Westpac has released its Leading Index for September, which shows that lacklustre growth will run well into 2024.

Westpac forecasts that per capita GDP growth be just 1.2% in 2023 and only 1.1% in the first half of 2024. Given the population is growing by around 2.5% currently and is expected to grow by 2.3% in 2024, this means that Australia’s economy will remain in a deep per capita recession well into next year.

Key Points:

- Leading Index growth rate lifts slightly to –0.34%.

- Long run of negative, below-trend reads continues.

- Lacklustre growth likely to carry into the first half of 2024.

- Components highlight stabilising activity and reduced drag from commodity prices offset by shaky sharemarket and softening labour market.

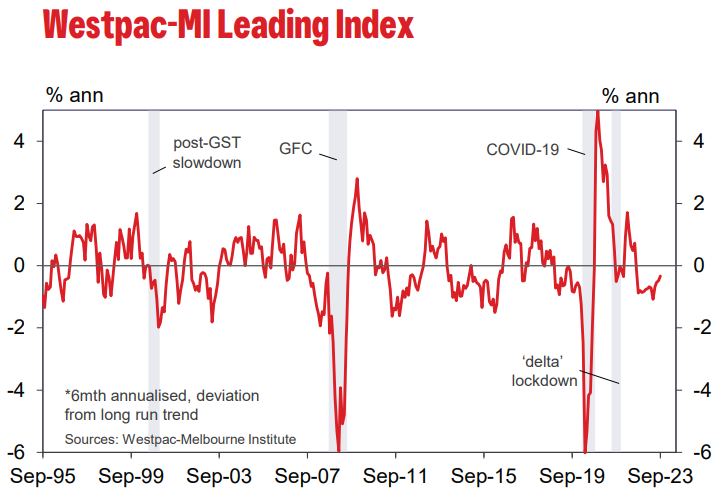

The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, rose to –0.34% in September from –0.48% in August.

The Index continues to point to an extended period of weak conditions. September marks the fourteenth consecutive sub-zero read on the headline Index growth rate, implying that lacklustre sub-trend growth momentum will carry well into 2024.

Westpac expects GDP growth to slow to 1.2%yr in 2023 and hold around this weak pace in early 2024 with an annualised growth rate of 1.1% over the first half of the year. This is well below population growth which will be running at around 2.3%yr.

The Leading Index growth rate has improved marginally since the start of the year, from –0.68% in March to –0.34% currently, a lift of 0.34ppts.

Three components have driven the improvement: a widening yield spread (adding 0.5ppts to the Index growth rate); a stabilisation in dwelling approvals (adding 0.31ppts); and a firming in US industrial production (adding a further 0.17ppts).

These shifts have been partially offset by weaker signals from equity markets, a 3.5% drop in the ASX200 taking 0.23ppts off the headline growth rate, and a 0.5% drop in total hours worked taking off a further 0.2ppts.

Other components took off another 0.2pts on a combined basis.

A notable detail amongst the components was a more stable contribution from commodity prices (measured in AUD terms).

These declined significantly over the year to July, weighing heavily on the Index growth rate, but have lifted 4.4% over the last two months, materially reducing the drag.

The Reserve Bank Board next meets on November 7. Today’s release highlights the slow growth environment, as higher interest rates and high inflation weigh on the household sector domestically with similar policy-related slowdowns evident abroad.

However, the inflation situation is still clearly unsettling for the RBA with the minutes to the October Board meeting showing a low tolerance for upside surprises.

At this stage, the RBA looks likely to revise up its near-term forecasts for headline inflation, but not its medium term view, which is what would be needed to trigger a further rate rise.

However, that could easily shift if there are significant surprises in the September quarter CPI, due October 25.