contributors to the rise in the September quarter were automotive fuel (+7.2%), rents (+2.2%), new dwellings purchased by owner occupiers (+1.3%) and electricity (+4.2%)”.

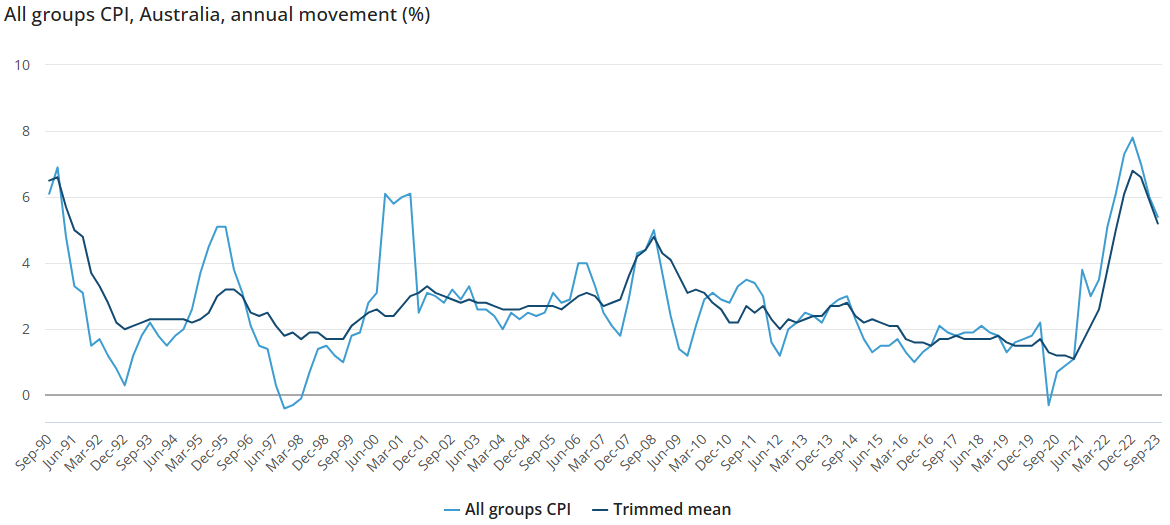

Annually, the CPI rose 5.4%, with new dwellings (+5.2%), rents (+7.6%), electricity (+14.5%) and automotive fuel (+7.9%) the most significant contributors.

However, September quarter’s annual increase of 5.4% was lower than the 6.0% annual rise in the June 2023 quarter.

