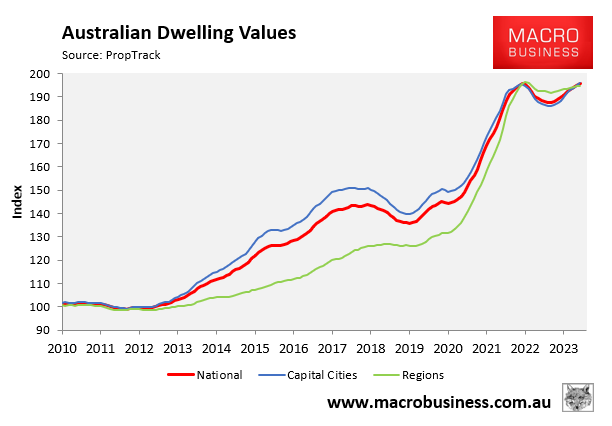

Earlier this month, PropTrack reported that Australian dwelling values hit a fresh record high in October after recovering all of the losses following the commencement in the RBA’s rate-hiking cycle in May 2022:

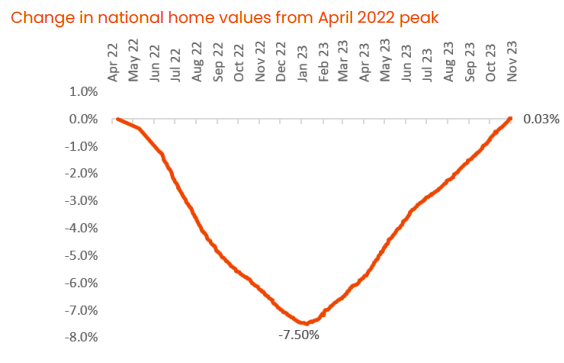

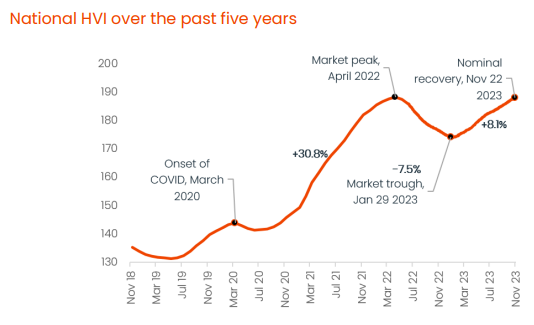

Now CoreLogic’s daily dwelling values index has recovered to a record high after falling 7.5% from its April 2022 peak:

CoreLogic Research Director, Tim Lawless, explained that the “counter-intuitive” rebound in dwelling values was caused by an “imbalance between supply and demand”:

“The ‘V’ shaped recovery may seem counter intuitive, given high interest rates, deeply pessimistic levels of consumer sentiment and high cost of living pressures. However, the recovery can be explained by an imbalance between supply and demand”.

“From a supply perspective, advertised stock levels have held remarkably low through 2023. Although inventory levels are now rebalancing as vendor activity picks up, listings remain 16.6% below the previous five-year average nationally”.

“At the same time, demonstrated demand, based on the volume of homes sales, is trending roughly in line with the five-year average”.

“The good news for prospective buyers is that the pace of growth is clearly easing in some markets as advertised stock levels rise and purchasing demand remains fragile”.

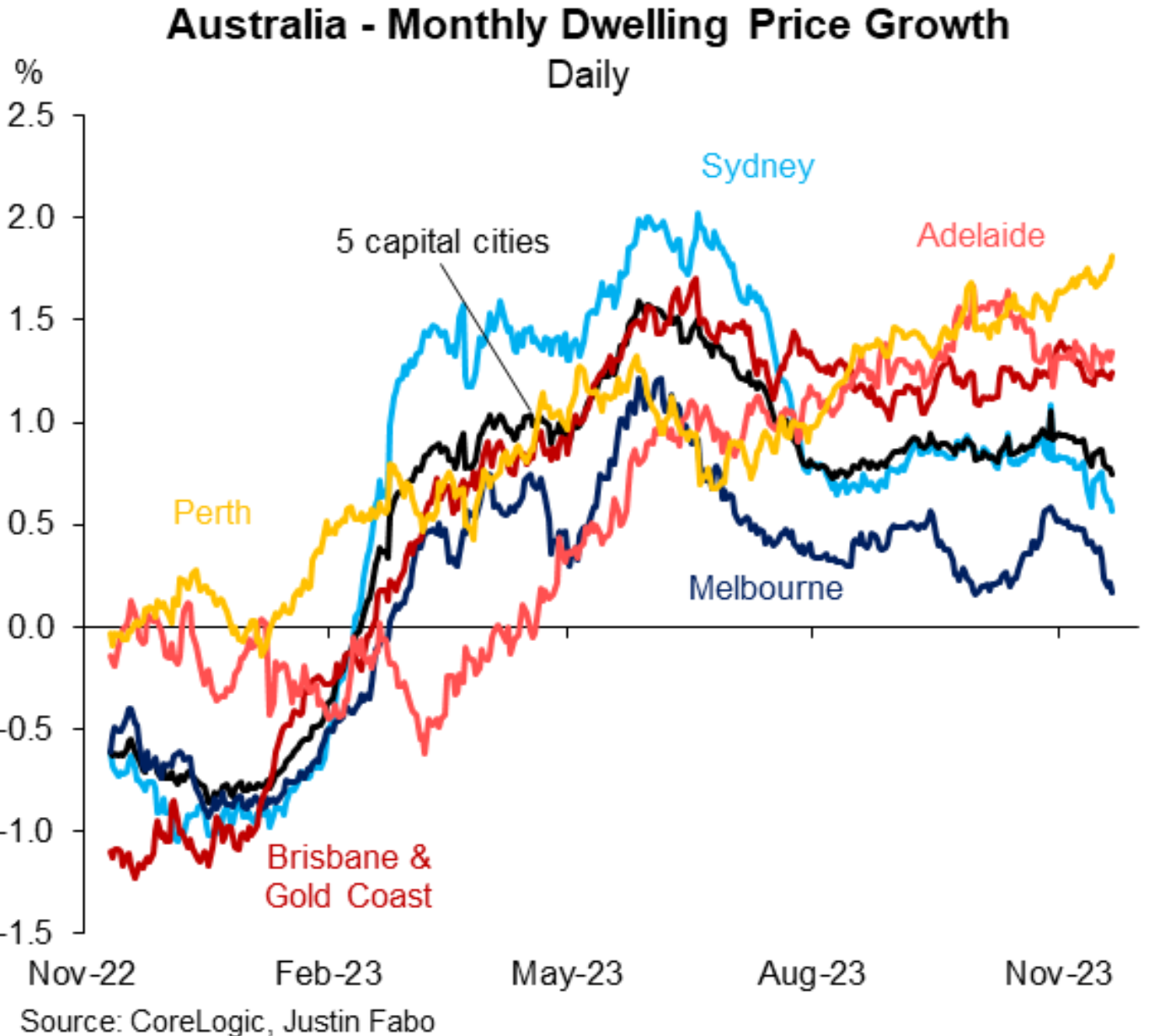

Indeed, the daily dwelling values index has rolled over across Sydney and Melbourne, whereas it is holding up better across the other major capitals:

Australia’s housing market is currently a tug-of-war between record population demand and the 30% contraction in borrowing capacity brought about by the RBA’s aggressive rate hikes.