Thursday’s ABS labour force release was another case of numberwang, with the unemployment rate rising to 3.7% despite 55,000 jobs created.

As noted by CBA economist Stephen Wu, “the unemployment rate remains much lower than implied by its historical relationships with other labour market indicators such as surveyed measures of unemployment expectations and job ads”.

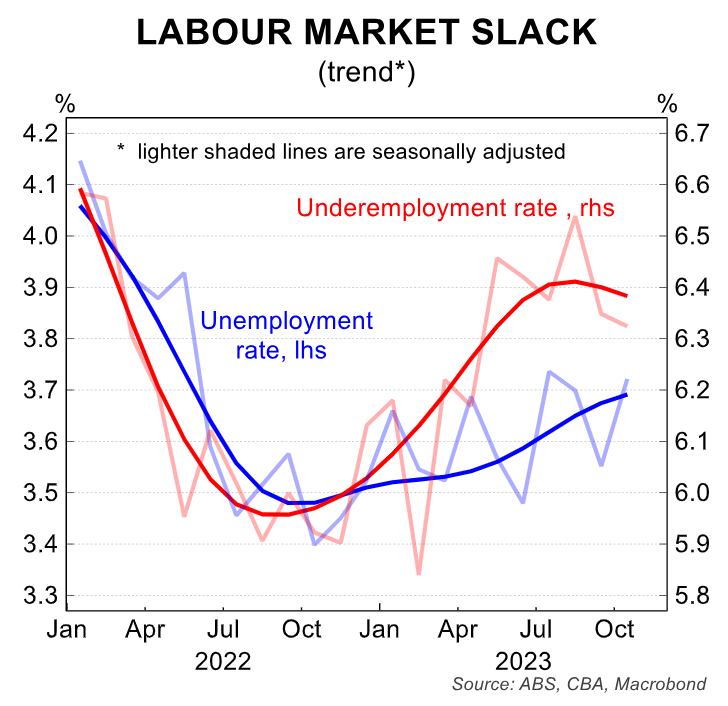

“The underemployment rate was unchanged at 6.3%. It stands well above the trough of 5.8% seen in February, but has been little changed over the second half of this year”:

However, “this month’s labour force report was influenced by the Aboriginal and Torres Strait Islander Voice referendum”.

“The referendum was held on 14 October, and the survey’s reference period was from 1-14 October. The ABS noted that the referendum had a temporary effect on employment, hours and participation in October”.

“Given that, we could expect some payback next month, perhaps more so in employment, given that was stronger than expected”.

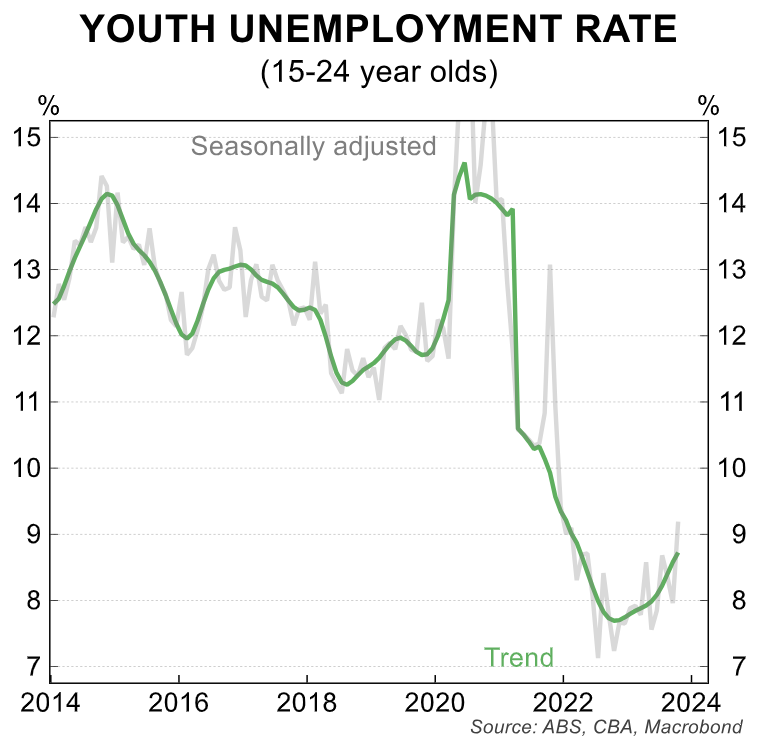

Moreover, the youth unemployment rate typically leads the broader labour market, and the “youth unemployment rate rose further in October, to 9.2%, the highest since late 2021”:

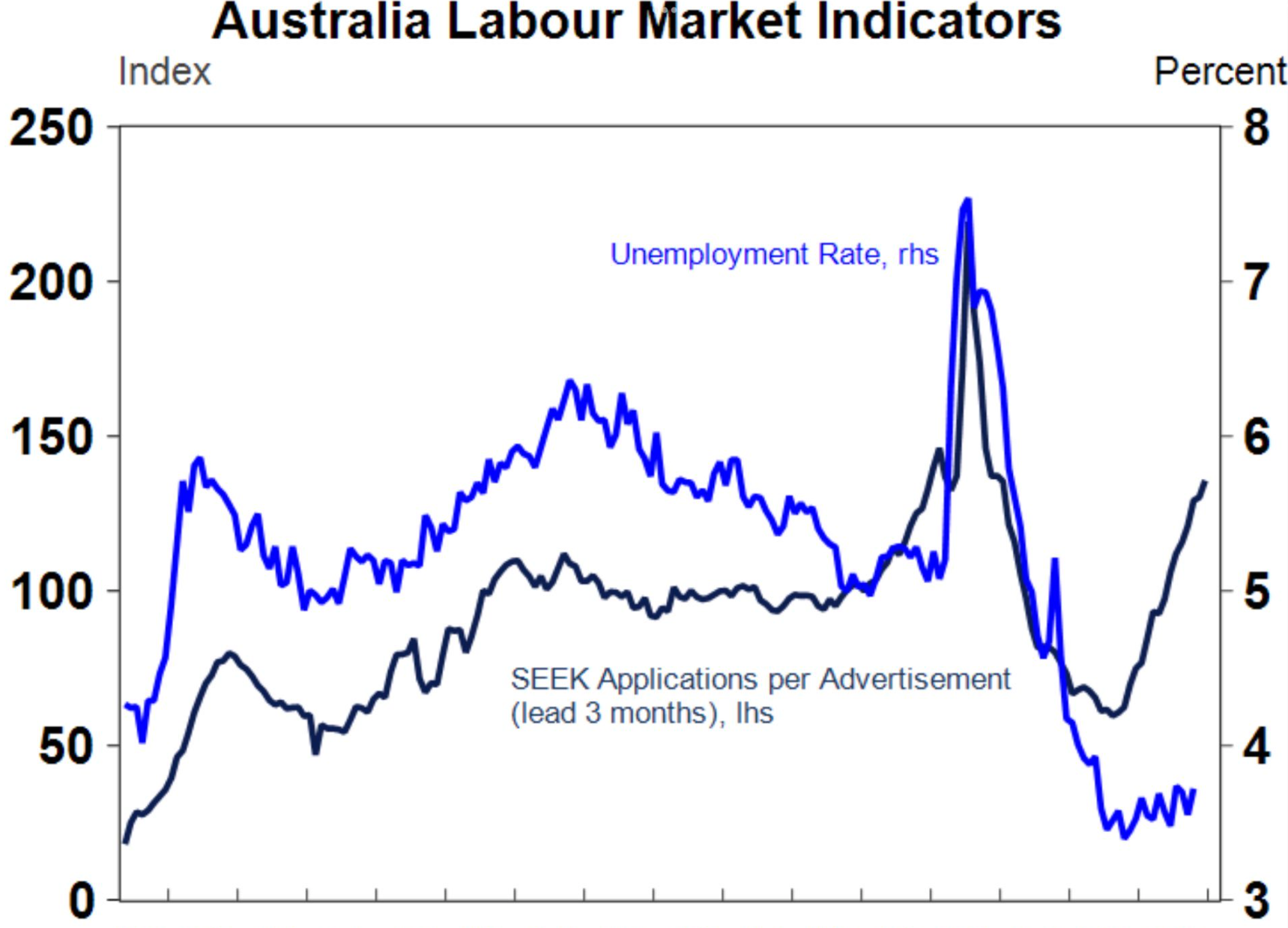

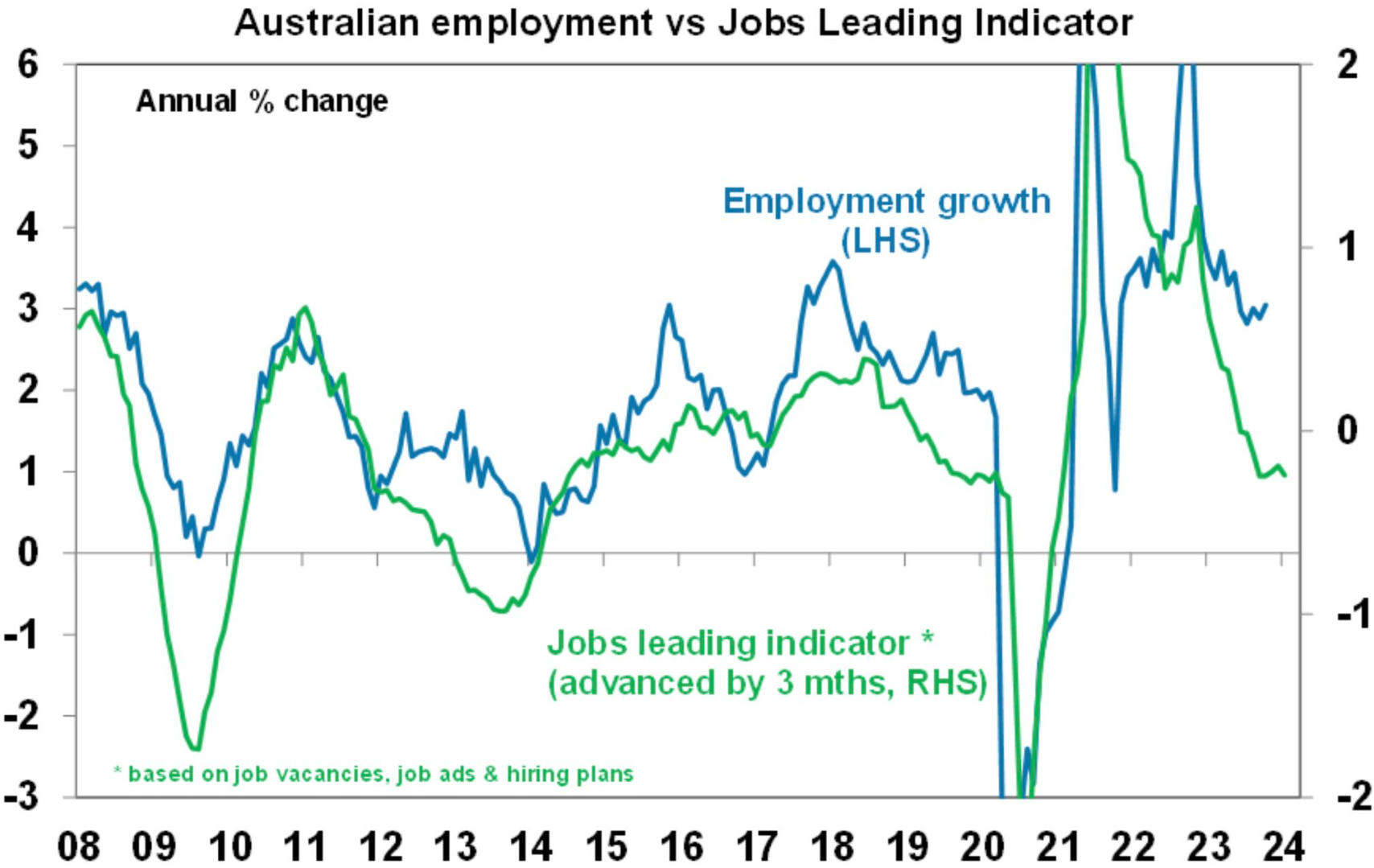

AMP chief economist, Shane Oliver, published a bunch of charts on Twitter (X) on Thursday showing that “leading labour market indicators point to a slowdown ahead”.

