Australian households have been financially devastated by the sharp rise in interest rates, soaring rents, and declining real incomes.

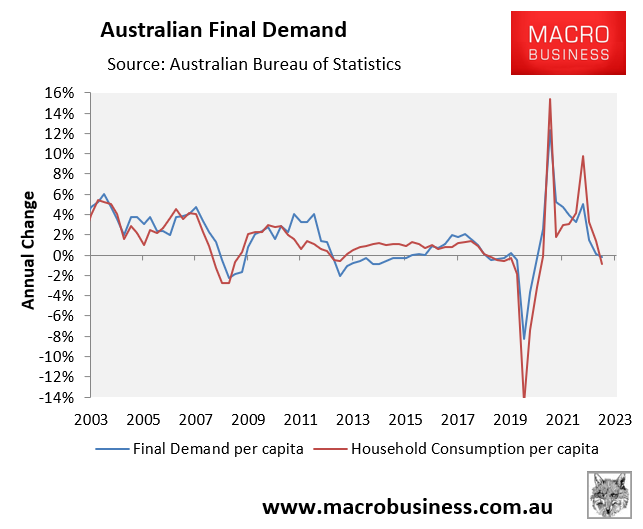

The latest national accounts from the Australian Bureau of Statistics (ABS) showed that real spending by households fell by 0.2% in the year to June 2023, driving a corresponding 0.3% real decline in per capita GDP over the same time frame:

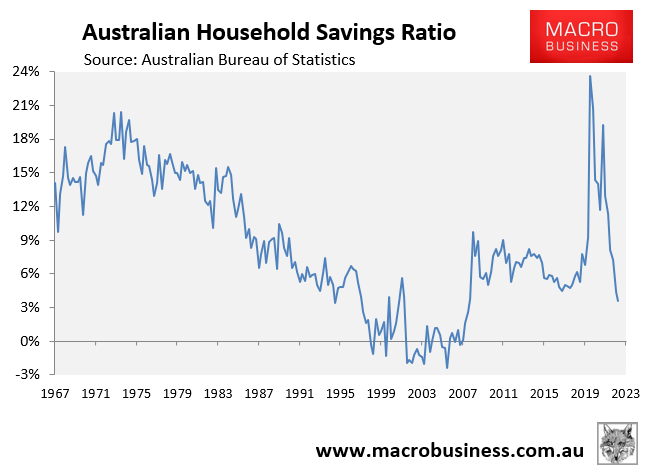

This decline in spending occurred despite the household savings rate falling to 3.2% in the June quarter, which is the lowest level since the corresponding quarter of 2008:

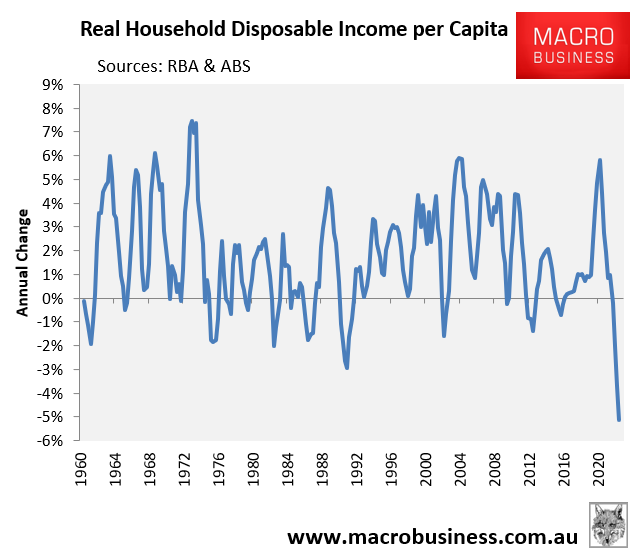

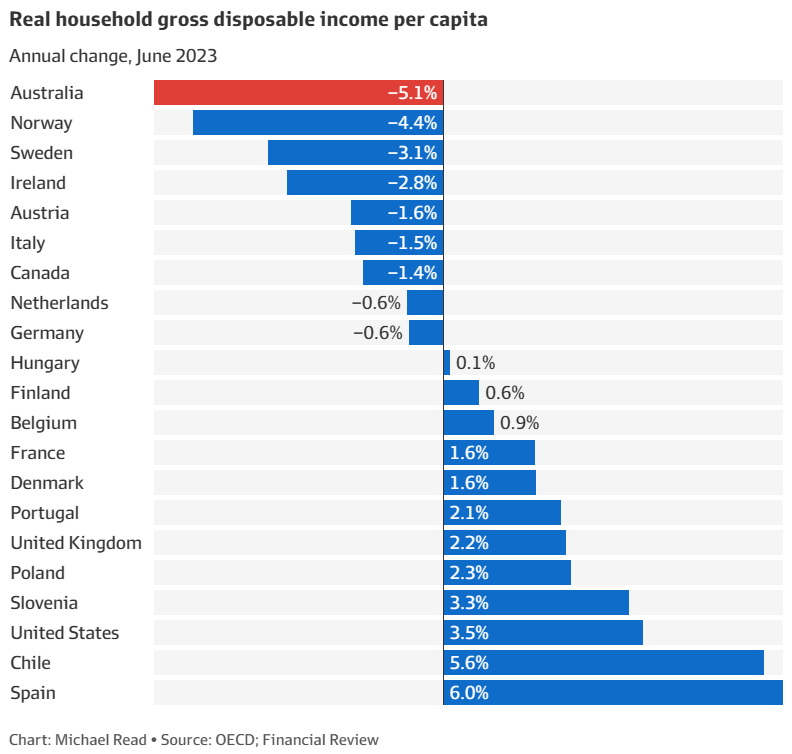

In the year to June 2023, real household disposable income also suffered its largest decline on record, falling by an unprecedented 5.1%:

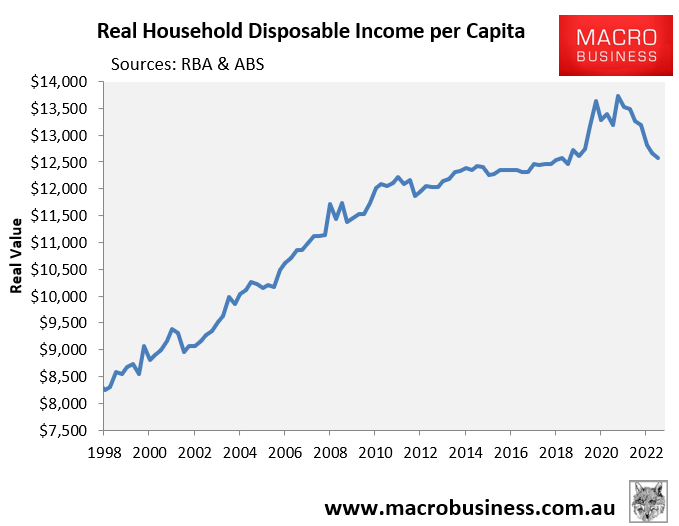

As a result, Australian households relinquished all of the income gains induced by the pandemic’s stimulus measures, with real per capita disposable income falling back to levels observed in early 2019, which were little higher than 2010:

This means that Australian households have endured around 13 years of near zero income gains.

