DXY continued to swoon last night:

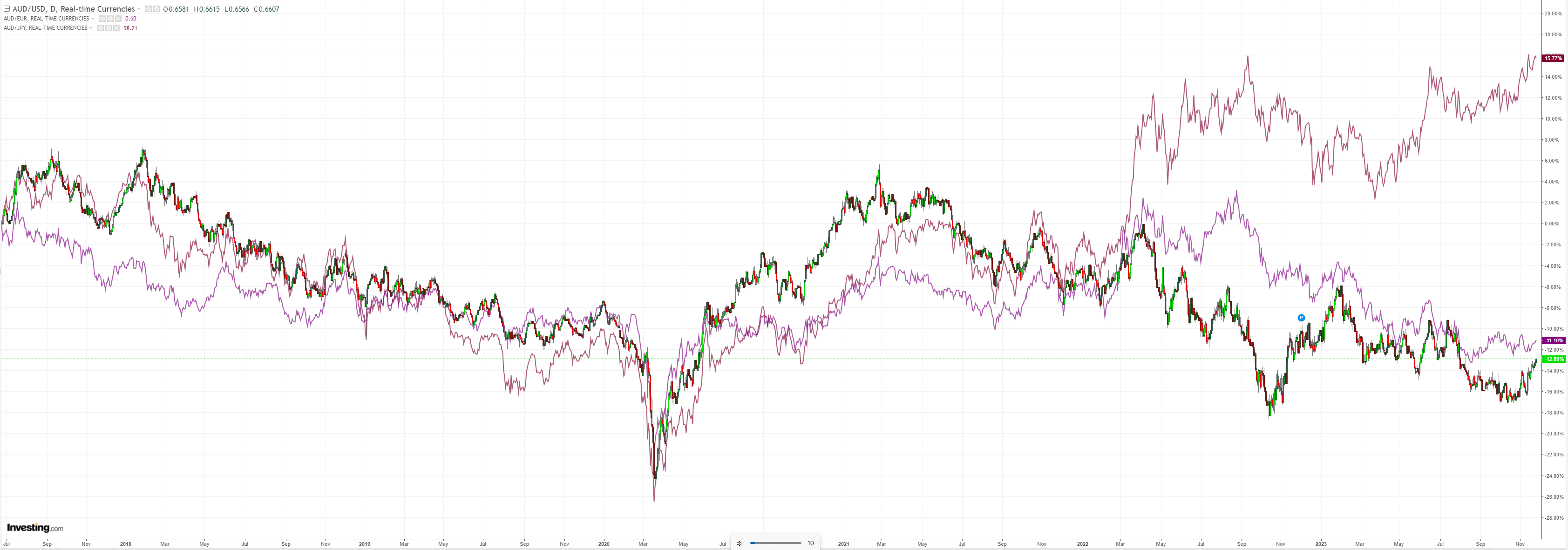

AUD rocketed on:

The peg is back:

Oil and gold are signalling a global landing:

