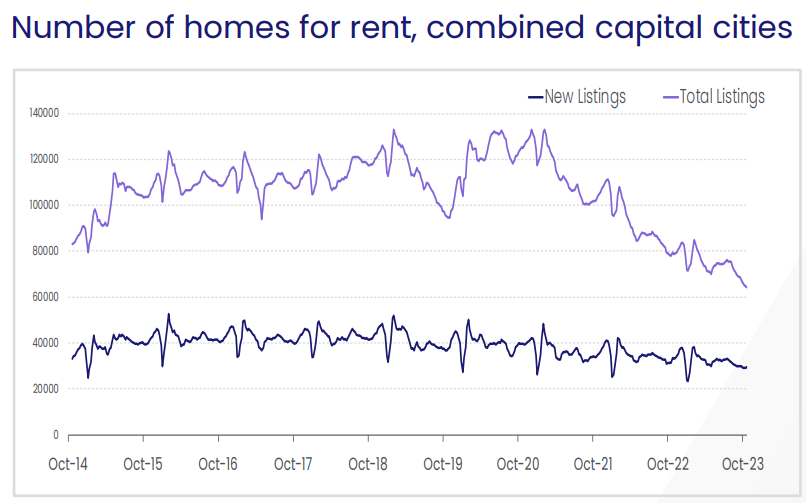

Rental supply continues to evaporate at an alarming rate across Australia’s capital cities.

The latest CoreLogic rental market snapshot shows that the number of rental listings across the combined capital cities has collapsed to its lowest level on record, as illustrated below:

Source: CoreLogic

Current rental listings are currently tracking at less than half normal October levels, according to CoreLogic.

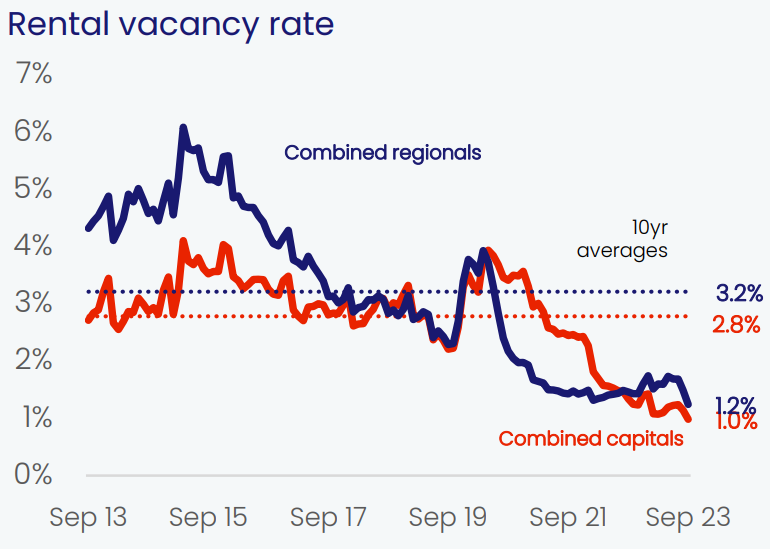

Reflecting this, the capital city rental vacancy rate has collapsed to an all-time low 1.0%, according to CoreLogic:

