Justin Fabo from Macquarie Group published the below chart on Twitter (X) showing how New Zealand’s unemployment rate has begun to rise, which follows the sharp increase in SEEK job ads:

Fabo also remarked that the Reserve Bank of New Zealand began its rate hiking cycle far earlier than Australia in October 2021.

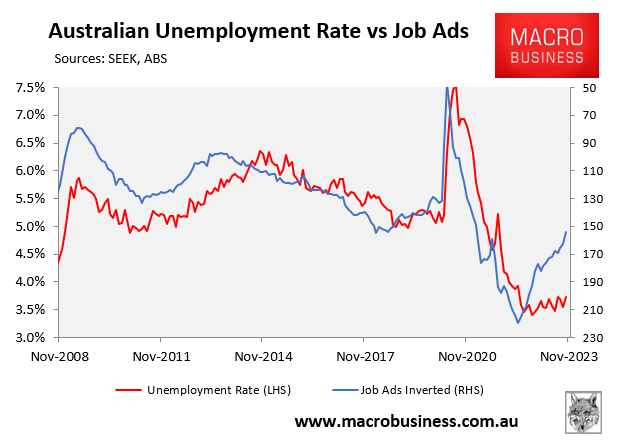

The above chart for New Zealand immediately prompted me to look at the same data for Australia, which is presented below:

As you can see, job applications have also fallen sharply in Australia, but the nation’s unemployment rate has remained relatively stable.

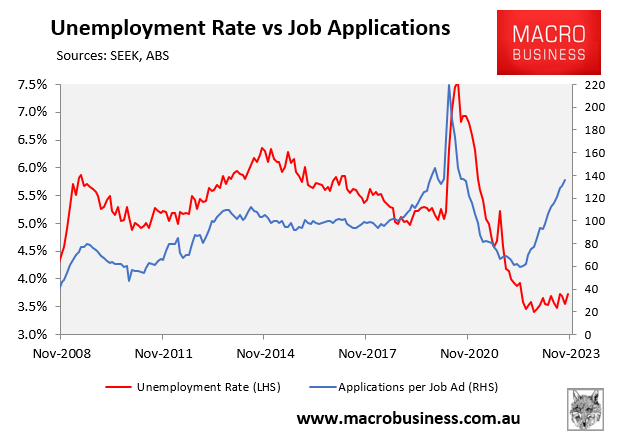

The same applies when we compare the unemployment rate against the number of applications per job ad:

Both SEEK series have historically been strong leading indicators for Australia’s unemployment rate.

However, the relationship has broken down over the past year.

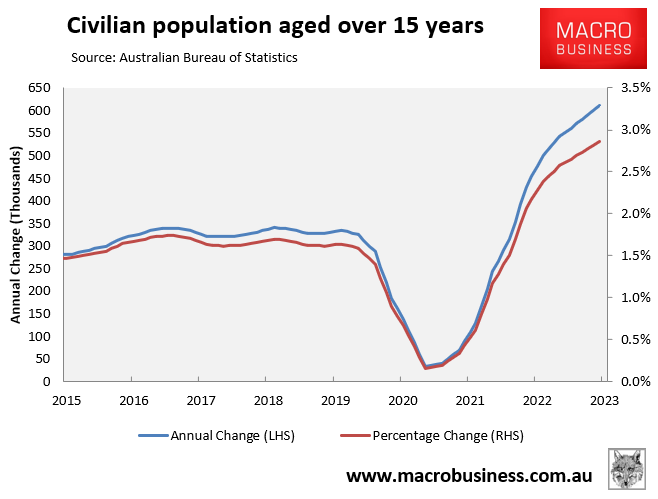

With Australia’s labour force currently growing at a record rate of 2.8% (600,000 people), Australia needs to create around 38,000 jobs per month just to keep the unemployment rate unchanged (assuming a stable labour force participation rate):

This will become increasingly difficult as the economy continues to slow on the back of the RBA’s aggressive interest rate hikes.

