The spring auction season is drawing to a close with clearance rates falling, a sign that the housing market is turning in favour of buyers.

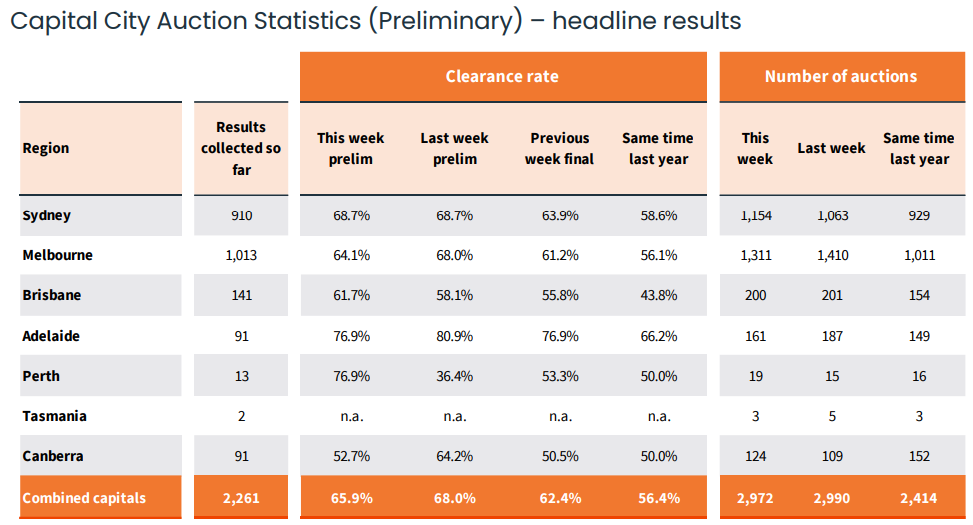

CoreLogic’s preliminary auction results reported a clearance rate of only 65.9% at the combined capital city level, which was 2.1% lower than the prior weekend’s preliminary result, which was downgraded to just 62.4% at final figures:

Week ending 26 November (Source: CoreLogic)

The decline in auction clearances was led by Melbourne, which recorded a preliminary rate of only 64.1%, down from 68.0% the prior weekend (revised to 61.2% at final figures).

Sydney’s auction results held up better, recording an unchanged preliminary rate of 68.7% (revised to 63.9% at final figures).

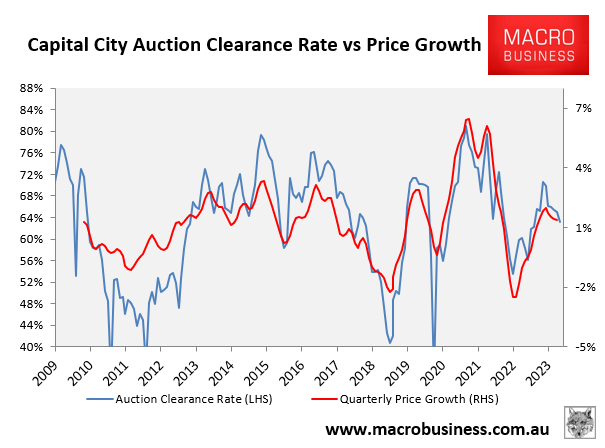

The next chart plots the trend in monthly average final clearance rates, which peaked in May at 71% and have since trended lower to 63% in November:

The trend decline in auction clearance rates has been matched by a slowing in dwelling value growth.

Commenting on the results, CoreLogic research director, Tim Lawless, projected “that selling conditions will continue to soften into 2024”.

Ray White chief economist, Nerida Conisbee, said that loss-making sellers were selling-up, which is starting to favour first home buyers:

“The market is definitely favouring first homebuyers. There’s a lot of the investors now that are really struggling to pay mortgages in the higher interest rate environment”.

“It’s harder for us to track but we’re definitely hearing of investors selling. That typically benefits first-time buyers but it doesn’t benefit renters because it will take stock off the market for renters”.

The property market is currently engaged in a tug-of-war between the stimulative impetus of record population demand and the dampening price impact of rising mortgage rates.

The latest rate hike from the RBA appears to have successfully snuffed house price momentum.