By Harry Ottley, economist at CBA:

Key Points:

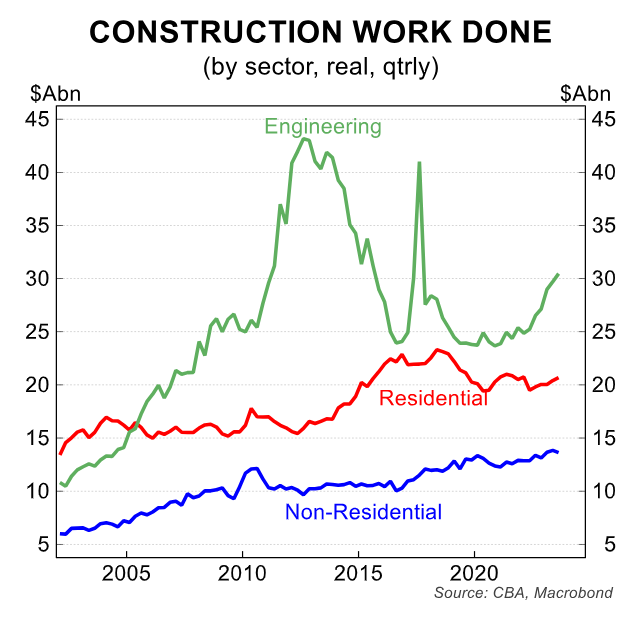

- Construction work done increased by 1.3%/qtr in Q3 23. The Q2 23 figures were revised up significantly, from +0.4% to +2.0%.

- Building construction rose by 0.2% led higher by residential construction which rose by 1.3%.

- Engineering construction rose by a large 2.6%/qtr to be 14.9% higher through the year.

- Dwelling investment is now likely to be a positive contributor to GDP in Q3 23.

Construction work done –Q2 2023:

Construction work done increased by a chunky 1.3%/qtr in Q3 23. The Q2 23 figures were revised up from +0.4% to 2.0%.

The ABS has flagged that the publication is currently at increased risk of revisions due to lower-than-average response rates to the survey.

Once again, growth was driven by engineering activity. Total engineering construction rose by 2.6%/qtr and is 14.9% higher through the year.

The significant pipeline of public capex and robust private business investment are both supporting engineering construction. This momentum should continue in the near term despite some flagged reductions in government infrastructure spending.

Building construction rose by 0.2%/qtr with a strong gain in residential construction (+1.3%) partly offset by a fall in non-residential construction (-1.6%).

The unexpected strength in residential construction was primarily driven by renovation activity (+5.1%) with new builds also registering a solid outcome (+0.5%).

Strength in the residential construction sector is a positive development and may represent some easing in labour supply constraints that have been plaguing the industry.

Recent building approvals have been soft but the pipeline of residential work to be done remains large. As such, if capacity constraints are easing, dwelling investment can be stronger than we had previously expected.

Residential construction work done feeds into dwelling investment in the national accounts (released next week). Today’s numbers indicate Q3 2023 dwelling investment is likely to add to GDP after three quarters of contractions.

There is also a chance that Q2 23 dwelling investment will be revised higher following today’s revision.

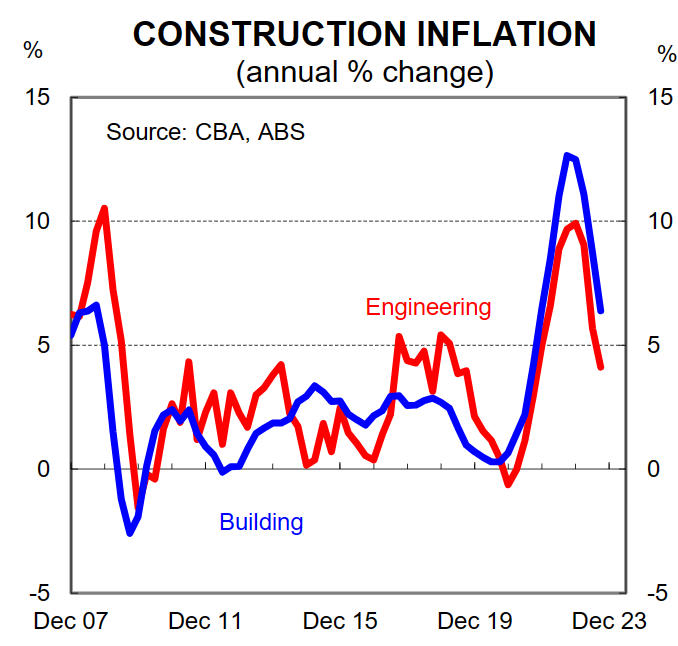

Inflation in the construction industry continues to ease, good news for both businesses and consumers.

According to this release, total construction inflation is down to 5.4%/yr, the lowest since Q3 2021.

The engineering deflator is down to 4.5% while cost growth in the residential building sector remains a touch stronger at 6.4%.

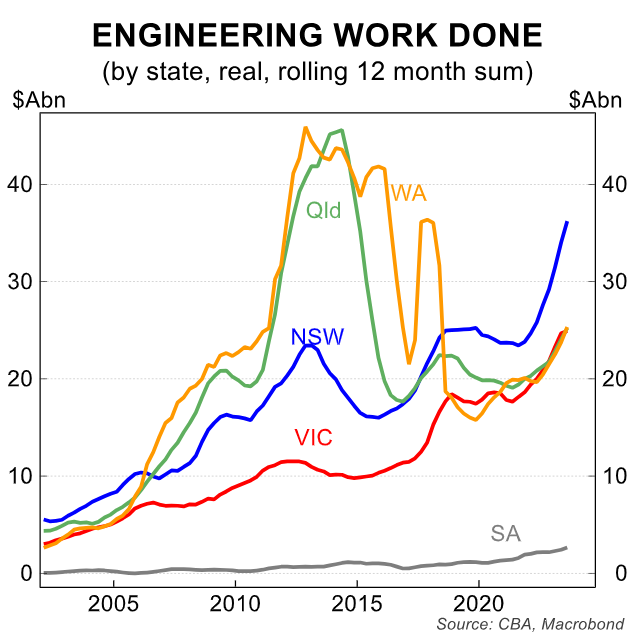

By state, total construction work done growth was strongest in SA (+6.9%) and WA (+6.6%) due to large gains in engineering activity.

NSW (+2.7%) also recorded solid growth with Vic (-2.5%), Qld (-0.8%) and Tas (-5.8%) all seeing contractions.