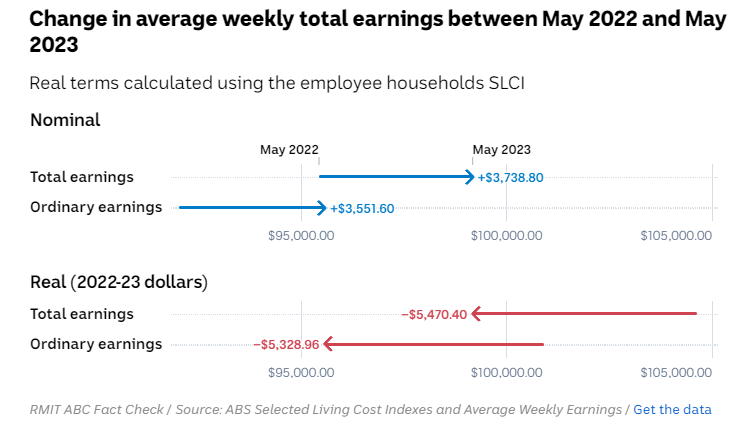

ABC Fact Check reported last month that if average wages are deflated by the Australian Bureau of Statistics’ (ABS) employee cost-of-living indices, then real earnings fell by $5,470.40 in the 2022-23 financial year:

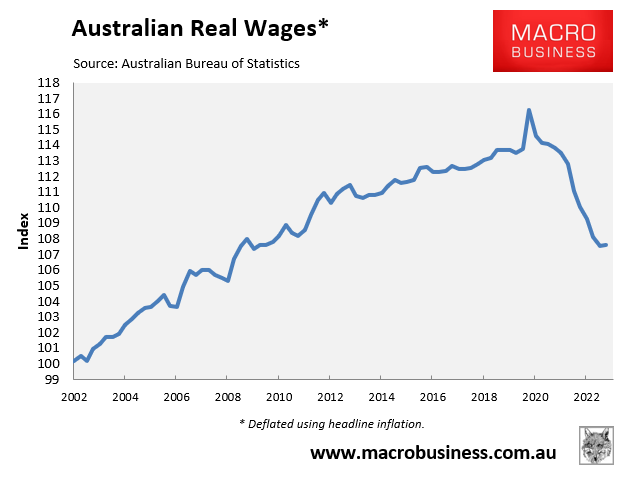

Adjusting Australia’s wage price index by CPI inflation also shows that real wages have plummeted to March 2009 levels after falling 7.5% since June 2020:

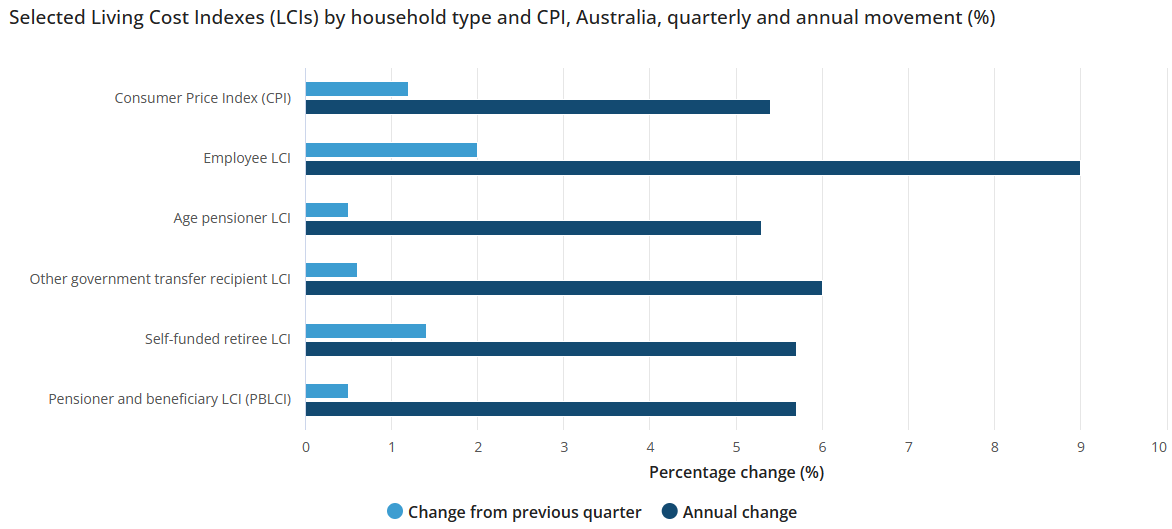

On Wednesday, the ABS released its living cost indices (LCIs) for the September quarter, which showed that employee living costs soared by 9.0% over the year, well above the 5.4% rise in the CPI and the 3.6% growth in nominal wages:

Source: ABS

According to the ABS:

“Living costs for employee households rose 2.0% in the September 2023 quarter, higher than the 1.5% rise in the June 2023 quarter”.