Last week, the OECD released data, published in The AFR, showing that Australian households suffered the largest decline in real household incomes in the world last financial year:

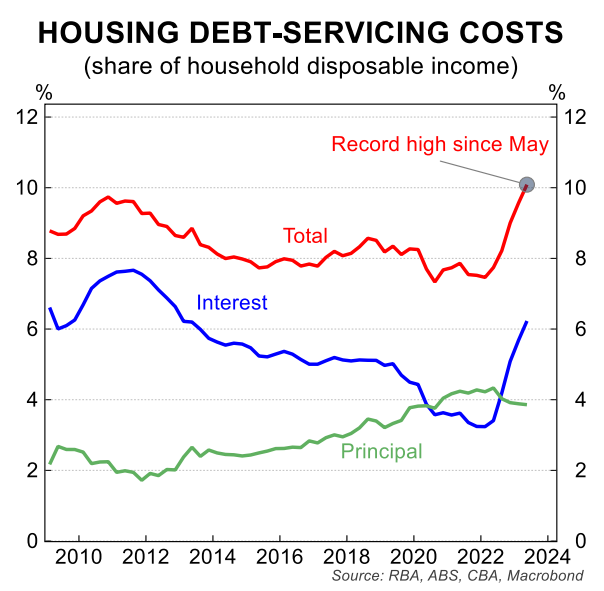

Meanwhile, Australian households are suffering record high mortgage costs relative to incomes: a situation that will worsen following last week’s interest rate hike from the RBA:

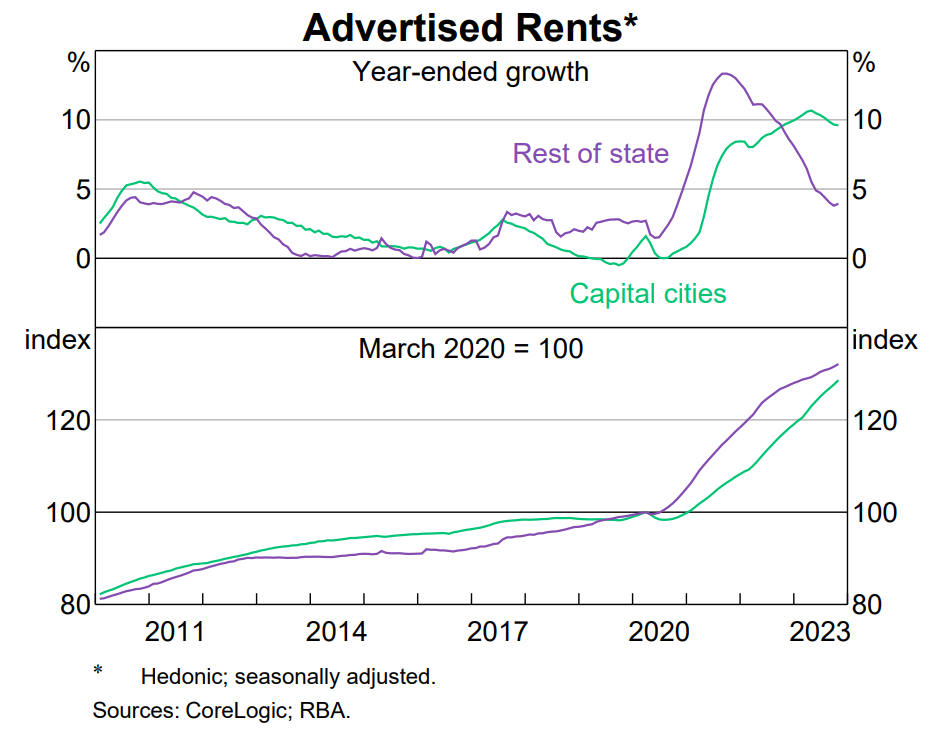

Australian residential rents are also soaring, which is further constricting the disposable incomes of the one-third of households that rent:

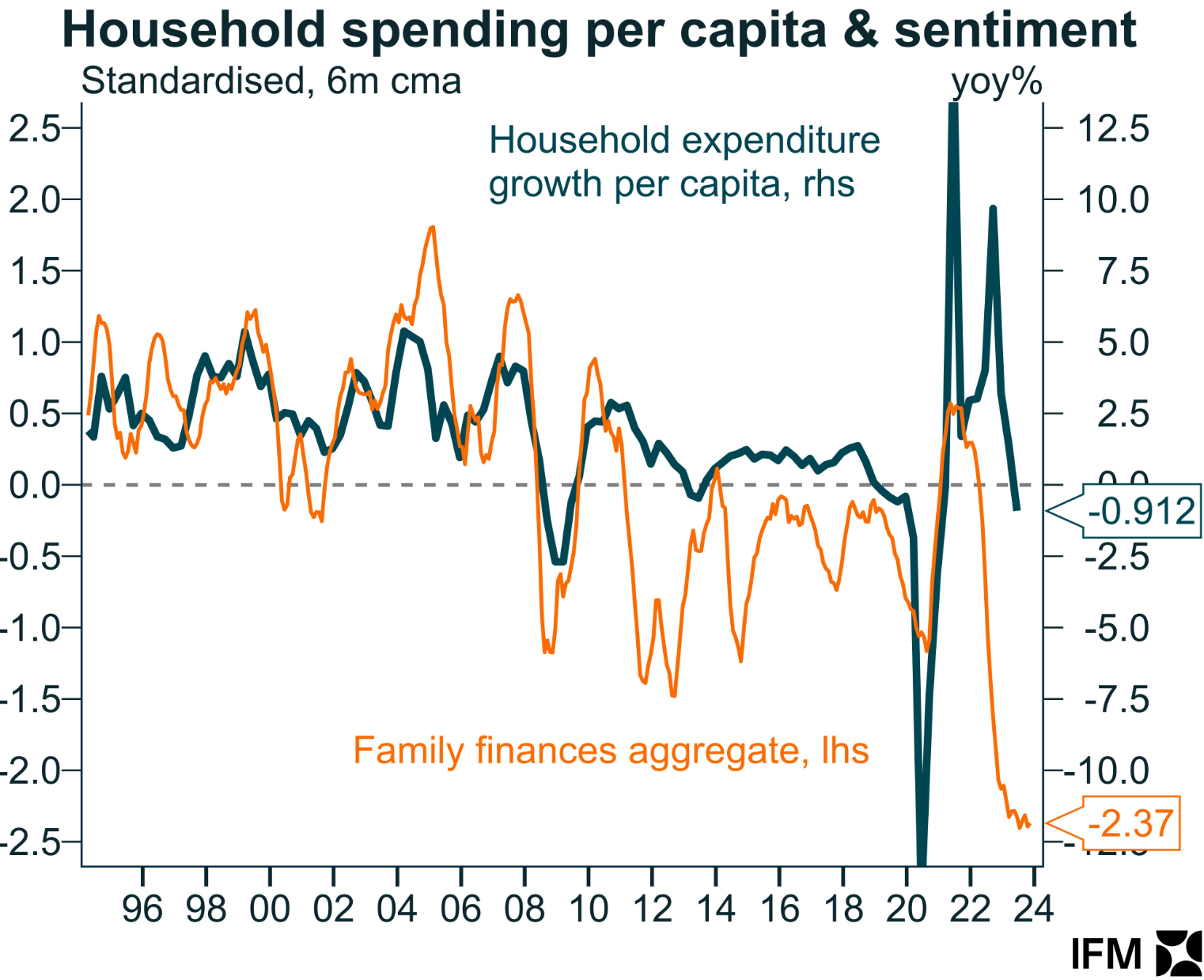

On Tuesday, Alex Joiner from IFM Investors published the below chart tracking the family finances sub-component from Westpac’s latest consumer sentiment survey against per capita household spending:

As you can see, both are in the doldrums.

In fact, the only thing supporting the aggregate economy right now is record (2.5%) population growth, which is keeping overall demand growing while per capita incomes and demand shrink.

Meanwhile, Australian households are experiencing a marked reduction in their living standards amid a deep per capita recession, falling real wages, soaring mortgage repayments and rents, and crush-loaded housing, infrastructure and services.

No wonder voters are turning against the Albanese government.