CBA Chief Economist, Stephen Halmarick, believes the hurdle for the Reserve Bank of Australia (RBA) to raise the official cash rate remains high and will not be met.

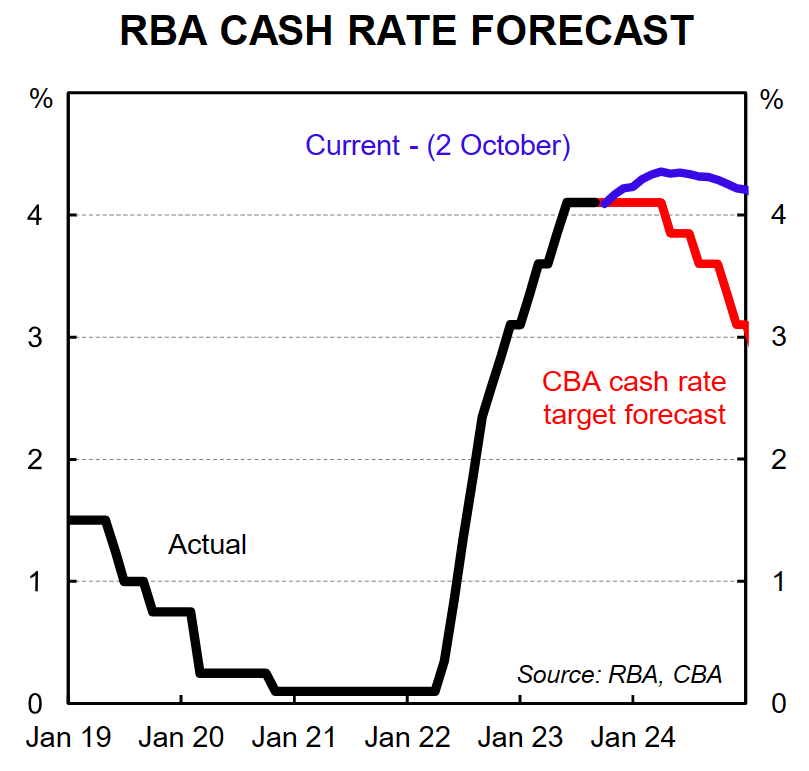

In turn, the RBA will keep interest rates on pause until May 2024 when it will commence an easing cycle.

Key Points:

- The new RBA Governor and Board have, as widely expected, held the cash rate steady at 4.1% this month. The RBA has not changed the cash rate since June.

- The RBA continues to signal that “some further tightening in monetary policy may be required”. This forward guidance is also unchanged over recent months. The RBA will be focused on upcoming inflation and wages data for Q3 23, which could keep them on alert over the November and December 2023 Board meetings.

- We remain of the view that the hurdle to a further rate hike is high and that the most likely scenario is an unchanged cash rate well into 2024. We expect a gradual monetary policy easing cycle to get underway in May next year, progressively taking the cash rate down to a more neutral level.

Rates on hold:

As widely expected by us, the consensus of economists and the market, the new Reserve Bank of Australia (RBA) Governor, Michele Bullock, and Board have left the official cash rate unchanged at 4.1%. The cash rate has been held steady since June this year.

In announcing the on-hold rate decision, the new Governor has made only minor edits to the policy decision statement.

The Governor has, once again, pointed out that the 400bp of tightening since May last year are “working to establish a more sustainable balance between supply and demand in the economy and will continue to do so.”

In a world of uncertainties, this extensive tightening affords the RBA the opportunity to continue to assess the impact on the economy and the inflation outlook in coming months.