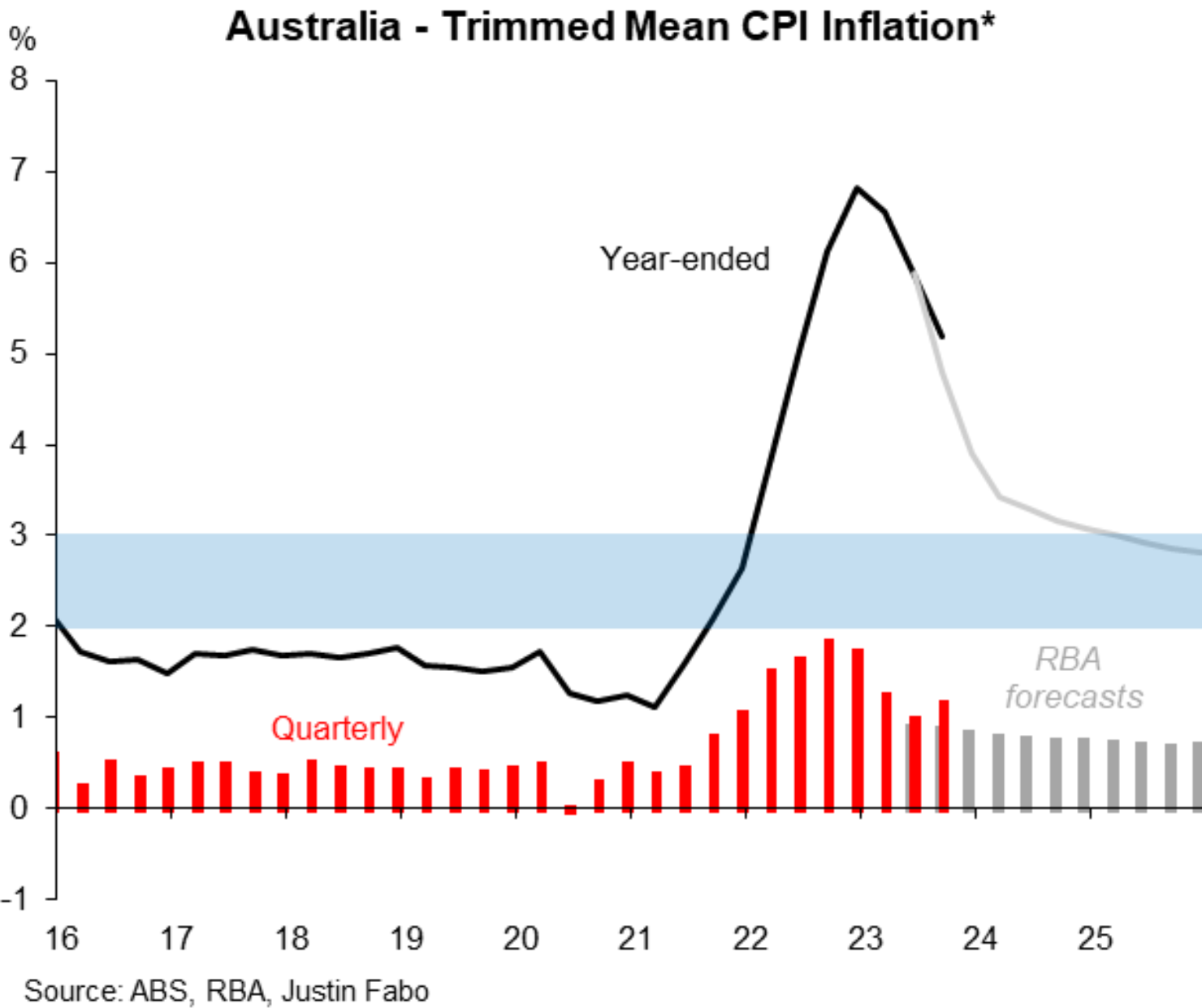

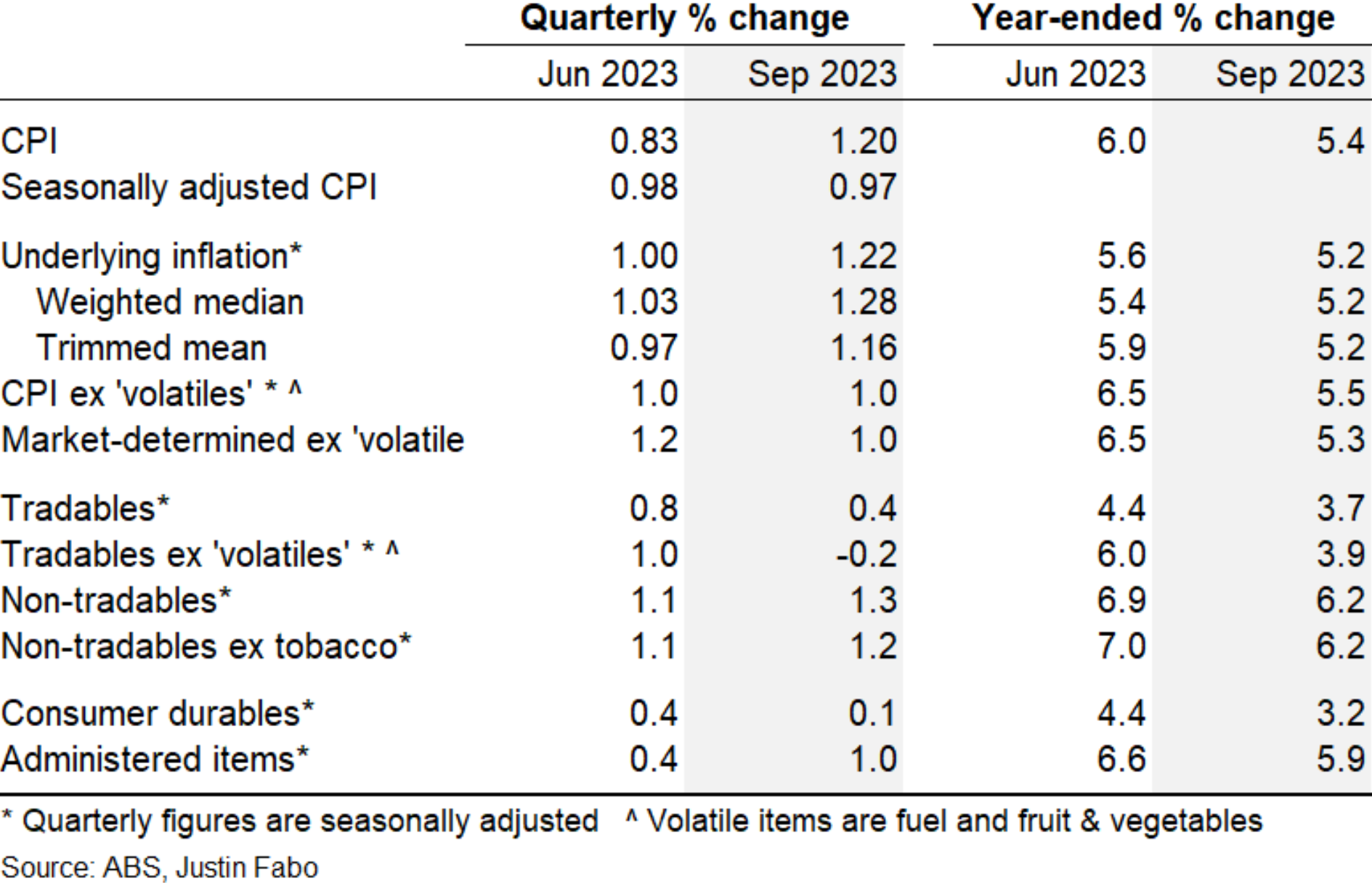

When stripping out volatile items, underlying (trimmed mean) inflation rose by 1.2% over the September quarter to be 5.2% higher year-on-year, down from 5.9% annual growth in the June quarter:

As noted by Justin Fabo from Macquarie group, “trimmed mean inflation in Q3 was MUCH stronger than the RBA’s August forecast…about 0.4ppts stronger on a year-ended basis”:

