When asked why Australia’s governments have opted for a mass immigration policy against the will of voters, I always explain that politicians are influenced by the “growth lobby”, namely Big Business, Big Property, and the education-migration industry, which get to privatise the gains from mass migration while the costs are socialised on the broader community.

Think about it from the perspective of a large retailer like Harvey Norman.

Importing hundreds of thousands of consumers every year juices sales and profits, while also inflating Harvey Norman’s land holdings.

High levels of immigration also give retailers like Harvey Norman a larger pool of labour to recruit, placing downward pressure on wages.

Not surprisingly, then, Gerry Harvey has vigorously lobbied for more immigration, previously saying that “it’s not possible you can maintain a population of 25 to 30 million people. In 100 years from now Australia will have a population of 50 to 100 million people”.

“Australia doesn’t have cheap labour. Many overseas workers would be prepared to move here for a much better life and half the money Australians earn”.

The same applies to many other oligopolistic businesses, be it property developers like Mirvac, the Big Four Banks, Transurban, etc.

For these corporations, the mass immigration ‘Big Australia’ policy is a win-win, with minimal downsides. Hence, they always lobby for a ‘strong’ migration program.

Last week, The AFR highlighted the above points in an article explaining how “surging immigration is putting huge strains on housing and infrastructure”, but “strong population growth could deliver a double benefit” for investors in local oligopolistic corporations:

“Australia has relied on driving economic growth through population growth for 20 years, and has failed to provide the investment to match this”.

“The result is a decline in precipitous living standards”.

“Population growth may actually create opportunities as well as problems”.

“Australia’s projected population growth of 1.3% during the 2020s is set to be among the strongest in the OECD. But even as that rate slows to around 1.2%in the 2030s and 1% in the 2040s, Australian population growth will be double or triple most major economies”.

“The beauty of the Australian population growth story for equity investors is how our companies can have the cake all to themselves”, [ UBS Australia strategist Richard Schellbach] says.

“For a range of reasons, Australia is incredibly difficult for others to crack into, and this is why most of our industries remain dominated by a few incumbents. This tight industry structure explains the abnormally high profit margins which companies here enjoy”.

“For incumbent businesses, this means that they will reap the boost to top-line growth which will come through population growth, but without the threat of seeing their profit margins competed away”.

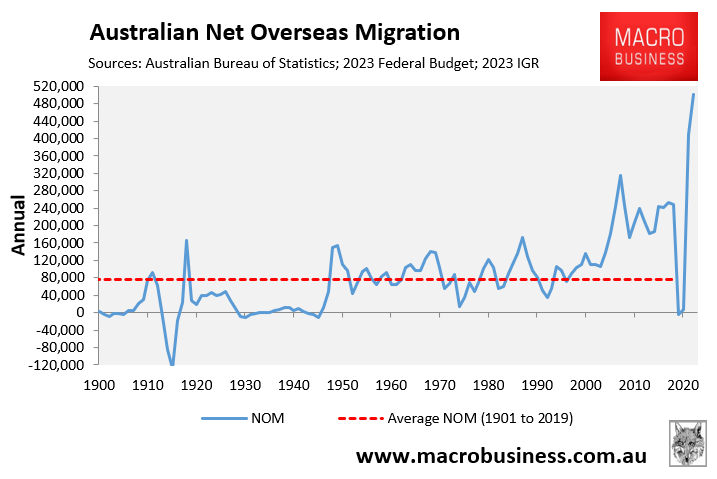

Meanwhile, the living standards of Australians and the productivity of the nation are being crushed by the endless population flood.

But who cares, right? So long as the growth lobby makes fat profits. Ordinary Australians can suck it.