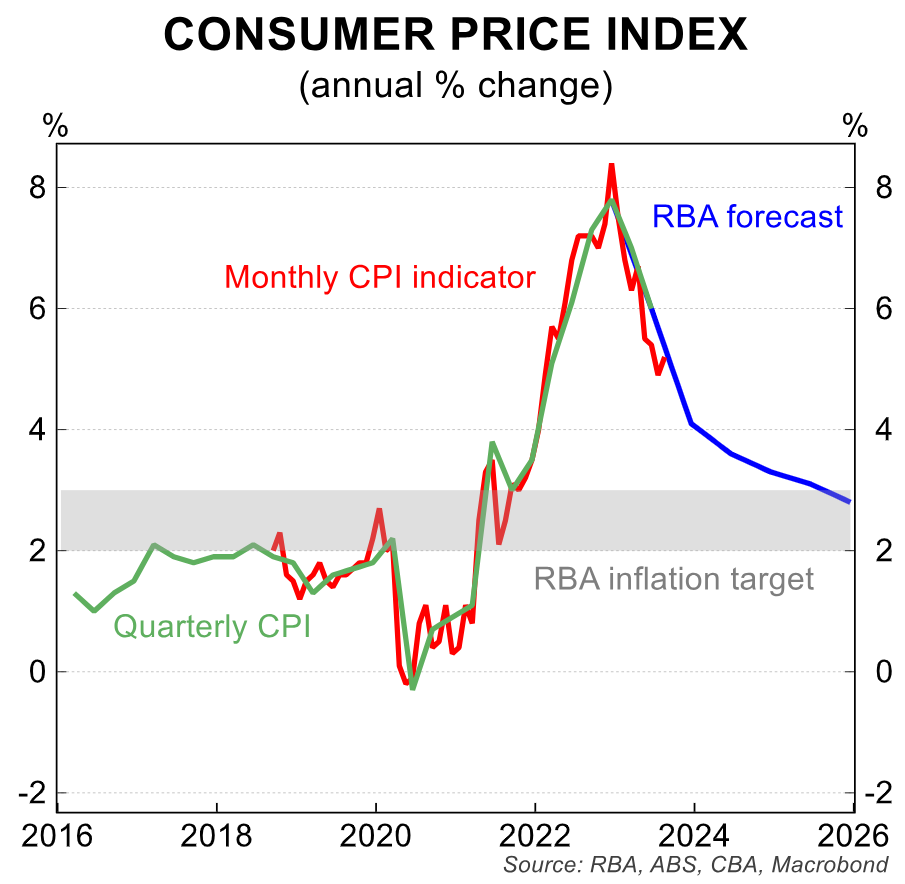

As shown in the first chart below, the RBA has noted that inflation has peaked, “but is still too high and will remain so for some time yet.”

While goods price inflation continues to ease, services price inflation is still trending higher. The RBA has also noted the recent rise in fuel prices and elevated rent inflation.

The RBA continues to emphasise that “returning inflation to target within a reasonable timeframe remains the Board’s priority.” The RBA’s forecasts have headline inflation back into the 2%-3% target range at Q2 25, whereas our own forecasts see inflation around 3% for much of 2024.

The RBA has also highlighted that “growth in the Australian economy was a little stronger than expected over the first half of the year”, a clear reference to the consecutive 0.4%/qtr GDP prints in Q1and Q2 23, giving an annual growth rate of 2.1%.

However, we expect some moderation in the pace of economic growth over H2 23, taking the annual growth rate down to 1.1% by year-end 2023.