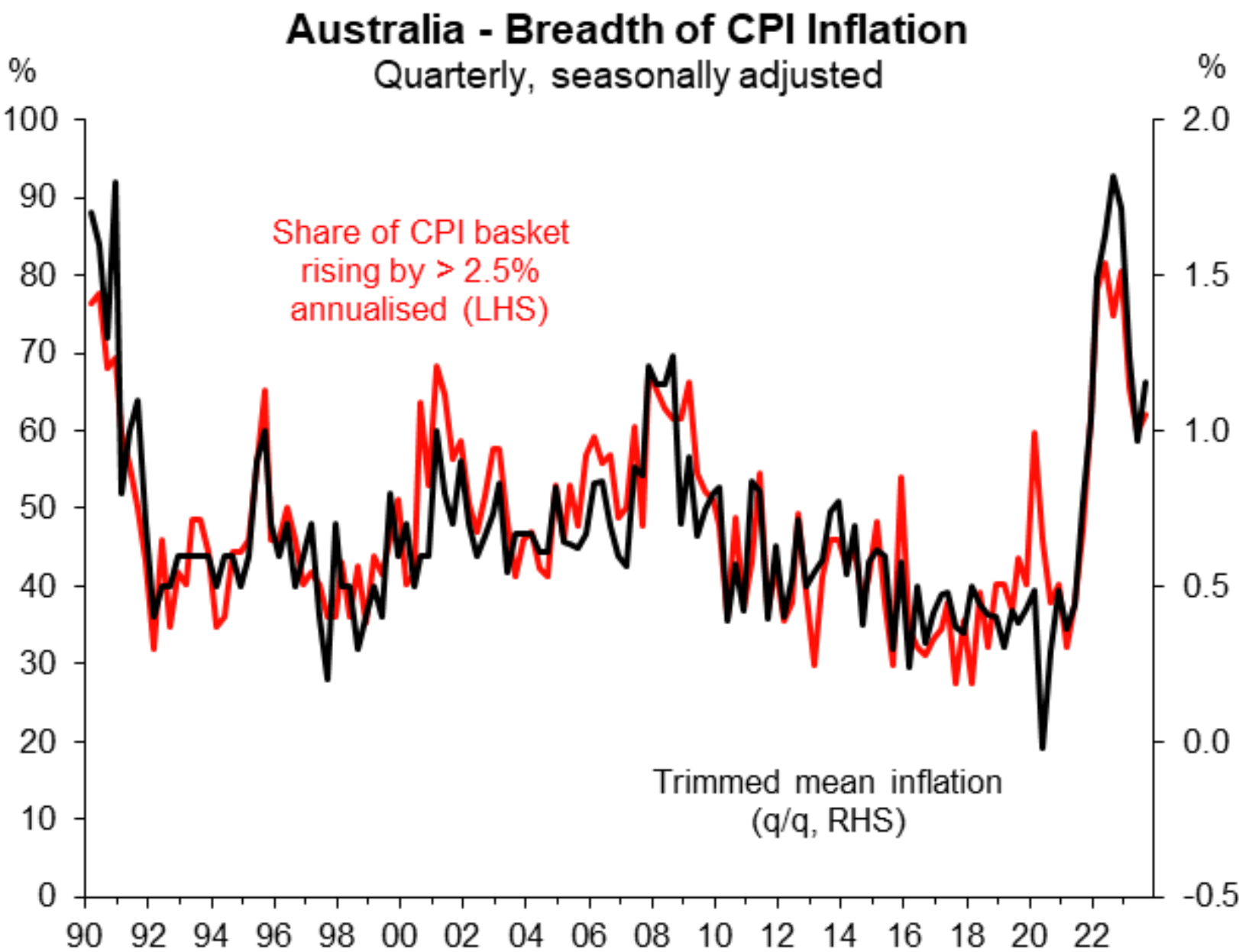

“Measures of the BREADTH of quarterly inflation ticked higher and broadly support the signal from the trimmed mean”, notes Fabo:

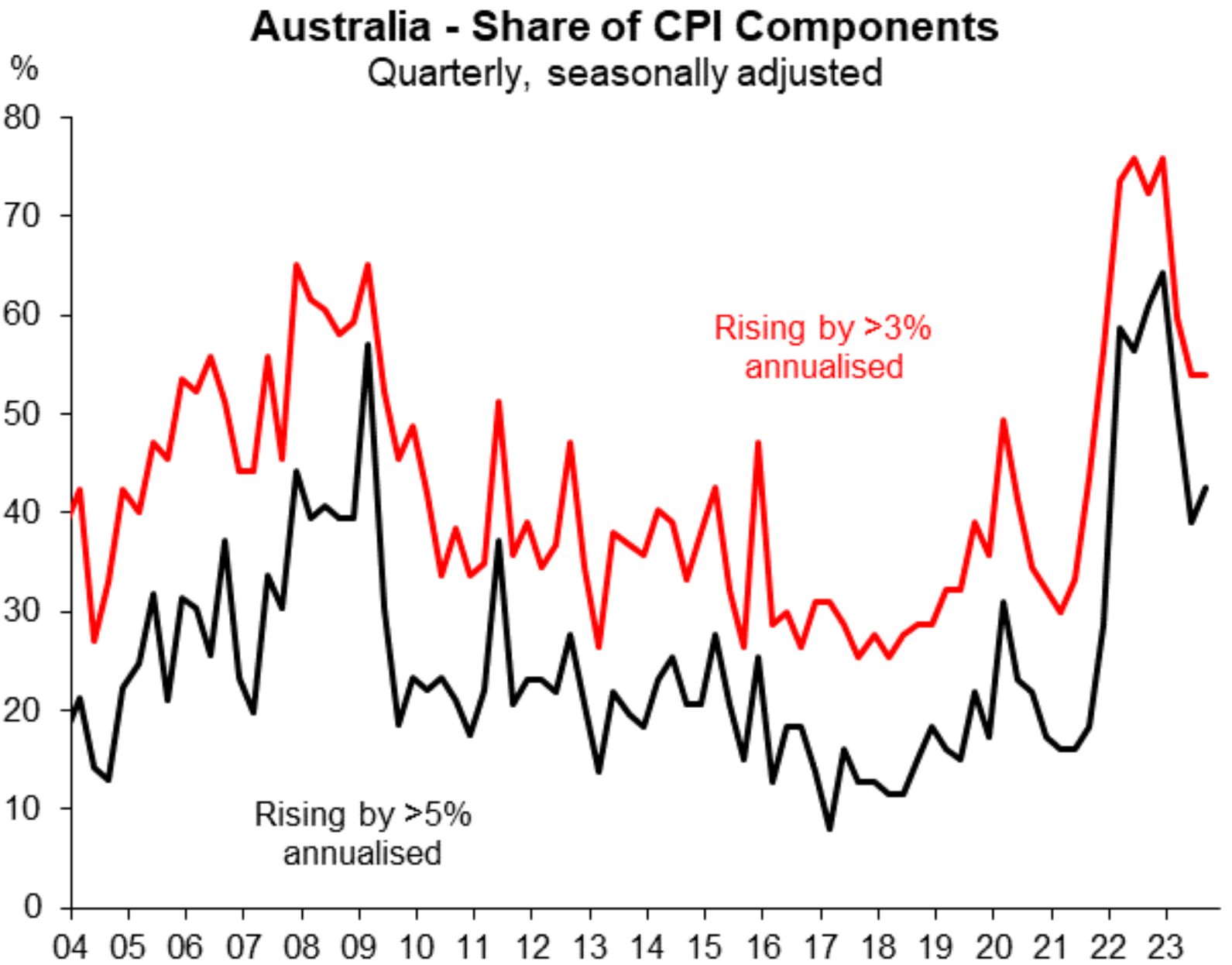

“43% of the CPI basket by number rose at an annualised rate of at least 5% in Q3”, says Fabo:

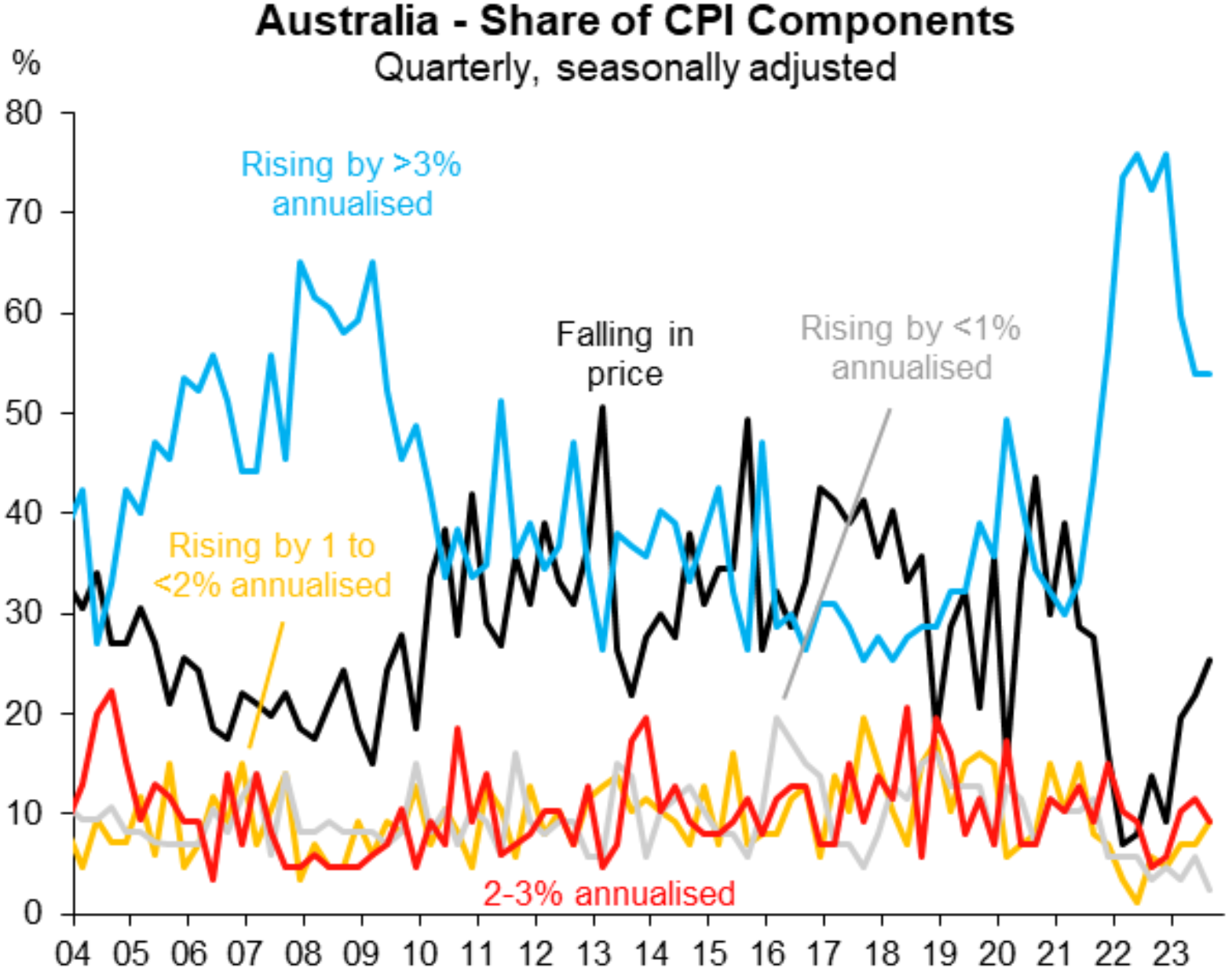

“The share of the CPI basket falling in price is heading towards “normal”, BUT the share rising at high rates remains elevated”, explains Fabo:

Finally, “‘Core’ tradables prices outright contracted but non-tradables inflation remained strong”, according to Fabo:

In short, the smoking gun is there if the RBA wants an excuse to hike interest rates on Melbourne Cup Day.