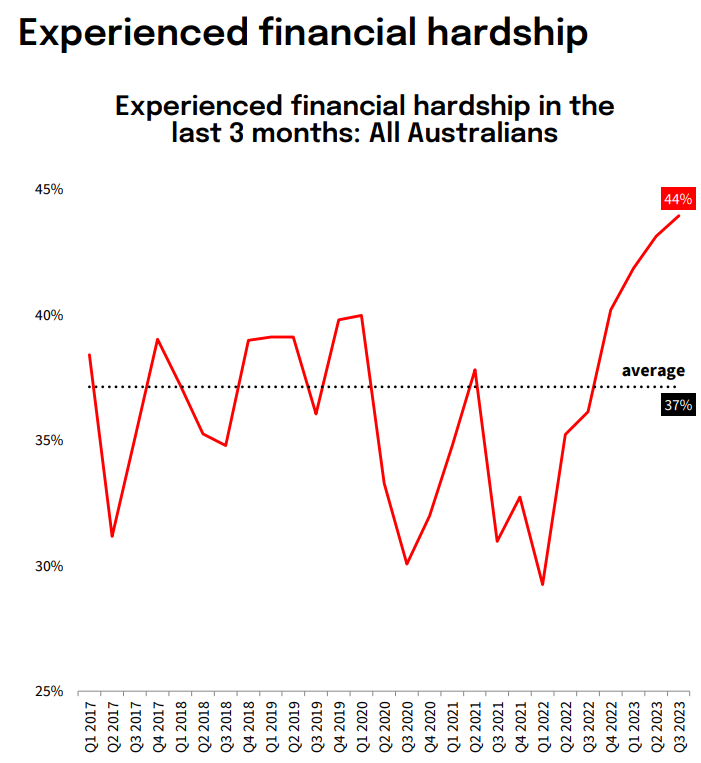

NAB has released its latest edition of its Financial Hardship Report, which reveals that the number of Australians experiencing financial hardship has risen to a survey high 44% (from 36% one year ago):

“This increase has occurred against a backdrop of rising inflation (particularly for every day essential such as groceries, petrol, gas, and electricity), and rising interest rates”, notes NAB.

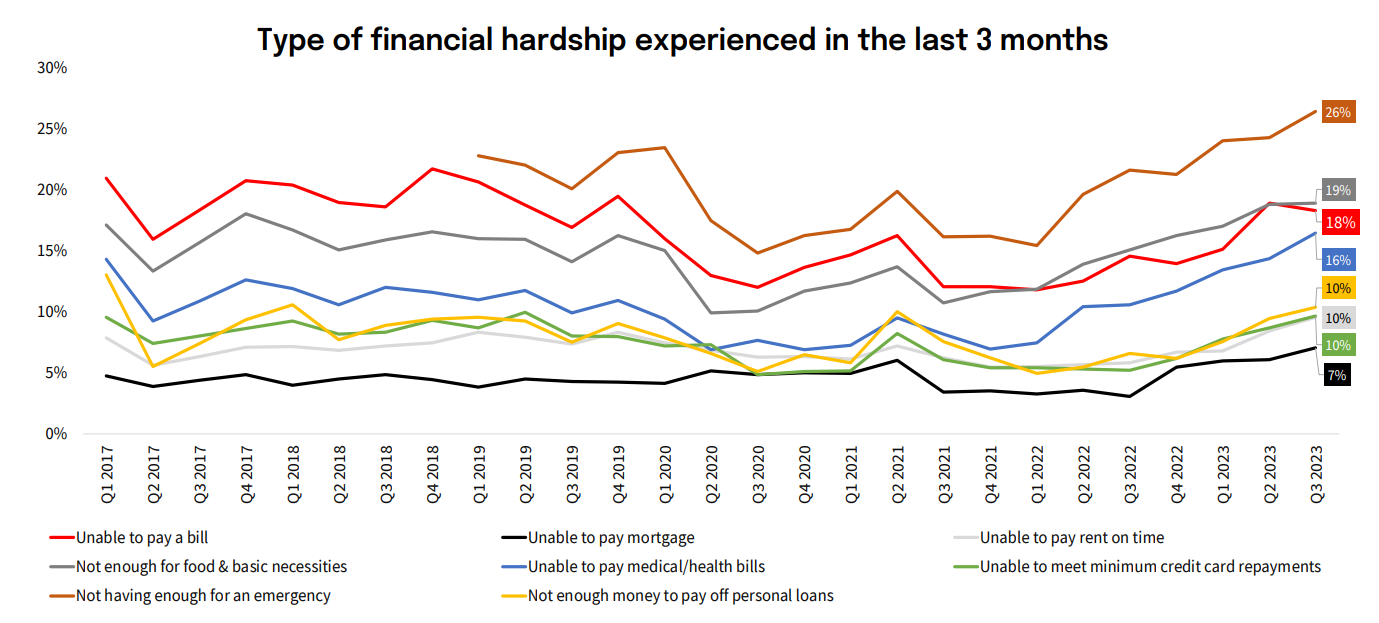

More than one in four respondents admitted that they had insufficient funds for an emergency, while one in five cited having insufficient funds for food and essential necessities or being unable to pay a bill.

Approximately 7% of respondents reported being unable to make their mortgage payments.