Source: CoreLogic

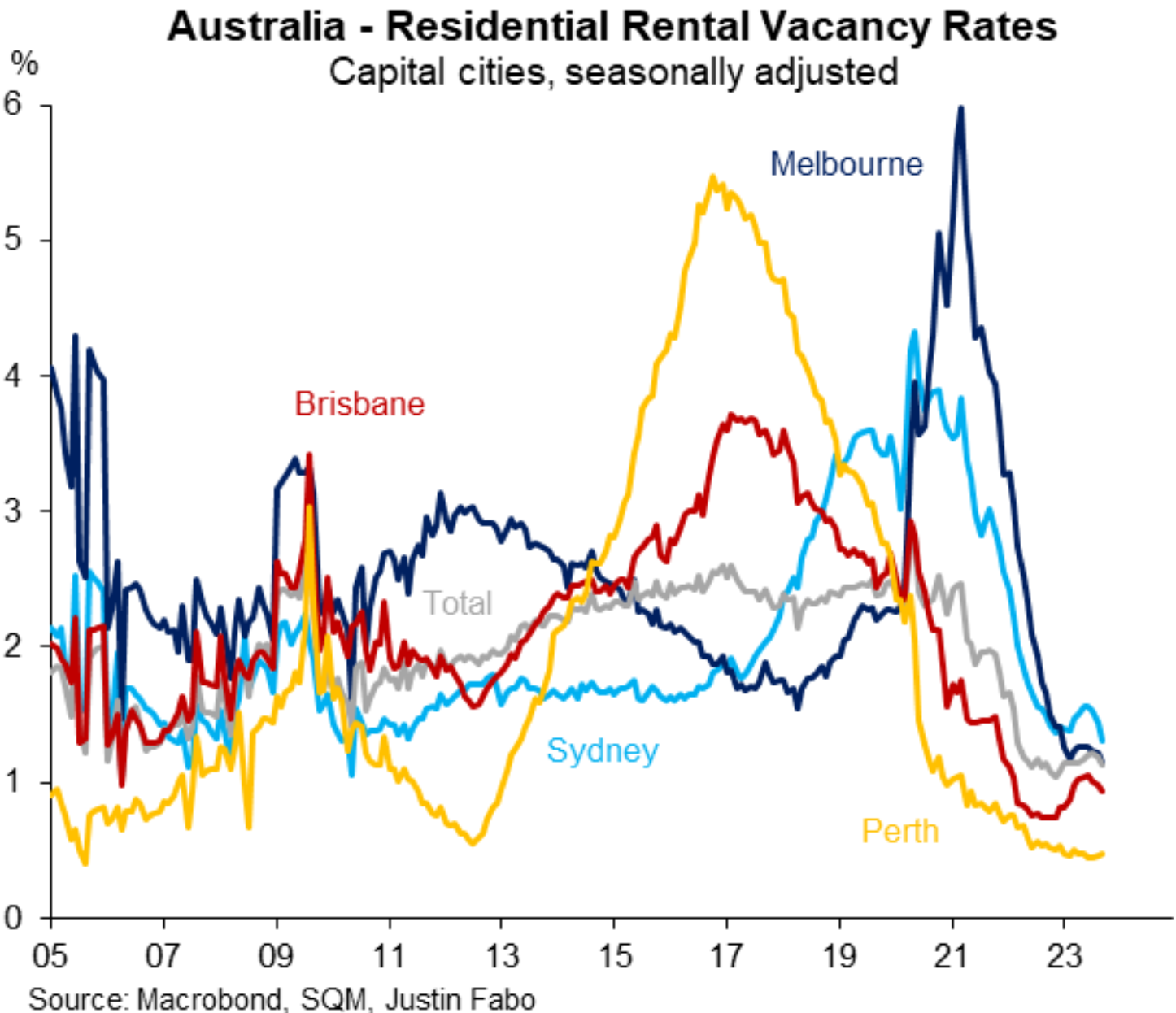

The below chart from Justin Fabo at Macquarie Group plots the vacancy rate across Australia’s major capital cities using SQM Research’s rental vacancy data:

Source: Justin Fabo (Macquarie Group) using SQM Research Data

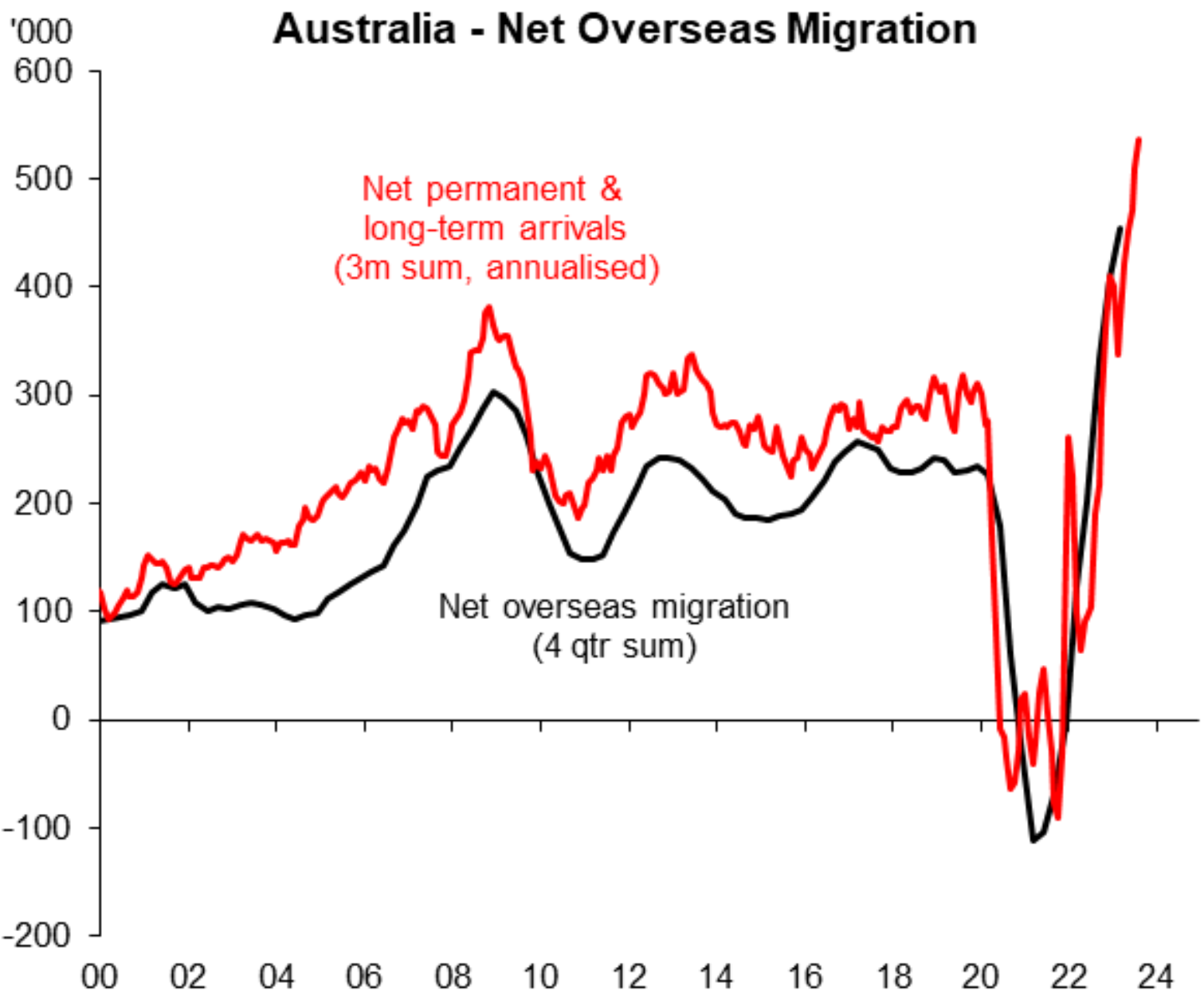

You can see that rental vacancy rates ballooned across Sydney and Melbourne at the start of the pandemic when 500,000 temporary migrants left Australia only to collapse to the current record low levels everywhere now that net overseas migration has rebounded to record highs:

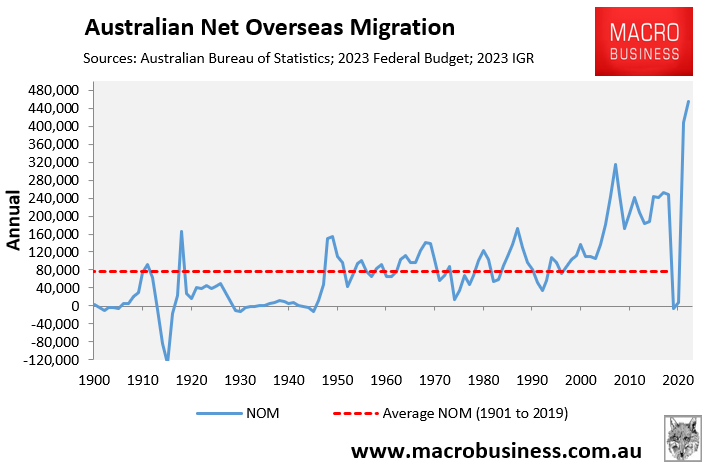

Given monthly ABS data suggests that net arrivals continued to surge over the June and September quarters, which is not reflected in the chart above, Australia’s rental market will continue to tighten.

Source: Justin Fabo (Macquarie Group)

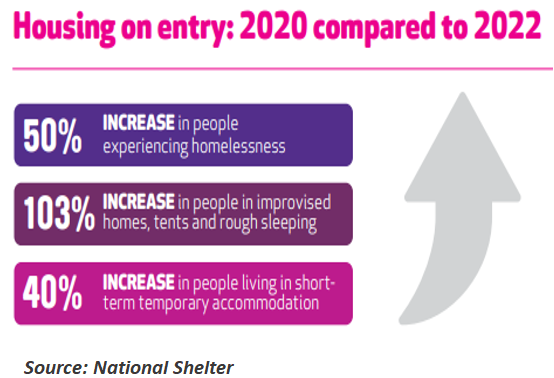

In turn, more renting Australians will be pushed into financial stress and group housing.

The rate of homelessness, which already jumped by 50% between 2020 and 2022, will also certainly rise.

In short, Australian renters are facing a diabolical situation brought about by the Albanese Government’s reckless immigration policy.