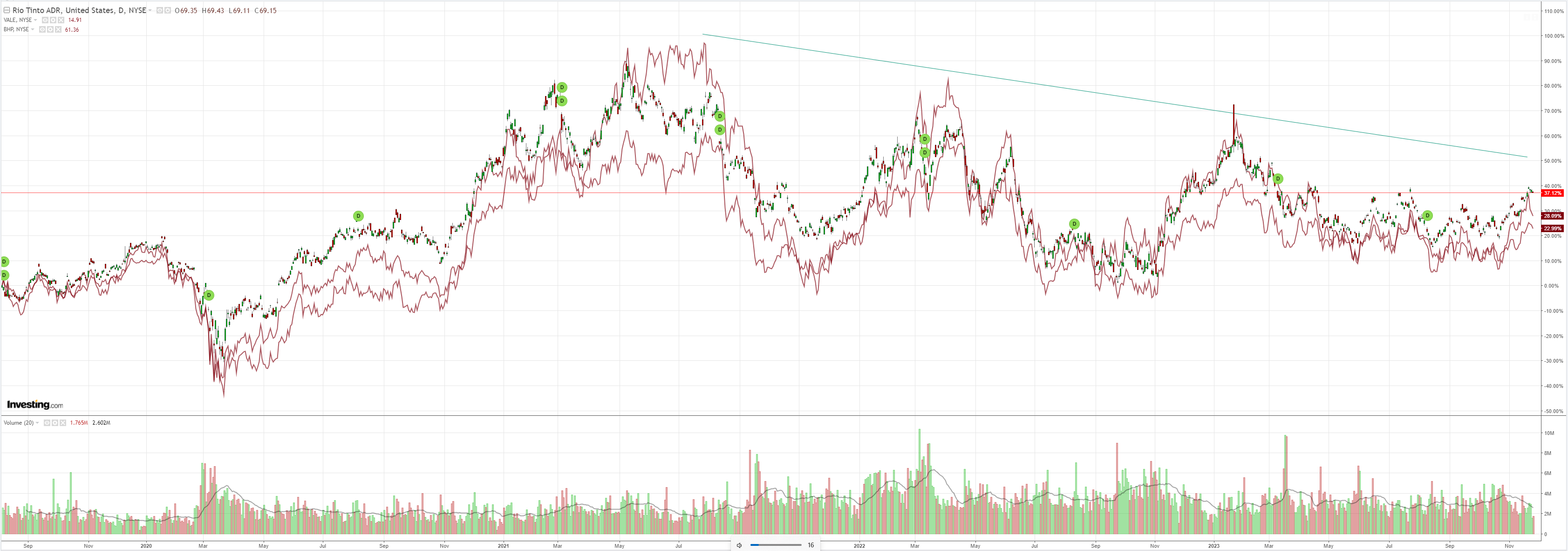

Dirt is half weak:

Miners meh:

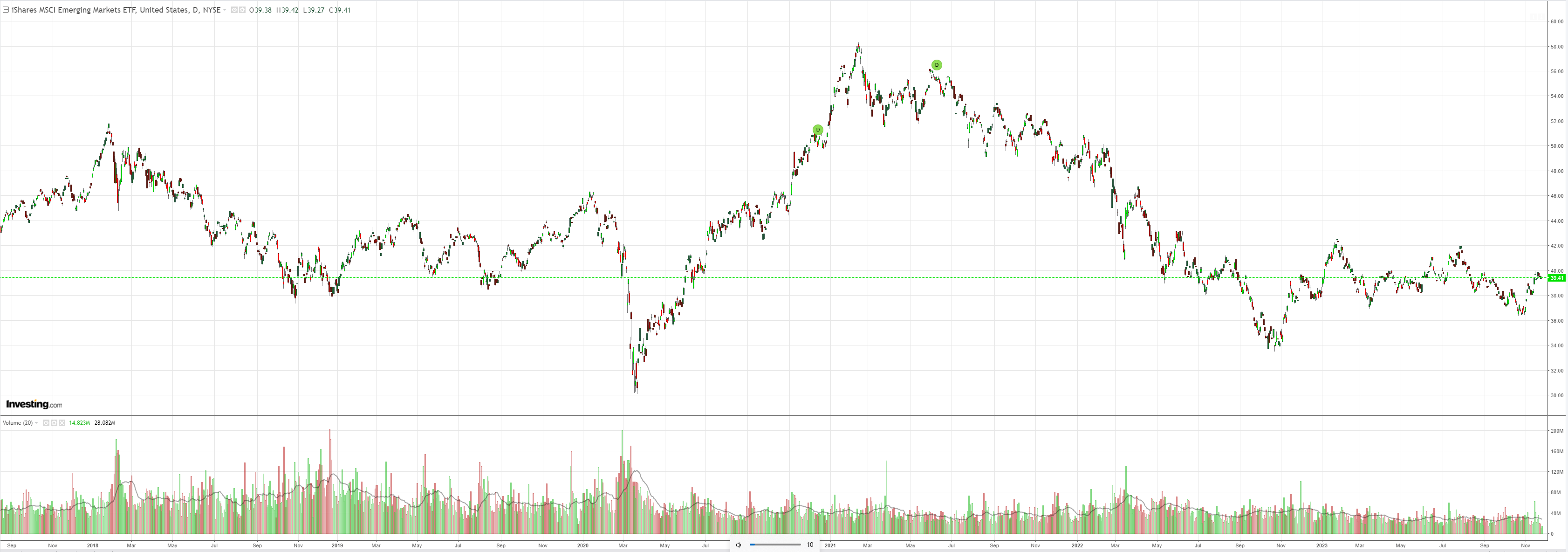

EM meh:

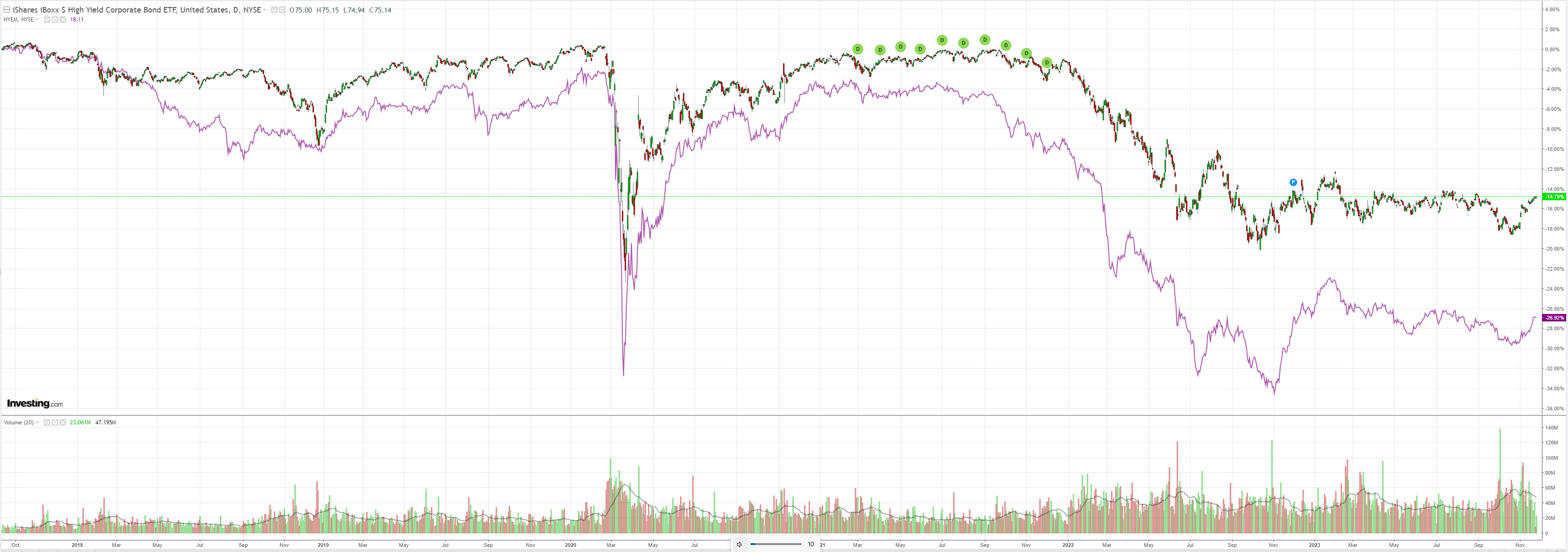

Junk meh:

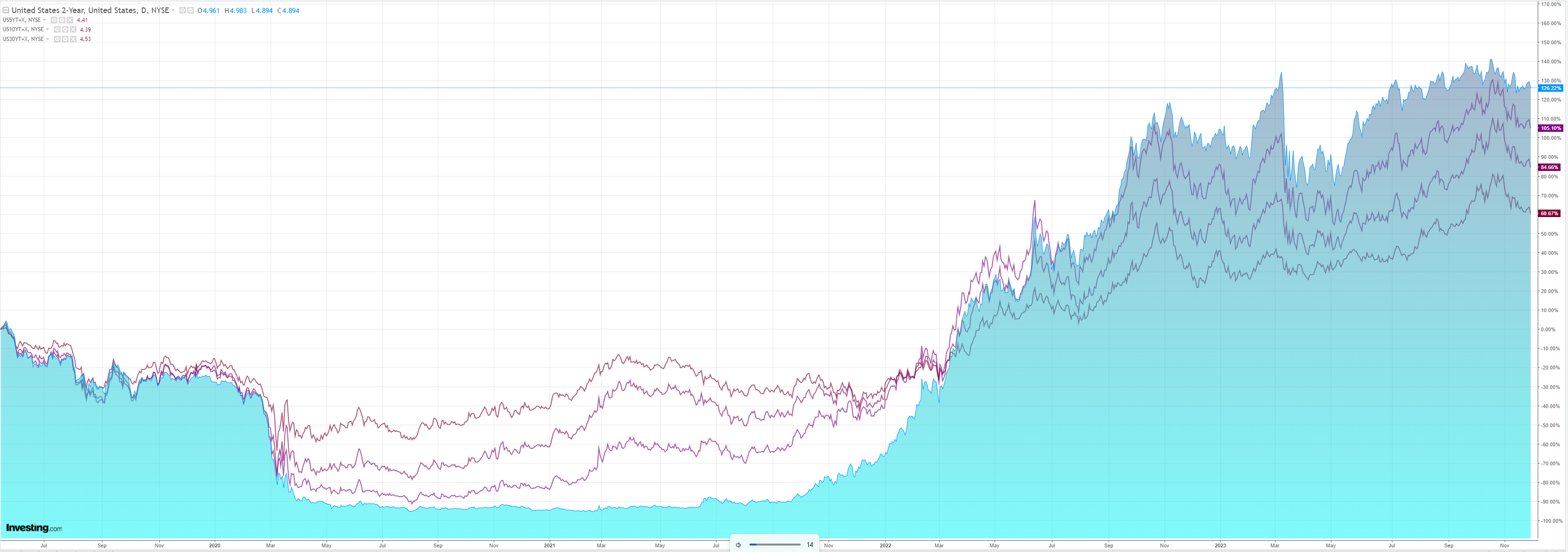

Yields keep falling:

But stocks have already priced perfection:

Shane Oliver sees five reasons for a higher AUD:

Firstly, from a long-term perspective, the Australian Dollar is somewhat cheap.

Second, relative interest rates are starting to swing in Australia’s favour with increasing signs that the Fed is at the top whereas there is still a high risk that the RBA will hike rates further.

Third, global sentiment towards the $A is somewhat negative and this is reflected in short or underweight positions. In other words, many of those who want to sell the Australian Dollar may have already done so and this leaves it vulnerable to a further rally if there is any good news.

Fourth, commodity prices look to be embarking on a new super cycle.

Finally, reflecting continuing relatively high energy and iron ore prices, Australia is continuing to run a current account surplus, albeit it is down from recent highs (as gas and coal prices have fallen back and Australians have resumed travelling internationally).

The first three points are rock solid. The last two are wrong.

Commodities are not in a new super cycle. Outside of lithium, and not even it for another five years, there are gluts in just about everything. As global inflation ebbs away, financialised hoarding will destock.

Worse, Chinese growth is done for good.

Sure we’ll have inventory cycles, such that transpiring in iron ore at the moment, but that is not a super cycle.

As well the current account surplus is an illusion made by gas exports that actually cost the Australian economy.

So, that makes the AUD rally very much a cyclical move. Further to rise, probably. And certainly so when the fog clears around how severe is the global economic landing and recovery.

The AUD is a chronic underperformer into the next cycle as Chinese growth never rebounds, Europe’s Chinese export machine dies, the US leads the new cycle around AI, and Australian economic management wins the stupid prize yet again.

I’d be surprised if the Poo makes it 70 cents as we move into the next cycle and can see it in the high 40 cents range before the cycle is done.