The Albanese government’s plan to build 1.2 million homes over five years is becoming increasingly unrealistic.

Data on dwelling approvals, loans for the building or purchase of new dwellings, and new home sales have all plummeted, implying that Australia will build fewer homes rather than more in coming years.

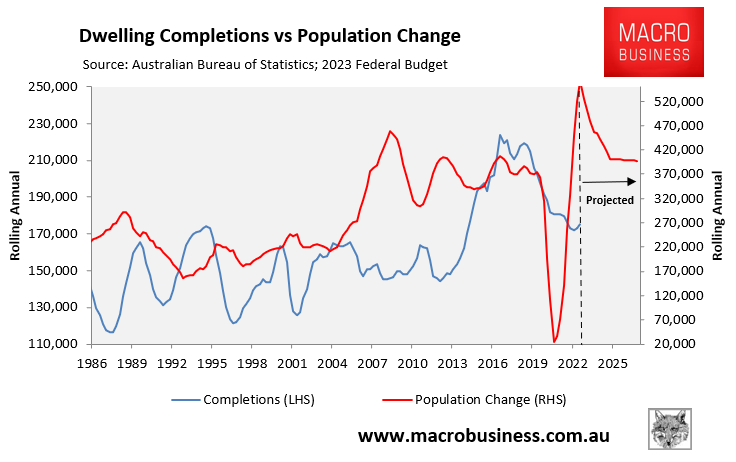

This fall in construction will occur at a time as Australia’s population is rising at an unprecedented rate, thanks to the Albanese Government’s record immigration program:

As a result, the nation is facing an worsening housing shortage, which will drive up rents and force more Australians into group housing or homelessness.

Last month, News Corp reported that Australia is running desperately short of builders, which has meant that housing projects have remained dormant:

“Billions of dollars worth of shovel-ready projects across South East Queensland are without a builder and developers are rapidly losing money on projects”.

Exclusive research by PRD reveals more than 40 per cent of all 196 residential projects worth over $10 million due to start construction in South East Queensland between January 2022 and 2024 do not have an explicit builder or design builder assigned”.

“If we can’t fully rely on projects that already have a builder going ahead, due to labour and material issues, higher construction costs, and delays in delivery timelines; how can we rely on our housing supply actually increasing?”, PRD chief economist Diaswati Mardiasmo said.

“Even if developers can get builders, the costs of building are such that developments aren’t stacking up”, Master Builders Queensland CEO Paul Bidwell said.

New figures from the Australian Securities & Investment Commission (ASIC) have revealed that external administration appointments in the construction sector jumped to 660 in the new financial year to 10 September, up 38% on the same period in 2022.

The $360 billion construction industry being impacted by rising costs in areas such as insurance and materials.

NSW is the state where the sector is struggling the most, accounting for 59% per cent of all construction collapses.

“There is still a hangover from the previous few years when builders were hit by the rising cost of materials and labour on fixed-price contracts”, Master Builders Queensland chief executive Paul Bidwell said.

“These issues caught out a lot of builders and they just did not have the resources to keep going”.

“The price to build a home in Brisbane went up 42 per cent in the three years to the end of 2022 but has only increased 10 per cent since then”, Mr Bidwell said.