“A significant difference between the Living Cost Indexes and the CPI is that the Living Cost Indexes include mortgage interest charges rather than the cost of building new dwellings”.

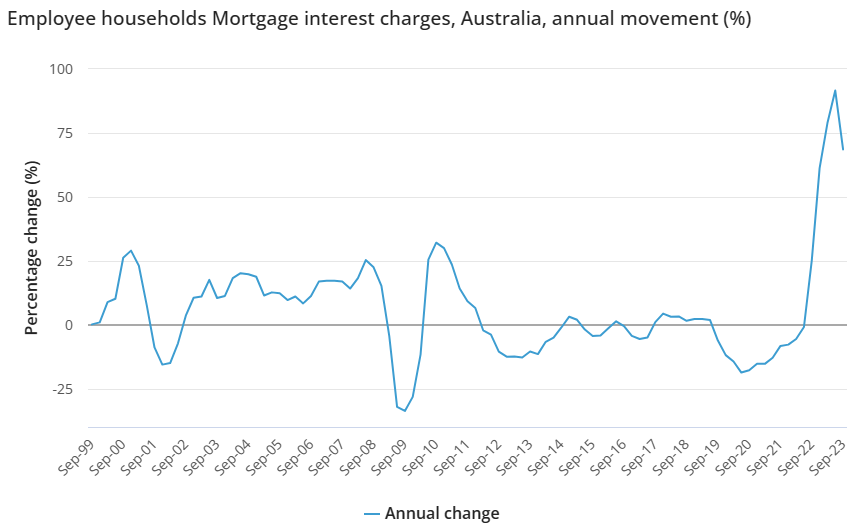

“Employee households were most impacted by rising mortgage interest charges, which are a larger part of their spending than for other household types”.

“Mortgage interest charges rose 9.3% following a 9.8% rise in the June 2023 quarter”.

“While the Reserve Bank of Australia has not increased the cash rate since July 2023, previous interest rate increases and the rollover of some expired fixed-rate to higher-rate variable mortgages resulted in another strong rise this quarter”.

Source: ABS

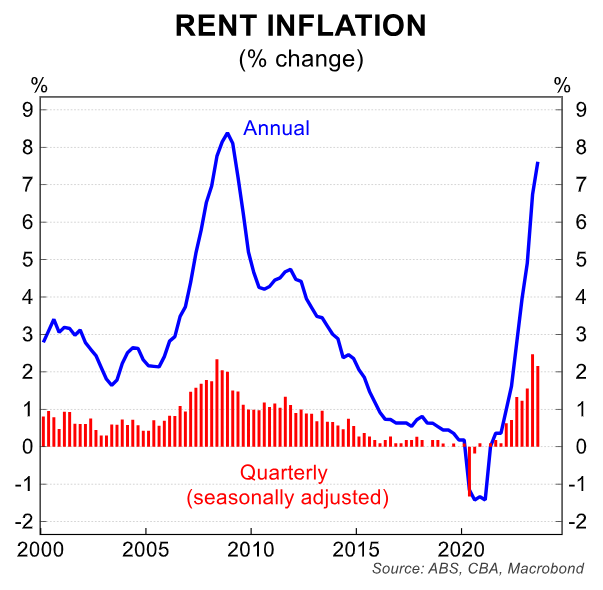

Soaring rental costs have also driven up living costs, especially for those reliant on government transfer recipients:

“Rents make up a higher proportion of spending for these households compared to other household types. Rental prices have increased over the last year reflecting strong demand and low vacancy rates across the country”.

The surge in cost-of-living can be blamed, to a large extent, on ‘Alboflation’ – i.e., juicing demand by running an immigration program well in excess of the supply-side of the economy (especially the housing market).

This Alboflation is adding directly to the cost of living and the CPI (e.g., via rents) and will likely force the RBA to push interest rates higher to slow demand and bring inflation back down.

In doing so, the RBA will drive up mortgage costs as well as rents by pushing housing supply even lower, which will add further to the cost-of-living crisis.

The obvious solution is for the Albanese government to reduce immigration to a level that is below the nation’s ability to supply housing and infrastructure.

Because importing record numbers of people into Australia while the RBA is trying to slow the economy with rate hikes is working at cross-purposes and will only guarantee higher rents, higher house prices, stronger inflation, more rate hikes, and bigger declines in real wages.

Albo’s record immigration is a recipe for disaster for Australian living standards.