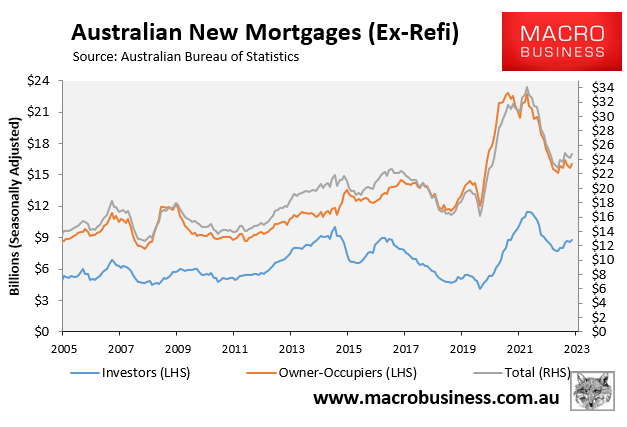

The Australian Bureau of Statistics (ABS) has released data on new mortgage originations for the month of August, which shows a solid rebound in investor mortgage commitments:

Overall mortgage commitments rose by 2.2% in August, with owner-occupier commitments rising by 2.6% and investor mortgage commitments rising 1.6%.

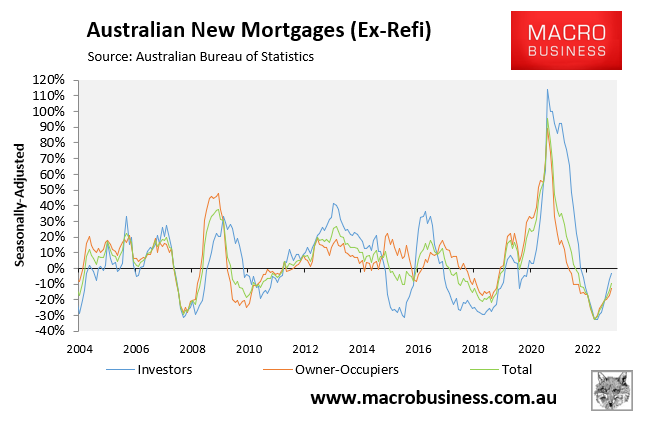

Over the year, overall mortgage commitments fell by 9.4%, with owner-occupier commitments plunging 12.5% and investor mortgage commitments falling 3.0%:

The above two charts show that the rebound in overall mortgage growth is being driven by investors, with the value of investor commitments almost back at the 2015 peak.

This flies in the face of recent reports claiming that investors are bailing out of the housing market.

While a higher than usual share of investors are selling, there are also more investors purchasing.

Thus, there is a lot of investor churn in the market.

The situation facing property investors should also improve over the coming year given the rental market is experiencing record tightness, population growth is booming, prices are rising, and actual construction levels are depressed.

Furthermore, the RBA is likely to cut interest rates next year, which will make investment more profitable by reducing mortgage expenses and lifting price growth.