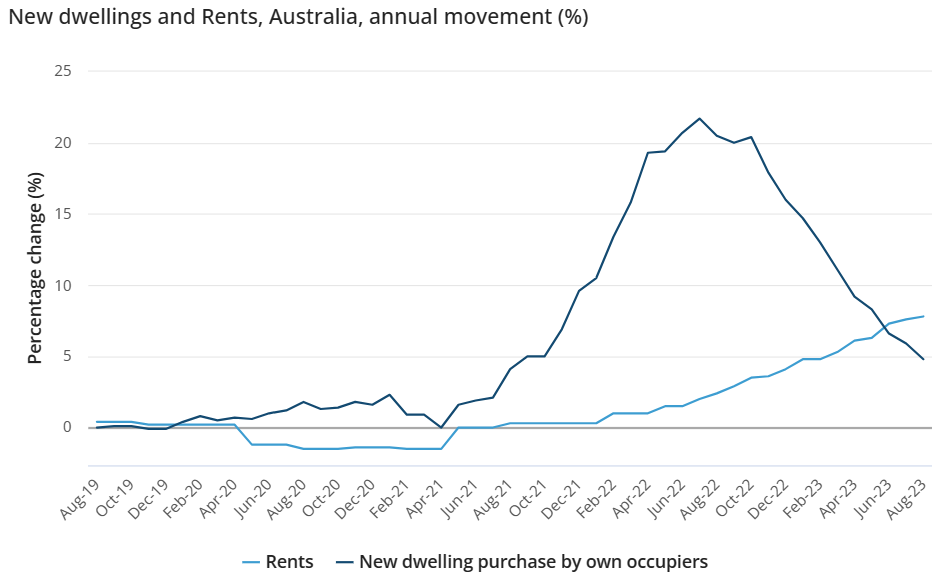

Thankfully, inflation in building costs is easing, according to the Australian Bureau of Statistics:

“New dwelling prices rose 4.8% in the twelve months to August, reflecting high labour and material costs. The rate of price growth has continued to ease reflecting improvements in the supply of materials and subdued new demand. The annual rise for New dwellings is the lowest since August 2021”.

Home builders now face a new headache with soaring insurance costs:

“The construction sector, in particular, is very reliant on insurance, and while price growth momentum in building materials is slowing, rising insurance premiums will be the next headache the industry will face”, CreditorWatch chief economist Anneke Thompson said.

How can the Albanese government meet its 1.2 million housing target when construction businesses are collapsing at an alarming pace, materials and financing costs are structurally higher, and there is a chronic shortage of builders?

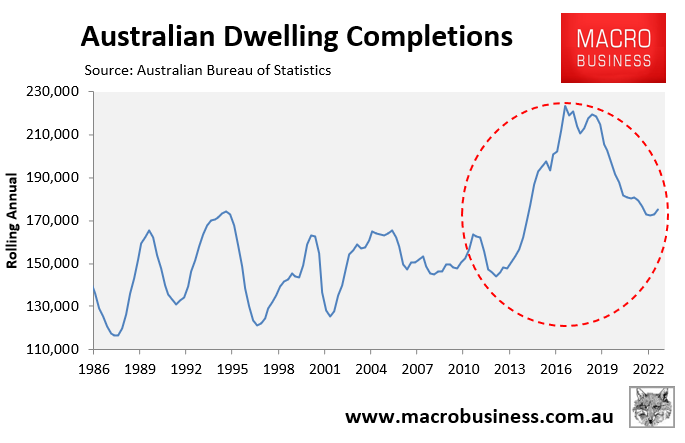

The Albanese government’s housing target requires the construction of 240,000 dwellings per year for five straight years.

However, Australia has only ever built more than 220,000 dwellings in a single year once, in 2017, when it built 223,000. And this was with much lower interest rates and material prices, as well as a relatively abundant supply of builders:

Everyone can see that Australia will not be able to build enough homes to meet the federal budget’s projected 2.18 million population increase over the five years to 2026-27, which is already being overshot:

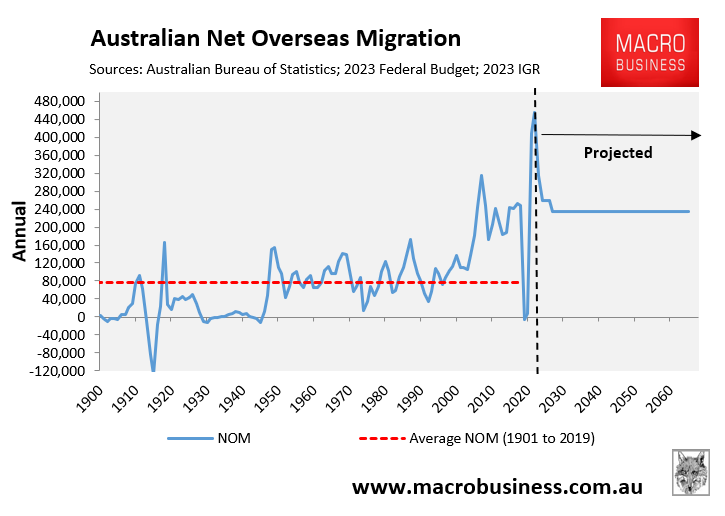

Let’s be real: reducing immigration to historical levels is the only viable solution to Australia’s housing shortage.

Net overseas migration must be decreased to a level that is compatible with the country’s ability to provide housing and infrastructure, as well as environmental carrying capacity.

Otherwise, the housing crisis and living standards will deteriorate even further.