Over the past decade, MacroBusiness has lobbied hard for Australia to implement global rules to counter money laundering into property.

In 2003, Australia agreed to implement comprehensive ‘Tranche 2’ global anti-money laundering (AML) rules covering so-called real estate gatekeepers: accountants, lawyers, and real estate agents.

These rules have been continually postponed by the federal government amid strong pushback from the same industries that would be subject to the regulation.

The two decades of delays have given Australia the weakest money laundering rules in the world:

It has also made Australian property a haven for dirty foreign money.

In 2015, the Paris-based Financial Action Taskforce (FATF) – the global AML regulator – warned that Australian residential housing was being used to launder large sums of money, particularly from China, and implored Australia to implement the AML rules to bring real estate gatekeepers into the regulatory net.

FATF’s findings were backed by the Australian Transaction Reports and Analysis Centre (AUSTRAC), which warned that “laundering of illicit funds through real estate is an established money laundering method in Australia”.

Over these two decades, literally billions of dollars are estimated to have been laundered through Australian homes, mainly from China.

Chinese money laundering has also been facilitated by the 888 ‘golden ticket’ visa, which was introduced by former Labor Treasurer Chris Bowen in 2012 and has operated for 10 years with zero rejections.

Chinese citizens make up 90% of successful applicants. And over 20,000 Chinese have been approved for the Significant Investor Visa scheme, which requires a $5 million minimum commitment.

These ‘golden ticket’ visas grant automatic permanent residency in Australia, and unlike other visa classes, no English language proficiency is necessary.

Anti-corruption campaigners have long lobbied for the visas to be revoked, claiming that corrupt officials are using them to enter Australia and launder funds.

Other developed countries have already discontinued such ‘golden ticket’ visa programs.

Australia’s Productivity Commission (PC) has called for the ‘golden visas’ program to be axed, noting they are conduits for money laundering and ‘dirty money’ into Australia.

As noted by the ABC’s Linton Besser on Tuesday, “Australia is now one of the few Western countries to still offer such a program”.

“Elsewhere, they have been terminated not just because they’re inefficient but also because they attract dirty money”.

“These risks are not unknown to Australian decision-makers. The same Productivity Commission inquiry included warnings that 888 visas carry with them the “potential for money laundering and other nefarious activities”. Surely similar advice has been provided to the government over the years since”.

“Extracted using Freedom of Information, the raw data is stunning, including the headline figure of 26,000 successful applicants”.

“It shows that from its inception in 2012 until May of this year, more than 20,000 Chinese nationals, including those from Hong Kong and Macau, have been granted golden visas to live in Australia”.

“What is stark about the data is that so few applications were rejected — at a rate of less than 2% (522)”.

“Of the 26,000 applications, the department has opened only 11 investigations into the good character provision. The first was not launched until the seventh year of the program”.

“Clare ONeil has said publicly that the scheme is under review. Why it hasn’t been scrapped already is apparently tawdry internal Labor politics; how to do so without bringing a blush to the cheeks of Chris Bowen, now energy minister?”

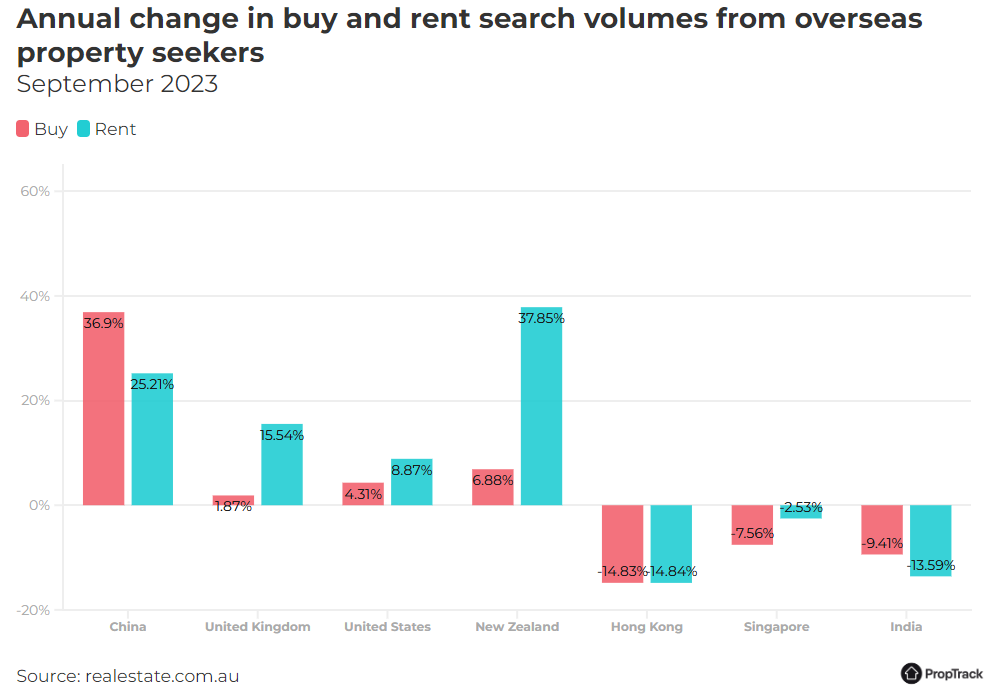

With Chinese interest in Australian property now surging according to both Juwai IQI and PropTrack:

The Albanese government must implement the global ‘Tranche 2’ AML rules as well as close the 888 ‘golden ticket’ visa program.

Australians must not be priced out of housing by dirty Chinese money.