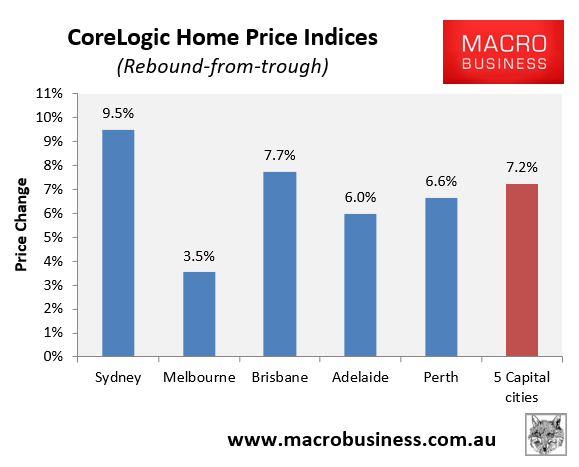

Australia’s extraordinary house price rebound rolled on in September, with CoreLogic data showing that values have risen by 7.2% at the 5-city aggregate level after bottoming in February 2023.

The rebound has also been broad-based with all five major capital city markets recording value rises:

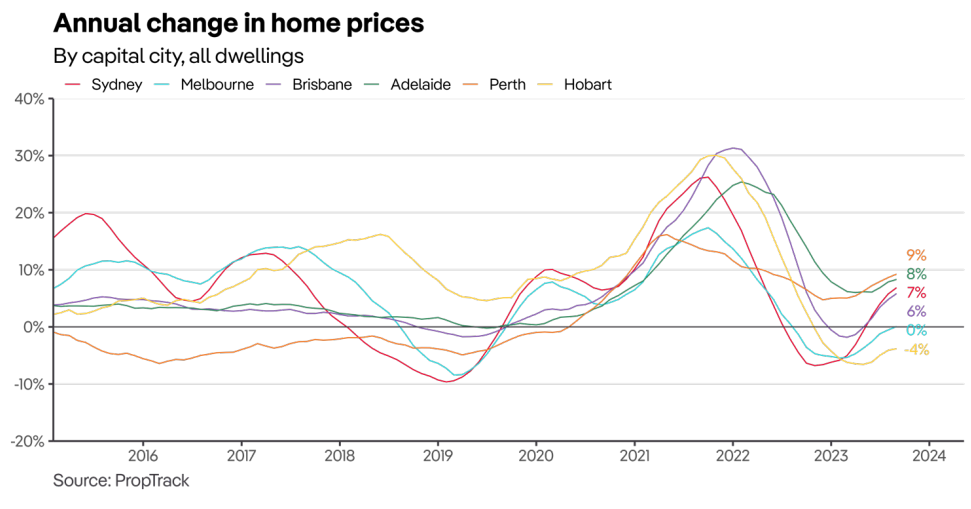

PropTrack’s property index has also recorded a strong rebound with values rising 4.3% so far this year at the national level to a fresh all-time peak:

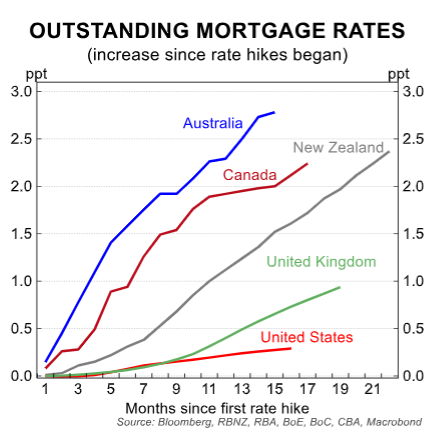

The rebound in values is extraordinary given it has occurred alongside the steepest interest rate rises in history, with the official cash rate 4.0% higher than its level in April last year.

Australia has also experienced the largest increase in mortgage rates out of English-peaking nations:

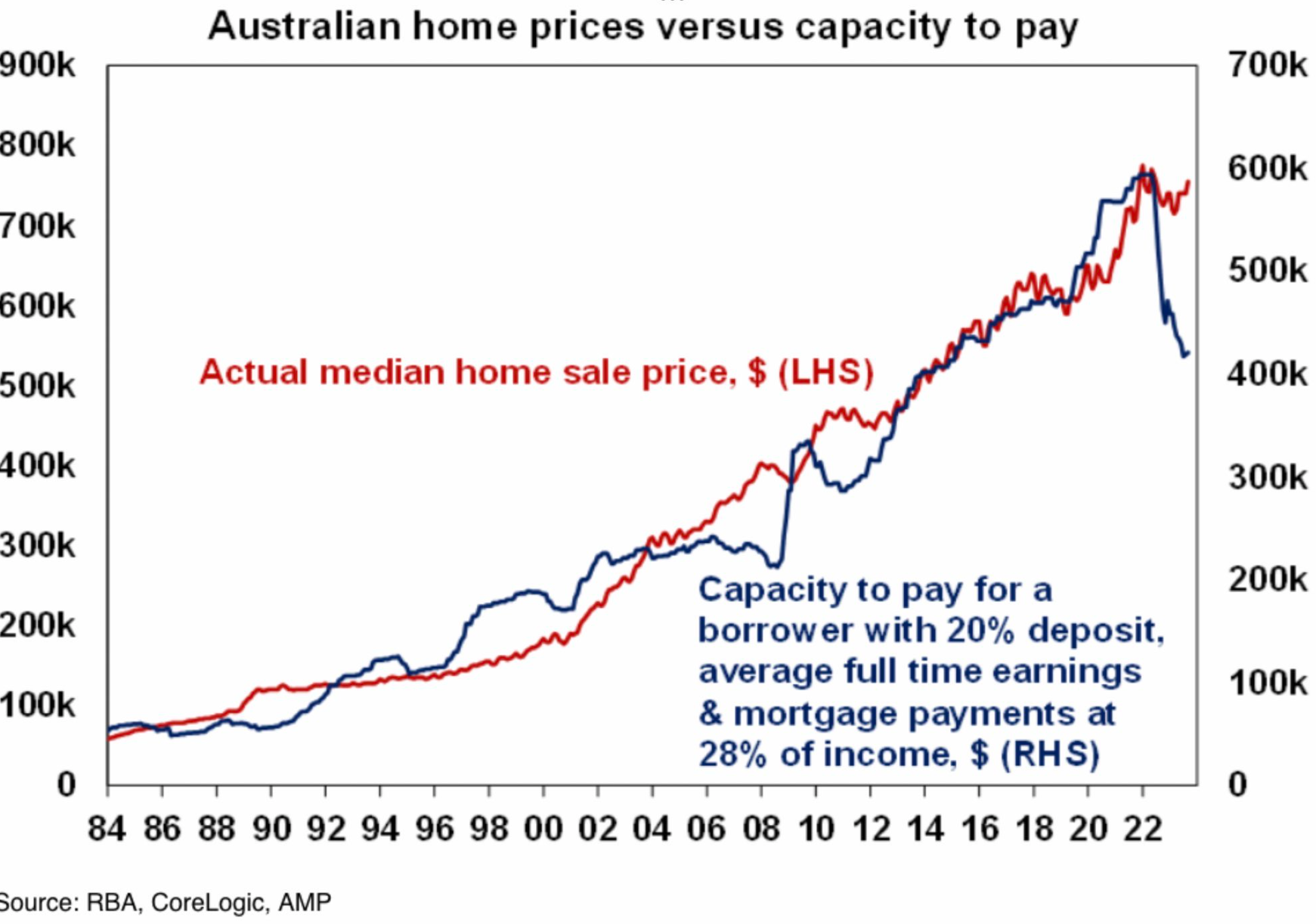

Historically, when interest rates rise and borrowing capacity falls, house prices tend to be dragged lower, as the next chart from AMP chief economist Shane Oliver shows:

Source: Shane Oliver (AMP chief economist)

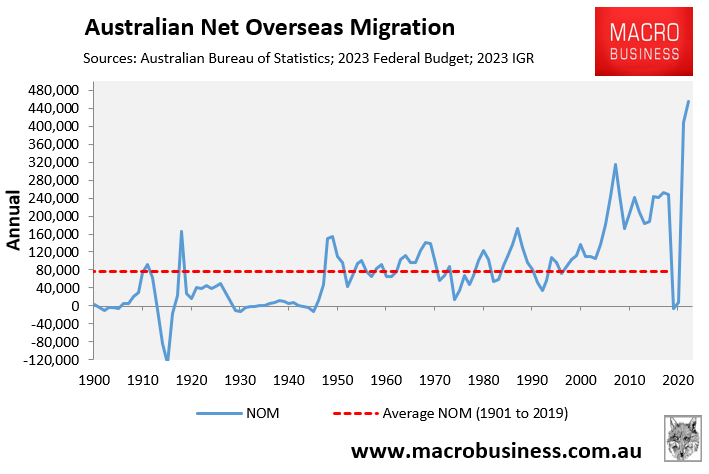

The main driver of the rebound in house prices is obviously the unprecedented surge in net overseas migration and population growth, which has created an acute shortage of homes to both buy and rent.