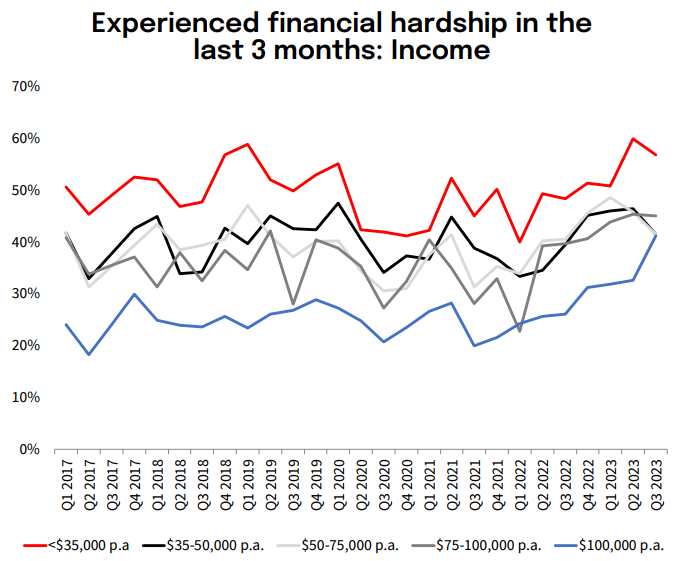

Although hardship continues to affect a significantly larger proportion of individuals with lower incomes, it is becoming more prevalent among higher income brackets.

One-quarter of respondents agreed very strongly with the statement: “I am struggling to make ends meet”.

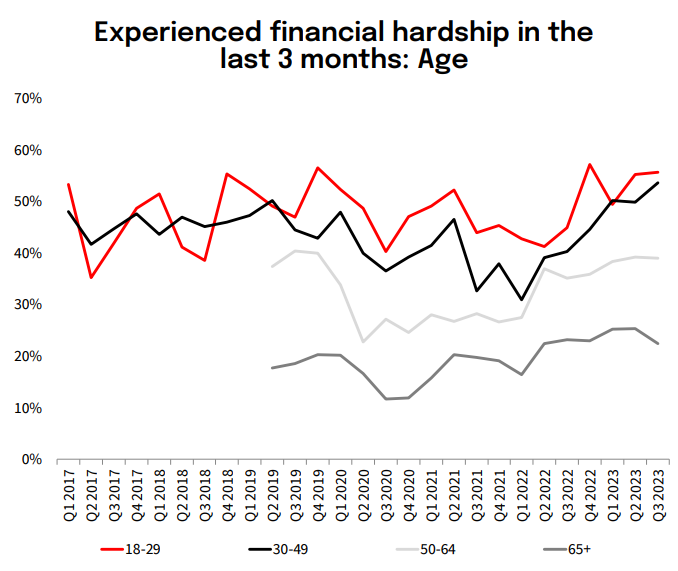

As expected, the incidence of financial hardship is highest among younger Australians.

Australians aged between 18-29 years experienced the greatest hardship (56% vs. 55% in Q2’23), followed by the 30-49 group (54% vs. 50% in Q2’23), the 50-64 group (unchanged 39%) and the over 65 group (22%).

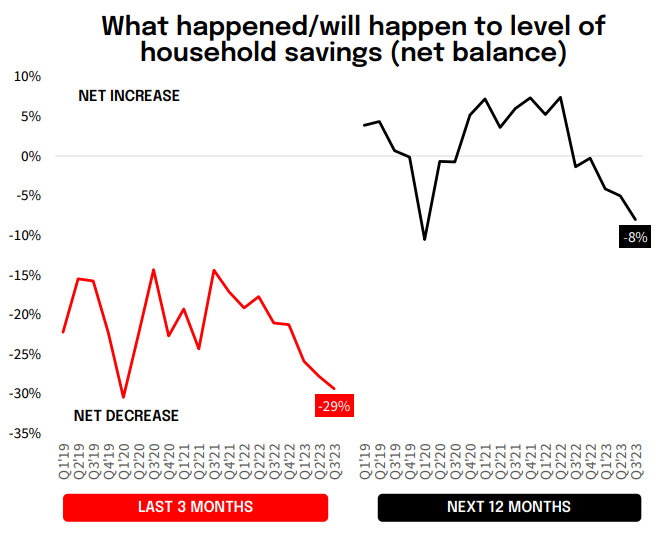

Household savings remained under pressure in Q3, with the number of people whose level of savings fell in the last 3 months outweighing those who said it increased rising for the fourth straight quarter to a near 4-year high -29% (-28%in Q2).

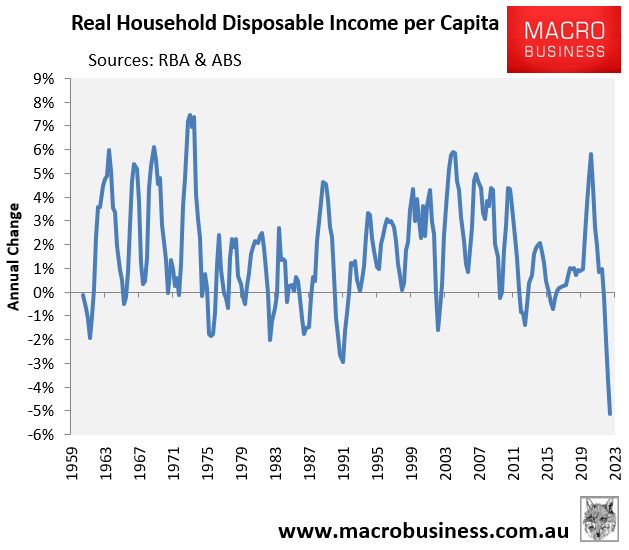

Overall, the results are unsurprising given Australian households experienced a record decline in household disposable income in 2022-23, alongside soaring mortgage repayments, rents and energy costs:

With real wages likely to continue falling into 2024 along with rising mortgage repayments and rents, Australian households are facing another year of financial pain.