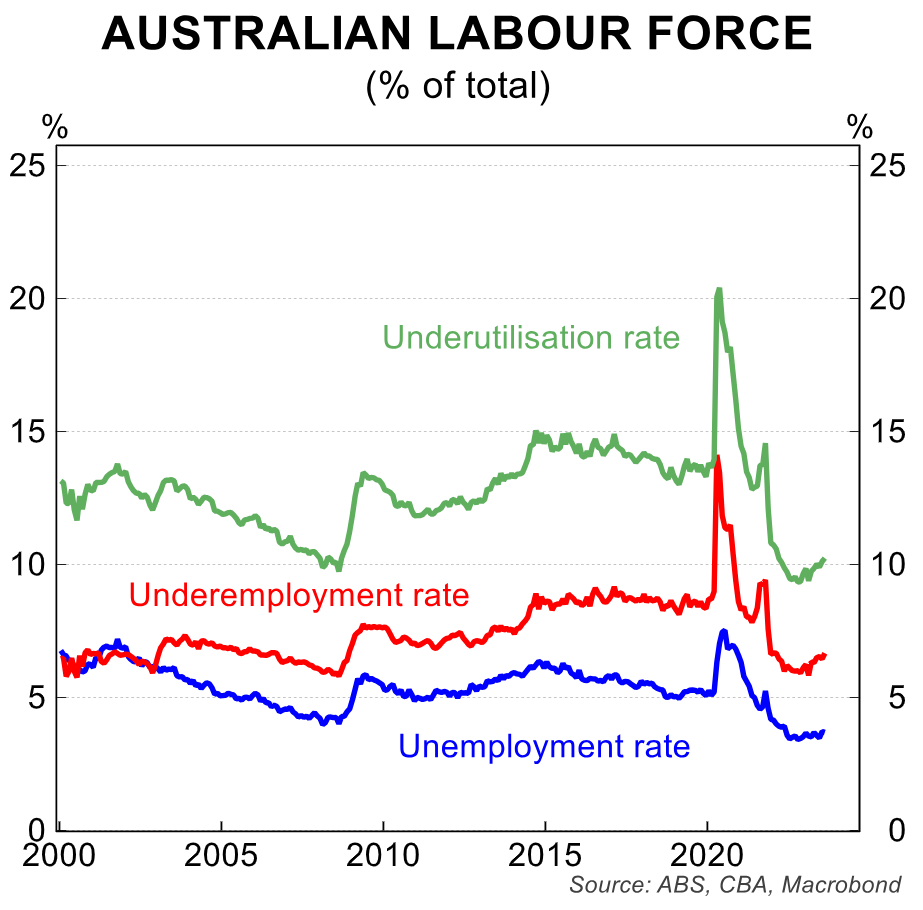

As shown in the second chart opposite, the RBA has also highlighted that the “conditions in the labour market remains tight, although they have eased a little”.

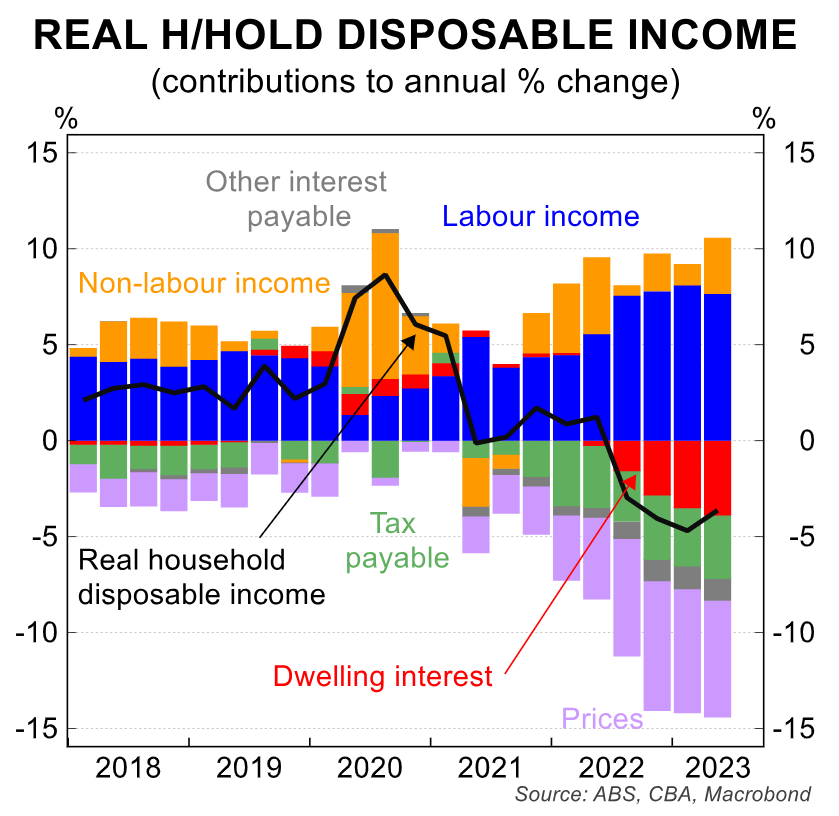

The RBA discussed the outlook for consumer spending by noting that “the outlook for household consumption also remains uncertain, with many households experiencing a painful squeeze on their finances (see top chart opposite), while some are benefitting from rising house prices (see second chart below), substantial savings buffers and higher interest income.”