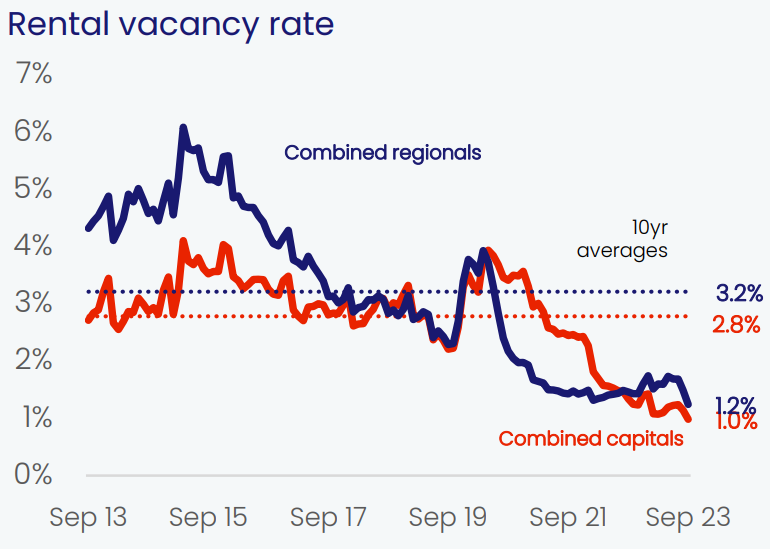

Rental vacancy rates fell to a record low in September, according to CoreLogic:

Source: CoreLogic

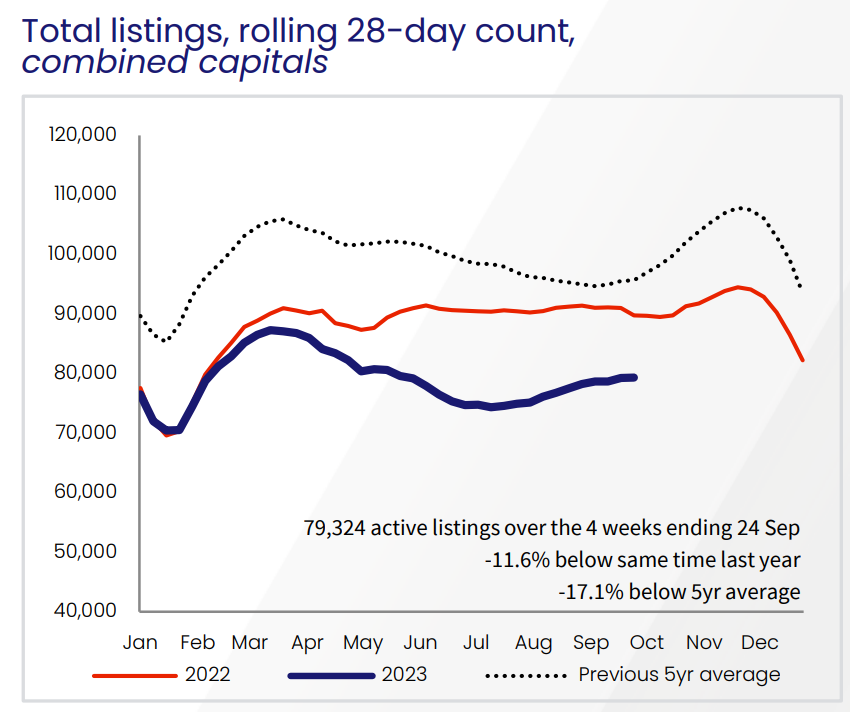

The number of homes listed for sale is also tracking 11.6% below the same time last year and 17.1% below the five year average, according to CoreLogic:

Source: CoreLogic

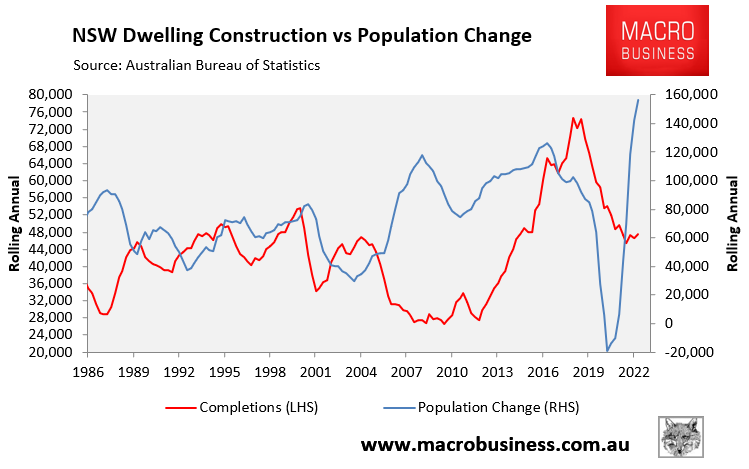

It is hard to see how the supply situation will improve given Australia’s population (immigration) is running at a record pace at the same time as dwelling construction is falling:

PropTrack’s assessment was right when it said: “Looking ahead, interest rates have likely peaked and population growth is rebounding strongly. Together with a shortage of new home builds, prices are expected to rise”.

If the RBA cuts rates next year, house prices could surge amid chronic undersupply and increasing borrowing capacity.