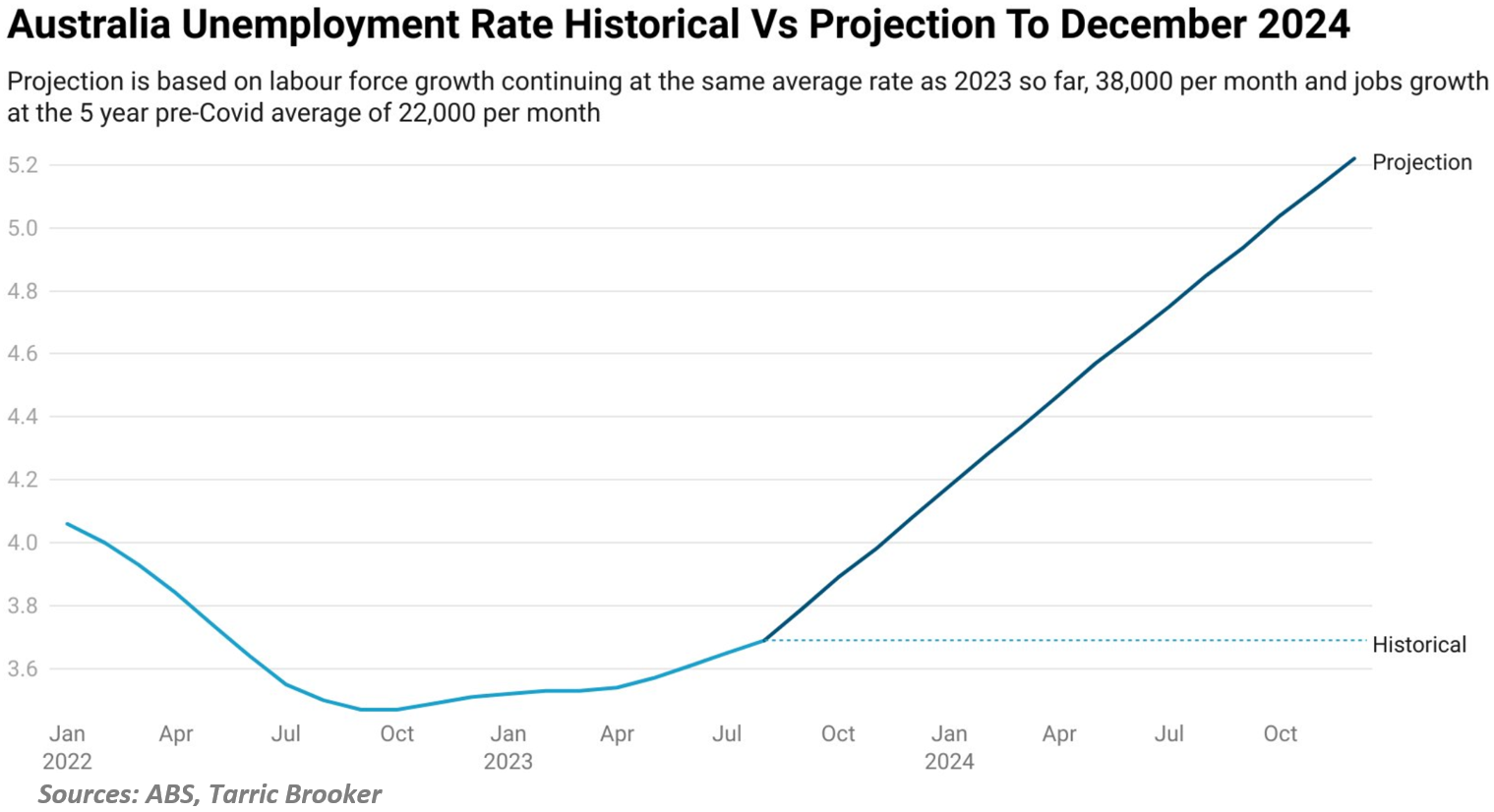

Independent economist Tarric Brooker estimated that if Australia’s labour force continues to grow at its current record pace and monthly jobs growth merely returns to its five-year pre-covid average of 22,000 per month, then Australia’s official unemployment rate would rise to 5.2% by the end of next year:

The aggressive interest rate increases by the RBA and the record immigration program of the Albanese government will continue to place pressure on Australian workers, who face rising unemployment and falling real wages into 2024.

It is only a matter of time before the situation is reflected in the official ABS data.