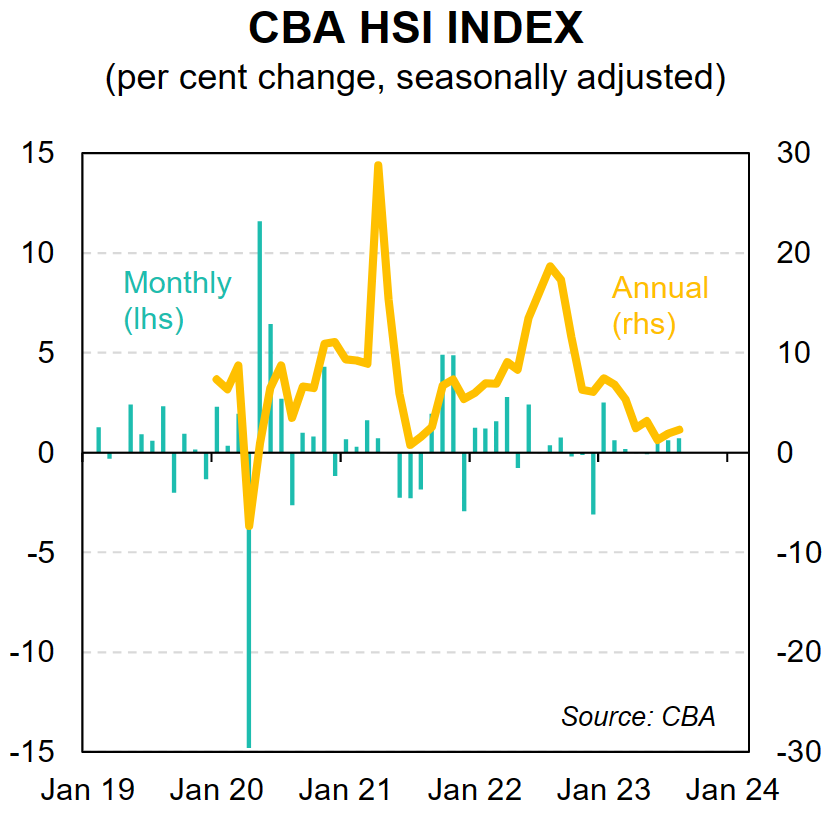

The CommBank Household Spending Insights (HSI) data will be a timely and important indicator to watch in assessing the path and outlook for the consumer. The September report is due for release on 11 October.

The RBA also repeated its view that “globally there remains a high level of uncertainty around the outlook for the Chinese economy due to ongoing stresses in the property market.”

Monetary policy outlook

The RBA’s forward guidance on monetary policy was unchanged, stating that “some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks.”

As we stated in our RBA Preview note last week, our view remains that the hurdle for another rate hike in Australia is high and that we are likely to see an extended period of no change in the 4.1% cash rate.

The risk to that view over the remainder of 2023 is, however, to the upside. This is especially so given the recent substantial increases in the price of oil will feed into the CPI in coming months.

There is also uncertainty as to what extent the Q3 23 Wage Price Index data (due 15 Nov) will show an acceleration in the pace of wages growth. The recent National Wage case, higher public sector pay rises and some increases in key Enterprise Agreements will all feed into the wages data.

However, by the time we get to the November and December RBA Board meetings we expect a further softening in domestic consumer spending and a slowdown in the pace of global economic growth; keeping the RBA on hold into 2024.

As we detailed in our Preview note, we have pushed our expectation for the first monetary policy easing by the RBA to the 6-7 May 2024 Board meeting.

By the time of the May RBA Board meeting (the third meeting for the year under the new 8 meetings-per-year schedule) we expect the RBA to be more confident that inflation is heading back into the 2%-3% target range and that a (slow) return to a more neutral monetary policy can get underway.

Apart from the expected ongoing deceleration in inflation we anticipate over H1 24, we expect further softening in consumer spending, a pick-up in the unemployment rate and slower global economic growth.

The May 2024 Board meeting will also see the release of the RBA’s updated economic forecasts in the Statement on Monetary Policy, which will be published at the same time as the 2.30pm policy decision announcement, rather than the following Friday.

This will give Governor Bullock the opportunity to update the RBA’s economic forecasts and use the update to layout the case for the start to a policy easing cycle.

As per the updated RBA communications commitment, there will also be a press conference at 3.30pm on the day of each RBA Board meeting policy announcement.

We hold to the view that after the first cash rate cut in May 2024 that the cash rate will be progressively lowered to 3% by year-end 2024, including 25bp rate cuts in May, August, November and December.