These include rising applicants per Seek job Ad:

Rising consumer unemployment expectations:

As well as AMP’s Jobs Leading Indicator, which “also points to softer jobs growth below the ~35k/mth needed to stop unemployment rising”:

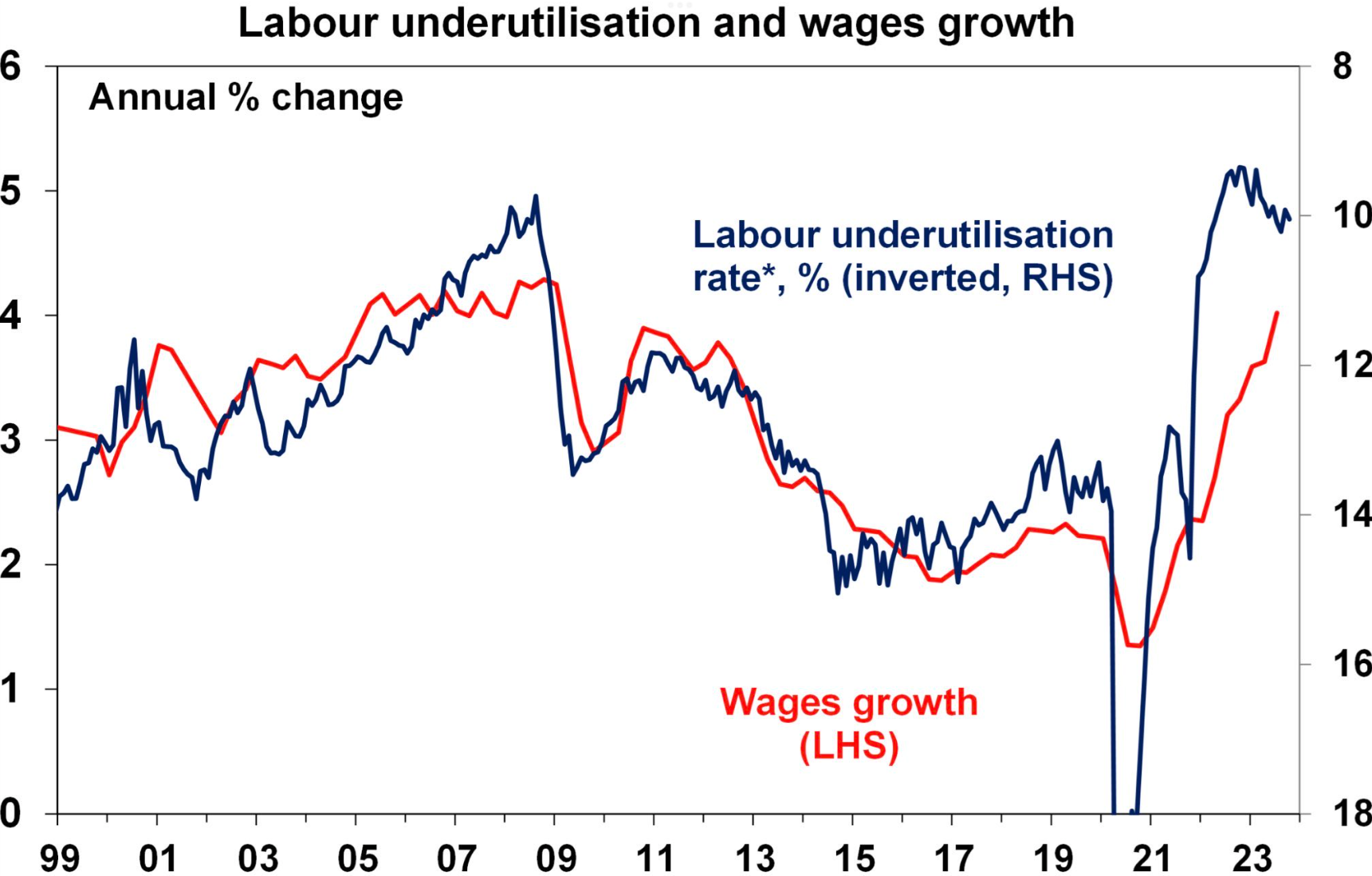

The outlook for wage growth has also worsened given the rise in the underutilisation rate, according to Oliver:

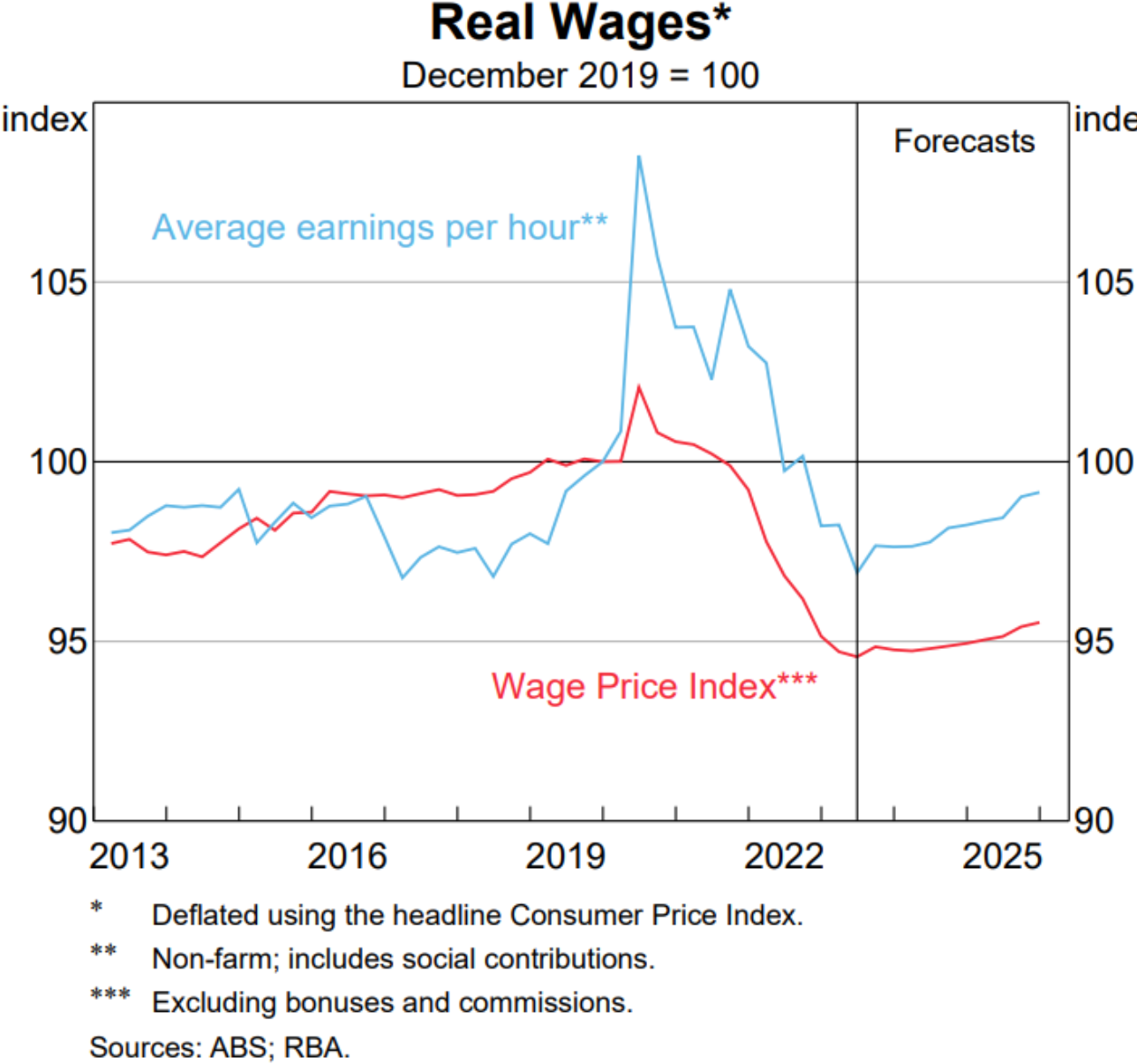

Indeed, the latest RBA Statement of Monetary Policy forecasts that it will take many years for Australian real wages to recover from the losses of the past three years:

It is going to be a long and painful road ahead for Australian workers.